Readers Question: Evaluate policies which a government could adopt in response to falling behind mortgage payments

The problems of mortgage defaults are explained here

What can the government / monetary authorities do?

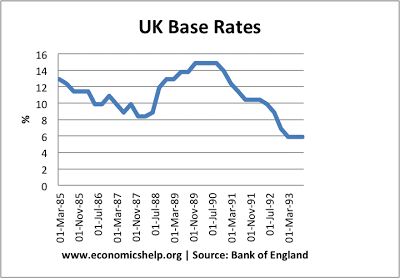

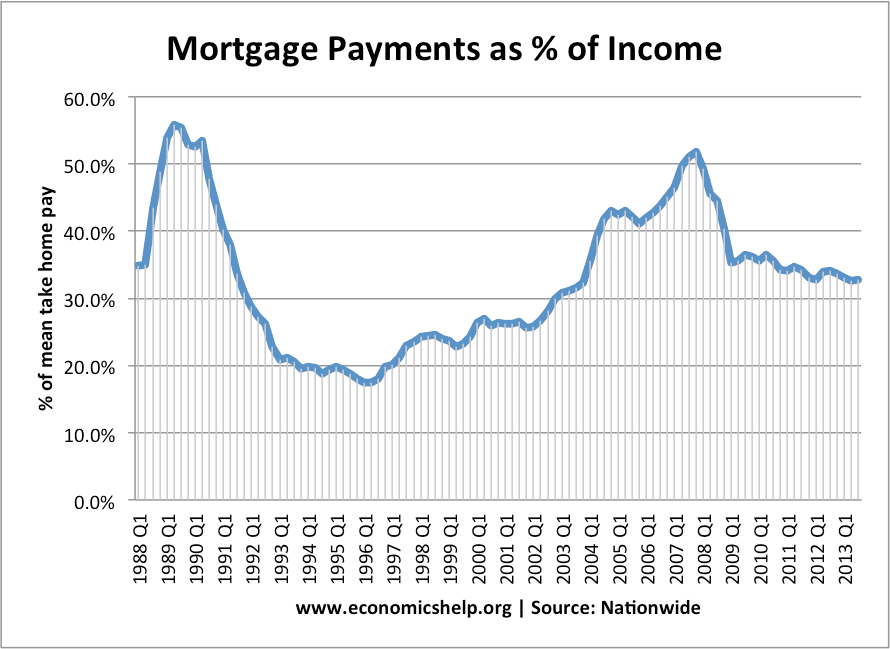

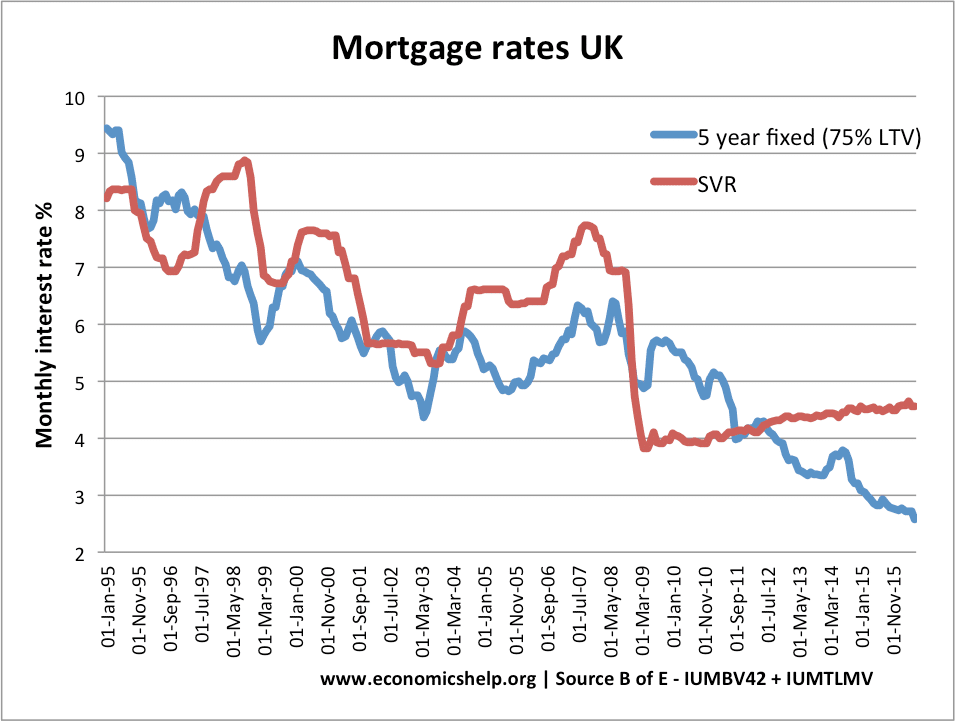

Cut interest rates. The MPC can cut interest rates as long as inflation is not a problem. However, the government do not set interest rates and mortgage default rates are not the main target of monetary policy. However, lower interest rates are the main way to make mortgage payments more affordable. After the 1990 recession, the government cut interest rates from 15% to 6% by 1993. This cut in interest rates helped to make mortgage payments more affordable.

Interest rates were also cut in 2008/09

Make commercial banks pass on the rate cut. One problem of the base rate cuts of 2009 is that many banks did not pass on the rate cut to consumers. The government was able to pressure the nationalised banks (like Northern Rock, RBS) to pass on rate cuts. But, they can’t actually make other private banks change their commercial rates.

In theory, the government could pass some kind of law to make banks pass on the rate cut. However, there are problems with making commercial banks pass on the rate cuts. Commercial banks say if they have to cut interest rates, savers will lose out and they may not be able to attract enough savers. If banks don’t have enough deposits they won’t be able to lend any new mortgages.

- So it is difficult to get banks to reduce lending rates and also increase the supply of new mortgages

Give more time

The other issue is to encourage banks to voluntarily allow people a longer time period before repossessing houses. This means people with financial difficulty can take a payment holiday without having house repossessed. This may work for some people but not for those who have lost their jobs.

Subsidy/tax breaks

This would be an expensive way to prevent mortgage defaults. But, the government could consider paying part of the cost of mortgage payments on the ground it is cheaper than the cost of repossession. I think the government would be reluctant to do this on the grounds that government borrowing is already high and why should they protect people who have bought a house over renting?

Reduce unemployment

A major cause of mortgage default is when unemployment rises. To solve this the government should try to reduce unemployment. They can do this through fiscal policy (higher spending) and supply side policies.

See: Policies for reducing unemployment

Related

Makes sense to me. Repossessing property actually costs the banks in the long term. If they can save a higher percentage of those loans, its actually better for everyone.