Readers question: Does the government determine the interest rate for their bonds?

- The government finances its debt by selling bonds on the open market. (in the UK they are termed gilts)

- In the UK, government debt is managed by the UK Debt Management Office DMO. They sell gilts on behalf of the government. Initially, they set the interest rate for new issues of gilts.

- A conventional gilt will have an interest rate and maturity set by the DMO.

For example:

3% Treasury Gilt 2019

- For example, this is a 5 year gilt at an interest rate of 3%

- This means the purchaser of the gilt will be repaid the value of the gilt (principal) in 5 years time (2019).

- During those 5 years, the holder will received interest payments of 3% per year.

The interest rate set at the point of issue will reflect market interest rates. The DMO has a mission to fund the government’s debt as cheaply as possible. Therefore, they will try and set an interest rate as low as possible so that people buy just enough.

Recent gilt issuances

- 08-Sep-2015 – 3½% Treasury Gilt 2045 (£2 billion sold) (Yield at AAP – 2.4%)

- 02-Sep-2015 – 1½% Treasury Gilt 2021 (£3.75 billion sold) (Yield at AAP – 1.5%)

- link UK DMO

The DMO set an interest rate of 3½% for 30 year gilts, and 1½% for 6 year gilt

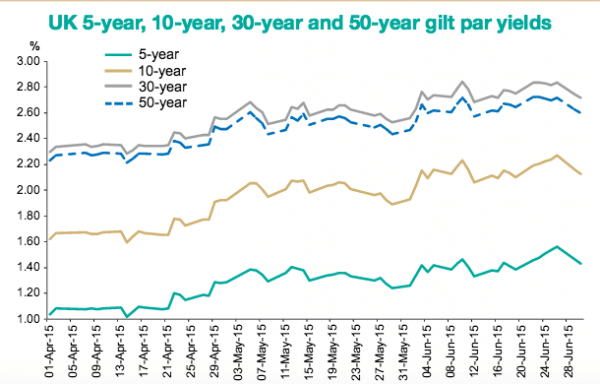

Current gilt yields

This shows yields on UK gilts during 2015. The rise during May / June suggests markets expect interest rates to rise.

Market determination of gilt yields

Once gilts are sold by the DMO (government). The gilt can be bought and sold on the open market. This enables investors to buy and sell gilts.

This bond market will determining the price of bonds and also the effective bond yield.

For example, if we start off with a £1,000 bond with 3% yield.

If investors are nervous about holding UK government bonds (e.g. fear inflation / debt default), then they will start selling bonds. This will cause the price to fall. If that £1,000 bond fell in price to £500. The new buyer would effectively get a 6% interest. (See also determination of bond yields and bond prices)

- Less demand for holding bonds, pushes up interest rates.

If the market doesn’t want to hold UK bonds, then in the future, the DMO will have to start offering higher interest rates. If the market rate is now 6%, it will have to offer higher bond yields on future gilt sales – making it more expensive to fund future borrowing.

The government doesn’t have much control over these market interest rates. Though the actions of the government and Central Bank can influence bond yields.

For example, if there was a panic over the government’s ability to finance its debt, the Central Bank could step in and buy bonds itself. Providing liquidity in the bond market would improve confidence and this will usually reassure investors.

This shows that bond yields on many Eurozone countries increased during 2011/12 because there were fears over the liquidity of Eurozone bond markets.

Intervention by the ECB has helped reduce market bond yields.

Factors that influence bond yields

Bond yields will be determined by factors, such as

- Relative inflation rates – higher inflation, will tend to cause higher bond yields

- Savings ratio – higher savings ratio may lead to higher demand for buying gilts and push down interest rates

- Economic growth – higher economic growth tends to cause bond yields to rise as investors expect higher interest rates. A recession, tends to reduce bond yields.

More at factors that influence bond yields

Related

Good, clear post. One typo though: in 3% gilt example, third bullet says 4%.

Thanks.