Readers Question: What will happen to the value of a currency during times of deep recession and high inflation?

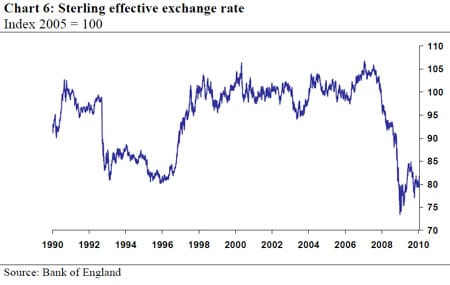

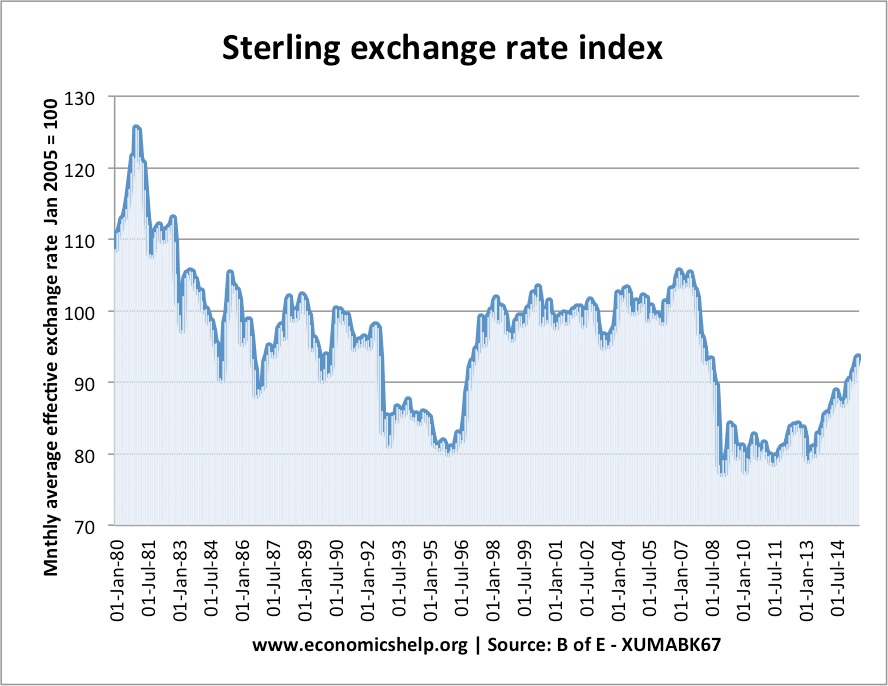

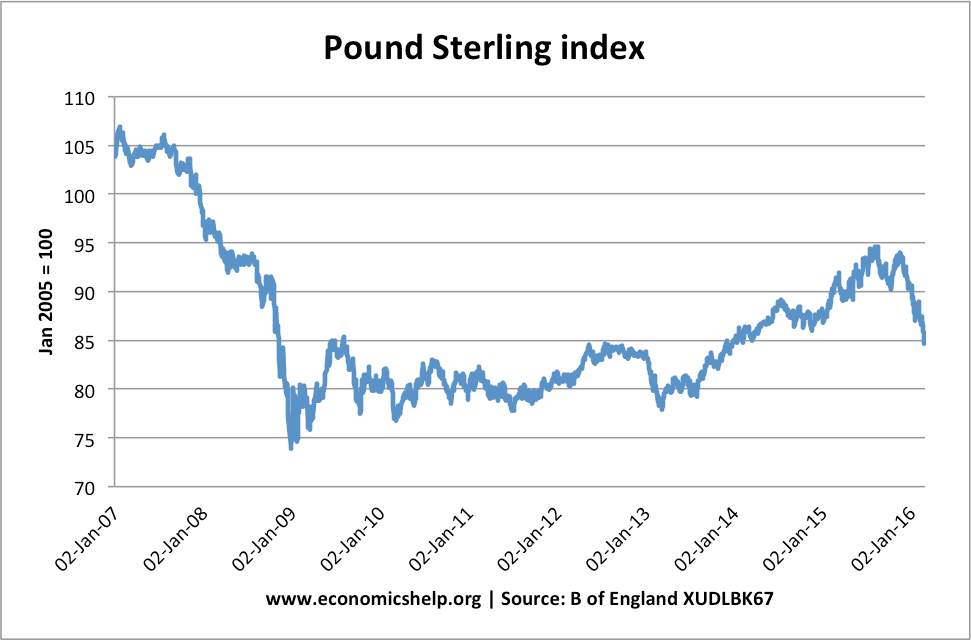

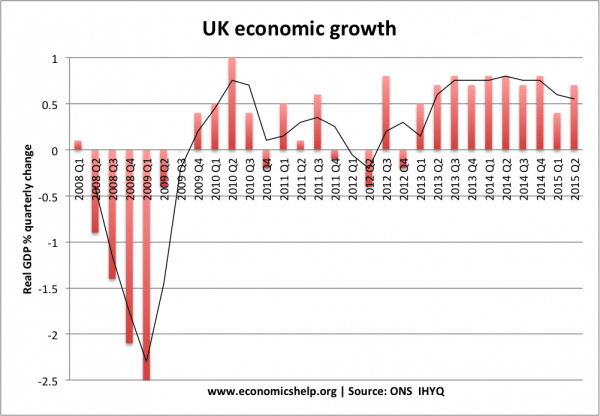

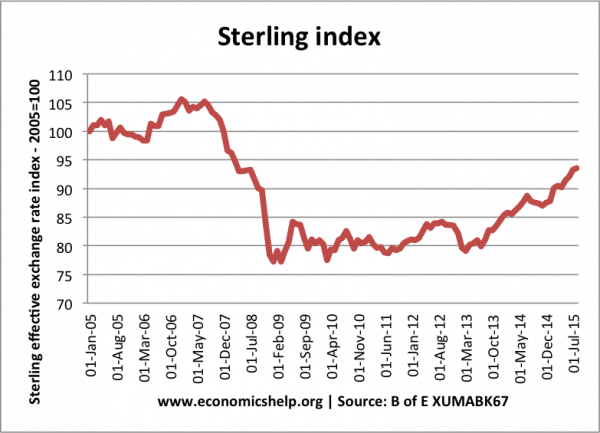

There is no hard and fast rule about what will happen to the value of a currency during a deep recession – though, a currency is likely to fall because country becomes a less attractive place to invest. For example, when the great recession started in 2008, the UK experienced a significant depreciation.

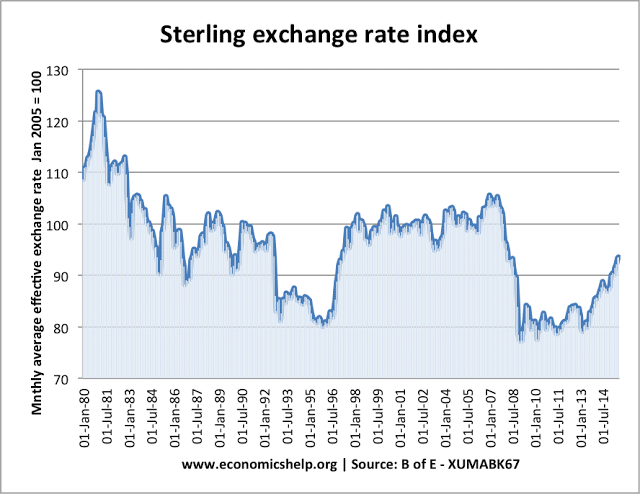

The Pound Sterling fell over 25% from 2007 (before the start of the great recession) to July 2009

But the Euro and Dollar were less affected by the great recession.

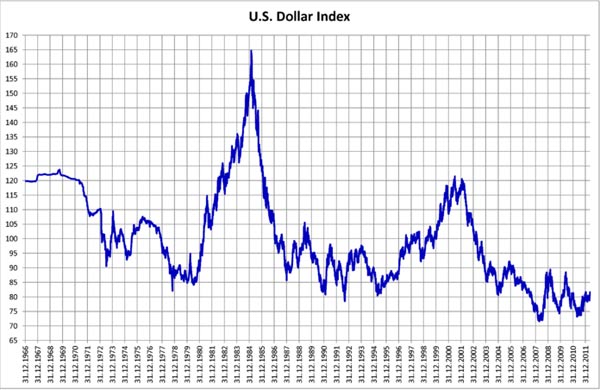

Note in early 1980, the US went into recession, but during this period the value of the Dollar rose.

It was a similar experience in the UK, in the 1980s, In 1980, there was a rapid appreciation in Sterling (which was one factor contributing to the recession of 1980/81.)

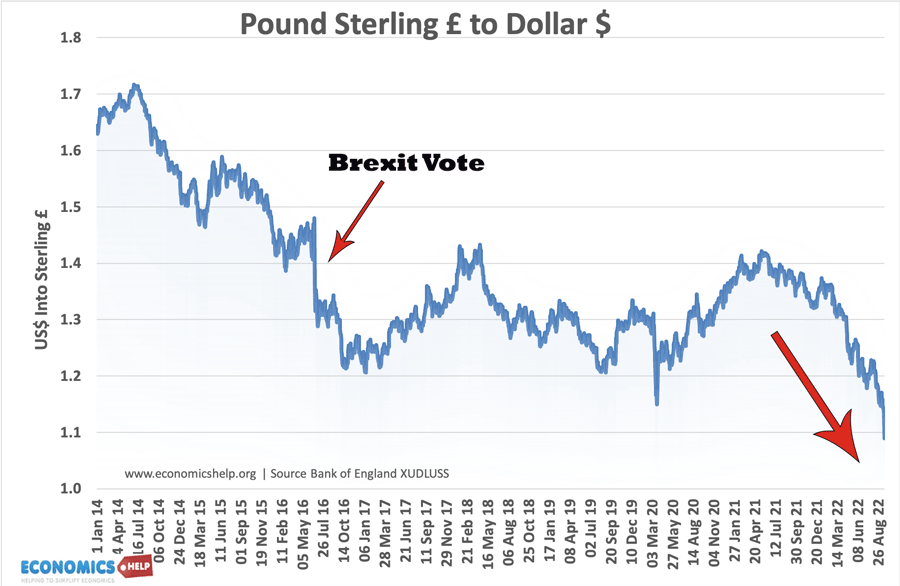

2022 Recession

The Pound Sterling has been sliding during 2021/22 and towards the end of 2022, it looks like UK economy is heading into recession.

Economic theory behind the value of a currency in recession

Suppose one country, e.g. the UK, enters a deeper recession than all its other competitors. How might we expect the currency to behave?

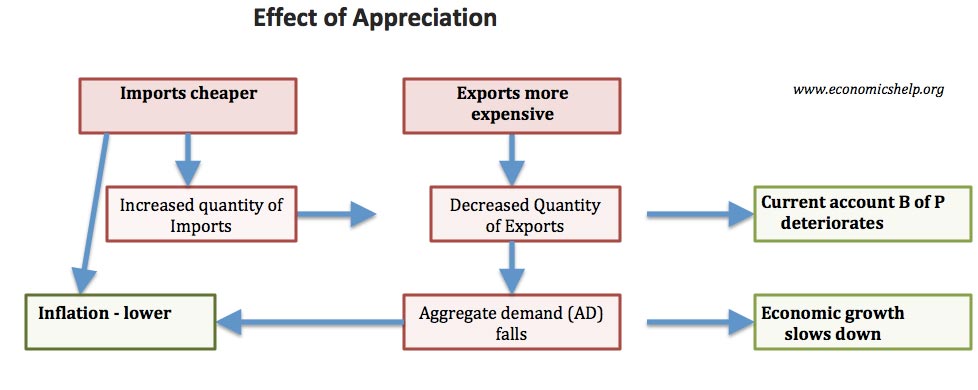

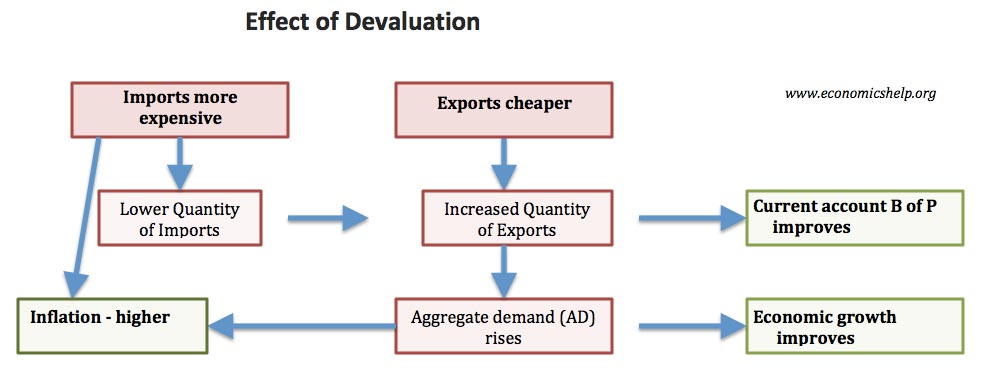

Recession and interest rates. If the UK enters a recession, then we would expect UK interest rates to fall compared to other countries. This would make the UK less attractive for investors to save money. Hot money flows are likely to leave the UK and move to countries with higher interest rates. If people move money out of the UK, they will sell Pounds and buy other currencies, causing a fall in the value of Sterling. Therefore, in theory, we might expect a recession to cause a fall in the value of the currency.

Evaluation

1. In a recession, inflation is likely to fall. Lower inflation will help the country become more competitive, and this may increase demand for the currency causing it to rise.

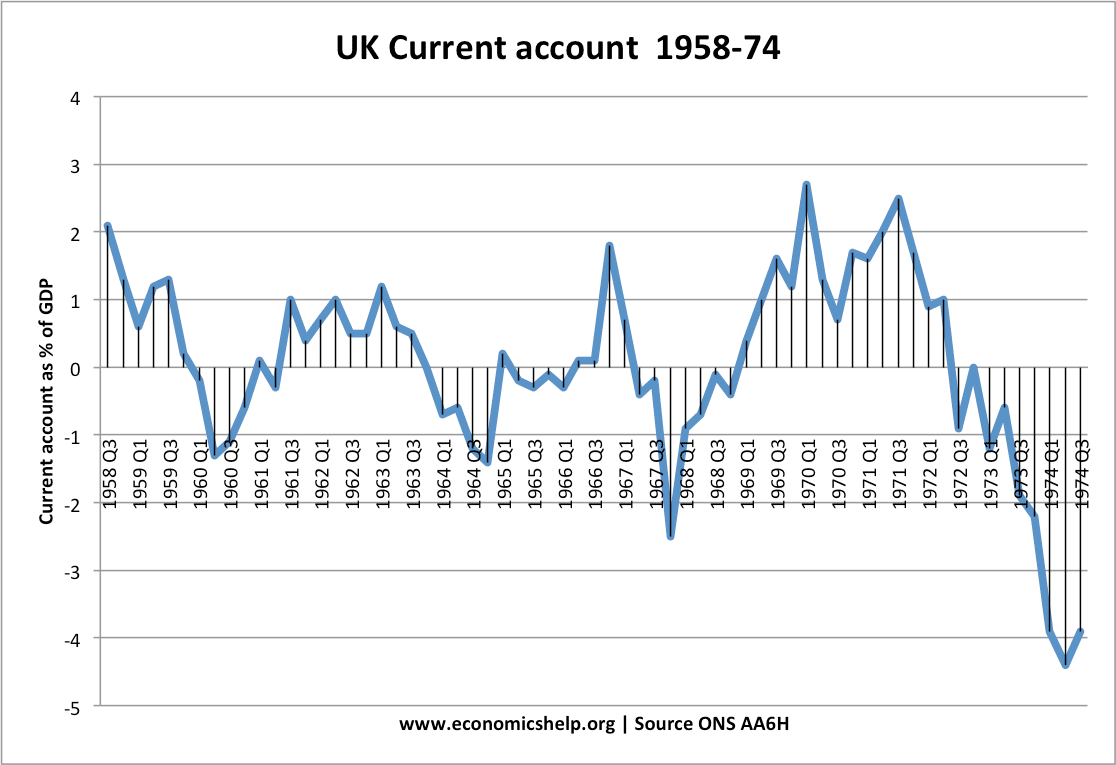

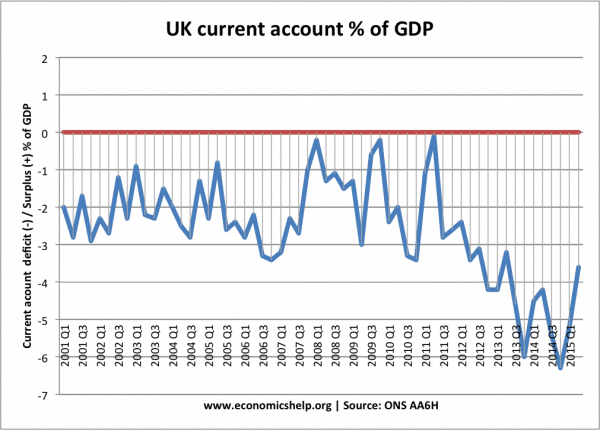

2. Many factors affect the value of a currency. For example, if the UK had a large current account deficit, then we might expect this trade deficit to put downward pressure on the currency. The fall in the value of Sterling in 2008 was partly related to the UK’s trade deficit and lack of competitiveness. However, if a country like Germany entered a recession, they may be less downward pressure on their currency (the Euro) because Germany has a large current account surplus.