Readers Question: Will interest rates rise? Some say yes, my investment analyst/advisor says no (“because the UK is largely living on credit and the government and bank of England do not want a repeat of 2008”)

Interest rates will rise when the Bank of England feel the economy has returned to a normal trend of economic growth and underlying inflation (ignoring cost-push factors) is predicted to rise above the government’s target of CPI 2%.

Given recent rises in US interest rates and a fall in UK unemployment to 4.7%, it is more likely interest rates will rise than in past several years.

But the first thing to mention is how often forecasts of rising interest rates have proved wrong in the past few years.

This graph shows how markets and analysts have been predicting interest rates will rise. However, this forecast of rising interest rates has not been inaccurate.

Each year, since 2009, interest rates have been forecast to rise in 12-18 months, but they never have.

Historical interest rates

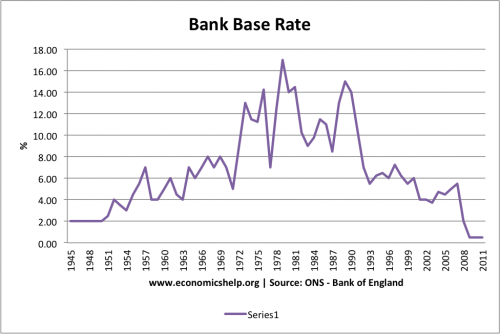

One reason for the prediction of higher interest rates is looking at historical interest rates.

Interest rates have never been zero for this long in history. Even in the Great Depression, interest rates stayed at 2%

Why have interest rates stayed so low for so long?

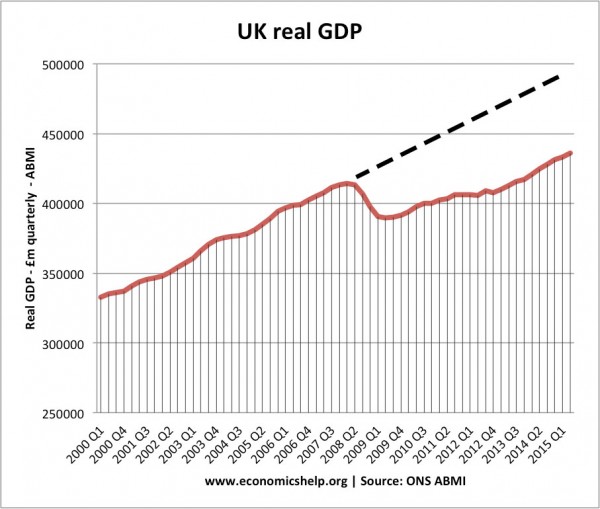

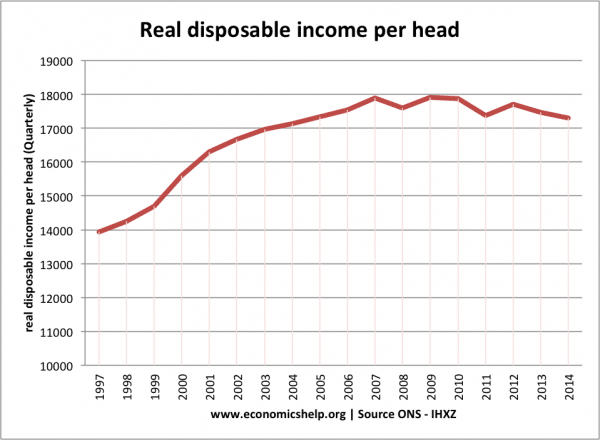

Essentially, the economy has been stuck in below trend growth since 2009. The economy has not caught up with the lost capacity of 2009 recession. GDP statistics flatter the actual performance of the economy. If we look at GDP per Capita and average earnings, the economic performance appears even more sluggish.

In the past two years, average earnings have performed slightly better, but not much.

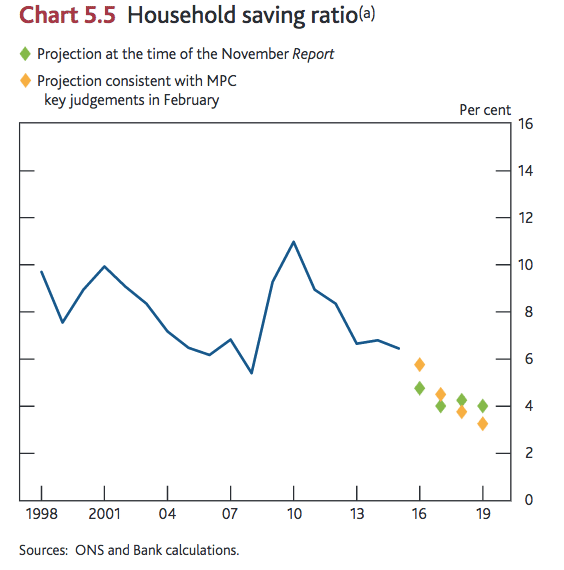

The strong levels of consumer spending have been partly maintained by a fall in the savings ratio

Continued fiscal austerity

At first glance, the government appears to be maintaining fiscal neutrality, but there is also n effort to reduce government spending as % of GDP which is exerting deflationary pressures. This government spending squeeze is one reason for the continued easing of monetary policy.

Prospects for rising in interest rates

- Despite sluggish growth and fragility of the economic recovery, unemployment continues to fall – 4.7% January 2017. It is unprecedented for unemployment to fall so much without a rise interest rates.

- US interest rates. The fact US interest rates have started to rise (0.75%) is perhaps the strongest argument to suggest UK rates will also rise in 2017/18. It shows the liquidity trap and era of low-interest rates can be broken. The US recovery is stronger than the UK, but rises in US rates make it more likely the UK will start to consider raising rates too.

- Inflation. UK inflation is forecast to rise in 2017, primarily due to the effects of Sterling’s depreciation. Usually, a rise in inflation to 3% would cause the Bank of England to increase interest rates. However, in 2011, we had inflation of 5% – without any increase in interest rates because they understood it was temporary, cost-push inflation. The problem is that the rise in inflation over 3% makes a case for higher interest rates to keep inflation on target. But, at the same time, the rise in inflation will also depress weak consumer spending, making a case for monetary easing.

A Repeat of 2008?

It is true the UK has a fall in savings ratio, high levels of consumer debt and households are being squeezed by stagnant incomes and rising prices, but there are also many differences with the lead-up to 2008. There hasn’t been the same binge in mortgage lending, and rise in bank lending. Despite low-interest rates, it has been difficult to get finance and loans.

I don’t think the Bank of England will be increasing interest rates to deal with the boom in housing prices or boom in bank lending.

So when will interest rates rise?

If you’re uncertain about economic predictions, just looking at what happened last year, makes a reasonable guide to the future. In other words, the best guide to predicting interest rates for the next year is just choosing the figure of the current year. Interest rates are now entering their eighth year at close to zero.

Related