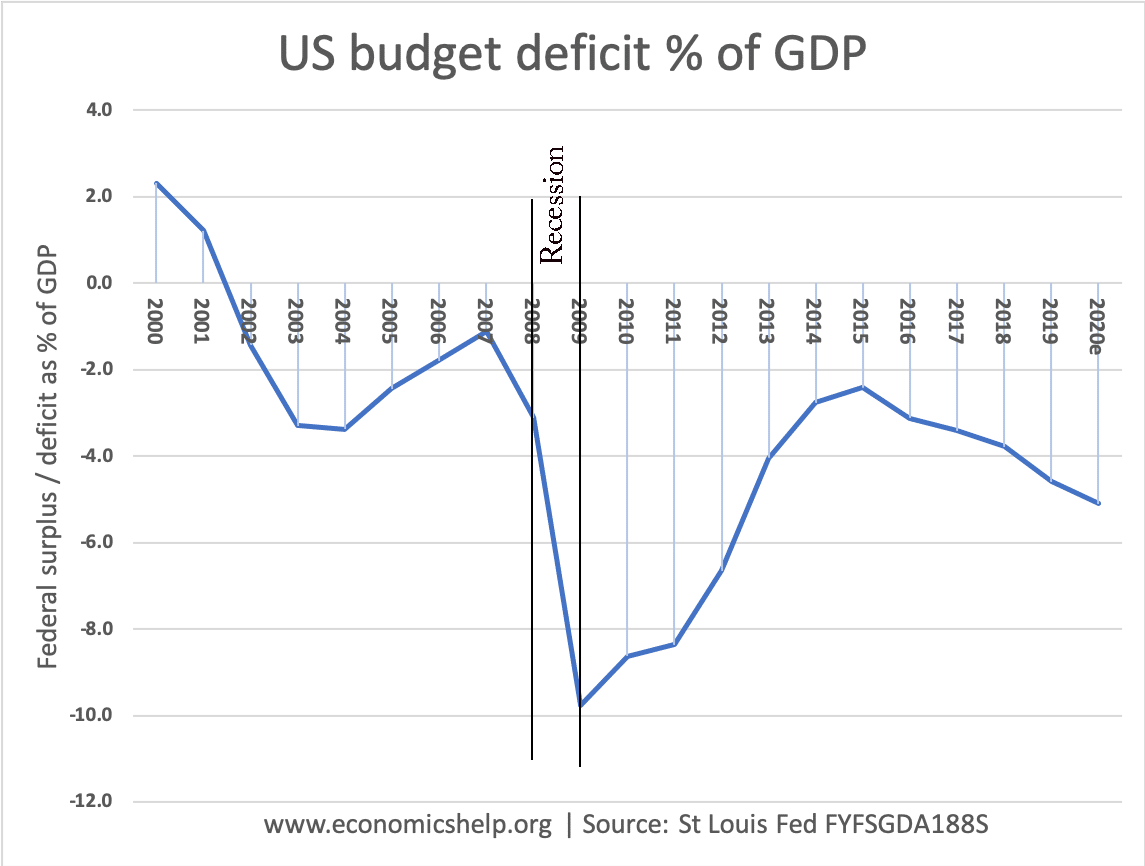

Since Jan 2017, US borrowing has increased – with over $2.7 trillion added to the US national debt. Whilst fears over debt are often over-blown, there is little long-term benefit or justification for these high levels of borrowing. The past few years represent a missed opportunity to reduce debt as % of GDP and/or invest in improving long-term infrastructure.

- Since President Trump took office in 2017, US debt has increased from $19.9 trillion to $22.7 trillion (Sep 2019). This is a 2.8 trillion increase in two and half years. This is the fastest increases in dollar terms on record.

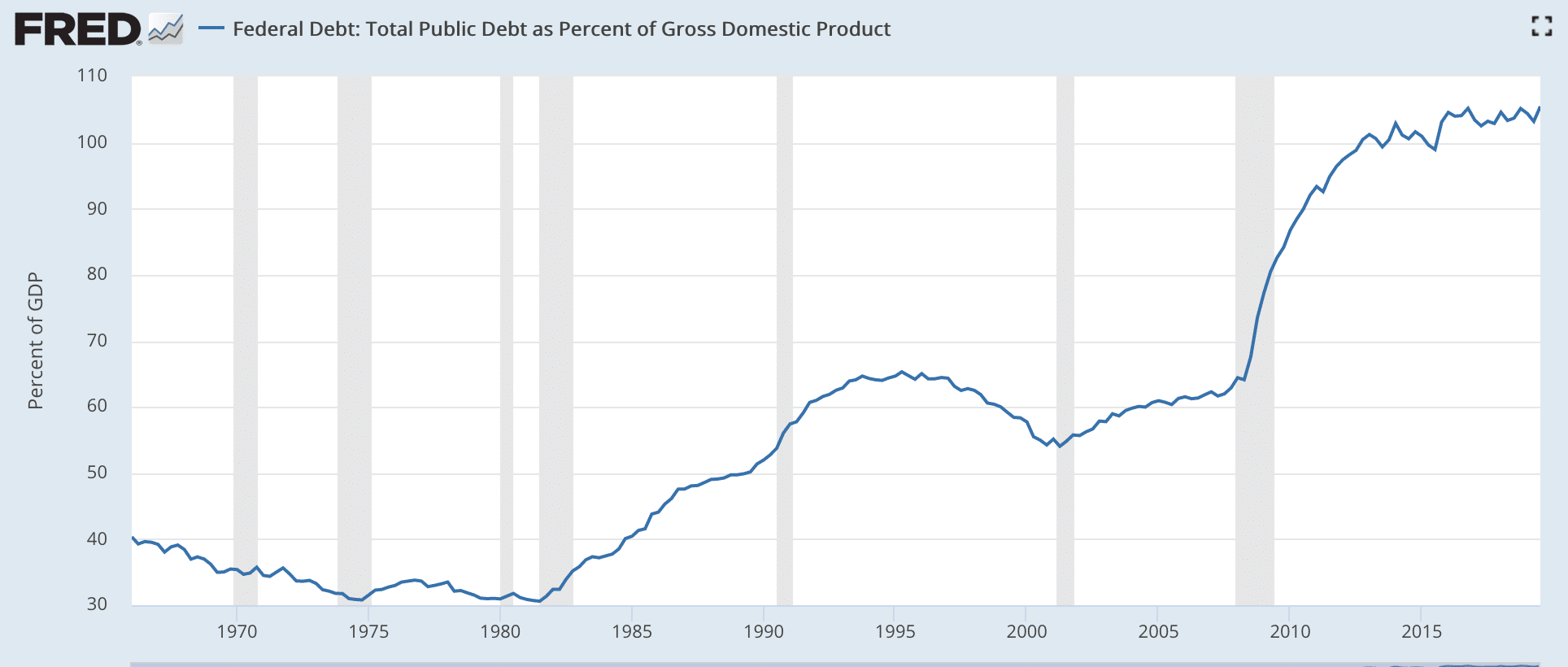

- Total Public Debt as % of GDP has increased from 103% of GDP in Q1 2017 to 105% in Q3 2019. (St Louis Fed) This is because economic growth of around 2.5% has meant the debt ratio as a % of GDP has only increased at a small rate.

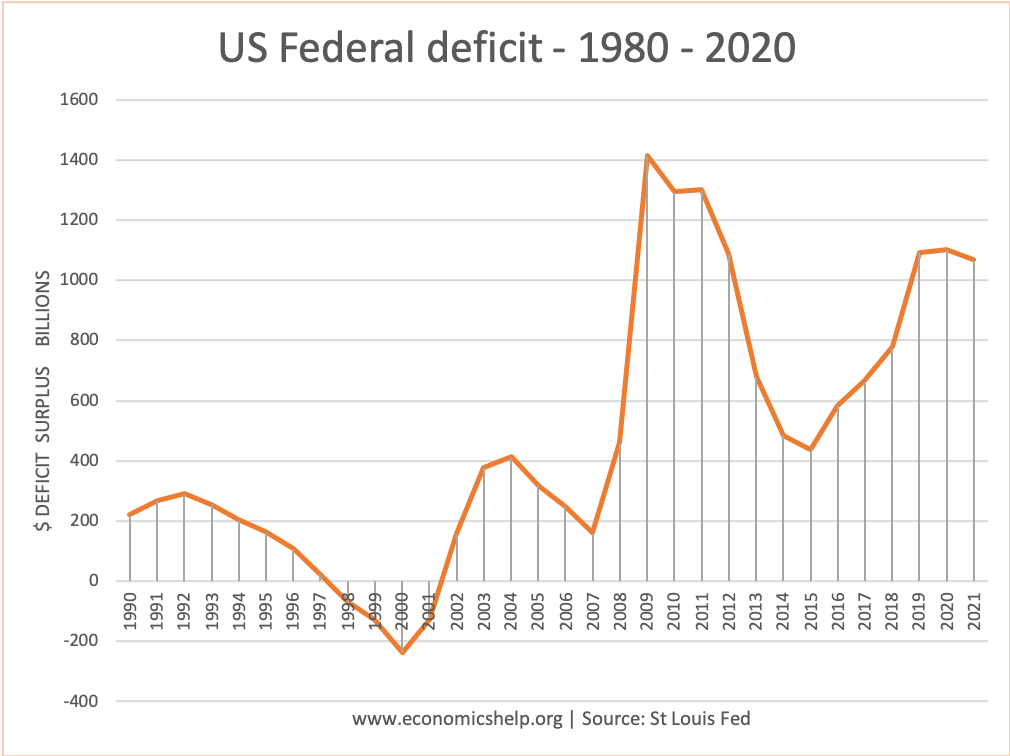

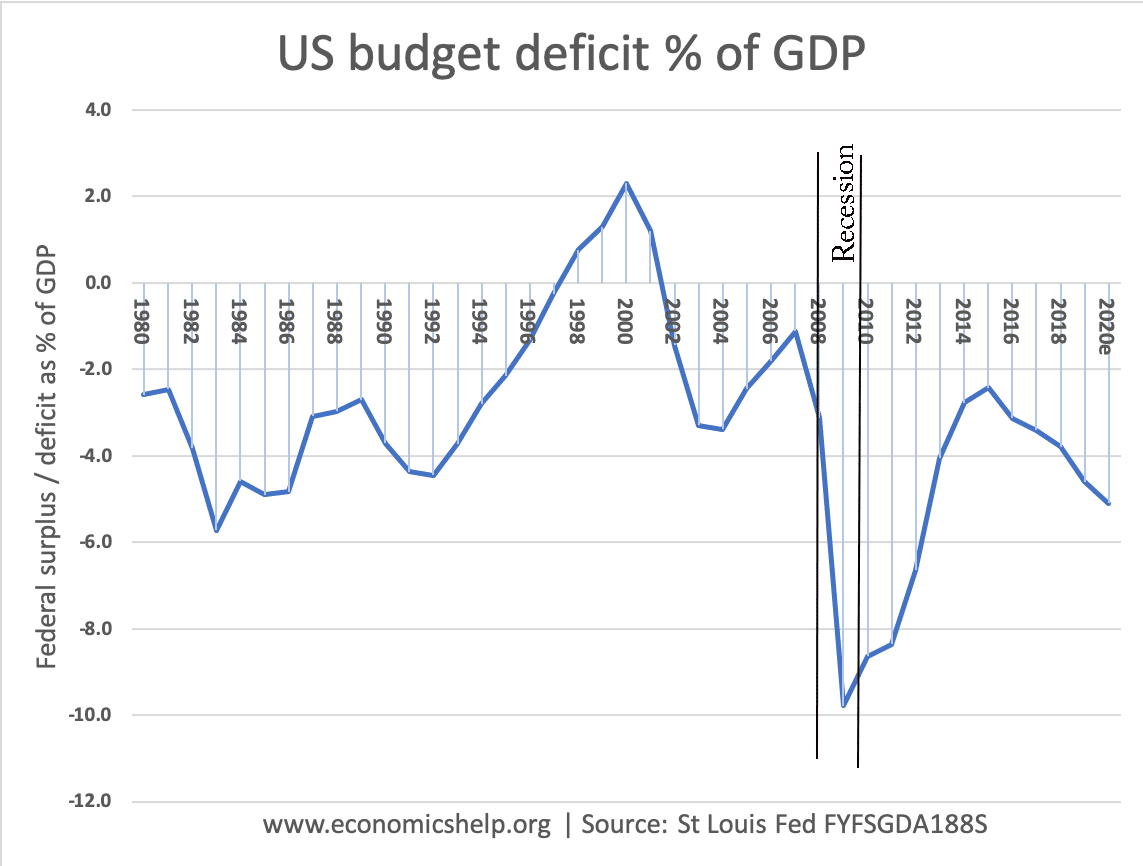

Annual Borrowing as % of GDP

There has been a significant increase in annual government borrowing since 2017 – especially when we consider the stage of the economic cycle.

Annual borrowing in dollar terms

Is the increased borrowing helpful or harmful to the economy?

A good question is whether this borrowing is helpful or harmful to the economy?

Bond yields have fallen. Firstly, fears over government debt are often exaggerated. Around 2010, there were many arguments that higher borrowing would lead to higher bond yields, and lower economic growth. Because of these fears, many western countries imposed austerity and in the US, Congress limited Obama’s fiscal stimulus after the recession of 2009/10. However, despite a significant increase in US debt, bond yields have fallen from 2.3% (Jan 2017) to 1.7% (Jan 2020)

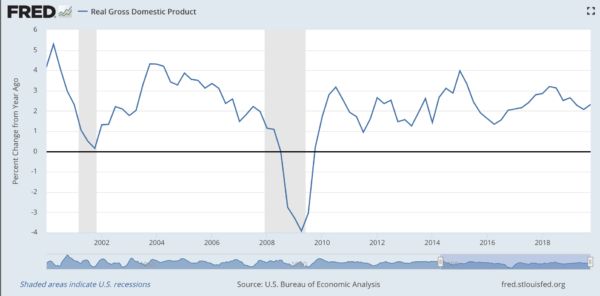

Economic growth. Since 2009, economic growth across the globe has been weak. Many economists point to evidence of secular stagnation – e.g. low productivity leading to weak economic growth. The fiscal stimulus of tax cuts has had an effect in boosting demand in the US economy helping to maintain economic growth rates of 2 – 3%. However, it is worth noting the Trump tax cut has not caused anything like the growth rates of 4%, which were promised at the time of the bill. Without the fiscal stimulus, it is likely US growth would be lower.

Cyclical deficit. A better reason to be concerned about the borrowing is that the US economy is at the stage of the economic cycle, where national debt as % of GDP should be reduced. In a deep recession (2009/10) it is necessary for debt as % of GDP and government borrowing to increase – government spending takes place of fall in private sector spending. However, Keynesian economics is not just about borrowing – the other side of the coin – is that during a period of growth, debt as % of GDP should fall and the government seek to reduce the debt burden. If the US was to enter another recession this year or next year, it would have less room for manoeuvre with debt already increasing to 105% of GDP.

US debt has increased – despite a fall in unemployment and reasonable economic growth. Therefore there has been an increase in the structural deficit

In 2000, US debt as % of GDP was 50%. Now 20 years later, debt is double that figure.

Borrowing to fund tax cuts for companies. A good question to ask is what is the purpose of increasing government borrowing. Borrowing may be justified if:

- The economy is in recession

- The borrowing is to fund infrastructure investment to improve long-term performance of the economy.

The biggest cause of the increase in US debt in recent years has been for the tax cuts enacted in 2017. These tax cuts disproportionately benefited companies, who used corporation tax cuts to fund share buybacks. There was no substantial increase in capital investment or an increase in real wages for workers. The tax cuts also benefitted foreign owners of US shares. The tax reform also opened up new loopholes which has encouraged people to re-label how they work from employer to independent contractor.

If the government was borrowing to fund green energy, fixing roads or building new airports and railways, there would be an increase in long-run capacity, this has not occured.

Conclusion

The increase in government borrowing is not of immediate concern. The demand for investors to buy US debt remains very strong. However, the past few years represent a missed opportunity. The large increase in debt has little if any benefit in terms of social welfare, environmental policy or infrastructure investment. Instead, the increase in debt has mostly represented a transfer to the wealthiest Americans.

Also, there is a strong element of hypocrisy that those who opposed government borrowing during the 2009/10 recession (when there was a good case for government borrowing), are now often very happy to allow a big increase in the deficit – despite the economic case being much weaker.

In 2010, calls for austerity were misplaced, but the past few years would have been a good opportunity to start to reduce debt to GDP ratio – rather than allow it to rise.

Related

Quick question – how did the tax cuts benefit foreign owners of US shares? Thanks

Tax saved led to companies buying back shares which led to rise in share prices. Also, lower corporation tax means you can pay higher dividends to shareholders.

Politicians are different from economists. they have to fulfil there objectives in 5 years at whatever the cost with it comes. Whether with higher debt or lower taxes with unequal distribution of wealth and income!!!