Readers Question: National debt is now extremely high. However aren’t there different kinds of debt e.g that which funds current spending, that which funds investment in infrastructure and emergency (bank bail out etc) Surely it’s the first we should really be worried about and less concerned with borrowing that makes the economy more efficient such as infrastructure

1. ‘National debt is now extremely high.’

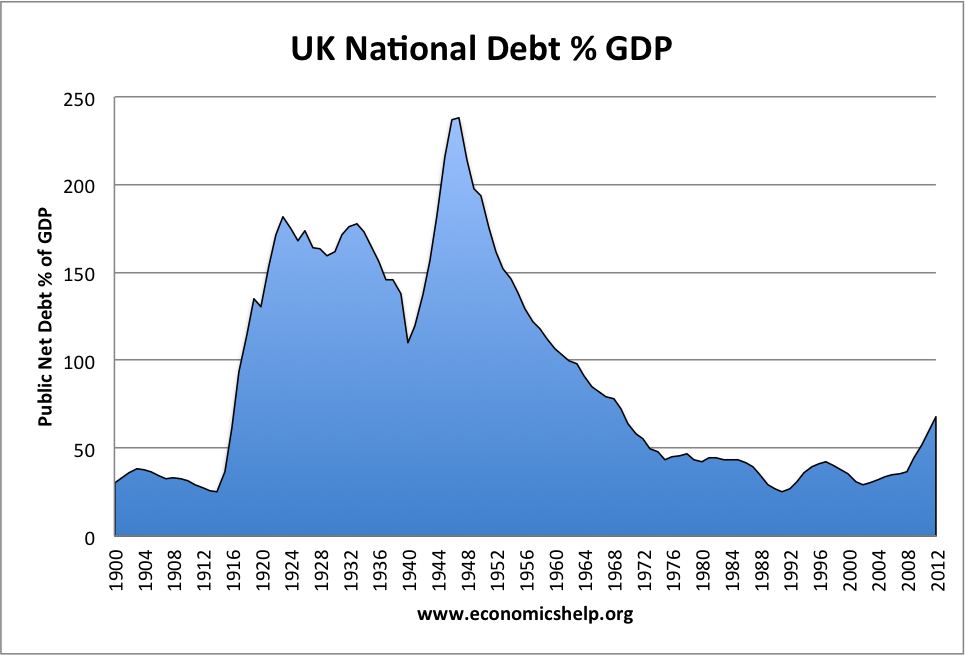

But, is national debt extremely high? In one sense, a public sector debt of £1,193.4 billion is very high. But, if we compare national debt as a % of GDP (which is most meaningful comparison) over the past 100 years, it is significantly lower than between the 1920s and the 1970s. The increase in national debt we have seen in the past few years, is partly a reflection of the recession and rise in cyclical borrowing. In a recession GDP falls, but tax revenue also falls and government spending increases. If the private sector cut back on spending in a recession, it is helpful to the economy for government borrowing to rise temporarily.

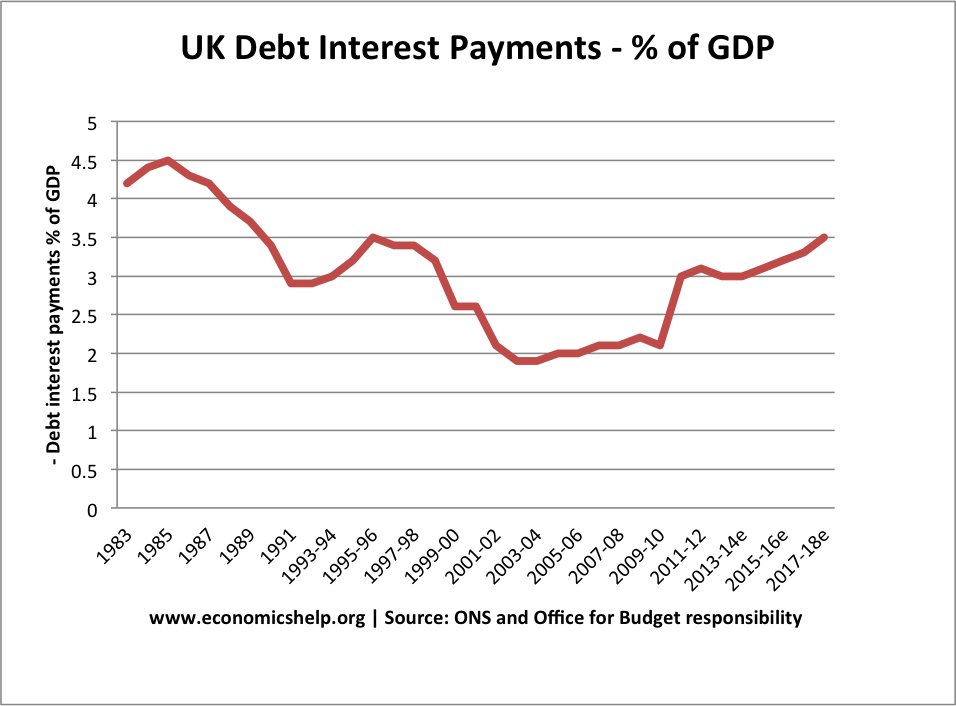

If you look at the cost of servicing national debt (interest payments as % of GDP) it is also relatively low. The cost of debt interest payments as a % of GDP was significantly higher in the 1980s.

2. aren’t there different kinds of debt

Not really. When selling bonds, the government doesn’t distinguish between the use of the government borrowing. However, we can split debt up into

- Structural deficit – the level of borrowing that would occur if the economy was operating at full capacity (i.e. ignoring borrowing as a result of the recession)

- Cyclical deficit – the level of borrowing that has occurred as a result of the economic downturn.

Different kinds of government spending

Within the government spending levels, there are different sections, including:

- Current expenditure

- Public sector investment

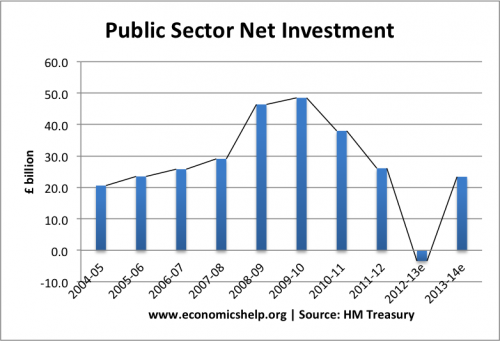

Public sector investment includes government spending on infrastructure (new roads, railways e.t.c) It is a small % of overall government spending.

During the period 2010-12, public sector investment was cut:

Does it matter whether the government cut current spending (e.g. benefits, health care spending) or public sector investment?

Firstly, whatever type of spending you cut, the impact on aggregate demand should be similar.

- If you cut welfare spending, people will have less disposable income, causing a fall in consumer spending and lower aggregate demand.

- If you cut investment in building new roads, there will also be a negative impact on aggregate demand, due to less investment in the economy.

It is possible the recessionary impact of cutting public sector investment may be greater. There is a bigger negative multiplier effect for cutting public sector investment which has several knock on effects throughout the economy. The government, to some extent, have reversed their cuts in public sector investment. They now see high profile public investment as a way to boost economic recovery.

- see also: Impact of cutting public sector spending

It is possible that cutting government spending may not reduce aggregate demand. Lower government spending and lower government borrowing, may enable more funds for the private sector to invest. If you cut government borrowing during a period of economic growth, then the private sector may offset the fall in government spending.

However, in a deep recession, in a liquidity trap (e.g. 2008-2012) this didn’t occur. The private sector were reluctant to invest. It depends when you cut government spending.

Supply side effects

If you cut public sector investment, then in the long term, there is likely to be lower economic growth. This is because the economy will increasingly experience supply constraints, such as road congestion due to lack of investment. Therefore, cutting public sector investment can be seen as a short-sighted policy because you reduce aggregate demand, but also restrict the growth of productive capacity. Cutting welfare benefits haver fewer supply side effects. Some economists may argue cutting welfare payments could actually boost productivity because it encourages people to go to work. However, cutting welfare benefits could increase inequality and doesn’t necessarily boost productivity; it could even damage worker morale.

Related

Fantastic help, really clear and concise

I appreciate that it points out the differences in what left and right actually are.

thanks for the information