The world economy is already entering a very deep recession, with GDP falling by an estimated 20-25%. Unemployment will rise very fast as large parts of the economy close down.

- An optimistic assessment is that the economic shock will be short-term, policymakers are responding with as much monetary and fiscal help as they can, and once worst is over, economies can bounce back.

- A more pessimistic view is that the unprecedented fall in GDP, investment, consumption and economic activity will cause lasting scars on the economy – higher debt, business closures, permanently lost income, and new barriers to global trade will cause a prolonged economic downturn.

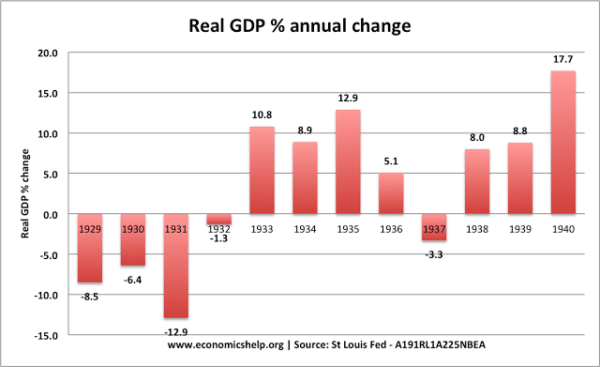

In the Great Depression 1929-32, world output fell by an estimated 15%. In the US, the economy contracted by 25%, and unemployment increased from 0% (1929) to 23% (1932) What made the Great Depression unique was the depth of fall and the length of time. Many economies did not recover until the end of the decade. In 2020, what is the likelihood of a bounce-back vs prolonged depression?

Reasons to be optimistic of quick recovery

V-Shaped recovery In 2020, there is a clear demand side and supply-side shock (economic shutdown). When that shock ends the economy can return to production and latent demand can be released. When people stop earning and spending, they hold off buying many goods. If there is a feeling the lockdown is over and the economy re-opening, then it will encourage firms to restart investment and consumers to buy the goods (durables) they have been put off buying. If you get a temporary 20% fall, that is a lot of potential spending and output that could return later in the year.

Policy response Policymakers have much more idea in 2020 than in the Great Depression. In the early 1930s, there was a strong economic orthodoxy of balancing the budget (See: Treasury View). In 1931, the UK cut unemployment benefits and increased taxes – something that worsened the depression. In 1932, the US treasury Andrew Mellon famously stated ‘liquidate everything.”

“liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. Purge the rottenness out of the system. High costs of living and high living will come down. … enterprising people will pick up the wrecks from less competent people.” – As recorded in diaries of Herbert Hoover.

It was the philosophy of the Austrian business cycle – any government intervention makes it worse, so it is best to let firms and banks go bankrupt. Thankfully, you don’t hear this liquidationist view in 2020.

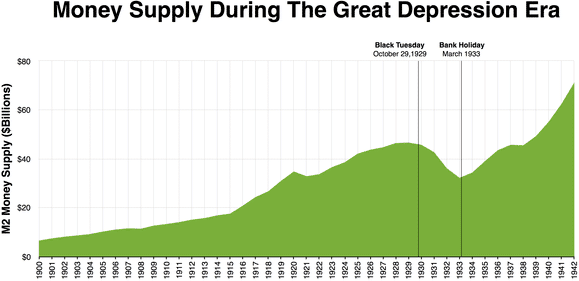

What turned the 1930 recession, into the great depression was the fact so many US banks went bankrupt (500 mid-sized banks by 1932) people lost money and lost confidence in the banking sector. This caused people to hoard cash under the bed. The same mistakes will not be repeated. Central Bankers know they have to maintain liquidity, and they will be willing to create money if necessary.

The Bank of England has already created an extra £200bn. The ECB has also announced €750bn of QE. The US Fed has announced ‘unlimited QE’ – it will buy whatever government debt is needed. The Fed said:

“Aggressive efforts must be taken across the public and private sectors to limit the losses to jobs and incomes and to promote a swift recovery once the disruptions abate.”

In addition to QE, the US and UK have been announcing large fiscal stimulus packages ($2 trillion in US) to try and provide support to those losing incomes.

Economies are adaptable. It is important to remember economies are adaptable. No matter how bleak the situation is, human resourcefulness can help economic activity bounce back. Japan and Germany were left in literal ruins in 1945, but very quickly became very successful economies. Even the worst economic shutdown will not see anything like these previous crises. Some sectors like travel and tourism may struggle for many years to recover, but we may also see new sectors of the economy develop – like even more home deliveries or some new form of economic activity.

Reasons a prolonged depression may still occur

The fall in GDP and rise in unemployment is unprecedented. Large sections of the economy have ground to a halt causing a record fall in GDP, and record rises in unemployment. The change is so rapid it is hard to even measure the impact on unemployment statistics. Benefit agencies are overwhelmed with surges in demand. This will profoundly affect confidence and lead to firms cutting back investment and households saving what they can.

Lost output. The shutdown is causing permanently lost output that will not be recovered. In a recession, people may delay spending because high-interest rates, but when interest rates are cut they resume spending. But, in 2020 exams, events and projects are all being permanently cancelled. Therefore, We are seeing a permanent loss in output and income, that will have long-lasting effects.

Debt levels. The depth of the recession will cause a rise in private sector debt and public sector debt. Some firms may go out of business, causing banks to lose money. We will see fall in asset prices which further weakens the financial system. Firms may survive by borrowing (e.g. UK £350bn gov’t borrowing fund) but, in any recovery, they will be forced to focus on repaying debts from this shut down – rather than invest. Even falling oil prices have serious consequences – it could bankrupt many oil firms investing based on much higher oil prices.

Negative multiplier effects. As output falls, there are numerous knock-on effects. China saw a slump during their shutdown, but now they may try to reopen the economy, they are seeing a slump in demand for orders. If UK and US clothes shops shut down for three months, they will not be ordering clothes. This will affect manufacturing workers in China and even cotton pickers around the world. The Chinese economy will experience a second wave of demand-shock. If the China economy goes into a serious recession, it will lead to a fall in their inward investment around the world – affecting many countries who have benefitted from their investment.

Global barriers. Before the crisis, the world was experiencing problems from a trade war. This is at another level with countries shutting borders and placing limits on the movement of people. The concern is that countries will increasingly prioritise certain goods, such as food and the amount available for export may fall. This could lead to a shortage of some goods, which causes more supply constraints.

Virus moving around the world. The peak of the virus seems to be about three months. Wuhan was on lock-down for three months. But, the virus is spreading around the world. Other countries, like Russia, India and Africa are just getting to the start of their ‘three-month’ peak period. The concern is also that even countries like Japan and South Korea which ‘flattened the curve’ may continue to see cases for the next several months.

By comparison, in 2009 global recession, countries like China were not affected – they continued to grow.

Overall

There is going to be a very deep recession, the length of time the slump remains is uncertain. The biggest factor is how the virus spreads. If it begins to fade away or some vaccine is developed, it will help to restore confidence and re-open economies. However, if it doesn’t it will lead to a prolonged economic slump and it may be very hard to re-open borders and usual economic activities.

Related

Surely the global recession will continue to harm already volatile countries? I imagine the economic impact on Italy, Spain and Portugal will be severe, especially on the EU too.

Furthermore, will we see a continued rejection of globalisation and a common occurrence of tariffs/trade wars?

Yeah its whatever. World is shutting down but this isn’t even the close being the end of the world. World wars, famine, and many more things are coming to this earth. This is a wake up call to everyone to believe on Jesus. We do what we can do, but our trust is only in God. We must repent of our sins and come to Jesus. Sadly, things will get worse and it might be very difficult for us to live, but there is peace and joy in Jesus! What are we waiting for?