Forward guidance is when the Central Bank announces to markets that it intends to keep interest rates at a certain level until a fixed point in the future.

The aim of forward guidance is to influence long term interest rates and market expectations. For example, the Central Bank might want to boost economic activity by convincing markets that interest rates will stay low for the foreseeable future.

It means that Central Banks are pledging to keep interest rates low, even if inflation starts to creep above its target. It can be seen as an indirect way of placing less emphasis on low inflation and more emphasis on economic recovery.

The Central Bank could say it intends to keep interest rates at 0.5% for a certain time period (until 2015) or

it could say it intends to keep interest rates at 0.5% until certain economic criteria are met (e.g. interest rates will stay at a certain level until unemployment falls below 6%).

What are the benefits of forward guidance?

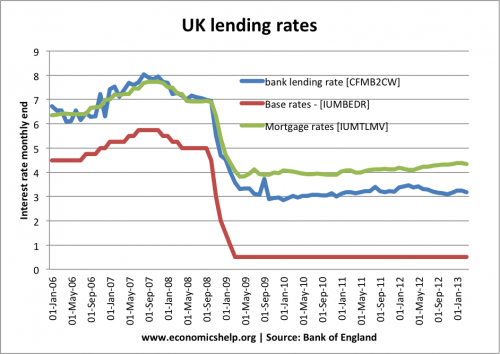

It helps the Central Bank to influence long term interest rates. The Central bank can only directly control short term rates – Base rates. In normal economic circumstances, a change in base rates usually leads to an equivalent change in commercial bank rates (the long term lending rates which are important in an economy) However, in the credit crunch / great recession there was a divergence between base rates and commercial bank rates. Lower base rates were not passed onto consumers.

mortgage rates and bank lending rates didn’t fall as much as base rates

If commercial banks feel the cut in base rates is temporary, they may not want to cut their long term rates. But, if the Central Bank confirms that it will keep base rates at 0.5% for a considerable time, then commercial banks may be more willing to reduce their long term rates (e.g. mortgage and lending rates) because they know they will be able to borrow from the Central Bank at 0.5%. The hope is that this will encourage banks to cut rates, and increase overall lending in the economy. This increase in lending should boost investment and economic growth.

Inflation / deflation expectations. Another feature of forward guidance is that it might influence inflation expectations. If the Central Bank states that interest rates will stay at zero until unemployment falls below 6%, markets, firms and consumers may be more liable to expect higher inflation than previously. Some economists argue that, if there is currently a risk of deflation, higher inflation expectations can help boost spending and economic growth. This is particularly beneficial in a liquidity trap.

How credible is forward guidance?

There is nothing to stop the Central Bank ignoring its own pledge. The Bank of England could pledge to keep interest rates at 0% until 2015, but if circumstances change – they could raise interest rates. Markets and banks know this and this could reduce the usefulness of the commitment, but it can still give an indication of how monetary policy will operate. Markets do tend to place a lot of weight on Central Bank pronouncements.

This is why forward guidance will generally be linked to the state of the economy. ‘We will keep interest rates at 0.5% until 2015 or unemployment falls below 6% / growth above 2.5% a year. This means if the economy recovery is much stronger than expected, they can increase interest rates.

Could forward guidance backfire?

Some economists suggest that a commitment to keep interest rates low for a long time, is an admission that the economy is deeply depressed and this could actually knock confidence and expectations – because of forward guidance people start to expect lower incomes. Therefore, rather than boosting lending and economic activity, forward guidance could be seen as an act of desperation and therefore not help. See paper by Professor Woodford

Will forward guidance actually reduce long term interest rates?

If a Central Bank pledged to keep interest rates low for a long time, in theory, this should reduce long term rates. However, it is not guaranteed.

- The commitment to low interest rates may not affect banks behaviour. They may keep interest rates high because they are short of funds and trying to attract deposits.

- Markets may feel the announcement doesn’t really change how they expect monetary policy to be operated.

Forward Guidance and Quantitative easing

Quantitative easing aims to reduce long term interest rates on bonds and securities. By creating money and buying securities, the price goes up and bond yields should fall. However, the Central bank may prefer forward guidance over Q.E. because

Q.E. didn’t translate into higher bank lending. Bond yields may have fallen in early parts of Q.E. but banks still kept lending rates high.

Q.E. involves the creation of money and pushing up the price of bonds. There is a concern that it can be difficult to unwind Q.E. and sell the inflated bonds. Forward guidance helps to reassure markets interest rates won’t suddenly rise, but will stay low.

However, there is nothing to stop forward guidance and quantitative easing introduced together.

Examples of forward guidance

Mario Draghi said the European Central Bank would commit to keeping interest rates low for an “extended period of time”.

The US Federal Reserve policy makers indicated at a meeting in Dec 20120, that they anticipated that a target range for the federal funds rate of 0 to 1/4 percent will be appropriate at least as long as

- The unemployment rate remains above 6-1/2 percent,

- Inflation between one and two years ahead is projected to be no more than 1/2 percentage point above the Committee’s 2 percent longer-run goal, and

- Longer-term inflation expectations continue to be well anchored.

The Bank of England under Mark Carney are expected to make a similar announcement on forward guidance.

Commentary

Forward guidance can be a tool to help deal with a liquidity trap, where the economy is stagnant and deflationary pressures are holding back economic growth. Critics argue it is a way to tolerate higher inflation, and the Central Bank could lose its anti inflation credibility. Other economists argue that’s the whole point – sometimes Central banks need to lose their credibility to targeting low inflation.

Related

This is an excellent article.