Since the credit crisis of 2008, the UK economy has experienced structural weakness of

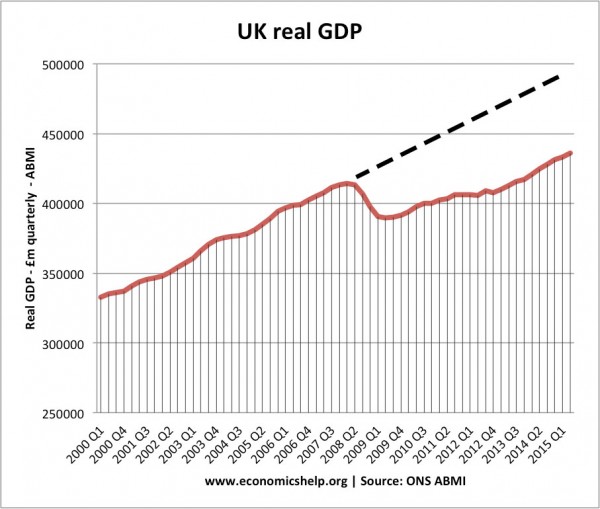

- Low economic growth

- Very poor productivity growth

- Weak demand

- Unbalanced economy geared towards consumption and low levels of investment.

In addition to these structural weaknesses, the UK economy in 2020 now faces real threats from

- A hard Brexit

- Risk of slowdown in China and the world

Some of the main threats to UK economy include:

1. Brexit

The Brexit pursued by the UK is likely to involve a ‘hard Brexit’ and the imposition of tariff barriers and non-tariff barriers with our EU trading partners. Around 50% of UK trade is with the EU, so this will be very costly – especially for manufacturing industries, such as the car industry. Many firms have invested in the UK on the basis of membership of the Single Market and free movement of goods and services. Manufacturing firms have deeply integrated supply networks with parts coming from over the world. Disruption to this will increase costs and discourage firms from setting up in the UK. Already the UK car industry is in serious difficulties with output falling and confidence very low.

Since 2016 referendum the main threats of Brexit have been uncertainty. But from the end of 2020, UK business could face very real changes in the way business is done, with notably higher costs and friction of doing business. An end to regulatory alignment and new tariffs with Europe could prove very costly.

2. End of free movement of labour

In the UK, many industries have relied on the free movement of workers from Europe to fill job vacancies, such as seasonal farm workers, hotel staff, waiters. Without access to this young, mobile labour source, some firms will struggle to keep producing goods and will be forced to raise wages or close down.

3. Weak global growth

The global economy is struggling to meet previous rates of economic growth. With the exception of US, many economies are experiencing weak / below trend growth. The biggest threat to UK growth is the European Union. Growth in the Eurozone is slow, and given the Eurozone is the UK’s main trading partner, a recession in the EU, will definitely affect UK exports and UK confidence.

Further abroad, there are fears that emerging economies, such as China may start to grow much slower than previously. Fears over the extent of the coronavirus have already hit normal economic activity with a fall in manufacturing in China and decline in global movements. Exports to China and other emerging economies are currently a small % of UK exports, so the direct impact may be limited. However, if China and the global economy slows down, the UK will be indirectly affected through lower confidence, leading to lower global investment levels.

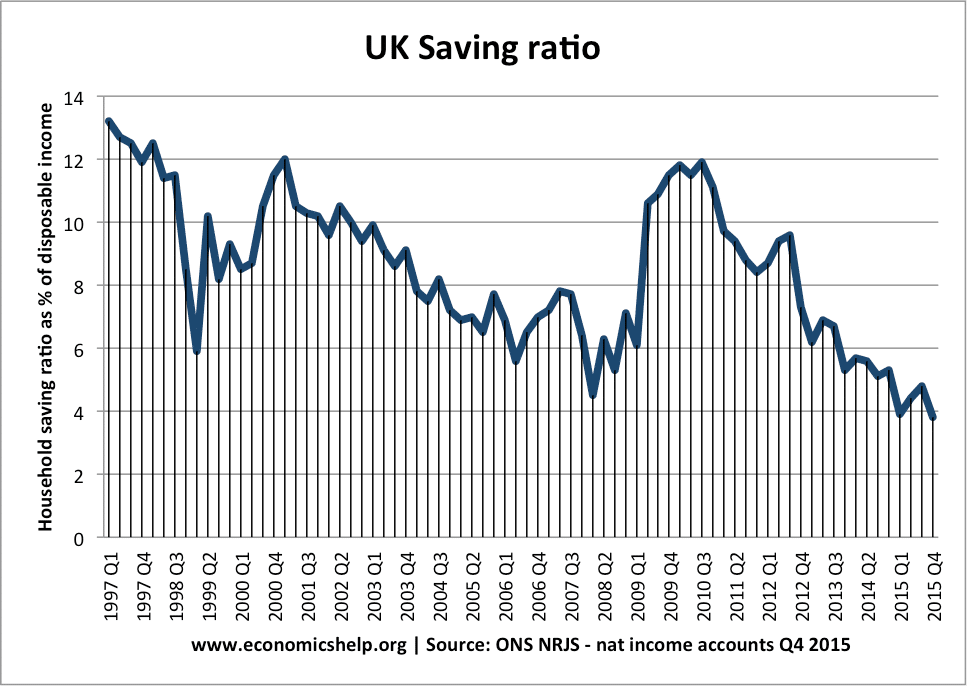

4. Unbalanced growth

Recent UK growth has been based on consumer spending and a low savings ratio. This leads to an unbalanced economy and lack of investment in the future infrastructure.

Low savings ratio, leads to lower levels of investment. The UK has many supply bottlenecks from congestion on roads and limited transport capacity.

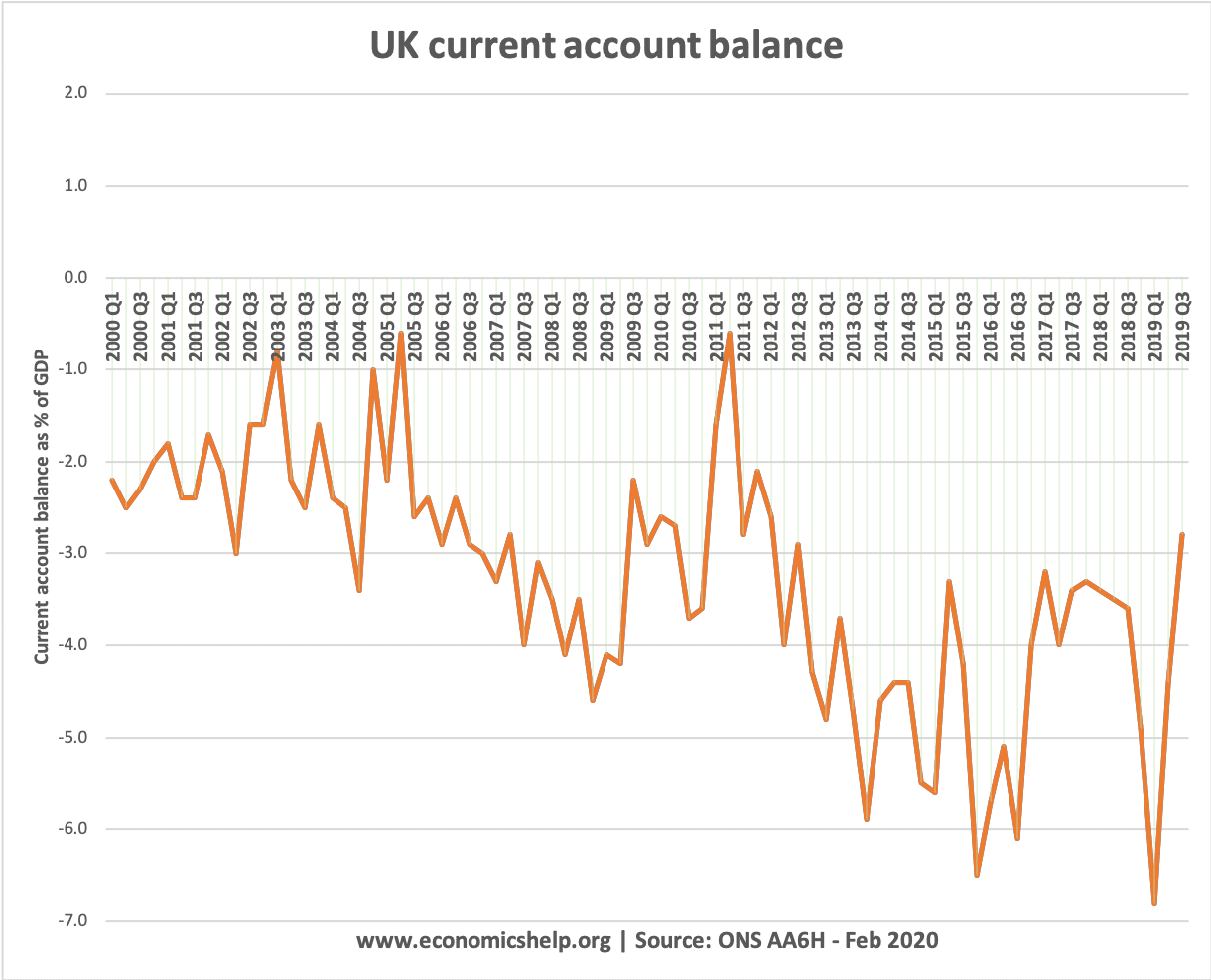

5. Current account deficit

Since 1980, the UK has had a persistent current account deficit, so in one sense, this is nothing new. Still to have a current account deficit of nearly 5% of GDP at the end of 2019 is a sign that the recovery is unbalanced – relying on consumer spending (leading to higher imports), but little export led growth.

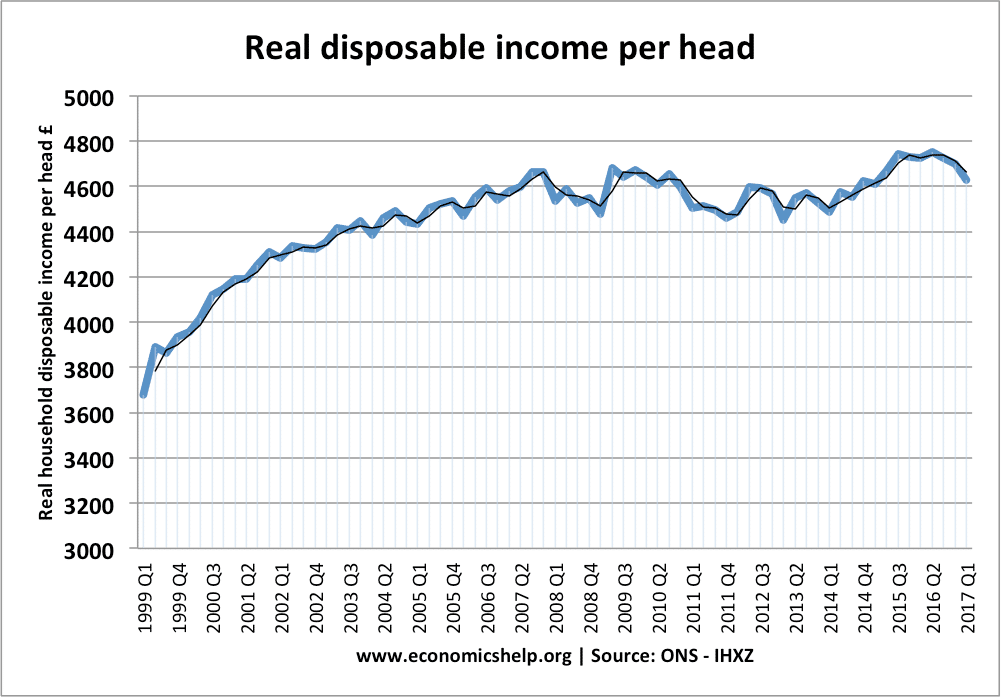

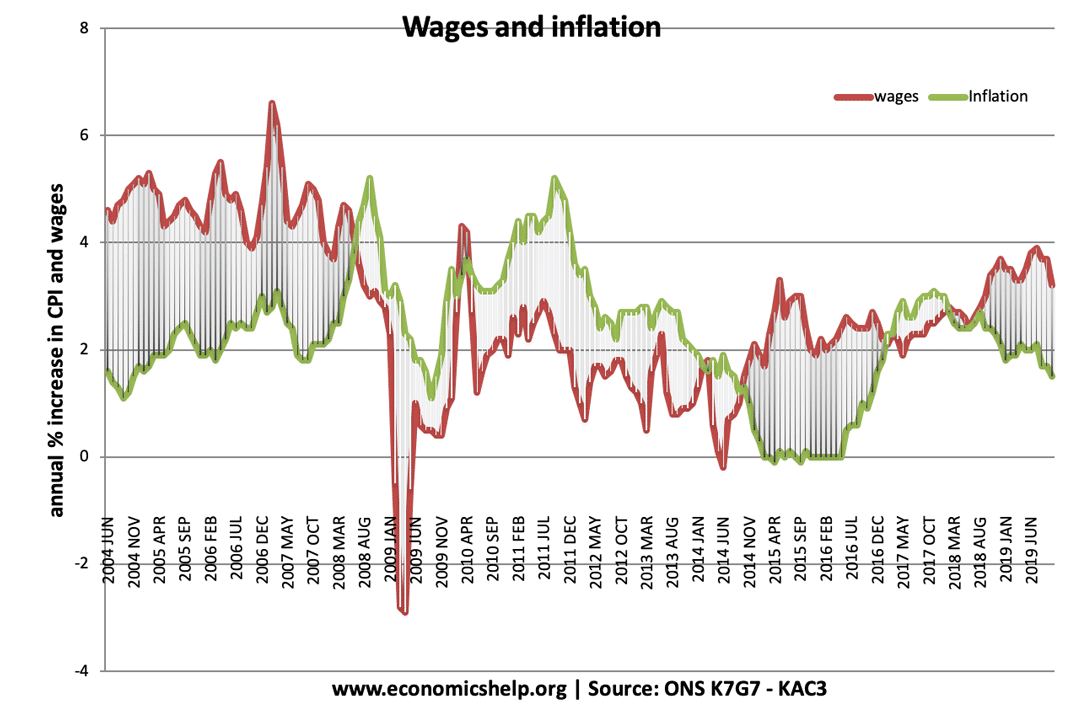

6. Stagnant real wages

For a long period the UK had a period of negative real wages. This limits household disposable income. There has been a small recovery in recent years, but the outlook is still poor compared to long-run trends.

UK economic growth is partly been driven by population growth. If we look at real disposable income per head. It is still below the pre-crisis peak. This explains why many households are facing difficult economic circumstances – despite official stats looking better. In other words, the UK recovery looks more impressive using real GDP, but if we look closer at average household incomes, living standards are stagnant. A prolonged period of stagnant real wages may influence long-term consumer spending patterns and limit future growth.

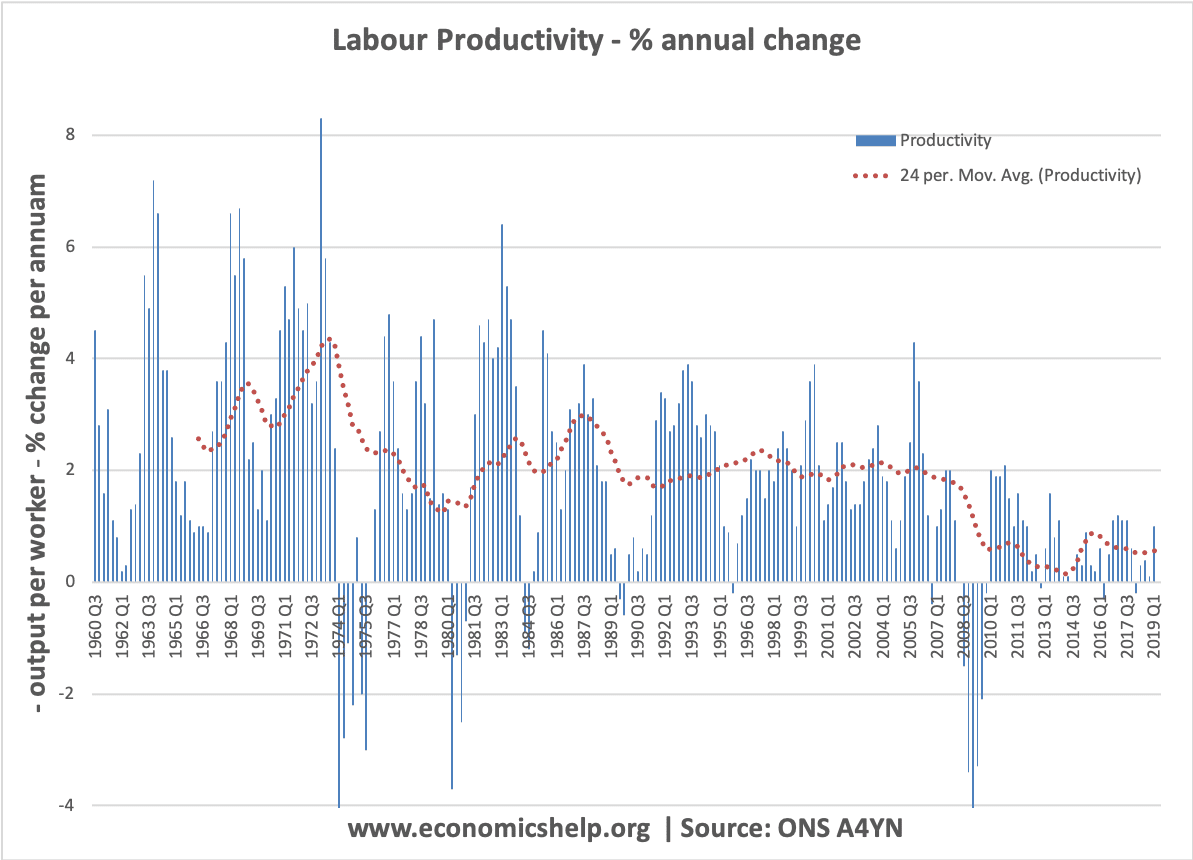

7. Low productivity growth

The ONS estimate UK productivity is 15% below a pre-crisis trend. Despite growth in the past couple of quarters, productivity is only just above the pre-crisis trend. Poor productivity growth limits long-term economic growth. Since 2008, productivity growth has remained low by historical standards and also low compared to our main international competitors.

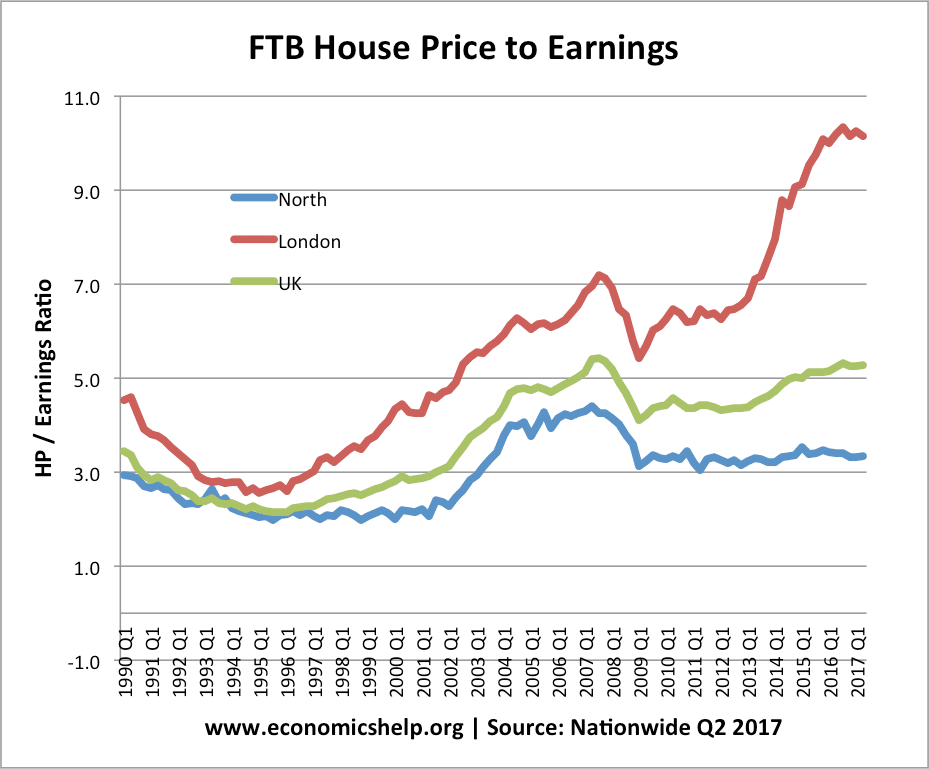

8. Housing market

Despite weak income growth, the UK housing market has seen record levels of house prices. The first fear is that house prices are overvalued, and that prices could fall (if, for example, interest rates rose from current level of 0.5%) If there was a house price correction, this would lead to negative wealth effect and a fall in spending. However, the other problem with the UK housing market is that the shortage of supply is making house prices very high. For many young people, housing costs have increased significantly, meaning that after-housing cost disposable income is low. It is also skewing the labour market in places like London, where housing costs are prohibitive.

9. Weak commodity prices – lack of global investment

In one sense, low commodity prices, such as oil are helping to boost disposable income and this is helping UK growth. But, others see reasons to be concerned about weak commodity prices. It is leading to a fall in investment from mineral producing countries, aggravating a global wide lack of private sector investment. Weak commodity prices are also a sign investors are pessimistic about future growth prospects. This confidence factor and low ‘animal spirits’ could be another drag on global growth which will affect the UK economy.

10. Financial system

The last recession was caused by a global credit crunch and financial problems, which were largely unnoticed. The concern is that financial institutions and banks are still vulnerable to bad loans and a contagion of negative financial confidence. For example banks are vulnerable to falling house prices, mortgage repossessions. It is unclear whether causes of last credit crunch have been resolved.

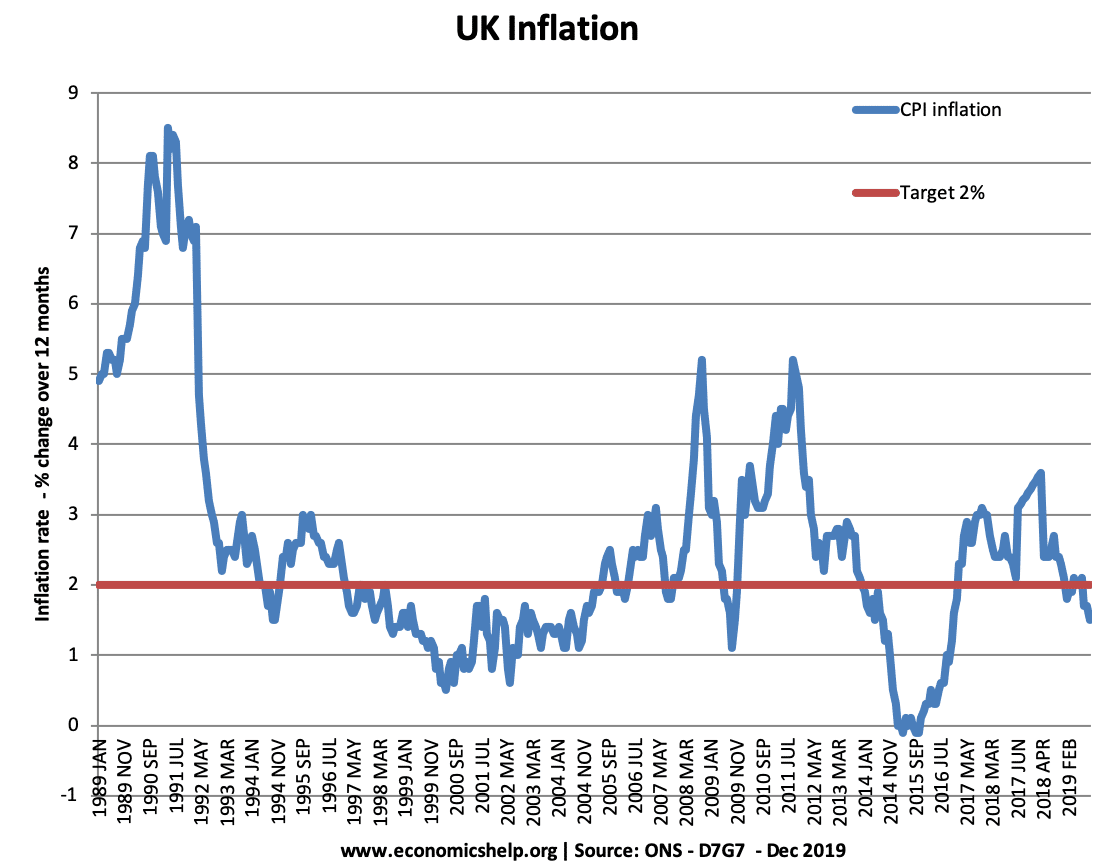

11. Low inflation

The Bank of England have an inflation target of CPI 2% (+/- 1) because the concern is that low rates of inflation can cause many problems associated with deflation. (rising value of real debt, consumers delaying decisions (See: Problems of deflation). With UK inflation heading towards 1%, the fear is that deflation / disinflation could become entrenched, leading to a prolonged period of stagnation. Monetary policy is already accommodative with zero interest rates – but this seems ineffective. The experience of Japan suggests that overcoming deflationary pressures can be much harder than expected.

Reasons to be optimistic

Despite all these potential threats, it is worth bearing in mind.

- Unemployment is near record lows.

- Also, economies are more flexible than many expect. After years of below trend growth, there should, in theory, be spare capacity and chance for the UK economy to catch up lost ground.

Related

- UK economy stats

i just would like to share my views, thanks’

28 november 2015 manila,ph

economy in an intelligent view,

“u.k. economy”

http://www.bloomberg.com/news/videos/2015-11-27/reasons-to-be-nervous-about-the-u-k-economy

https://uk.finance.yahoo.com/video/reasons-nervous-u-k-economy-170634925.html

http://www.msn.com/en-gb/money/other/reasons-to-be-nervous-about-the-uk-economy/vi-AAfJrE1?srcref=rss\

http://finance.yahoo.com/video/reasons-nervous-u-k-economy-170634475.html;_ylt=A0SO8xCgaVlWE8EA6J1XNyoA;_ylu=X3oDMTEyZGN0NXVyBGNvbG8DZ3ExBHBvcwM0BHZ0aWQDQjExNzhfMQRzZWMDc3I-

with due respect to deutsche bank chief u.k.

economist sir george buckley. this is my

view. first of all, i dedicate all my writings

not only to all the people in this world, but

specially to all the brilliant, the smart, genius,

intelligent economists in the whole wide

world. since day one of year 2008 month of

september i already wrote not one country

will ever be spared (this is absolute). i did

not exclude this very beautiful, enchanted

country the united kingdom. america the

greatest and powerful country in the whole

world made a “big mistake” in solving the

year 2008 fall down of the economy. and

thru this negative solutions it brought up a

ripple effect (it spreads, encompass, stretch)

precisely contaminated the world economy.

thanks’

facebook: [email protected]

kindly please take good care and God bless . . . . . . . raul