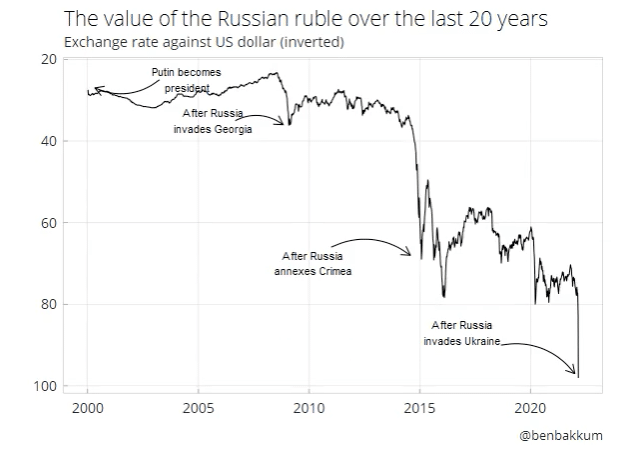

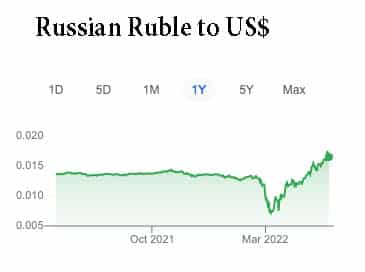

Despite unprecedented economic sanctions imposed on Russia, the Russian Rouble has become the best performing currency in the world. Rising 30% in the year 2022 to 26 May 22 (source: Reuters)

After the initial sanctions and freezing of Russian foreign currency reserves, the Russian rouble fell 25%.

But, since then the Rouble has performed a remarkable comeback. This is due to high oil prices, a fall in Russian imports and credit controls which have prevented Russians from buying foreign currency.

Why has the Rouble become the world’s best-performing currency in 2022?

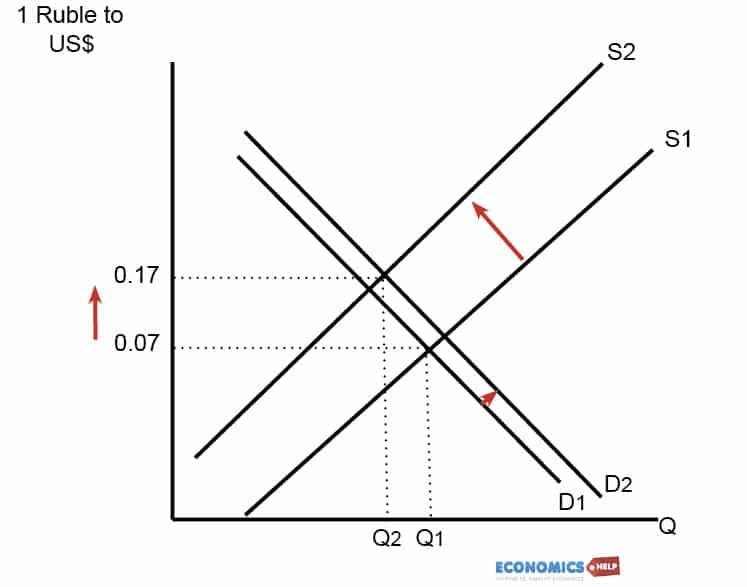

Fall in supply or Ruble has pushed up value

1. Collapse in imports. Trade sanctions have limited Russia’s ability to import goods from abroad. A fall in imports means there is less demand to sell Rubles to buy foreign currency (and pay for imports). Therefore, with a fall in the supply of Ruble’s on foreign exchange markets, its value has increased. This illustrates how the value of a currency does not necessarily reflect economic strength. The collapse in imports has strengthened the Ruble, but a stronger Ruble is not much benefit if you are not able to buy critical imports. This fall in imports will lead to lower living standards and importantly make it difficult for Russia to produce cars, tanks and military equipment which relies on the import of critical inputs and components from abroad.

“Russian imports of manufactured goods fell by 50% in March compared to the September 2021-February 2022 average” (Russia losing access to imports) Russian imports are falling from US and Europe, but also there are signs that there are lower imports even from China as Chinese firms do not want to be caught up in US sanctions. Reuters reports Russian imports could have fallen 70%

2. Rise in price of oil and gas. An unintended consequence of economic sanctions is that there has been a sharp rise in gas and oil prices – which means that Russian exports of gas and oil have increased in value. Russian export revenue has remained strong.

3. Strong sales. Although there have been minor sanctions on Russian gas and oil, sale volumes are still high, with Europe finding it difficult to reduce its demand of natural gas. Europe is hoping to ban the import of Russian oil, but other countries like China and India will still be willing to buy oil from Russia. Even at discount from the world market price, the high price of oil means revenues remain strong. The FT reports how Italy has actually increased its import of oil from Russia because Lukoil – its Russian owned oil refinery has had difficulty accessing credit due to sanctions, so has started buying 100% Russian oil as opposed to 30% before the sanctions.

4. Credit controls. Since the economic sanctions hit the Ruble in March 2022, the Russian Central Bank has imposed credit control on Russian firms. This means that 80% of foreign earnings have to be converted to Rubles. This limits the ability of Russian businesses and consumers to sell their Rubles and save in foreign currency. When there is a crisis in the exchange rate, it can lead to capital flight and a self-fulfilling fall in the value of the Ruble. In fact, credit controls have been so successful, the Russian bank is planning to reduce the limit from 80% to 50%.

5. High interest rates. In the wake of sanctions, the Russian Central Bank increased interest rates to 20% to prop up the currency. 20% interest rates make it more attractive to save in Russian banks. The high interest rates have also helped reduce inflationary expectations. In fact, the Russian central bank have been able to cut interest rates from its peak of 20% to 11% in May 26th.

Conclusion

The rise in the Ruble since economic sanctions shows that credit controls and a high price of raw materials can keep the value of a currency high. However, a cursory glance at the value of the Ruble may give a misleading impression of the Russian economy. Exports do not actually reflect living standards. Exports means the goods are enjoyed by other countries. We assume exports increase living standards because it enables a country to afford more imports. In Russia’s case, earning export revenue is only part of the issue. The key thing at the moment is actually being able to buy the imports they need. The lack of imports is ironically one factor strengthening the Ruble.

The most powerful sanctions on the Russian economy are banning Russian imports of key components and inputs in the manufacturing process. The effect of these will be increasingly felt over time as manufacturing processes slow down due to a lack of key components. Also, over time, Europe will increasingly seek to diversify away from Russian gas and oil and these markets will be hard to replace.

Video version

Related

What is not convincing is, that when imports are halted people will not be able to enjoy luxury, what if the home country makes good cars, and other durables and they are self-sufficient? In other words, does this statement hold good when one says US is enjoying luxury because it imports, if it holds good, then is that not reason enough that it is the other countries that make luxurious products? Demand and supply for currency seem to provide more meaningful explanations all the time than anything else. Be that what it may, let us take India, why Indian Rupee should weaken against the dollar, unlike Russia now (after sanctions) it has huge $ reserves and they are procuring crude cheaper from Russia, banks in India too have taken proper steps to contain inflation, etc by taking off cycle rate hikes.