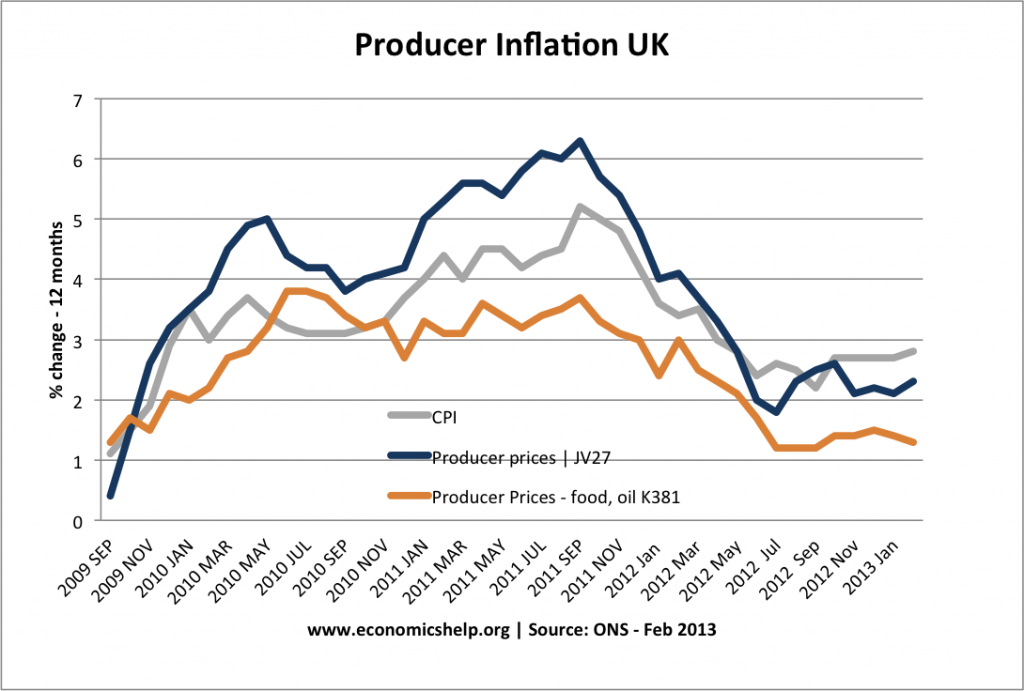

Another guide to inflationary pressures is the producer price index (PPI).

Producer inflation measures the price of goods produced by manufacturing firms. This is sometimes referred to as ‘factor gate prices’

In the year to February 2013 the output price index for home sales of manufactured products rose 2.3%. In the same period the total input price index rose by 2.5%.

Narrow measure of producer prices

The narrow measure of producer prices excludes industries which tend to be more volatile. This volatile industries included food, beverages, tobacco and petroleum industries. Excluding these industries, the producer price inflation has been lower during this period.

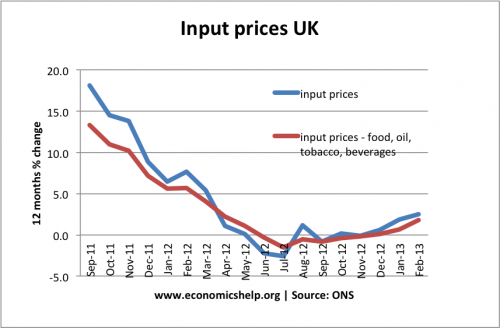

Input prices

Input prices are the cost of raw materials used in the manufacturing process. This will involve the cost of metals, plastic, oil and other raw commodities.

Again, there is a narrow measure of input prices, which excludes the more volatile industries of food, oil, tobacco, beverages and petroleum. This graph shows the quite significant input price inflation during 2011.

Leading indicators

Producer and input prices are known as ‘leading indicators’. This is because they will tend to influence future inflationary pressures. If input prices rise, firms will put up their producer prices, and in turn, this is likely to translate into higher consumer retail prices.