Readers Question Why is the forward guidance threshold set at 7% unemployment and how does this affect the threshold for inflation?

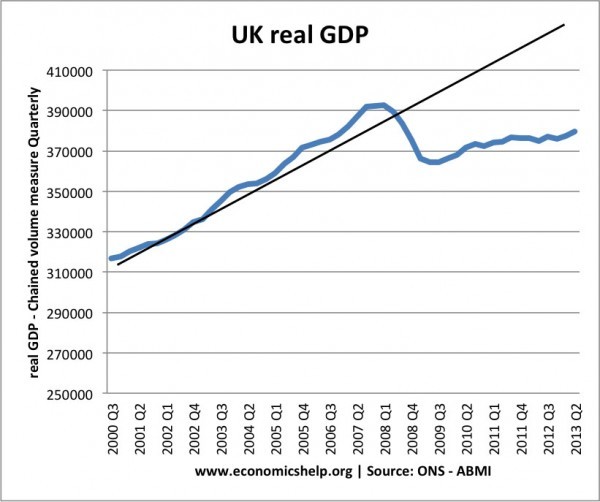

The MPC have a remit to target inflation of CPI = 2% +/-1. But, the MPC also consider wider issues of economic growth and unemployment. UK Real GDP is still lower than the level reached in 2008. It is an unprecedented decline in output, and actual growth and fallen well behind trend growth.

Because of this the MPC have been concerned to return the UK to a normal path of economic growth, aiming at full employment, whilst avoiding any surge in inflation.

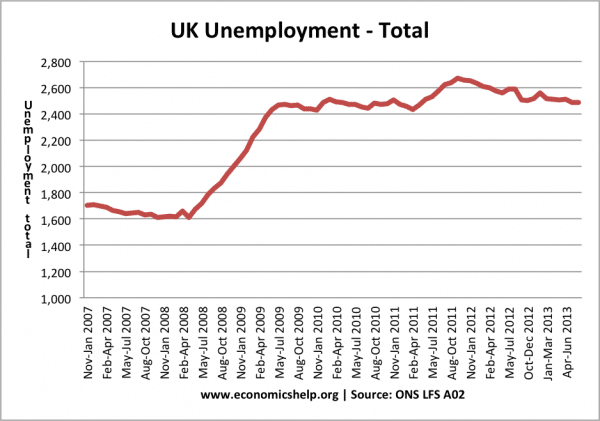

Because of the unexpected nature of the ongoing recession and economic weakness, last year they introduced forward guidance, stating that they wouldn’t raise interest rates above 0.5% until unemployment had fallen to 7%.

In 2014, unemployment has continued to fall faster than expected (unemployment is now 7.2%). But, at the same time CPI inflation has fallen below the government’s target. The MPC have updated their guidelines to say that there is scope for unemployment to fall below 7% without causing inflationary pressures. (Bank of England note on forward guidance)

Why 7% threshold?

To some extent, 7% is a little bit arbitrary. You could make a case for 6% or even 8%. But, essentially, it is a level of unemployment which the MPC believes shows that the UK is stuck with spare capacity (and below trend growth). With unemployment of 7%, the MPC believe that there is likely to be no demand pull inflationary pressures, and therefore they can afford to keep interest rates low without it causing any inflation.

With unemployment of 7%, the MPC predict that wage inflation will remain muted. 7% unemployment is sufficiently high to deter workers from bargaining for higher wages. Wage inflation is a key factor in determining headline inflation. The fact that wage inflation has remained very low is a key factor in encouraging the policy of forward guidance and keeping interest rates close to zero.

The MPC hope that forward guidance will giver greater confidence for firms to invest – knowing that interest rates are more likely to stay low.

Impact on inflation

If the economy recovers sufficiently and unemployment falls further, then we could see a re-emergence of inflationary pressure. As unemployment falls, wages may start to increase causing both cost-push and demand pull inflation. With higher inflation, interest rates of 0.5% will look unsuitable for a recovering economy.

The fear is that by promising to keep interest rates at 0.5% until 2015, the MPC may be too late in dealing with an increase in inflationary pressures caused by the economic recovery.

However, there are various factors suggesting that despite falling unemployment, there is still a strong case for keeping a loose monetary policy (keeping interest rates low)

- Headline unemployment has fallen due to a rise in part time / temporary contracts.

- The fall in unemployment has been helped by stagnant wage growth.

- Some suggest that the headline rate of unemployment is somewhat misleading to the state of the economy and labour market. (UK unemployment mystery)

- Support for the continued existence of spare capacity in the UK economy is strengthened by the fall in CPI inflation to 1.7% in Feb of 2012. Inflation has now fallen below target. Some economists are concerned that there is still a risk from disinflation (low inflation) Deflation is very unlikely in the UK.

- There are likely to be deflationary pressures from ongoing weakness in the European economy and further fiscal tightening from the government. Given these deflationary pressures, the MPC are keen to do help maintain demand.

Should Central Banks have a target for unemployment?

On a slightly different note, there is a case for Central Banks to have a target for unemployment (though I admit it is hard to decide on a figure for full employment.)

But, we may contrast the role of the MPC with the ECB which has placed much less emphasis (if any) on European unemployment, but seems primarily concerned with inflation.

Related

How times change. Unemployment between about 1950 and 1970 averaged about 5% according to the chart here:

https://www.economicshelp.org/blog/780/economics/unemployment-rates-history/