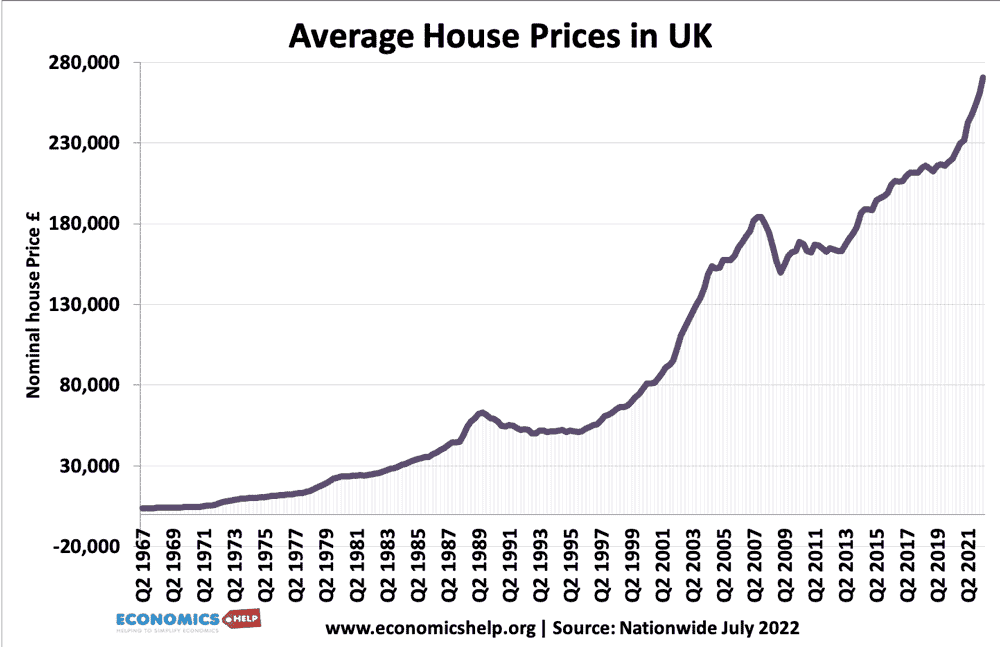

Generation rent is a term to describe those young adults (18-40) who have been priced out of the housing market – unable to buy and having to pay a high percentage of income on rent. As well as an expensive housing market, generation rent faces financial difficulties from high living costs, student loans and low wage growth. It is related to the concept of ENDIES – Employed with no disposable income. The problem of generation rent is mostly related to a broken housing market, where house prices have risen faster than inflation for a number of decades.

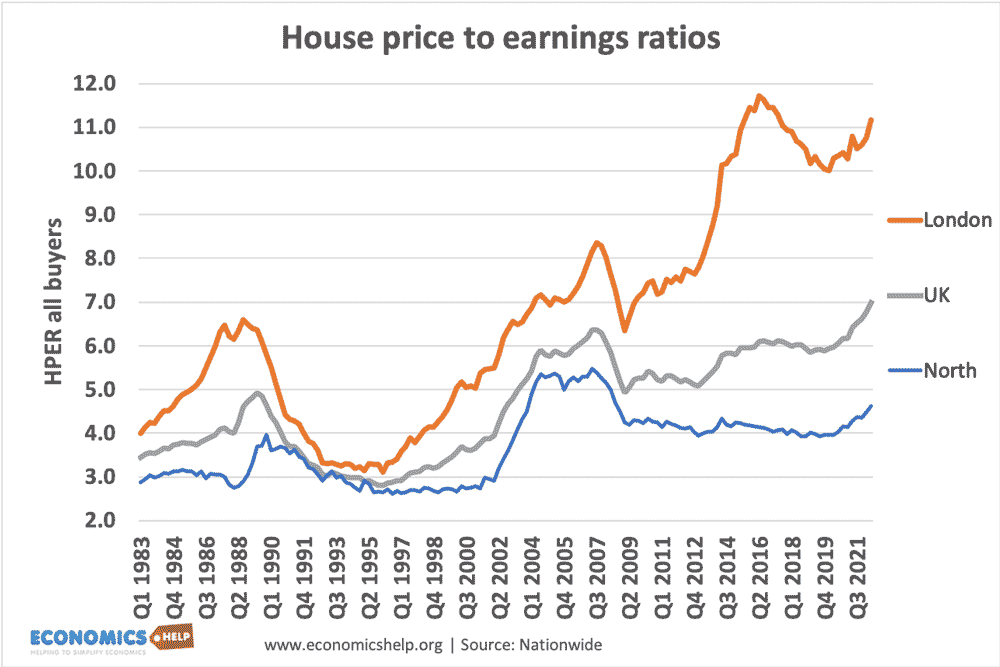

Rising ratios of house price to earnings for all buyers. Despite a small dip since 2015, house prices are still well above long-term averages. The UK has one of the most expensive housing markets in the world.

Causes of generation rent

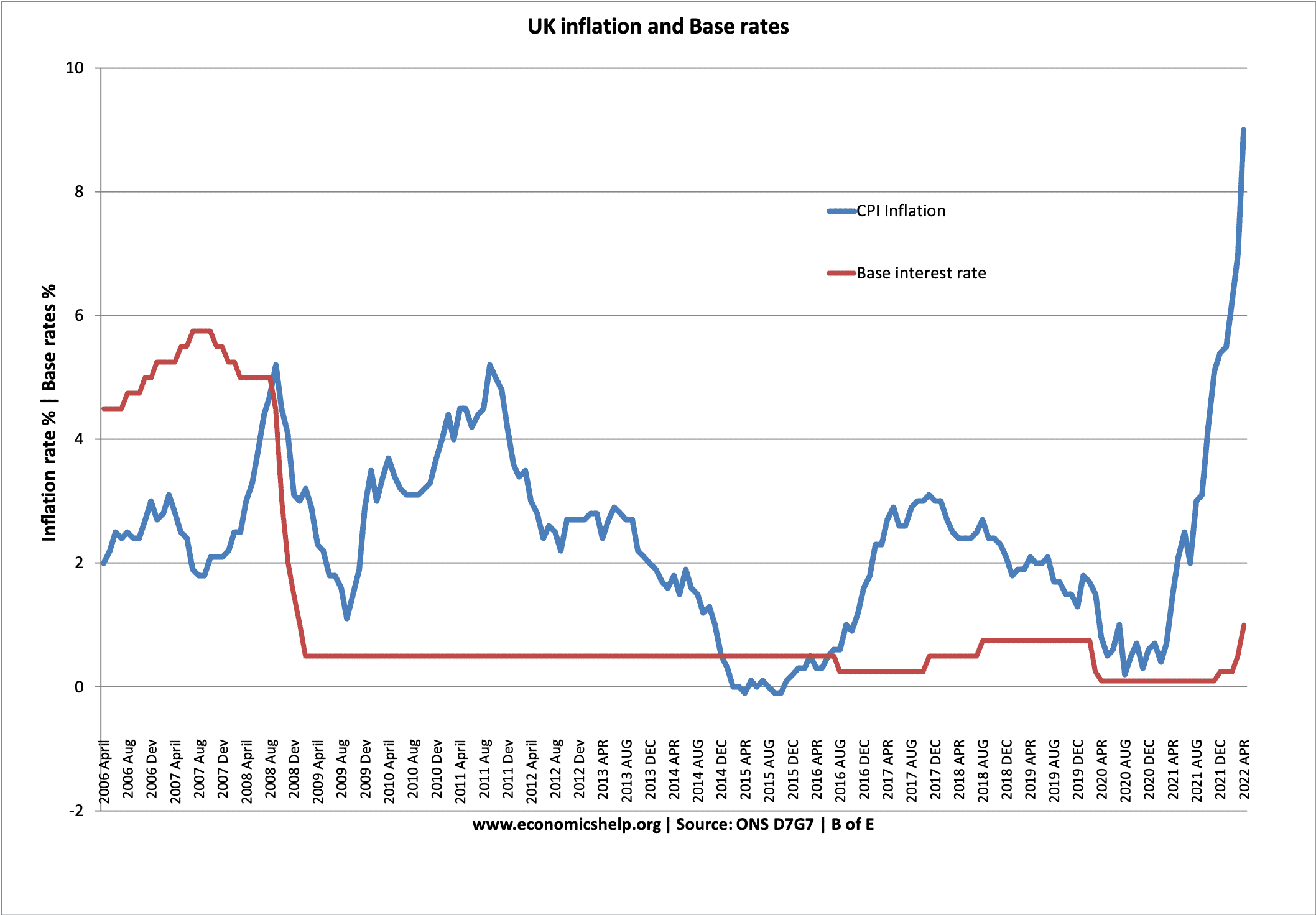

Period of low-interest rates. Low-interest rates have increased the desirability of buying rather than renting. This has encouraged more buy to let. The desirability of buying outright has also pushed up average house prices, meaning that young first-time buyers struggle to get a sufficient deposit.

Shortage of supply. The UK population is growing relatively fast, and the number of households is forecast to grow sharply (also more single people living alone). Demand is forecast to grow by 250,000 a year. However, supply is constrained by planning permissions and the difficulty of making land available.

Other financial constraints on young people. The introduction and expansion of tuition fees has led to growth in student loans. The financial burden of repaying student loans increases the difficulty of also saving to buy.

Weak productivity and real wage growth. Since 2009, the UK has seen poor growth in productivity and real wages. This means that wages have not been able to keep up with rising house prices

Impact of generation rent

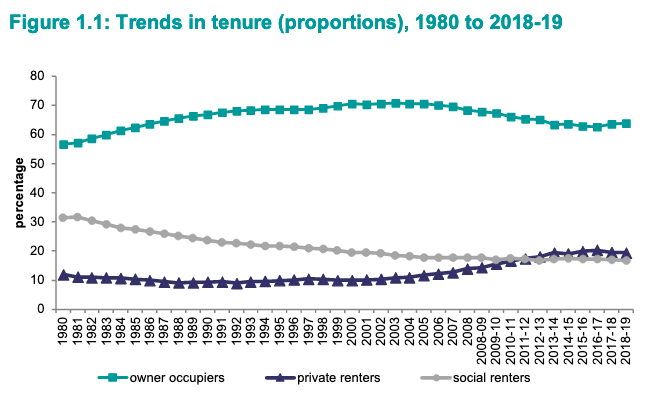

1. Fall in the proportion of mortgage owners. Due to rising house prices and rents, we have seen a fall in the proportion of mortgage owners, and a doubling of the number of private renters.

Source: English Housing Survey 2013-14

2. Increased cost of renting

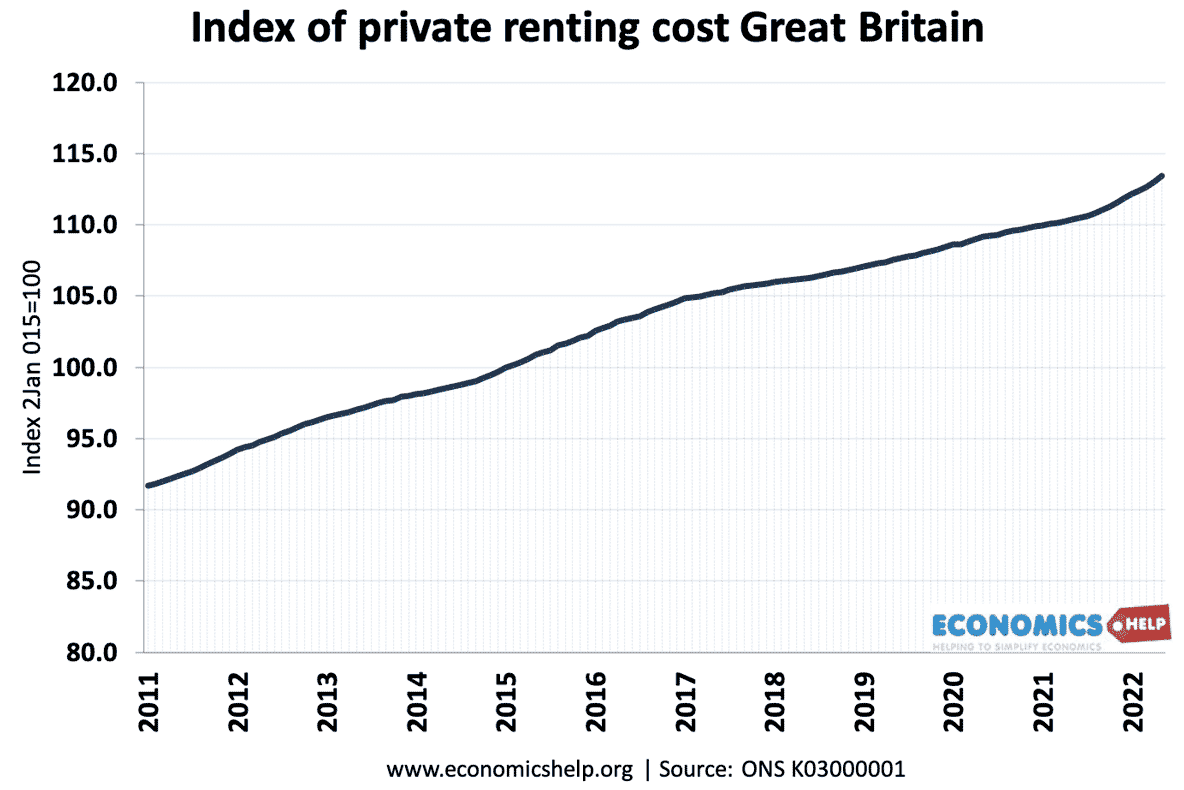

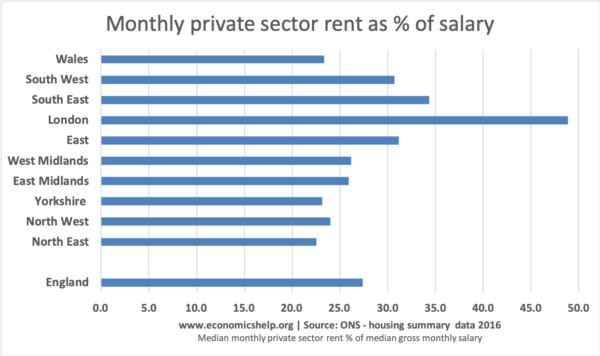

Because of the housing shortage, private rents have also been rising faster than inflation. For workers in London, renters can pay up to 50% of their income in rent.

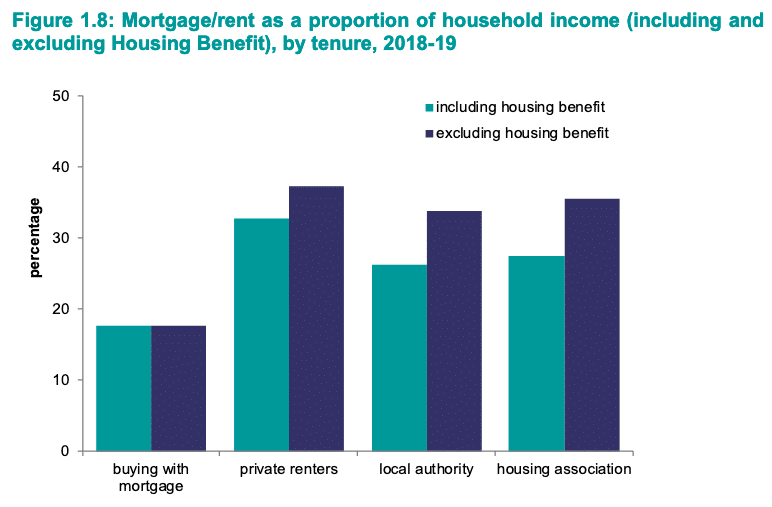

This shows the contrast between owner-occupiers (buying with a mortgage) and private renters) Due to low-interest rates, people who own a house are paying a smaller percentage of income on housing costs. Private renters are paying nearly double housing costs – and unlike owner-occupiers cannot look forward to ever paying off the mortgage.

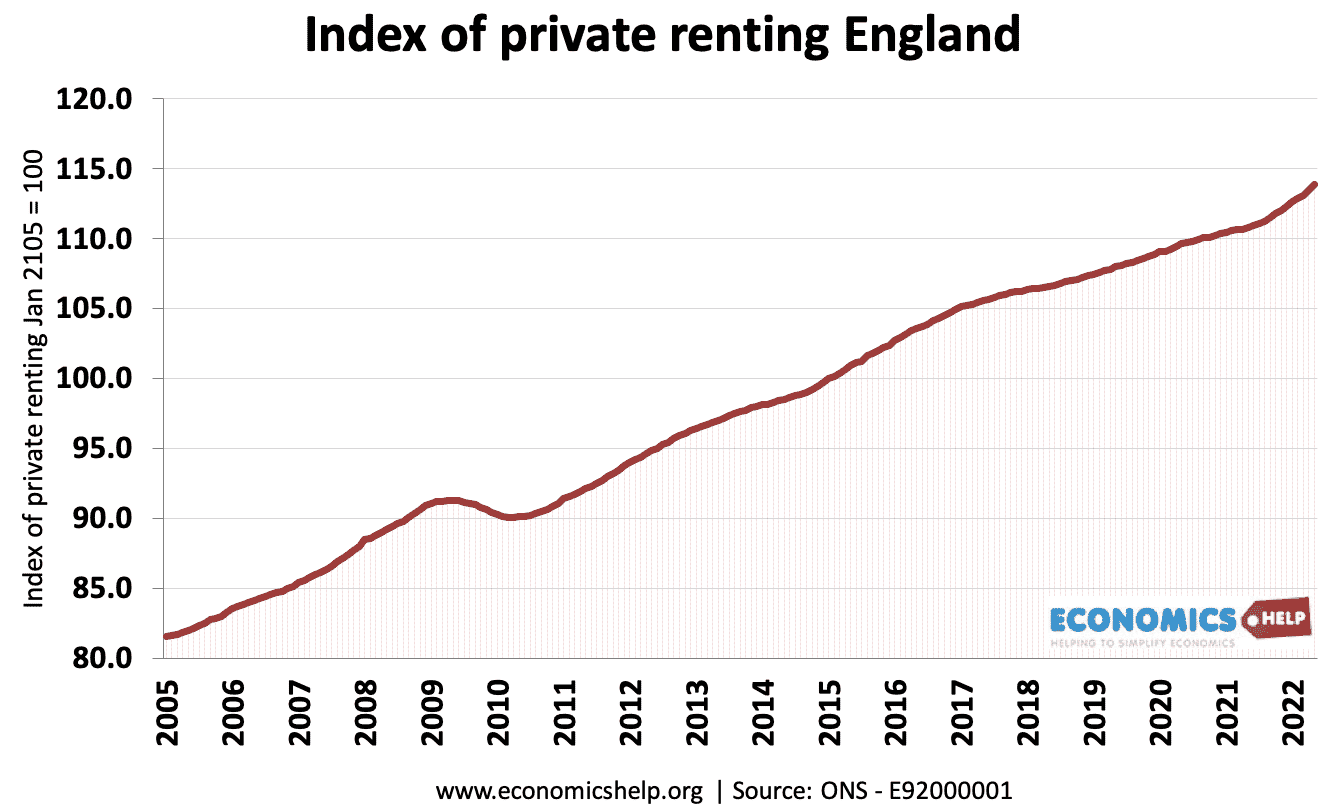

Index of private renting in England

- Between 2005 and 2022, the cost of private renting in England has increased nearly 40% (index from 82 to 114)

3. Inequality between property owners and renters.

The traditional method of measuring inequality is to compare average incomes. However, average incomes only tell part of the story. If renters are paying 50-70% of their incomes on rent, the discretionary income they have is relatively low, compared to a pensioner, who has paid off their mortgage and is living rent-free.

People with a mortgage typically spend 19% of their income on mortgage payments (£612 a month). Those who rent typically have lower incomes; privately renting accounts for 50% of income (£702 a month), though this falls to 45% after benefits.

This has an important impact for government policy. It is not enough to look at incomes – after housing cost incomes are a much better guide to actual living standards.

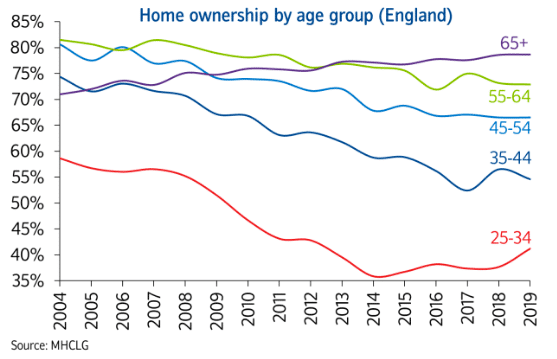

4. Inequality between generations

In addition, there is greater scope for inequality between generations. Whilst pensioners have benefited from a triple lock guarantee, young people have faced numerous issues making living more unaffordable – rising costs of tuition, student loans, rising housing costs and stagnating real wages. This is reflected in the homeownership rates by age profile.

5. Rent time bomb

The problem renters face is that there is no end in sight for paying high rents. It is one thing to pay £2,000 a month rent when you are working and have a good salary. However, when people retire, incomes will fall, but private rents are likely to keep rising. Many people will be unable to meet rents when they retire – forcing them to move to cheaper areas, keep working or more government benefits to meet housing costs will be required.

When people take out a mortgage, mortgage payments don’t rise in line with inflation. Over time, with rising real wages, mortgage payments as a % of income tend to fall. However, rents are rising at least as fast as inflation (and in some areas higher). Therefore, there is a big discrepancy between those who buy a mortgage and benefit from low-interest rates and the cost of private renting.

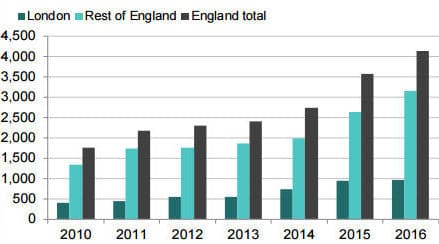

6. Housing benefits

One of the biggest growth areas of government social security spending (apart from pensions) is housing benefit. In 2019 the UK government spent £22 billion on housing benefits. This high cost has increased due to the rise in private sector rents and the increased numbers renting from the private sector. Five million people were entitled to housing benefit in 2014. By comparison, government spending on unemployment benefits is approx £4-5bn. With rising rents and a rise in the number of households, the housing benefit bill is likely to keep rising.

7. Labour market shortages

With London rents becoming unaffordable, many workers are considering moving out of London to areas of the country with more affordable rents/chances to buy. This will have an adverse effect on the London labour market, with shortages of key public sector workers, such as teachers, nurses and doctors.

8. Homelessness

The precarious nature of the housing market makes young people more vulnerable to becoming homeless and losing a place to stay. The number of homeless has increased in recent years.

Evaluation

In many countries, such as Germany and France, it is more typical that people rent. The UK is unique in cherishing home-ownership so much. German has roughly 50% of households privately renting. Privately renting can give more flexibility for people moving around. Also if interest rates rise from the current lows of 0.5%, the balance between home-ownership and privately renting may change and owning a home may be less attractive than it is.

However, the share of income that many people are paying on renting is a matter of concern. There are 1.8 million on the waiting list for social housing, and in many areas, the shortage of supply is pushing up private rents, which means the problem will be difficult to solve.

One consequence of the housing crisis is that the number of houses built may need to increase. But, this in itself will create issues as there is often local opposition to building even a moderate number of houses.

Solutions to Generation rent

1. End to the period of ultra low-interest rates. A Bank of England working paper found that the current very low-interest rates are a major factor in high house prices and to a lesser extent renting.

“Over time, a 1 per cent rise in real interest rates from their present level would push real house prices down by nearly 20 per cent.”

Bank of England Staff Working Paper No. 837, Dec. 2020.

2. Higher stamp duty on landlords buying to rent. Cheaper stamp duty for young first time buyers.

3. Increase the supply of housing. Build more houses.

4. Replacement of tuition fees with free or much cheaper university fees.

Related

Very interesting.. Could you advise me on where I might find similar statistics on Scotland?

There are some here. https://www.gov.scot/publications/private-sector-rent-statistics-scotland-2010-2021/

Owner occupiers should also be able to get housing benefits, otherwise they just distort the system by propping up renting.

I think this distortion effect is huge.

with such a shortage of housing, why did we permit mass immigration by immigrants with low skills and low earning potential?