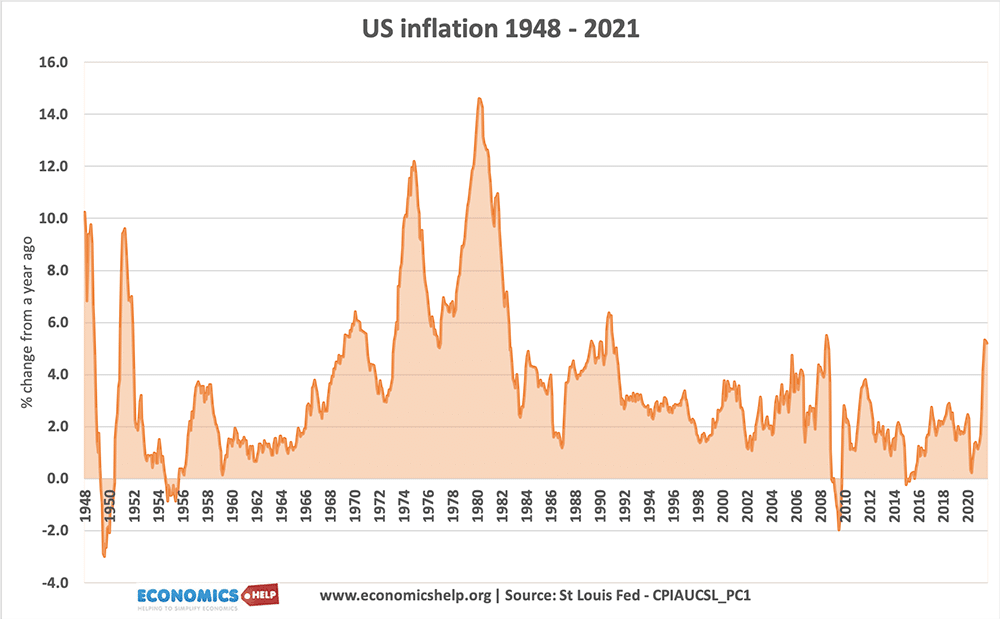

This is a graph showing US inflation in the post-war period. In a nutshell, US inflation has been fairly low and stable in the post-war period. The exception being in the 1970s and early 1980s when inflation became embedded.

After the Second World War there was lingering inflation for a few reasons. Firstly, the war had created rapid economic growth with the economy running at full capacity and full employment. This led to a degree of demand-pull inflation. Normal supplies were also disrupted because of the war effort, leading to inflationary pressures.

The spike in inflation in the early 1950s, was short-lived. It resulted from a mini-boom as the economy expanded and transformed itself from a war-based economy to producing other manufactured goods. American consumers had also saved during the war, and now that manufactured goods were available, there was a surge in consumer spending as people sought to buy a new range of consumer durables. Due to the rapid growth and transformation in the economy, there was cost-push inflation as firms faced supply bottlenecks in trying to keep up with demand. However when these temporary supply shortages were resolved, inflation fell quickly back down close to zero.

Throughout the 1950s and 60s, inflation remained fairly low. It was a period of rapid economic expansion, but despite strong growth, there was increased productivity, and falling price of some commodities, enabling both rising wages, increased GDP and low inflation.

1970s

In the 1970s, inflation increased. The most notable cause of inflationary pressure was the 1973 oil price shock, which saw rising oil prices. This had a big impact on the US economy which was dependent on oil imports. On it’s own this inflation may have been short-lived, but it was combined with a fall in productivity growth, which led to creeping inflation. Also, in the 1970s, inflation expectations started to rise and this fed into higher wage demands. Higher wages caused higher costs for firms and they increased prices to be able to meet the growing demand. The growth in wages was a key factor in turning temporary cost-push inflation into more sustained inflation.

1980s

At the start of the 1980s, inflation was in double digits, briefly touching 20%, the recession of 1981 caused a fall in inflation. Inflation crept up at end of the decade due to the late 1980s economic growth.

1990s – era of low inflation

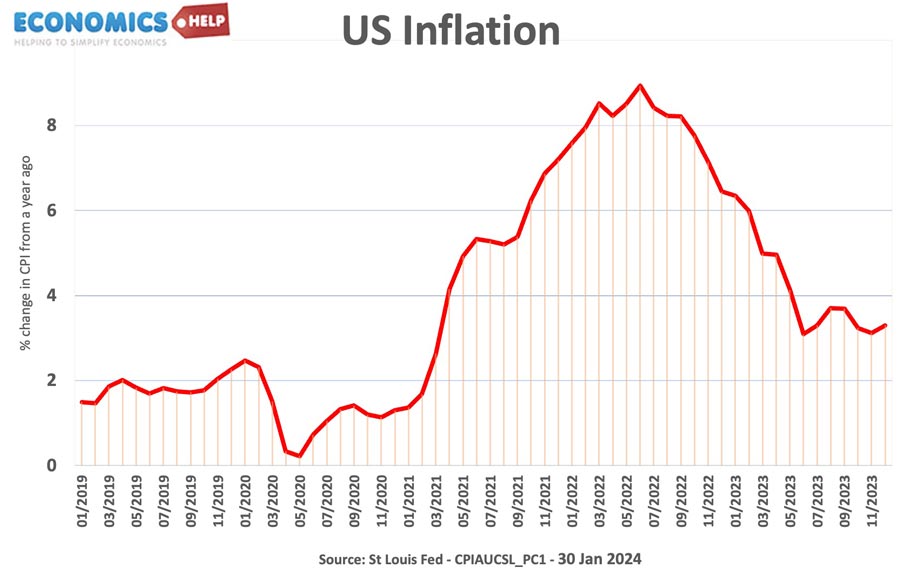

After 1992, US inflation remains largely under control. Alan Greenspan as chairman of Federal Reserve seemed to have inflation and the economy under control, with careful use of monetary policy. He was also successful in reducing inflation expectations. However, low inflation of the early 2000s, masked an asset bubble that burst in the 2008 financial crisis. 2008 and 2021 have both seen spikes in cost-push inflation due to higher oil prices.(2008) and Covid supply constraints (2021)

Related