Sticky inflation is an undesirable economic situation where there is a combination of stubbornly high inflation, (and often stagnant growth). Sticky inflation is often associated with cost-push factors, i.e. factors which cause a rise in the inflation rate but also lead to lower spending and economic growth.

Sticky inflation is also sometimes known as Stagflation – Rising prices, but stagnating economy. The UK experienced stagflation back in the 1970s as a result of cost-push inflation(higher oil prices and rising wages)

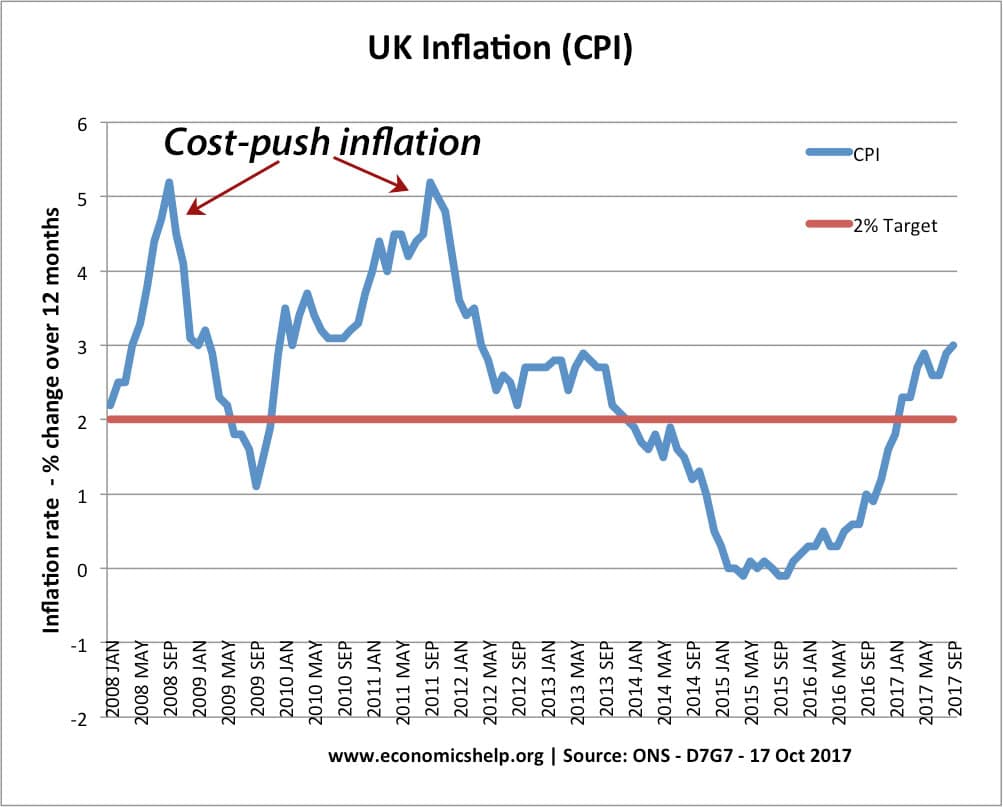

In 2008, we experienced a rise in inflation, but economic growth fell leading to recession. In 2011, we had a similar rise in inflation, but a fall in the growth rate.

Causes of Sticky Inflation

Cost-Push Factors Upward pressure on inflation could come from higher fuel prices, higher food prices and some supply constraints in key sectors. If inflation does remain above the government’s target of 2% it will limit the capacity for the MPC to cut interest rates. However, these cost-push factors can occur during low growth, therefore, the MPC may be reluctant to increase interest rates to reduce inflation because they are worried about growth

Expectations. Inflation is often sticky and difficult to reduce when people expect higher inflation. When people expect higher inflation, it can be more difficult to reduce it. (e.g. workers bargain for higher wages in anticipation of inflation.

Wage Push Inflation. If labour is able to push for higher wages, despite lower growth, then we could get a combination of rising inflation, but slow growth. This is especially a problem if a country is part of the single currency. If wages rise, they become uncompetitive leading to lower demand. Therefore there is an unwelcome combination of rising prices, but lower growth. If countries were not in a single currency, the uncompetitiveness would lead to a depreciation in the exchange rate to restore competitiveness and increase demand.

Temporary Inflation. Sticky inflation may occur due to a rise in tax rates (e.g. VAT) this increases the headline inflation rate, but the higher taxes reduce living standards leading to lower growth. Therefore, it is important to look at different measures of inflation which strip away temporary factors such as higher taxes.

Related

Article on Sticky inflation at Times

3 thoughts on “Sticky Inflation”

Comments are closed.