The new Bank of England governor, Mark Carney, has implemented a type of unemployment target.

As part of forward guidance, the Bank of England state that:

Interest rates won’t rise from 0.5% until unemployment falls below at least 7%.

Essentially, the bank are committing to expansionary (loose) monetary policy until there is a stronger economic recovery and unemployment has fallen. The hope is that the commitment to low interest rates will encourage firms to invest and consumers to spend.

However, this unemployment target of 7% has a few caveats. The unemployment target and forward guidance on interest rates can be ignored if:

- Inflation is forecast to breach a 2.5% target over a 24 month horizon.

- If there is a sharp rise in the public’s expectations of inflation

- If low interests are likely to imperil the stability of the financial system, e.g. low interest rates could fuel an asset bubble.

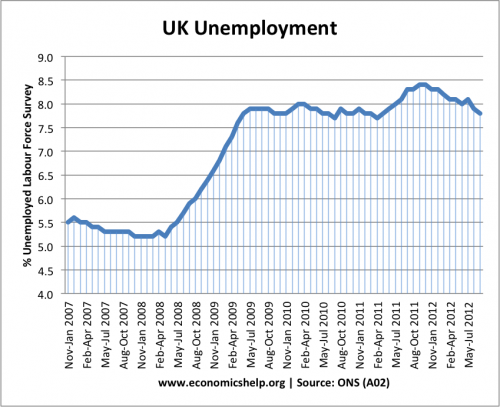

Under the Bank of England’s latest targets, it does not expect unemployment to fall below 7% until 2016. According to the ONS, unemployment is currently 7.8%. It would require the creation of nearly 750,000 new jobs for the rate to fall below 7%

Equilibrium Unemployment

The Bank of England also mentioned the term ‘equilibrium unemployment’. They believe the equilibrium unemployment rate is around 6.5%. The equilibrium rate means that if unemployment falls below 6.5% it might start causing inflation (e.g. competition for employers pushes up wages). If unemployment is above the equilibrium rate of 6.5% then there is slack in the economy (demand deficient unemployment) and this will keep inflation low.

This equilibrium rate of 6.5% is therefore composed of structural factors / supply side factors (the natural rate of unemployment)

Commentary on the Unemployment Target

One prolonged feature of the Eurocrisis has been the failure of the ECB to give adequate weight to the problem of unemployment. There policy of inflation targeting – ignoring the much bigger problem of unemployment / low growth has created deep economic misery throughout Europe.

The Bank of England’s approach is more pragmatic. They retain an awareness of inflation, but also seem determined to give unemployment and economic recovery a reasonable weight in monetary policy.

In one respect forward guidance is not a huge departure from the previous policy of the Bank of England. In the great recession, the Bank of England have tolerated headline inflation rates of up to 5%. This clearly implies they were implicitly aware of the unemployment situation and not religiously committed to inflation targets.

Also, the three criteria give the Bank of England substantial room to wiggle out of the 0.5% interest rates, if they want to. Headline inflation of 2.5% can easily be breached by a bit of cost push inflation. A braver monetary policy would be to target core inflation – which strips out temporary cost push factors and therefore is a better guide to demand pull inflationary pressures in the economy. However, I’m sure the Bank will be aware of the political and economic cost of being too loose on inflation. Savers will already feel aggrieved interest rates are forecast to be low for even longer. It could be embarrassing for the Bank, if headline inflation rises to 4%, but they are committed to 0.5% interest rates.

There also needs to be an awareness of the limitation of monetary policy. It is true that Monetary policy can have an effect in providing economic stimulus, or at least preventing a much deeper recession. But, monetary policy can not deal with the more long-term structural problems of an unbalanced economy.

After many false dawns and green shoots of recovery which wilted, the Bank is correct to commit to an escape velocity (strong growth to be self-sustaining). This strong growth is essential if we want to see interest rates and the economy return to ‘normal’

The Bank’s commitment to strong growth and lower unemployment will have some impact on improving expectations. It will hopefully boost investment (assuming banks are willing to lend). And, it may prove that the economy is able to recover quicker than 2016. But, if it does we should we remember the contrast between a country with own monetary policy, and countries stuck in the Eurozone like Italy.

Related