Supply and demand illustrate the working of a market and the interaction between suppliers and consumers. Supply and demand curves determine the price and quantity of goods and services. Any changes in supply and demand will have an effect on the equilibrium price and quantity of the good sold. It will also affect the incentives for producers and consumers

- Supply is the amount of the good that is being sold onto the market by producers. At higher prices, it is more profitable for firms to increase supply, so supply curve slopes upward.

- Demand is the quantity of the good that consumers wish to buy at different prices. At higher prices, less will be demanded. As prices fall, more will be demanded.

Why do goods cost a certain amount?

The most significant feature of supply and demand is their role in determining the price of a good/service.

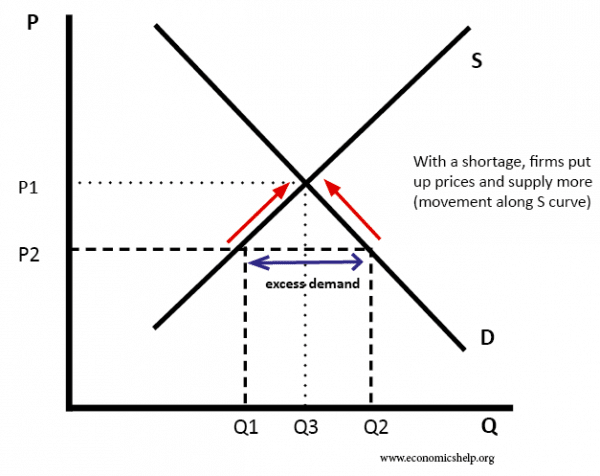

This working of the ‘invisible hand‘ explains why market equilibrium will occur where demand equals supply. Only at this point is there no tendency for the price to change.

The invisible hand was mentioned by Adam Smith in the Wealth of Nations (1776)

Every individual… neither intends to promote the public interest, nor knows how much he is promoting it… he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention.

The Wealth Of Nations, Book IV, Chapter II, p. 456, para. 9.

Adam Smith was a pioneer in explaining how market forces operated – firms (supply) and consumers (demand) would work out the market price without any specific intervention.

Comparison between different goods

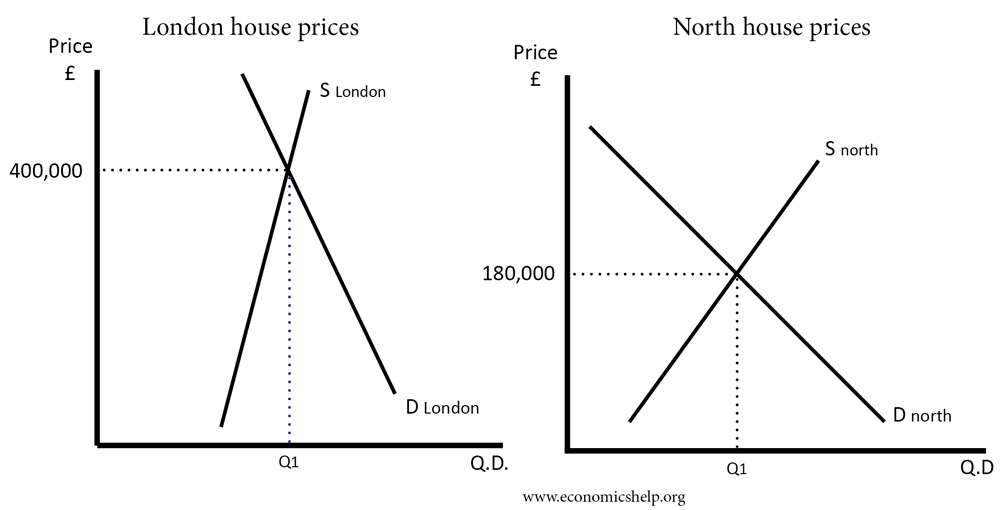

A simple example of supply and demand is to consider why house prices in London are over twice as expensive as average house prices in London. It comes down to supply and demand.

- In London, there is a limited supply, but demand is considerably higher because of the number of jobs and attractiveness of living in the capital city. International investors also like buying houses in London.

- In the north, there is more potential for increasing supply, and demand is correspondingly weaker. There are lower incomes and fewer job prospects. Because of weaker economic growth, the area is less attractive to buy to let investors.

Drawing the two diagrams shows the difference in prices.

Changes in market equilibrium

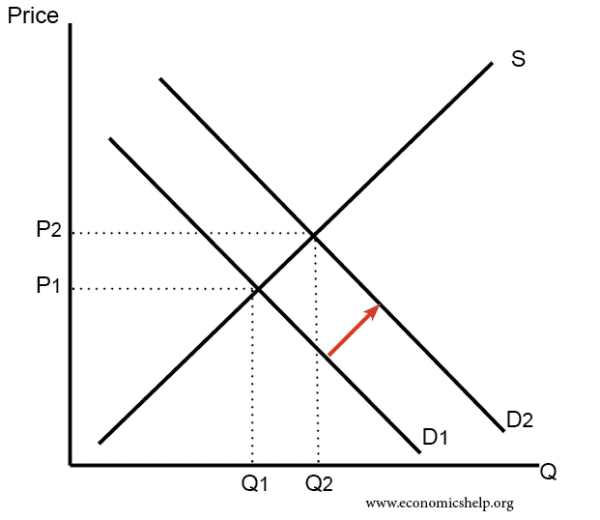

A shift in the demand curve could occur due to any factor other than price. For example, if a good becomes more fashionable, better quality or if there is an increase in the price of a substitute. A shift in the demand curve to the right will lead to a different equilibrium. It will lead to both higher price and quantity.

An increase in demand leads to a higher price and a higher quantity of the good sold.

Changes in supply

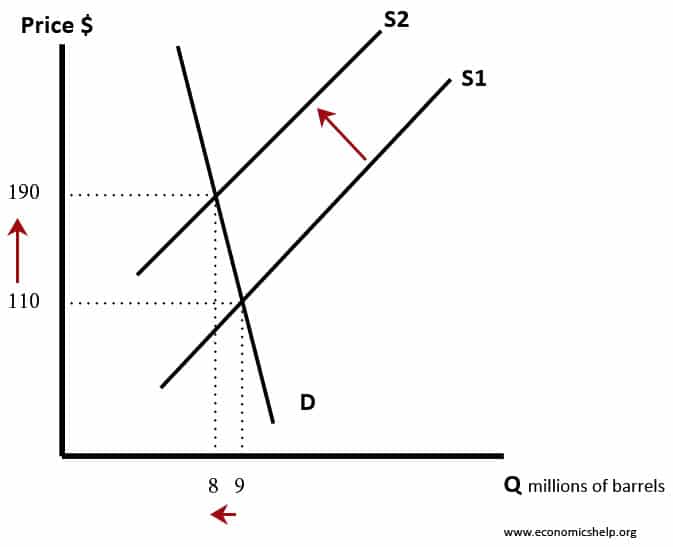

If there is a fall in the supply of good, this will push up prices and lead to a fall in demand.

The amount by which demand falls depends on the elasticity of demand. In the above case, a higher price of oil will only cause a small fall in demand because there are few substitutes to oil.

Supply and demand in the long-term

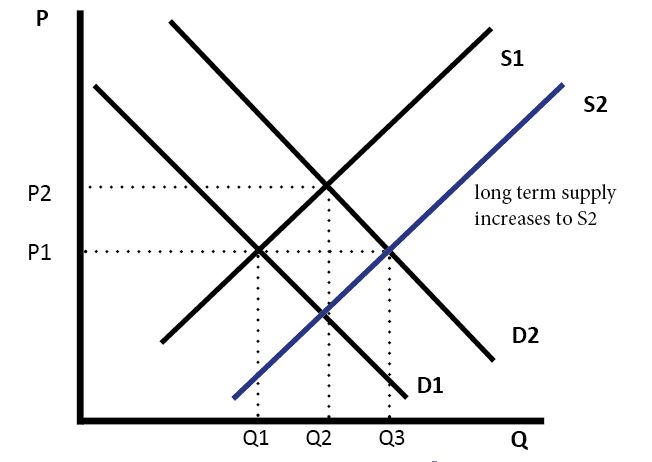

Supply and demand are constantly changing. In the short-term, a higher price may lead to a small fall in demand. However, in the long-term, consumers may respond in a different way. Rather than just paying for more expensive petrol, they may switch to buying an electric car. Therefore, in the long-term demand will be more elastic (more sensitive) to a change in price.

Long-term shift

For example, we have seen rapid growth in demand for personal computers, but there has been an equivalent rise in supply of computers so prices haven’t risen.

Related

- Diagrams for Supply and Demand

- Factors affecting supply and demand of housing

- Wage determination in perfectly competitive labour markets

This is an incredible site indeed