Capital controls are government measures to limit the flow of financial capital and financial assets. Capital controls include limits on foreign currency exchange, limits on the purchase of assets and taxes on financial transfers. Some economists argue that capital controls can help limit destabilising capital flows which cause banking crisis and economic booms and busts. Other economists are critical of capital controls arguing it prevents capital from moving to the most efficient location.

During the post-war Bretton Woods system (1944-71), most countries adopted some form of capital controls and this helped contribute towards a ‘golden’ period of economic growth and stability. However, in the 1970s, economic shocks encouraged capital controls to be removed enabling the free movement of capital. The 2008/09 credit crunch and financial crisis renewed interest in the debate over capital controls.

Pros of capital controls

1. Avoid speculative booms and busts. The free movement of capital can cause investors to move capital around the world. If a country looks an attractive investment in the short-term, it can experience a rapid inflow of capital, e.g. loans and bond purchases. However, this rapid inflow of capital can contribute to an inflationary boom and excessive confidence in the economy. If there is a change in market sentiment, these capital flows can be reversed causing capital flight, devaluation, inflation and a destabilising effect on the economy. We see this in many examples, such as the South East Asian crisis of 1997/98. Capital flight caused rapid devaluation, rising inflation and a fall in output.

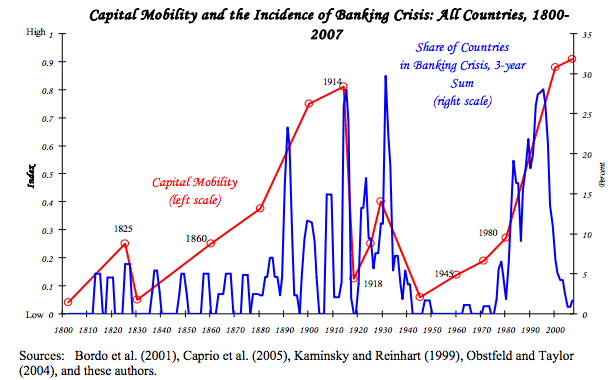

2. Strong link between capital mobility and the banking crisis. It is argued that the free movement of capital is closely linked to a greater incidence of a banking crisis. “This Time is Different: A Panoramic View of Eight Centuries of Financial Crises,” argues that as capital mobility increases, it makes a country more susceptible to a banking crisis.

The relative success of Bretton Woods system. Under the Bretton Woods system, most countries had some form of capital controls. Countries pursued independent monetary policy and targetted stable exchange rate. To prevent fluctuations in the exchange rate, capital controls were used to prevent deterioration in the value of a currency. The period 1945-71, was a period of high economic growth and low incidence of a banking crisis. Between 1945 and 1973, economic growth in the developed world was 4% and the banking crisis were rare (1)

Impact on developing countries of receiving loans. With free movement of capital, we often see a flow of capital to developing economies, loans and investment. Whilst this has a benefit in the short-term, it can leave developing economies vulnerable to any change in market conditions. For example, if the US lends money to African economy to finance investment, this could be a problem if there is a devaluation in the value of African currencies as this makes loan repayments higher and the capital flows become a debt burden which takes a high share of foreign currency earnings, and in the long-term lead to lower growth.

Allows monetary and fiscal autonomy. There is a policy trilemma with countries having to choose two objectives out of three

- Independent monetary policy

- Free movement of capital

- Stable exchange rates.

What it means is that if a country allows free movement of capital and wishes to target a stable exchange rate, they loose independence of monetary and fiscal policy. In the first age of globalisation 1900-39, countries were on the gold standard – which meant fixed exchange rate, but with free movement of capital, it left countries with limited independence over monetary and fiscal policy, e.g. the UK had to pursue deflationary fiscal and monetary policies in the 1920s, which caused mass unemployment. In the 2010s, some Eurozone economies lost independent monetary and fiscal policy due to being in the Euro, with free capital flows. Paul Krugman has argued for capital controls, especially during a crisis. This is because during a crisis, the government may be forced to raise interest rates to protect the currency, but this could be highly unpalatable to the economy. In this case, Krugman argues capital controls are the least bad response.

Imposing capital controls gives countries the ability to pursue an independent monetary and fiscal policy. This is not only important for economics but also democracy. Countries with capital flows may become dependent on the monetary policy set by US or ECB. Dani Rodrik in “Globalisation Dilemmas and the Way Out” quotes how Keynes valued capital controls as a way to avoid the loss of economic sovereignty of the 1920s and 30s.

“Keynes famously said in 1945 that capital controls as part of the Britain Woods regime were not meant to be simply a temporary expedient. They Globalization Dilemmas & the Way Out were permanently an integral part of the regime because he understood that, for the healthy functioning of domestic economic management, countries needed certain amount of insulation from the vagaries of short-term international finance and trade regime.”– Rodrik Dani, The Indian Journal of Industrial Relations “Globalisation Dilemmas and the Way Out” ” January 2012.

Arguments against capital controls

Free markets. Free market economists believe that capital controls prevent the flow of capital to where it is most profitable and most efficient. It forces domestic investors to gain a lower rate of return on investment and have a lower income.

FDI. Free movement of capital can lead to substantial inflows of foreign direct investment in developing economies, enabling them to have a higher rate of economic growth and ‘catch up’ with the developed world. Capital restrictions it is argued, slow down this rate of catch up.

Ability to evade capital controls. The difficulty with capital controls is that markets are adept at finding ways around them. For example, new internet payment systems enable investors to side-step traditional regulations. In a paper by Professor Michael Klein Capital Controls: Gates and Walls, he argues that when Brazil imposed short term capital controls after 2009 crisis, it had no discernable effect on limiting capital flows and rapid movements in the currency.

Capital controls can deter investors. After the 1980s Latin American crisis, several countries reimposed capital controls, however, this deterred foreign investors who were more dubious about investing in a developing economy with capital controls.

Capital control requires restrictions on personal finance. For example, in the 1960s, the UK had a limit of £50 for tourists taking money on holiday. There would be significant liberty and political issues with reimposing these kinds of personal controls. China has imposed personal capital controls, but then it is not a democracy and state intervention is much greater.

Related

A very good post Tejvan, as someone who usually has trouble understanding economics, I admire how you make it easy to understand without losing any intelligence in the discussions.