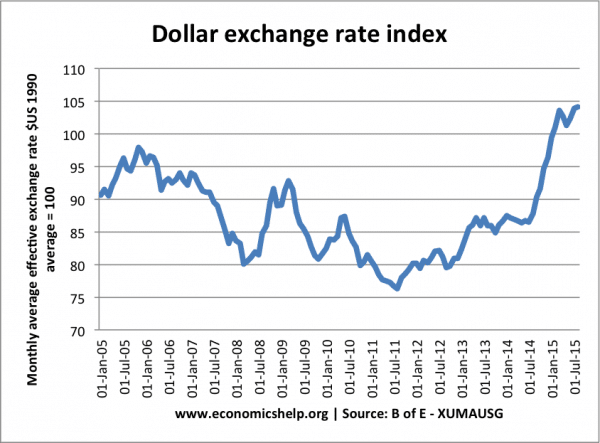

The past few months have seen a rise in the US dollar. The trade-weighted index has risen from 95 in 2011 to 111 in Jan 2011. There has been a near 10% rise in the value of the dollar since July of 2014.

Against the Euro, the dollar has been even stronger.

One Euro was worth $1.38 in May 2014, but has now has the Euro has fallen to $1.175 (Jan 8, 2015

Reasons for strength of Dollar

- Stronger economic recovery in the US. The last economic growth figures Q3 2014 showed very strong growth of 5%. With strong economic growth, unemployment has fallen to 5.9%. This is in marked contrast to the rest of the developed world. The Eurozone, in particular, is struggling to post anything other than anaemic growth; EU unemployment is nearly double the US rate. Strong growth tends to increase interest rates because of expectations of rising interest rates.

- Rising interest rates. The US is emerging from a deep balance sheet recession and liquidity trap – with strong growth and falling unemployment, it has become a matter of when the Fed will consider raising interest rates from the current low of 0.5%. Higher US interest rates compared to the rest of the world will attract capital flows into the US. This will increase the demand for dollars as investors look to save in US dollar. This hot money flows will push up the value of the dollar. Other countries, don’t look ready to raise interest rates yet.

- Also, the news that the US will end asset purchases further strengthens the Dollar. Quantitative easing which involves increasing supply of currency tends to lower the value – because quantitative easing is more liable to increase inflation.

- Despite strong economic growth, US inflation is still low at 1.3%, making US goods relatively competitive.

- Weakness of the Euro. One of the US main trading partners, the Eurozone is at a very different stage of the economic cycle. Falling oil prices have pushed the Eurozone into deflation (Inflation rate -0.2%). Combined with low growth and high unemployment, there is an expectation that the ECB will try some form of asset purchase / quantitative easing. This is making the dollar more attractive than the Eurozone; the ongoing concerns over Eurozone debt is another factor which will encourage capital flows to the US.

- The Eurozone is not the only big economy stuck in recession. Japan is in recession and Latin American countries, such as Brazil are struggling. Even the big two Asian economies of China and India are slowing down.

- Falling oil prices. Falling oil prices are generally good for the US economy. It helps to reduce inflation and costs for business. It is true the US has some oil and energy sectors, which will be damaged by low prices. But, the US economy is much broader and is a big consumer of oil. Its fortunes are definitely not tied to oil prices, like many of its competitors, such as Russia.

- An inverse relationship between oil prices and the dollar. As oil prices are priced in dollars. Falling oil prices often lead to a rise in the US dollar.

Related

Nice….well described…gonna read more blogs

great job GUYS!!!

Well done. Thanks for the info.

U.S is on the rage of economic power

Well done plain explanation and helpful thanks

thanks would you explain the reasons for gradually increasing in dollar value from 1913 -2017