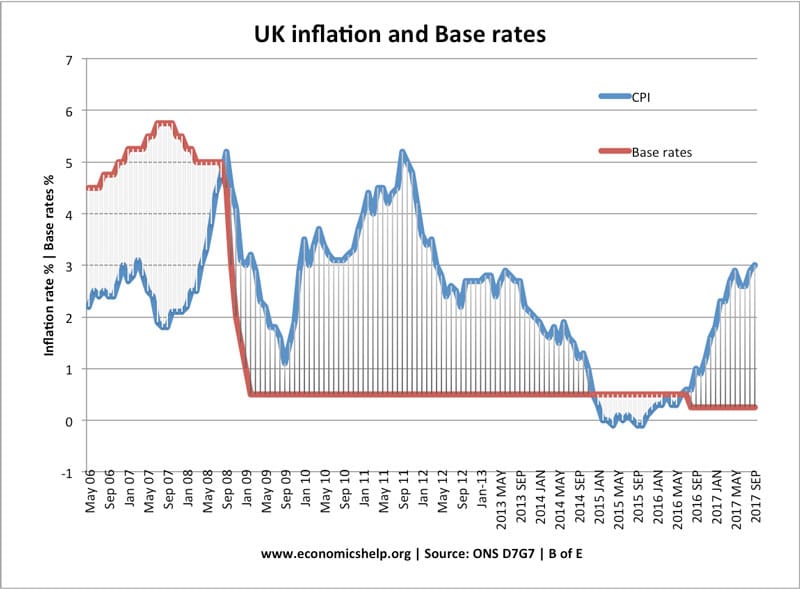

UK interest rates were last raised over a decade ago – July 2007, but it is widely expected that this week the MPC will vote to raise base interest rates from their current low of 0.25%.

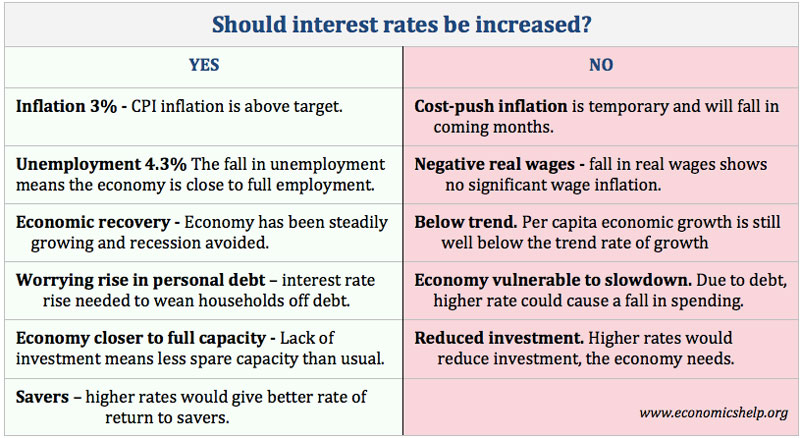

- The logic for an interest rate rise is that – inflation (3%) is above the 2% target, fall in unemployment and record levels of consumer borrowing.

- However, critics warn the UK recovery is still weak and the cost-push inflation only a temporary effect due to devaluation.

Effect of higher rates.

To summarise, an interest rate rise increases the cost of borrowing and tends to reduce the growth of consumer spending and investment. In turn, this leads to slower economic growth and lower inflation. See: effect of higher interest rates.

Case for interest rate rise

Inflation is above the government’s target. The government’s target for inflation is 2% +/-1. With CPI inflation at 3%, this is at the upper end of the target. Higher interest rates will depress growth in spending and reduce inflation in the coming months.

Record levels of personal borrowing. Consumer credit growth is running at 9.9% a year (link). This is despite stagnant real incomes; evidence suggests people are responding to the pay squeeze by reducing savings and borrowing more. Low-interest rates have helped to fuel the growth in consumer credit. In 2010 a £10,000 personal loan had an interest rate of 10%. In 2017, that is now 4%. (link) Credit card companies are offering longer periods of 0% balance transfers. The concern is that this period of ultra-low interest rates is fueling an ‘addiction to debt.’

Warning interest rates can rise. People have become so used to cheap borrowing it has become part of many household strategies. An interest rate rise now would be a signal to households that they cannot rely on these low interest rates forever. The argument is that a small interest rate rise now, may be less damaging than allowing credit growth to increase even further. A modest 0.25% rise will be a reminder interest rates can rise and the current period of close to zero is historically unprecedented.

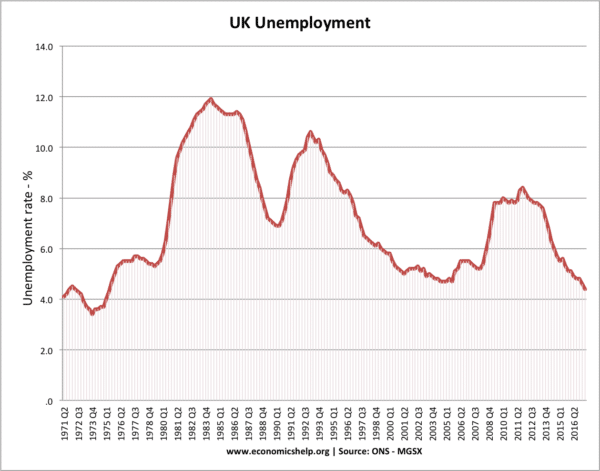

Fall in unemployment

The official unemployment rate is 4.3%. A rate not seen since the 1970s. Usually, a fall in unemployment is a sign that the labour market is experiencing a tightening and this, in turn, tends to cause inflationary pressures. With lower unemployment, firms may need to start increasing nominal wages to attract workers. Already some firms report labour shortages – especially in those sectors reliant on immigrant labour. It is not only a fall in unemployment, but also a rise in employment levels with more people attracted into the labour market. With unemployment at record lows, historically it is a time for interest rates to rise.

Recession did not materialise

Case against an interest rate rise

1. Economic growth per capita is weak

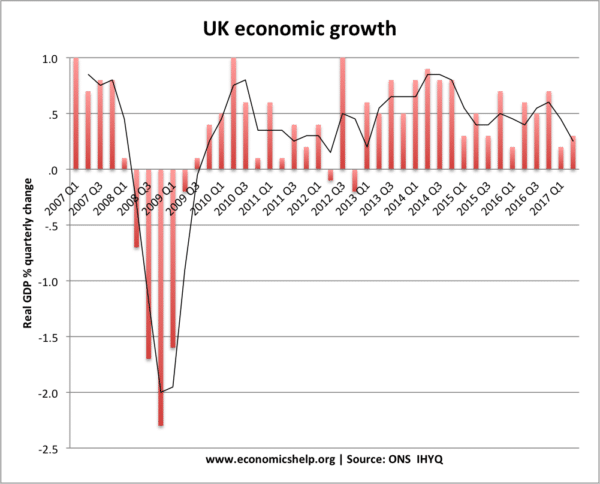

Last quarter economic growth was 0.4% – it means the UK annual growth rate is around 1.3% – but this is around half the long-run trend rate (of 2.5%). Furthermore, GDP growth is exaggerated by growth in the population (population growth has accounted for roughly 33% of recent UK GDP growth in recent years). If we look at GDP per capita, the economy is growing well below the trend rate of growth and therefore no need for interest rate rise.

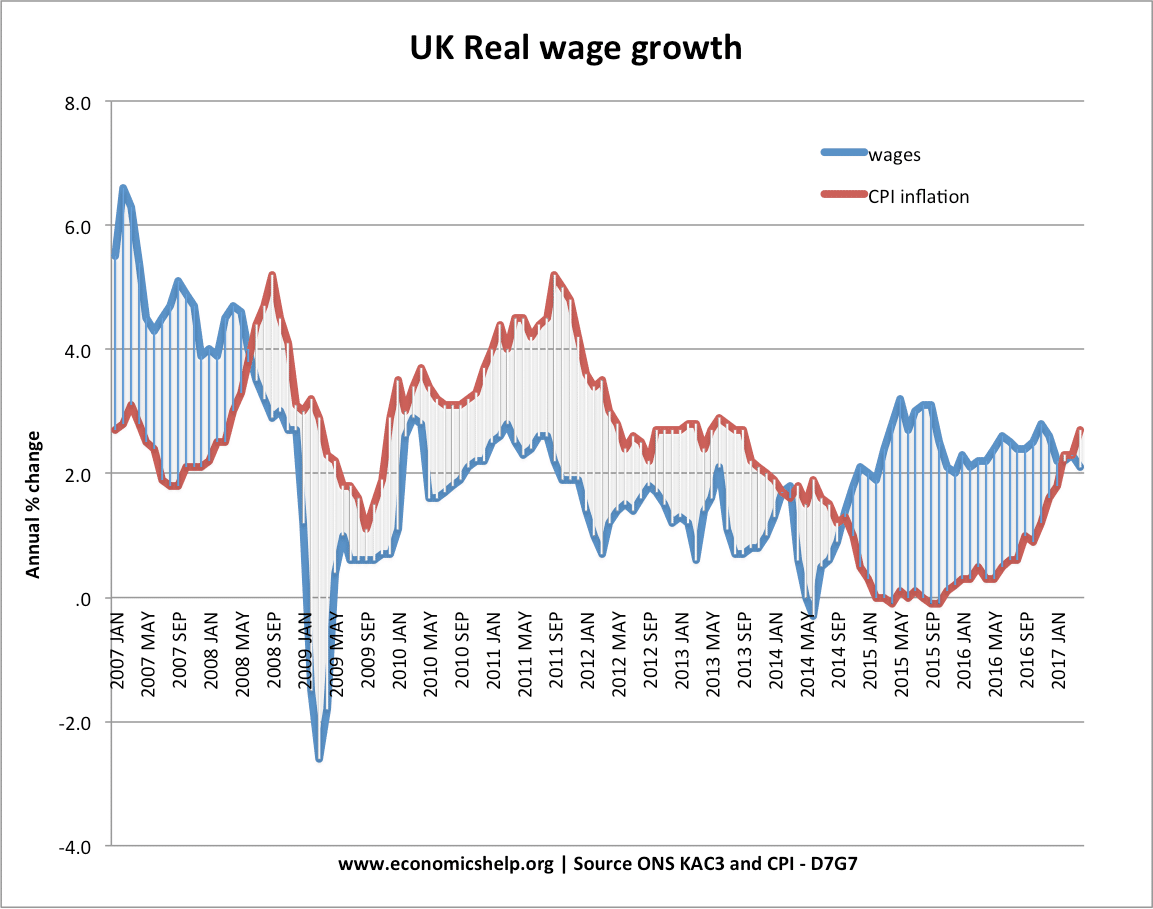

Real earnings growth is negative

A better insight into underlying inflationary pressures is the negative real wage growth. This is important for a few reasons. With negative real wage growth, demand will already be weak. We don’t need interest rates to reduce consumer spending and investment. Secondly, negative real wage growth shows that there is no sign of any wage inflation. Nominal wage inflation is around 2% a year. This shows that there are not any underlying inflationary pressures in the economy.

Cost-push inflation will soon dissipate

The current UK inflation is being driven by temporary cost-push factors – mostly the impact of the recent devaluation which increases import prices. However, in a few months, this cost-push inflation will fall away from the inflation statistics. Interestingly in 2011 UK experienced cost-push inflation of close to 5%. In this case, the Bank correctly kept interest rates at zero, knowing the inflation was only temporary. Arguably, it is no different in 2017.

Low unemployment is a misleading indicator

In recent years, the labour market has changed considerably. We seem to have a much more flexible labour market, and a fall in the NAIRU. Simon Wren-Lewis at Mainly Macro, argues the Resolution Foundation index on unemployment is a better guide to the state of the labour market, arguing long-term unemployment is still above pre-crisis levels

Poor productivity and investment

The UK economy is suffering from an unprecedented supply side shock with low productivity growth. Higher rates would discourage investment when the economy needs investment. However, if firms won’t invest with interest rates this low – it suggests there is a deeper problem than interest rates.

Fiscal tightening will continue

With poor productivity harming tax revenues, the chancellor is committed to limiting the growth of public spending.

Conclusion

It is interesting the Bank is considering a rate rise now – despite similar inflation and growth figures to 2013. From purely an inflation perspective, there is a good case to ignore the headline rate of 3% as it will almost certainly prove temporary. A better sign of long-term inflationary pressures comes from nominal wage growth – but this is still very weak.

It seems the strongest case for raising interest rates is concern over record levels of consumer borrowing. The Bank may fear that the current ultra-low interest rates are encouraging an unhealthy addiction to debt, and a small rate rise now, may slow-down the growth in consumer credit before it becomes ‘more of an unsustainable credit bubble.’

Related