The best guide to US elections is the state of the economy. If the economy is doing badly with high unemployment and/or higher inflation. The party of the sitting US president tends to get punished by the voters. But, how much influence does the President have on the economy and the rate of inflation?

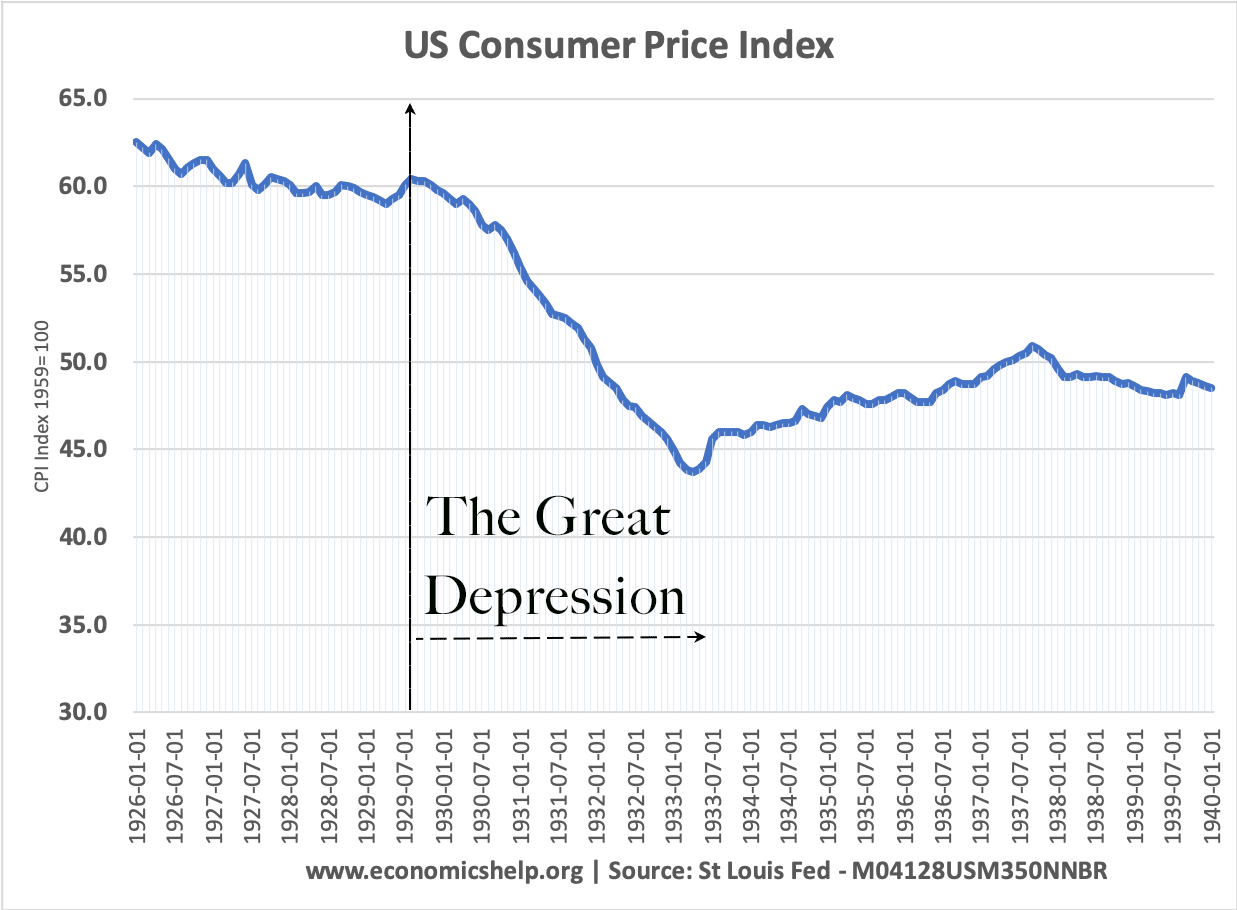

In short, very little. The bulk of economic performance and the inflation rate is determined by factors outside the President’s control in particular – market forces, private business, productivity growth, the state of the global economy, and policies of the Federal Reserve (who set interest rates). This is not to say the President has no influence over the economy. At certain times, the President can give have significant influence, primarily through the use of fiscal policy, such as a large tax cut or higher public spending. In 1932, Roosevelt’s New Deal and more optimistic outlook played a role in helping the US economy to recover from recession. Hoover’s paralysis from 1929-32 where he seemed unwilling to step in and help the economy, undeniably played a major role in worsening the Great Depression and leading to a long period of deflation.

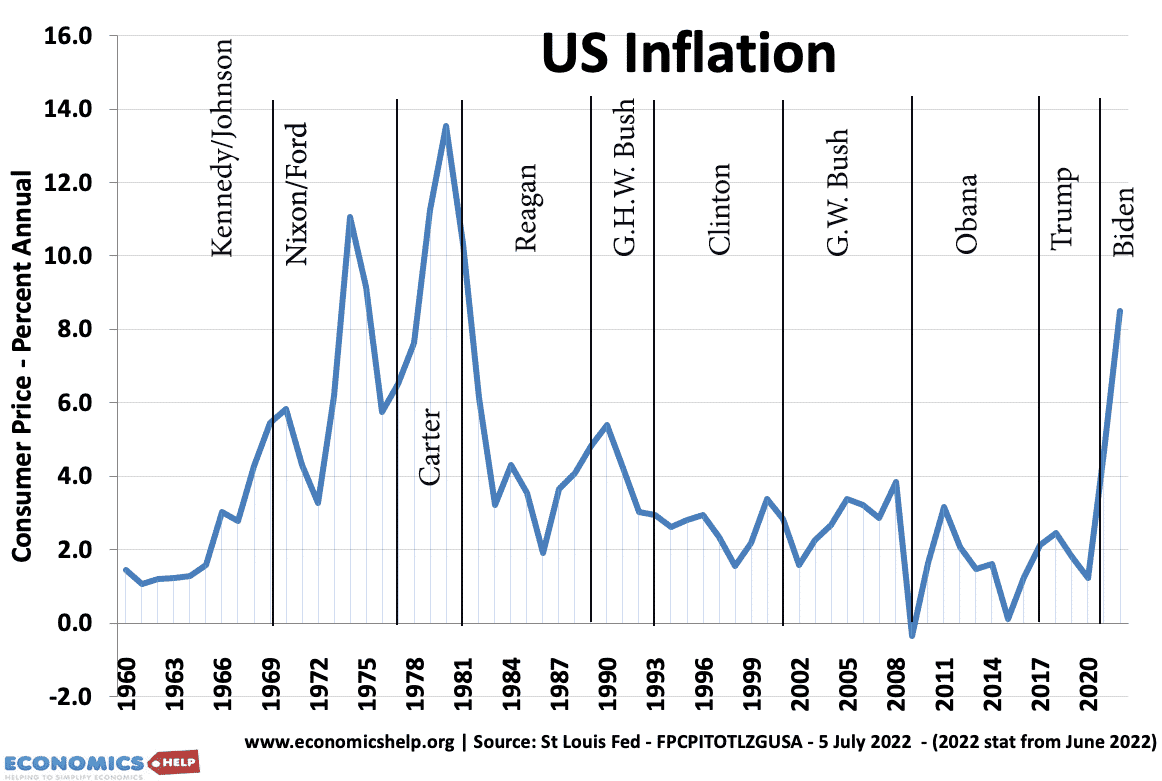

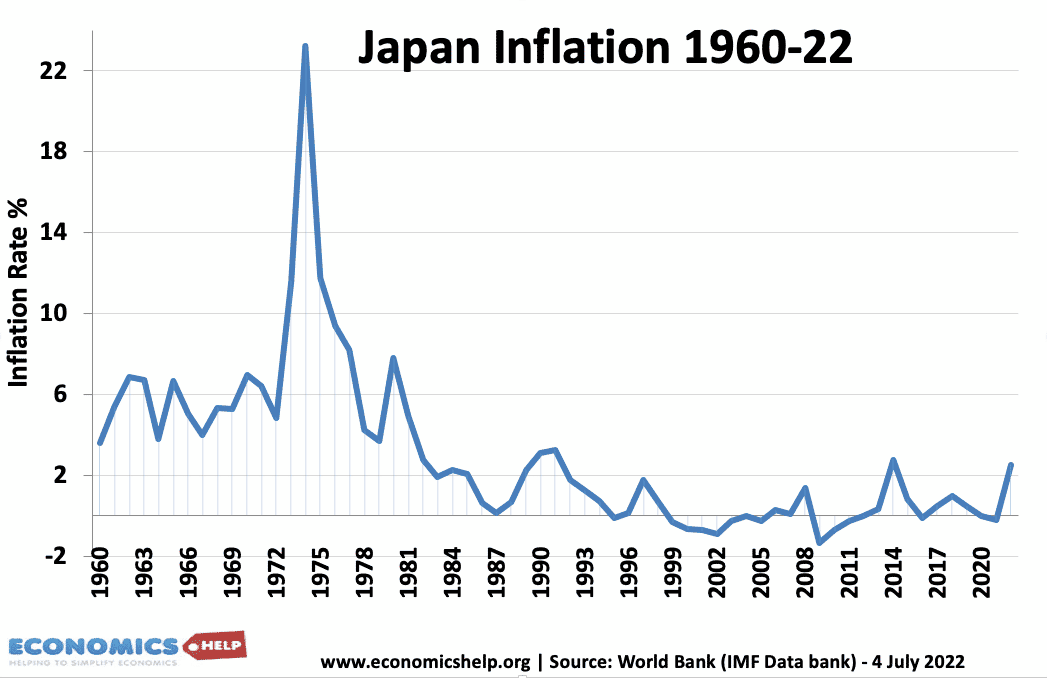

If we look at the top graph for inflation since 1960, we can see the ‘unluckiest president’ was President Carter who inherited a global climate of high inflation. (See why inflation was high in the 1970s inflation). This high inflation was a legacy of the rise in oil prices and inflationary pressures which became embedded in the US and global economy. Even a country like Japan experienced high inflation in the 1970s.

By contrast, we could say Bill Clinton (1993-2001) was a ‘lucky’ president in that he inherited a goldilocks economy with low global inflation, strong growth and an economy near full employment. Clinton even managed a budget surplus, a rare feat in US politics. True, he didn’t make any bad economic decisions. But, primarily he was able to ride the wave of strong economic performance, an effective Federal Reserve and productivity improvements, which had begun even before he took office. In the 1990s, Alan Greenspan as chairman of the Federal Reserve, made economic management seem easy. Though he and the Federal Reserve benefited from an era of productivity gains, improved technology and lower prices of manufactured goods coming from China.

The Biden Inflation

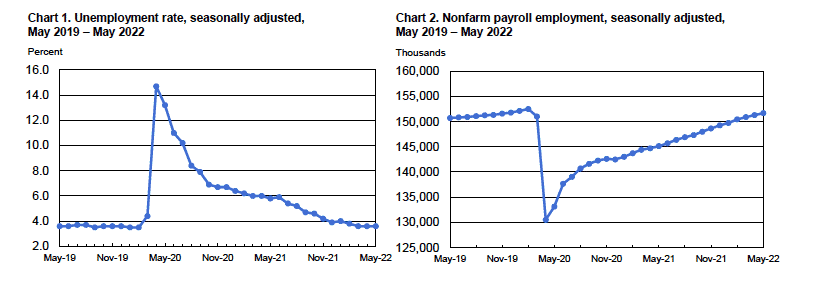

By contrast, President Biden has had to contend with an inflationary surge that took many (including top officials at the Federal Reserve) by surprise. Rising oil prices and cost-push factors from the end of Covid lockdowns led to a rise in inflation around the world. However, in Biden’s case, he can take some responsibility for the high inflation in the US. On coming to office he passed a very large fiscal stimulus package ($1.9 trillion Relief Stimulus Bill of March 2021), which included one-off payments to most American citizens. Combined with previous fiscal stimulus during Trump’s presidency, this meant when the economy started to pull out of Covid lockdowns, households had a large pool of saving and the disposable income they could spend. This led to the US economy growing very strongly (6.9% GDP growth at the end of 2021 (BEA)) (and record levels of new jobs created)

Therefore, we can say US inflation is partly due to Biden’s economic policy, and not just cost-push inflation beyond his control. Though equally, the strong recovery is also due in part to Biden’s policy.

The role of the Federal Reserve

However, one caveat, is that the inflation rate we see in 2022, is also a reflection of the decisions of the Federal Reserve. If they had been more hawkish on inflation, they could have raised interest rates earlier to reduce economic growth and keep inflation closer to the target. In an ideal world, Biden’s fiscal policy could have been combined with a monetary policy which avoided demand-pull inflation.

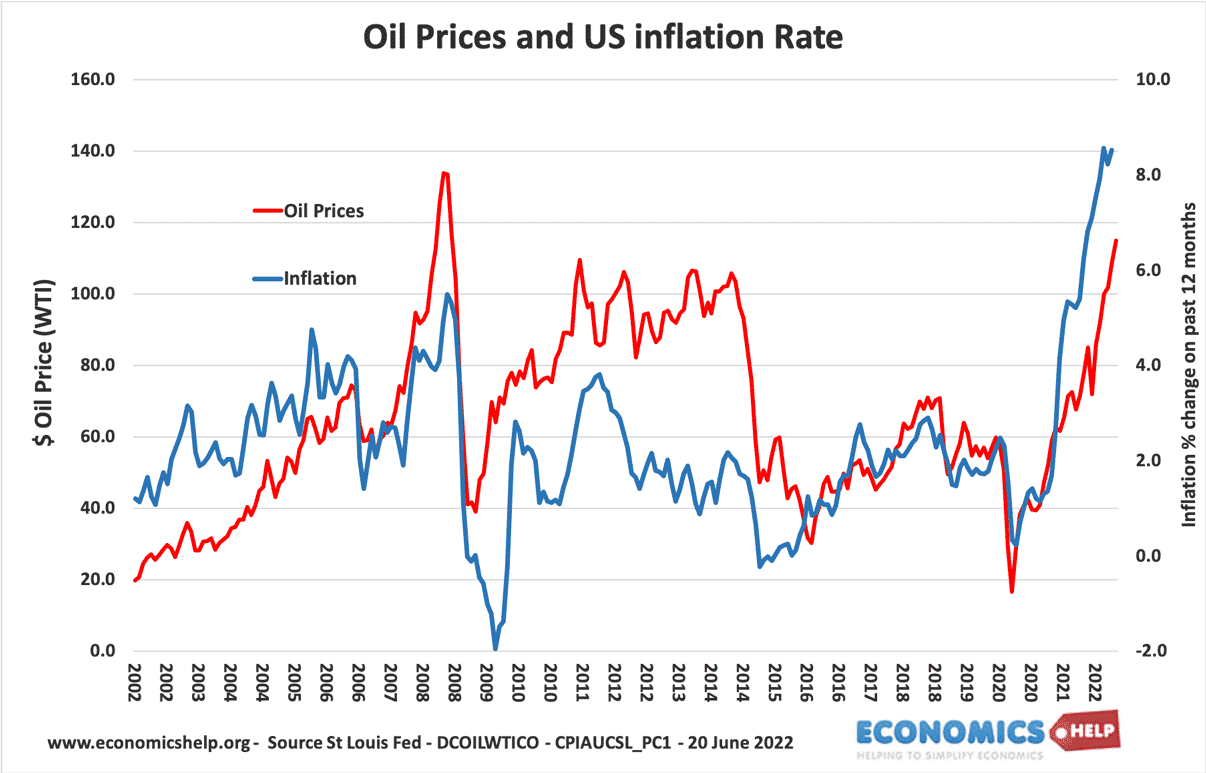

But, even if the Federal Reserve had been more hawkish and raised interest rates early, the US would still have seen strong inflation due to rising oil, food and raw material prices. For example, the UK which has had stagnant growth in 2022, has had a similar inflation rate of 9%. This begs the question could the President do anything about oil prices and cost-push inflation?

Oil Prices

The oil price is primarily determined by market forces and the decisions of OPEC members (OPEC + members control 90% of global supply). Ever since the price of oil became briefly negative in 2021 (due to Covid lockdown), OPEC have been keen to restrict supply and make oil more profitable. The Russian invasion of Ukraine inevitably pushed up the price of oil even further. Also another factor behind rising petrol prices is a bigger profit margin for oil companies.

In response to this, the President does have a few very limited options. The first is that Biden released 1 million barrels of oil a day from the US strategic reserve. This was of minor help, but only really a drop in the ocean for the overall global price of oil. The second is Biden can try to put political pressure on OPEC countries, e.g. visit Saudi Arabia and promise to keep quiet about human rights violations etc. In the long-term, the president could allow more investment in oil, e.g. allow more investment in Alaska or the Arctic region – this may conflict with environmental concerns but the main thing is there would be a long-time delay in the oil coming on stream. In short, there is little that the President can do to change oil prices. The price falls we start to see in July 2022 are more a reflection of market forces than any policy of the president.

Price controls

Another potential policy to control inflation is price controls – to limit price increases by firms. The conventional wisdom is that price controls don’t work and firms find a way around them. For example, in 1971 President Nixon imposed a price freeze that he reintroduced in 1973 after winning the election. The price freezes were politically popular for a short time, but basically failed. Firms restricted supply and when price freezes ended, suppressed inflation returned with a vengeance. It is worth noting that price controls during wartime were successful in reducing inflation. One study by Paul Evans found in WWII price controls were successful in keeping prices 30% lower than otherwise. (though this was with rationing and 7% lower output).