Readers Question: How important is the budget deficit?

The budget deficit is the annual amount the government borrow. The government usually financed the budget deficit by selling bonds to the private sector

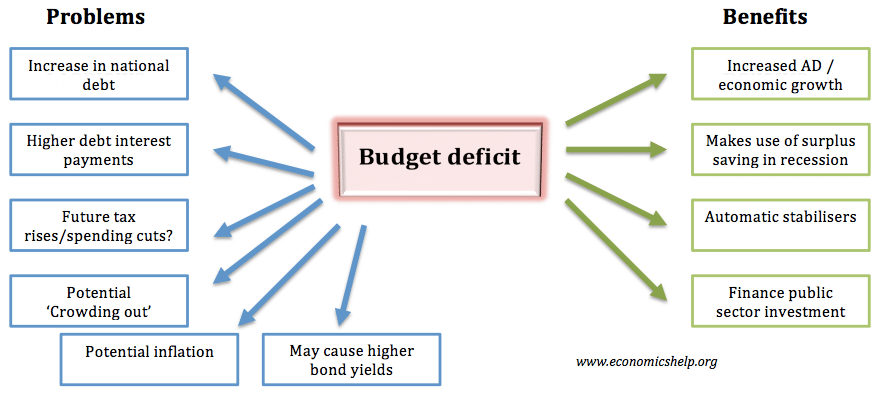

To libertarian and free-market economists, budget deficits are liable to cause significant economic problems – crowding out of the private sector, higher interest rates, future tax rises and even potential for inflation. However, Keynesian economists are more sanguine arguing that in an economic downturn, a budget deficit plays an important role in stabilising economic growth and limiting the rise in unemployment.

Budget deficits have potential economic costs, but it depends on the economic climate, the exchange rate system, interest rates and the reason for government borrowing.

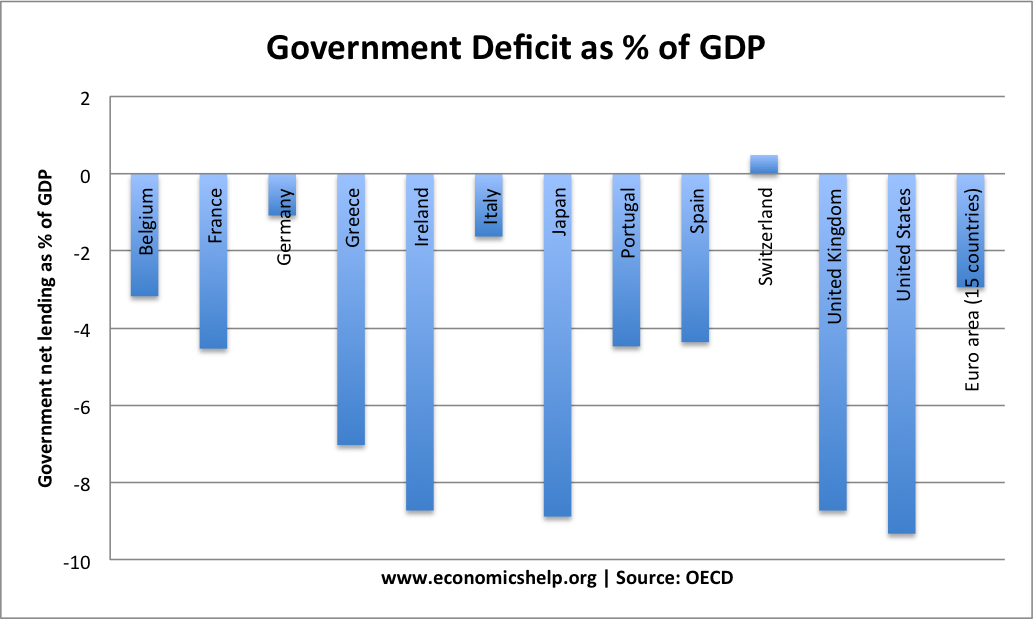

OECD – Budget deficits 2012

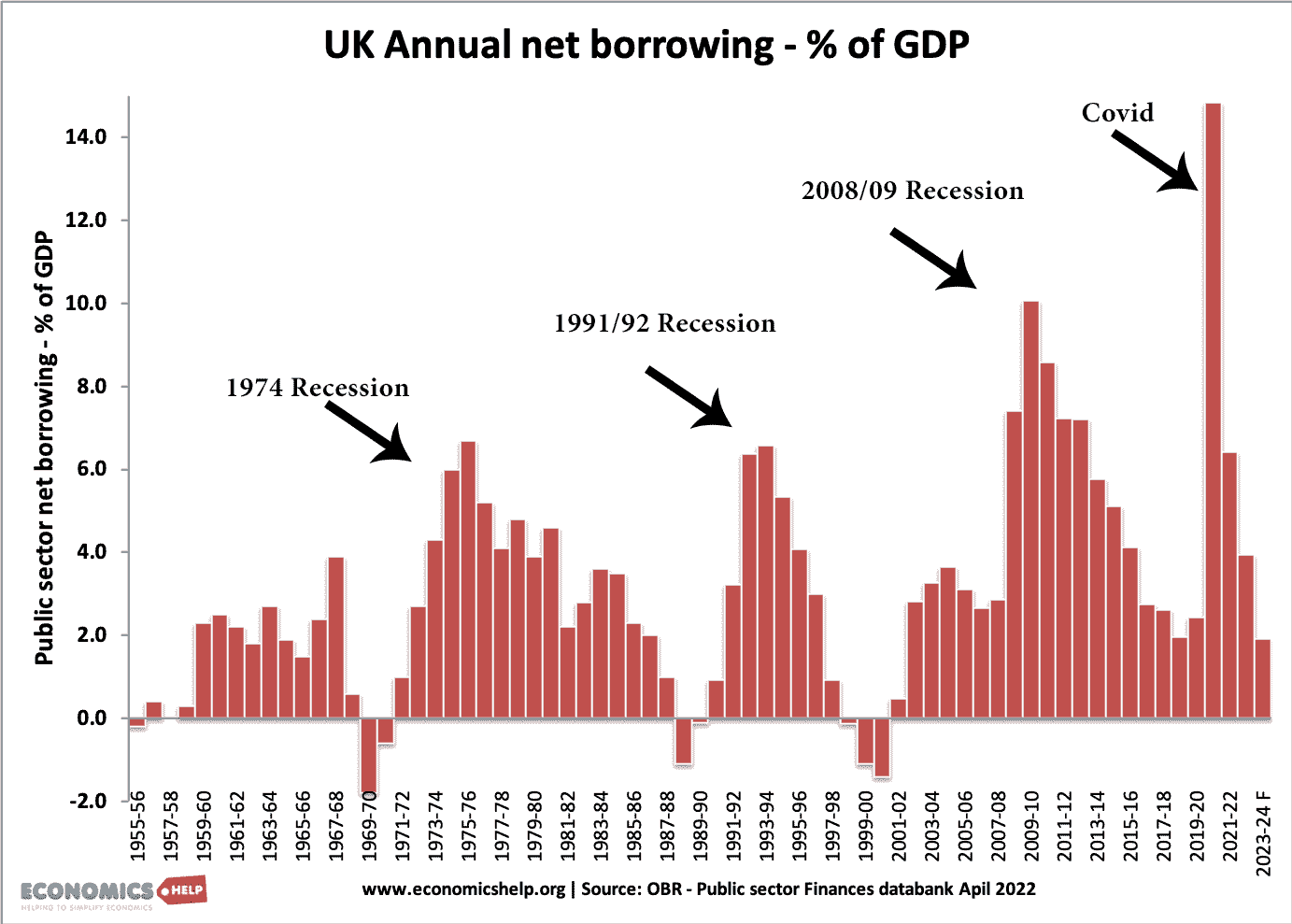

The most useful way of measuring the size of the budget deficit is as a % of GDP. The graph below shows that in 2012, there was a large variance in the size of budget deficits. The biggest deficits occurred in Ireland, Japan, UK, and US – with budget deficits of over 8% of GDP.

Potential benefits and costs of a budget deficit

Reasons to be concerned about a budget deficit

- Need to cut spending in the future. Higher deficits are not sustainable forever. Reducing a budget deficit can be problematic. If a country has a deficit that increases too quickly, the government may be forced to adapt policies aimed at a sharp deficit reduction. These ‘austerity measures’ can cause a fall in aggregate demand. For example, during 2012-16, many countries in the Eurozone sought to reduce their budget deficit to comply with EU rules. This deficit reduction caused lower growth, recession and unemployment.

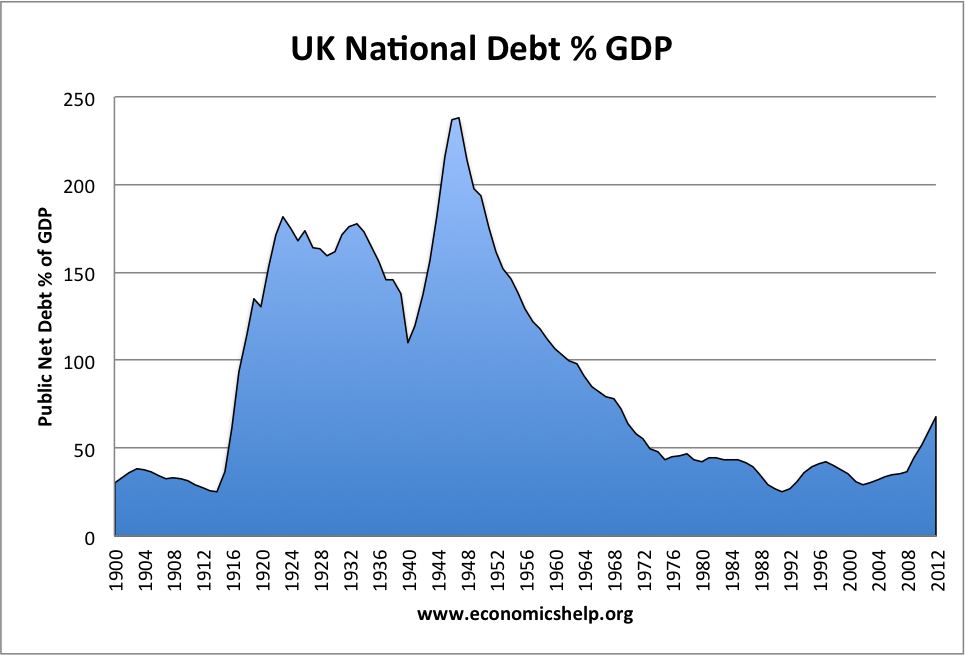

- Increasing national debt. A budget deficit increases the level of public sector debt. Large deficits will cause national debt as a % of GDP to increase.

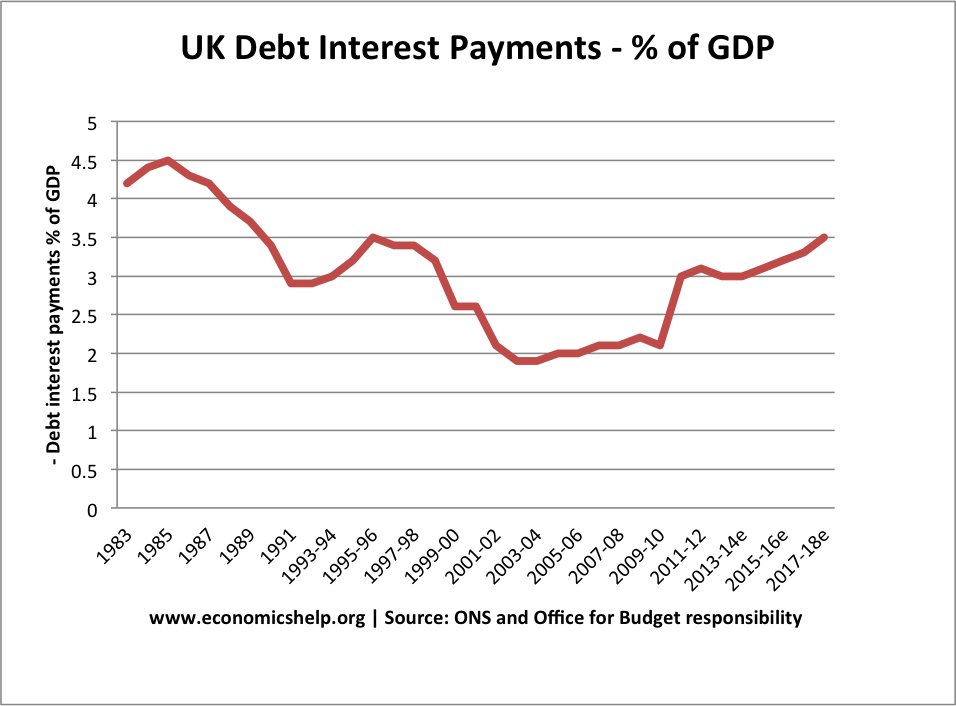

- Opportunity cost of debt interest payments. A higher deficit will also lead to a higher % of national income being spent on debt interest payments.

- Crowding out. One way of thinking about a budget deficit is that if the government is borrowing from the private sector, the private sector has lower funds to spend and invest. The government is, therefore ‘crowding out’ the private sector – and some economists will argue government spending is liable to be more inefficient than the private sector.

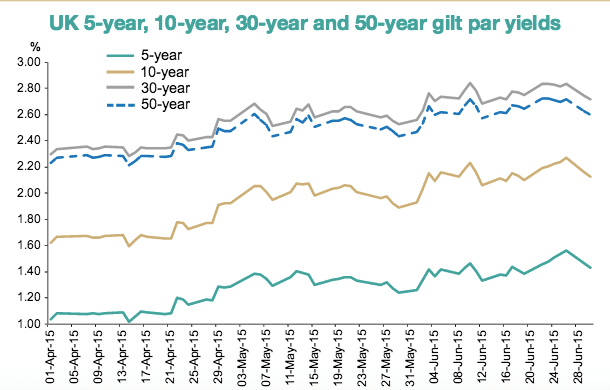

- Potential rise in bond yields. Countries with large deficits may struggle to attract sufficient investors to buy bonds. If this happens, bond yields will rise causing the deficit to be more expensive to finance.

- Potential inflation. There is a fear that budget deficits could be inflationary. For example, if a country like the UK was struggling to attract sufficient investors to buy UK bonds, the Central Bank could effectively print money and buy bonds. However, unless the economy is in a liquidity trap, printing money will cause inflation, and reduce the value of savings, including government bonds. It is worth pointing out, that in developed economies – inflation from printing money resulting from a budget deficit is quite rare.

- Confidence effects. High levels of government borrowing may adversely affect confidence as consumers and firms fear future tax rises or higher interest rates.

Evaluation

There is no simple answer to whether a budget deficit is helpful or harmful because it depends on quite a few factors.

1. It depends on when the deficit occurs. Basic Keynesian analysis suggests that a rise in the budget deficit during a recession is a good thing. In a recession, private sector spending falls and saving rises – leading to unused resources. Government borrowing is a way of utilising these unused savings and ‘kickstarting’ the economy. The deficit spending can help promote higher growth, which will enable higher tax revenues and the deficit will fall over time. If you try to balance the budget in a recession, you can make the recession deeper. Austerity can be self-defeating.