Placing a tax on a good, shifts the supply curve to the left. It leads to a fall in demand and higher price.

However, the impact of a tax depends on the elasticity of demand.

If demand is inelastic, a higher tax will cause only a small fall in demand. Most of the tax will be passed onto consumers. When demand is inelastic, governments will see a significant increase in their tax revenue.

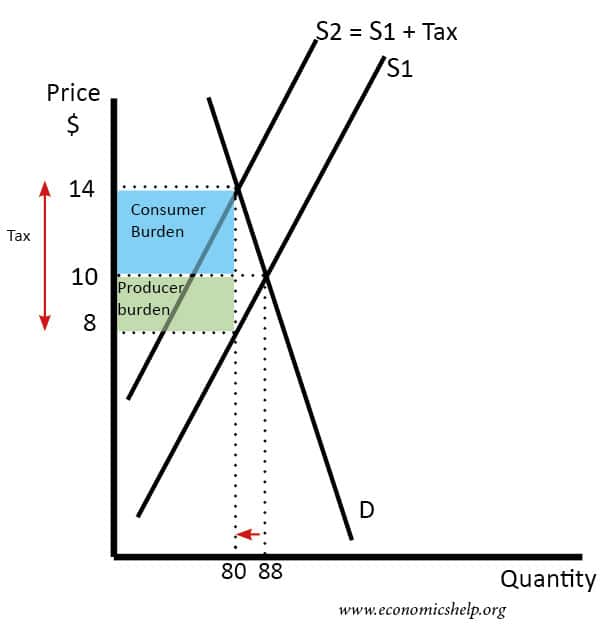

Diagram of tax on inelastic demand

Consumer burden of tax rise

- The consumer burden of a tax rise, measure the extra amount consumers actually pay.

- In the above example, the specific tax is $6.

- The price rises from $10 to $14 so the consumer burden is $4 (x) 80. Total consumer burden is $320

Producer burden of tax rise

- The producer burden is the decline in revenue from the tax

- In the above example, producers used to receive $10, but now after the tax is paid, they are left with $8 per uni

- The total producer burden is $2 (x) 80) = $160

Tax revenue for government

The total tax revenue for the government is $6 x 80 = $480

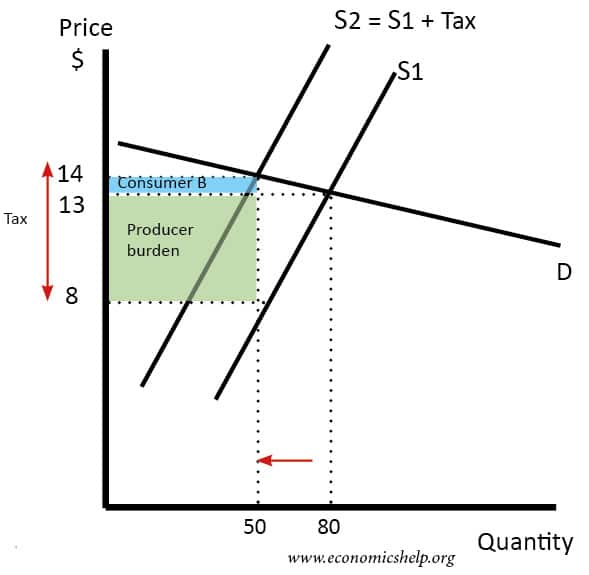

Effect of Tax on Elastic Demand

If demand is elastic, then an increase in price will lead to a bigger percentage fall in demand.

- In this case, the producer burden is greater than the consumer burden

- The tax will be more effective in reducing demand, but less effective in raising revenue for the government

- The total tax revenue for the government is $6 x 50 = $300

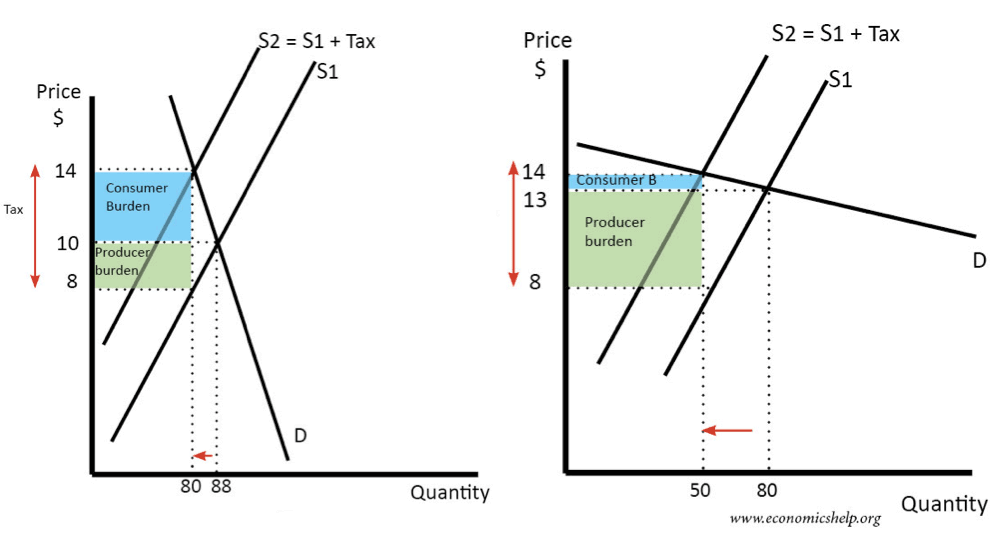

Comparison of inelastic and elastic demand

Related

Video of Elasticity

Is elasticity of supply have any role to play in this? Like, say, elastic supply will result in larger reduction in quantity and bigger Deadweight loss?

The best thing to do is draw a diagram. Then change the elasticity of supply.

When I drew a diagram and made the supply curve more inelastic, the price increase was lower for same amount of tax rise.

This helped alot, thank you!