Reader’s Question: Why does printing money cause inflation? Does this always occur?

Summary

- If the money supply increases faster than output then, ceteris paribus, inflation will occur.

- If a government prints extra money, households will have more cash and more money to spend on goods. But, if the amount of goods stays the same, the extra cash will just cause firms to put up prices.

Explanation of why printing money causes inflation

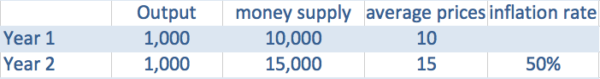

- Suppose the economy produces 1,000 units of output.

- Suppose the money supply (number of notes and coins) = $10,000

- This means that the average price of the output produced will be (10,000/1000) = $10

- Suppose then that the government prints an extra $5,000 notes creating a total money supply of $15,000; but, the output of the economy stays at 1,000 units.

- Effectively, people have more cash, but, the number of goods is the same. Because people have more cash, they are willing to spend more to buy the goods in the economy.

- Ceteris paribus, the price of the 1,000 units will increase to $15 (15,000/1000). The price has increased, but, the quantity of output stays the same.

- People are not better off, and the value of money has decreased; e.g. A $10 note buys fewer goods than previously.

Therefore, if the money supply is increased, but, the output stays the same, everything will just become more expensive. The increase in national income will be purely monetary (nominal)

If output increases by 5% and the money supply increases by 7%. Then inflation will be roughly 2%.

The Quantity Theory of Money

The Quantity theory of money seeks to establish this connection with the formula MV=PY. Where

- M= Money supply,

- V= Velocity of circulation (how many times money changes hands)

- P= Price level

- Y= National Income (T = number of transactions)

If we assume V and Y are constant in the short-term, then increasing the money supply will lead to an increase in the price level.

Printing money and devaluation

If a country prints money and causes inflation, then, ceteris paribus, the currency will devalue against other currencies.

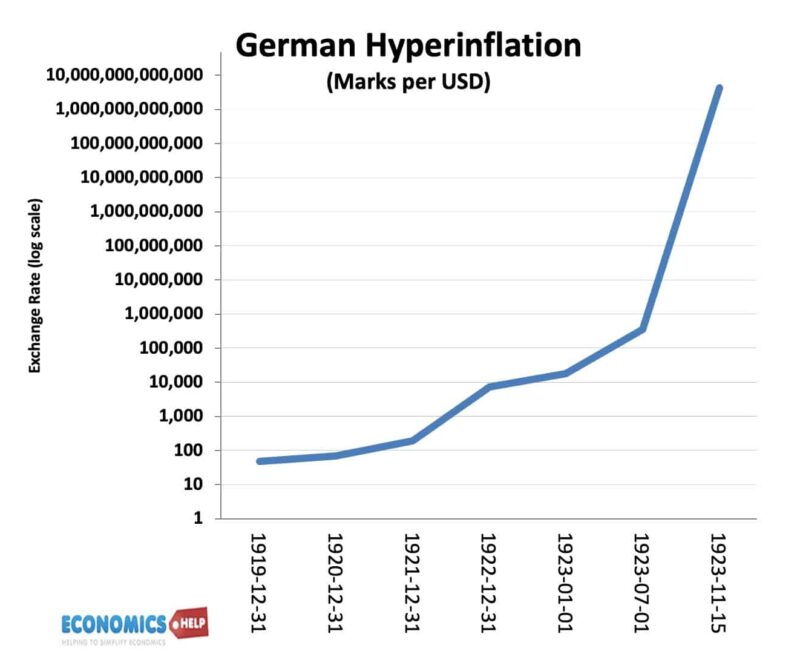

- For example, the hyperinflation in Germany of 1922-23, caused the German D-Mark to devalue against the currencies that didn’t have inflation.

- The reason is that with the German currency buying fewer goods, you need more German D-Marks to buy the same quantity of US goods.

Examples of inflation caused by an excess supply of money

- US Confederacy 1861-64. During the Civil War, the Confederacy printed more paper money. In May 1861, they printed $20 million notes. By the end of 1864, the amount of notes printed had increased to $1 billion. It caused an inflation rate of 700% by April 1864. By the end of the Civil War, the inflation rate was hitting over 5,000% as people lost confidence in the currency.[“Inflation in US confederacy. Encyclopedia.com]

- Germany 1922-23. In 1921 one dollar was worth 90 Marks. By November 1923, the US dollar was worth 4,210,500,000,000 German marks – reflecting the hyperinflation and loss in value of the German currency.

Evaluation – Link between money supply and inflation in the real world

- It is possible that if the government printed money, people could just decide to save the extra money and therefore, prices wouldn’t automatically rise.

- It is also possible that increasing the money supply could stimulate more output. For example, in a recession, there is unemployment of resources and a lack of demand. If a government prints more money and households start spending more, this may encourage firms to start increasing output and investing in future capacity, which helps to cause an increase in real output. Therefore, the link between increasing money supply and inflation will be weaker.

- Also in the real world, it is hard to measure the money supply (there are many different measures from M0 narrow money to M4 wide money)

However, the above provides a rough explanation why printing money usually reduces the value of money causing prices to increase.

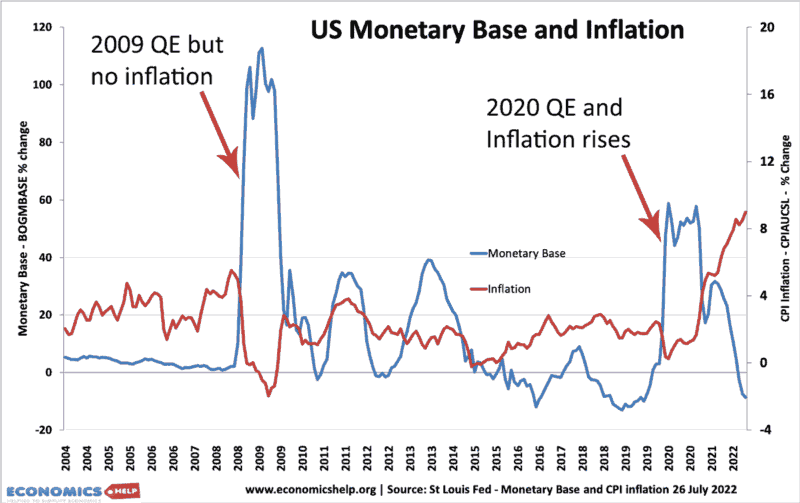

Does Quantitative Easing cause inflation?

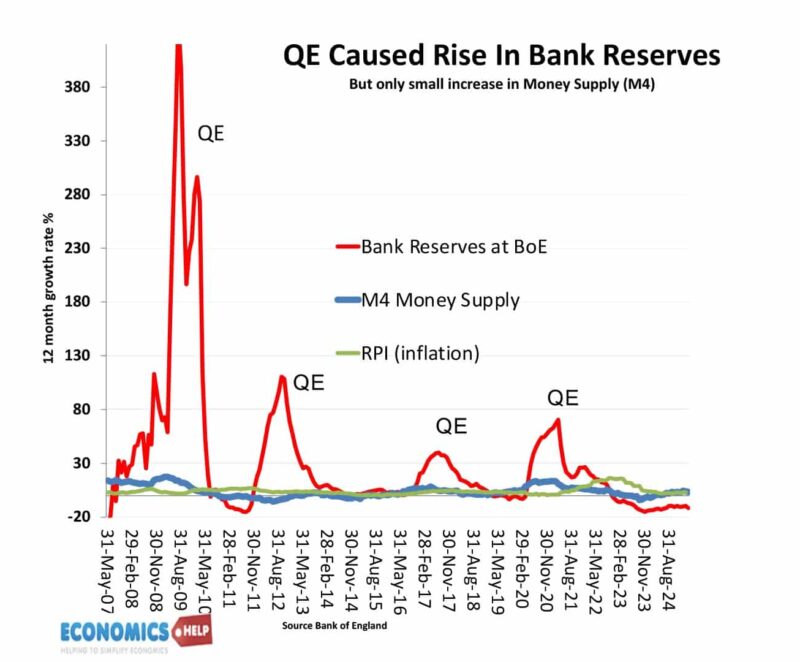

Quantitative easing involves Central Banks creating money electronically and buying bonds from commercial banks. (This is not printing money, though, it is causing a large increase in the monetary base (M1). However, this does not necessarily lead to increase in broader money supply M4. It depends on the actions of commercial banks. If they just keep the excess financial reserves, impact on inflation is limited. Don’t forget in a modern economy, it is commercial banks who create most of the money supply through lending. The amount of notes and coins in circulation is around 3% of total M4 money supply

QE – no inflation – then inflation

By 2015, the US monetary base had increased 600%, but the consumer price index has only increased 15%, an average inflation rate of 2%. It was the same in the UK, inflation remained relatively low, despite the Central Bank creating all this extra money. However, 13 years after quantitative easing started, we did see the return of inflation. So was it just a delayed effect or was something else causing inflation?

QE

When a central Bank creates money and buys bonds. It doesn’t actually print money. The important thing to understand is that it creates money for commercial banks who now hold more cash reserves with the Central Bank. But, here’s the really important question: between 2009 and 2015, did the Central Bank create any money in your bank account? The answer was no. So on the one hand there is more money created in the economy, but it was not really reaching the average household. Some argue that quantitative easing helped fuel asset inflation. Because of all these cash reserves, banks were more willing to lend mortgages and more able to invest in stocks. Certainly, UK house prices rose in this period. But, there were also other factors pushing up house prices, mainly the ultra-low interest rates.

This is the money supply in the UK. The monetary base includes reserves held in the Bank of England. M4 is the broader money supply which includes all the notes and coins plus different types of bank accounts. Basically, quantitative easing didn’t have much influence on this broader money supply. Which is why quantitative easing can have a very limited impact on inflation.

Further reading

Can you explain this more simply because I don’t understand it that much

If the government prints money and pay the debts without using it in the country That also caused the inflation rate to lower

As in the above example it clearly explaining the value of currency depreciation.

If your country prints a lot of notes then the money supply increase artificially without any production (Exports). therefore against foreign currencies your currency value dropdown.

that means if you have to pay loans by foreign currencies, you need to find foreign currencies. but without income how does forex come into your country?

If you use printed money to buy forex, again and again, the money supply increase & the money value further down.

it is inflation….

How does each household receive the extra cash put in the system? That would mean a wage increase. Or illegal earnings. That’s the bit I don’t get.

I’d love if someone can explain that bit please…

Exactly my question. How can households have more money if Central bank prints money?

Stimulus packages to the people eg in Covid times

QE after the recession of ’08 and Stimulus during COVID sent checks to all Americans. It also extended unemployment benefits and gave $600 extra per week during the Pandemic.

Whatever you got, IRS rebates during QE, or direct checks of $300 then $1200, or $2400 per married couple and an extra $500 per child.

This is the money you got.

Cantillion Effect.

Normally if money is printed and supplied by Bank of England to the market. These money first goes to other banks or financial institution as BOE purchases bonds from banks with a certain rate of interest, banks will receive money in exchange. As more money supplied, they may put down interest rate at a very low rate, about 0-1% to encourage households to borrow and increase consumer spending which is one of the components of aggregate demand. The another method is called helicopter money, this is similar to several support schemes taken place during Covid-19, this is when government or chancellor of exchequer may propose schemes, for example furlough scheme, in order to support those who are unemployment, low wage rate and firms by directly giving money to households.

The money circulation in an economy will increase thereby making households to have extra cash to spend on goods and services thereby making the production industries to raise their prices hence causing inflation

If a country that can print Euro print money to pay off debt in Euros as well so the extra money isn’t circulated, how would this cause inflation?

Because it still wouldn’t increase the supply of items but demand would increase

Just a thought, Govt can control price to control inflation. Govt can put a cap. Please let me know if this can help and if not and used, what cud be the consequences.

Thanks in advance

See… I can totally understand that raising the minimum wage definitely causes inflation. But I whole heartedly disagree with (or something… I don’t know. I just can’t subscribe to this idea…) the sentence that says “If a government prints extra money, households will have more cash and more money to spend on goods.”

There has to be some further process, beyond printing the money, that results in households having more money. And that’s again, raising the minimum wage.

I knew I wasn’t crazy when I wondered about this. For a reputable economics website to say the above sentence is absolutely insane to me. God bless America!

It is clearly explained by Friedman, if more money is printed on a certain currency, there is an excess in supply and all the prices expressed in this particular currency tends to go up; and the demand for that particular currency tends to fall; it loses value; there is an excess of money in the street but with less purchase power.

Rather than using the arbitrary term ‘money’ I think it is easier to

consider value as ‘wealth’….ergo printing more notes doesn’t increase the value of anything, nor improve anyone’s wealth.

in fact it can’t by nature..ceteris paribus there is a finite pool of wealth (that a sensible estimate could be placed upon), so how could running a printing machine conjure up more gold etc.

What I find interesting (shocking) is the general ignorance of the fact that state mandated money printing is wealth theft. Cash is the worst possible store of value…hedging via assets is effective to a point, but CGT/tax allowance freezes etc are cunningly designed to counter any attempts at protecting from the effects of inflation.

It’s a complex subject and this is difficult to relay in laymen’s terms but it really should be exposed for the utter sham it is.

Ultimately it boils down to future borrowing against debts to be picked up by the next generation and is the ultimate ponzi scheme.

what is not being indicated in any of these posts, is how that extra money would somehow be injected into the economy. The posts would be correct if the printed money was simply distributed to businesses or consumers, but that’s not necessarily the case. So there is somewhere pressure that requires more funds. Now, if inflation is the case already, the economy is already requiring more ‘paper’ of some form because both prices and wages are increasing and there isn’t sufficient paper for the needs. Its not specifically the paper itself causing the inflation, but a reaction to it.

In response to some prior comments

Historically from what I can see, governments have usually printed more because of an insufficient supply of such. Normally this would be caused by inflation already in place. I can find no particular instance where any government simply started issuing vast sums of extra currency and dumping it into the economy if their economy wasn’t already in trouble. Sometimes its subtle, but it would make absolutely no sense for any government to simply run off large amounts of currency, knowing it would devalue the currency, or in many cases, make it worthless.