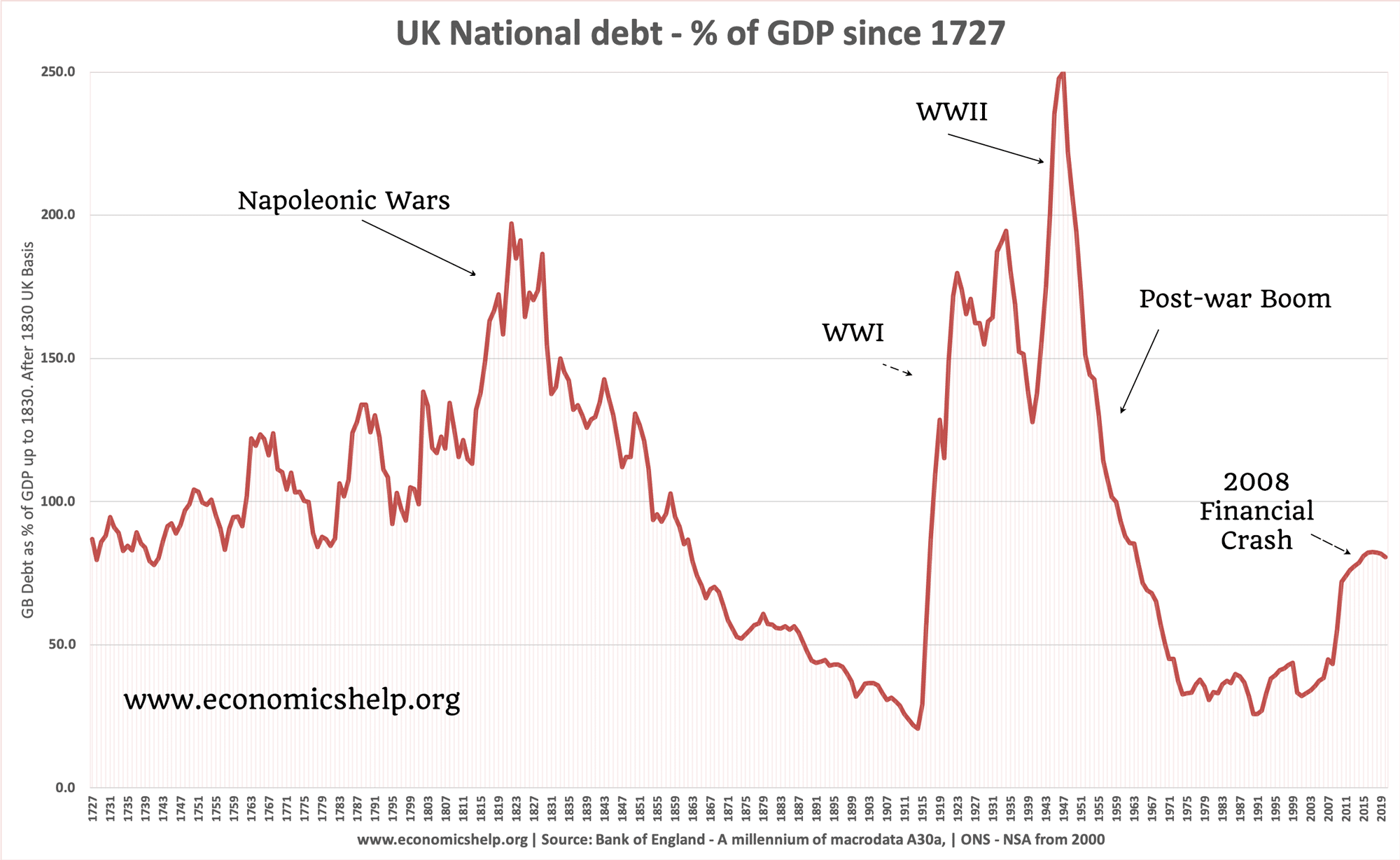

The Covid recession is very expensive for governments. Not only are we experiencing the usual cyclical fall in tax receipts, but there has been unprecedented government spending – such as the furlough scheme for workers, loans for business and a large rise in welfare payments. Government borrowing will increase to record peacetime levels. In April the UK borrowed more in one month (£62bn) than it was forecast to borrow in whole of 2020.

Government debt to GDP ratios is likely to rise to levels not seen since the world wars. Given the unprecedented rise in government borrowing, it is unsurprising many fear that it will lead to a new era of austerity (e.g. cuts in government spending) – when the crisis abates. However, whilst the government will definitely need a long-term plan to cut debt to GDP ratios, there is no necessity that we will have to see the same kind of austerity as in the period 2010-17.

Low bond yields

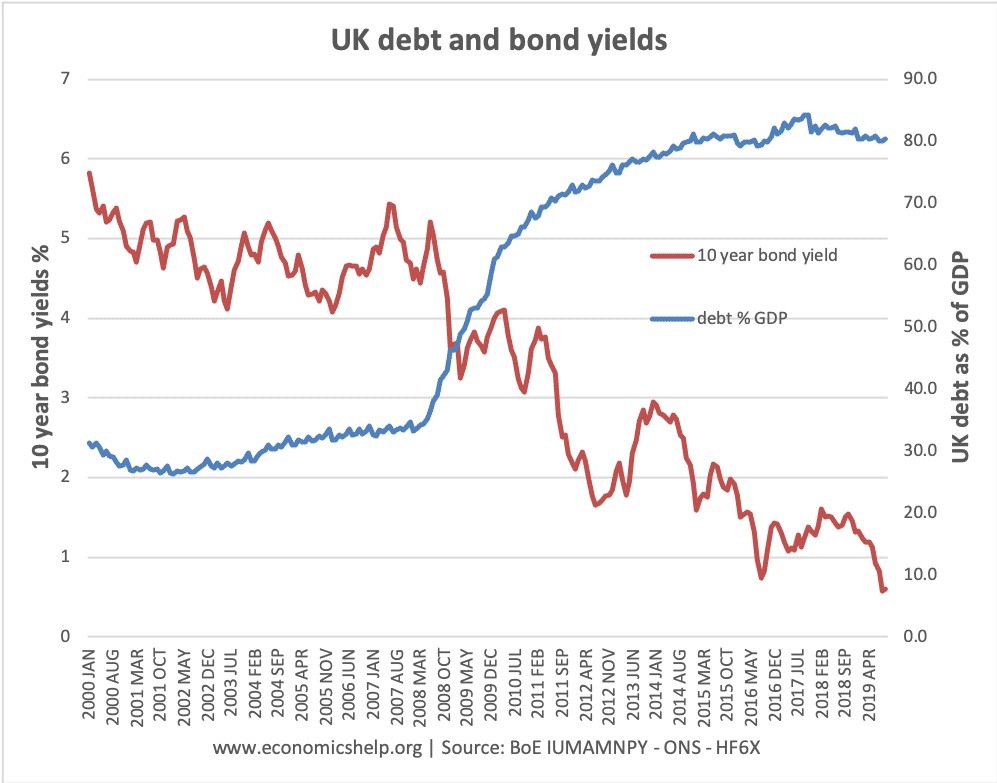

An important factor is the cost of servicing debt. As debt rises, bond yields have continued to fall. This may be counter-intuitive. An argument for austerity back in 2010 was that if we didn’t cut debt, bond yields would rise and we would pay more for borrowing. However, in this Covid recession, markets have a high level of excess liquidity. This is excess savings that investors do not know what to do with it. With the economy in recession, investors like the security of buying government bonds, so even though bond yields are close to zero, investors are still buying. This is why economists sometimes say government borrowing is like borrowing from different family members. The private sector has cut back on spending meaning there is surplus private sector saving, the government is just making use of this surplus saving.

The good news is that this fall in bond yields means

- There is strong demand to buy government debt.

- The cost of servicing government debt is very low.

Far from imposing a burden on future generations, borrowing at this low level of interest, means it will take only a small percentage of tax revenue and the high levels of debt will be relatively manageable..

Evaluation – Whilst bond yields are likely to remain very low for the foreseeable future, there is no guarantee this will not change in the future. If the market’s appetite for government debt dries up or the amount of debt sold grows faster than the markets demand for bonds, we could see rising bond yields in 2-3 years time, This would increase pressure to cut debt faster. However, it is worth bearing in mind that:

- If there is a shortage of liquidity, Central Banks can step in and buy government bonds. (through money creation – though this creates the risk of inflation)

- Previous forecasts of rising bond yields have frequently been proved wrong. In 2008, no one was predicting bond yields of 0% twelve years later.

- If bond yields do rise, it will probably be a sign of economic recovery which will help debt to GDP ratios.

Self-defeating austerity

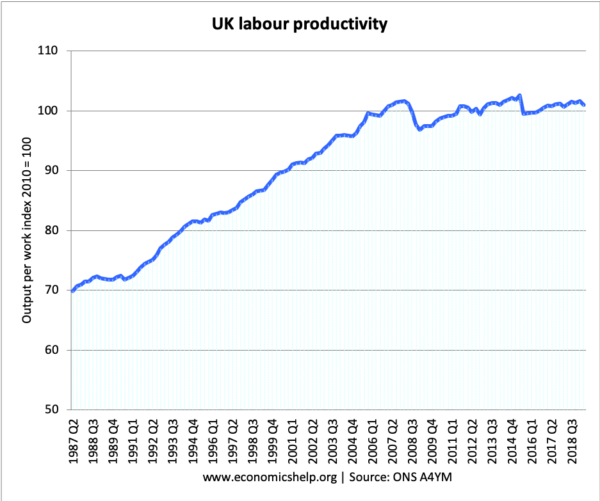

A feature of 2010 austerity is that it involved real cuts in spending – especially in certain areas like local government, public sector investment and police service. Areas like welfare spending were not cut, but benefits grew by a very small % – leaving many feeling relatively worse off. The period of austerity also coincided with low productivity growth and low wage growth. Critics of austerity argue that the deflationary policies of spending cuts itself contributed to the anaemic growth and stagnant wages. Therefore austerity was self-defeating.

The argument is that the best way to reduce debt to GDP ratios is not to have a harsh policy of austerity which holds back spending but promote long-term economic growth which enables improved tax revenues and then be patient about reducing debt to GDP ratios.

Austerity coincided with low productivity growth and low economic growth.

Austerity coincided with low productivity growth and low economic growth.

Alternatives to austerity

Supporters of austerity argue if you wish to reduce very high debt levels what is the alternative but to cut government spending and/or raise taxes?

Depends on the taxes. Some economists argue there is scope for raising substantial tax revenue from closing tax loopholes, wealth taxes, taxes on international currency transactions. These taxes could raise revenue without affecting most household spending. It could raise revenue without creating a feeling of ‘austerity’. Tax rises on average workers would have a much more noticeable effect on living standards.

Spending cuts but loose monetary policy. In the past countries have cut government spending without causing low growth of 2010s, e.g. Canada in 1990s. In 1990s, Canada was able to combine fiscal cuts, with looser monetary policy and lower exchange rate. The problem is that in 2020s, interest rates are already at close to zero, so fiscal cuts cannot be offset easily by looser monetary policy.

Did we get austerity after previous record levels of borrowing?

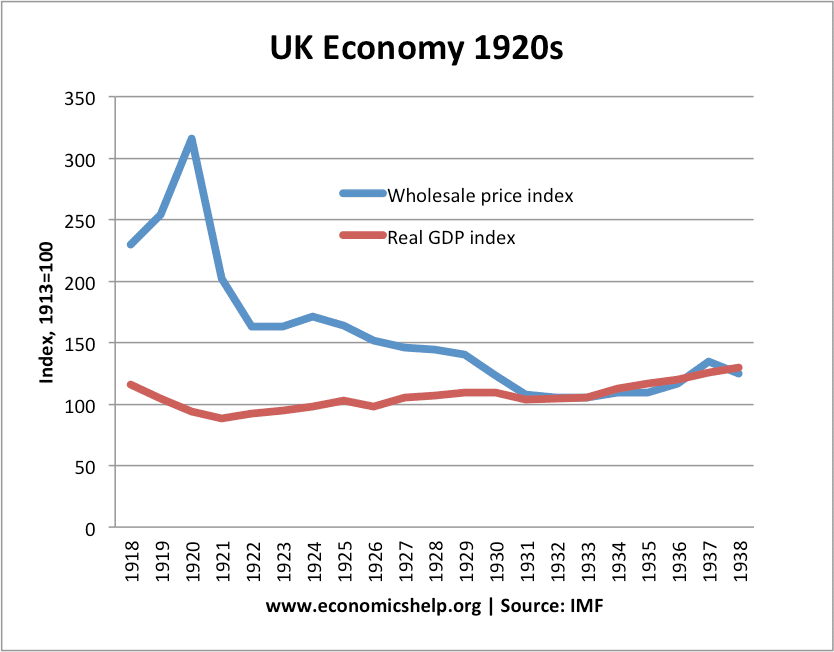

Post World War One

After world war one, the UK did pursue austerity (see Economy of 1920s). The government sought to run a primary budget surplus and this led to a prolonged period of deflation, low growth and high unemployment. The policy of austerity was compounded by rejoining the gold standard in 1926. The policy was also notably ineffective in reducing the debt to GDP ratios. Despite government spending cuts, deflation and low growth made it very difficult to reduce debt to GDP.

Post World War Two

After World War Two, the Labour government pursued the opposite of austerity – setting up the NHS, welfare state and nationalising many industries. Debt to GDP continued to rise until early 1950s. Far from burdening the economy, the 1950s and 60s were periods of high economic growth and during theses decades debt to GDP fell steadily as higher growth chipped away at the debt ratio. In one sense 1945-50 did feel like austere times (This was still a period of rationing) but in terms of government spending, there was no panic to cut spending.

It is worth pointing out that in the post-war period the UK was reliant on large loans from US which they threatened to withdraw (until Communists tried to take over Greece) Even in the 1960s, UK prime ministers were reluctant to criticise US because of large debts UK owed US.

The post-war period shows you can have a very high level of debt and reduce it without austerity. But, a very good question to ask is – will we ever see this kind of post-war period of high growth again? Even before Covid-19, many economists were asking whether we were entering a period of secular stagnation with permanently lower growth.

Appetite for a different economy.

A final thought is that Covid-19 may create such a shock that there is a desire to see a different kind of economy where there is greater equality and greater political willingness to tax wealth, redistribute income and close tax loopholes. Whether that happens is very uncertain.

Very interesting read! Thank you!