Readers Question: From my studies in economics I have always known that when there is a recession, there is a high tendency for people to borrow at a low interest rate since there is a fall in the mpc due to high unemployment right?

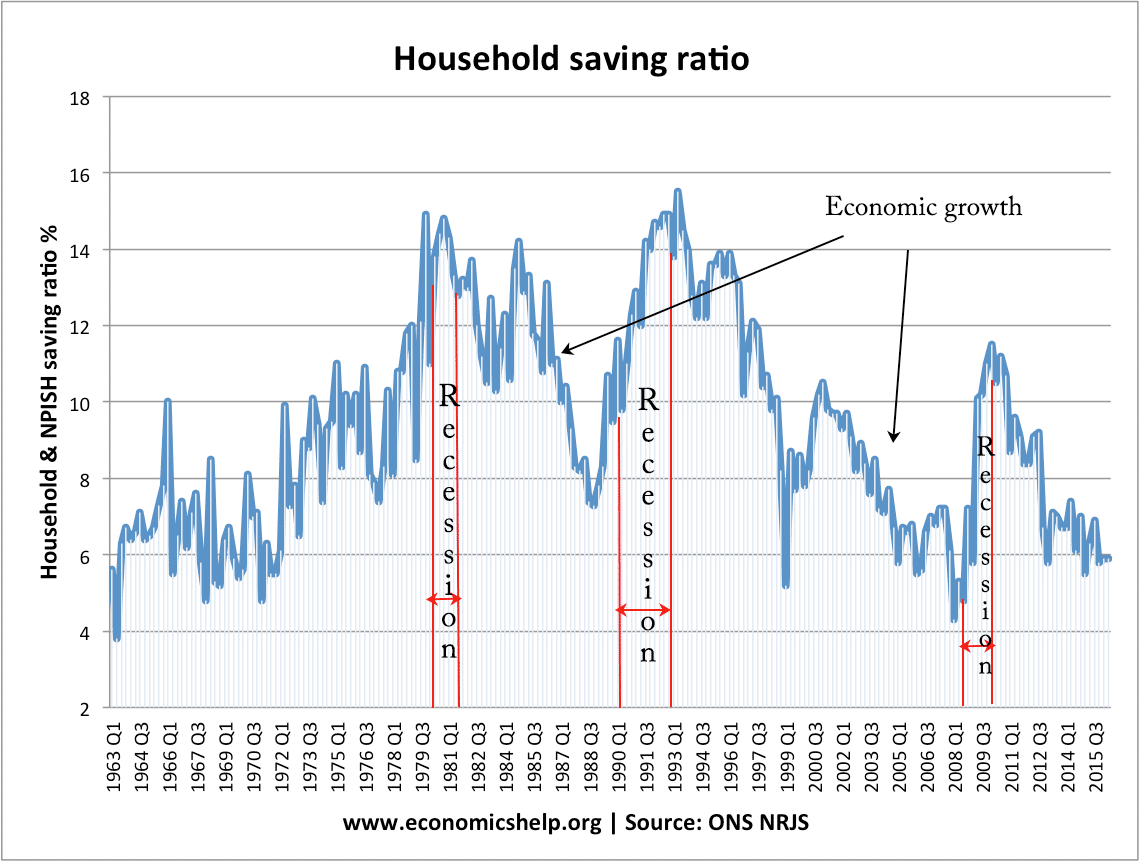

In a recession, people tend to borrow less and save more. People are nervous about the prospect of unemployment, so the propensity to consume falls. An example of the decrease in borrowing and a rise in savings can be seen by the graph for housing equity withdrawal. In the boom years, we borrowed against the value of our houses. In the recession, and with falling house prices, we saved more.

Keynes felt one of the problems in a recession was the paradox of thrift. The idea that everyone saved more causing a large fall in aggregate demand and consumer spending. He felt the government’s job was to try and offset the rise in private sector saving by increasing government borrowing and government spending.

Note, even though UK interest rates have fallen to 0.5%, this has (so far) had little impact on encouraging people to spend and borrow. It is because confidence is low and shows that it can be difficult to encourage people to borrow, spend and invest when they don’t want to.

This is one reason why it can be difficult to get out of a recession and why the authorities are pursuing quantitative easing in addition to interest rate cuts.