Readers Question: Why was inflation higher in the 1970s?

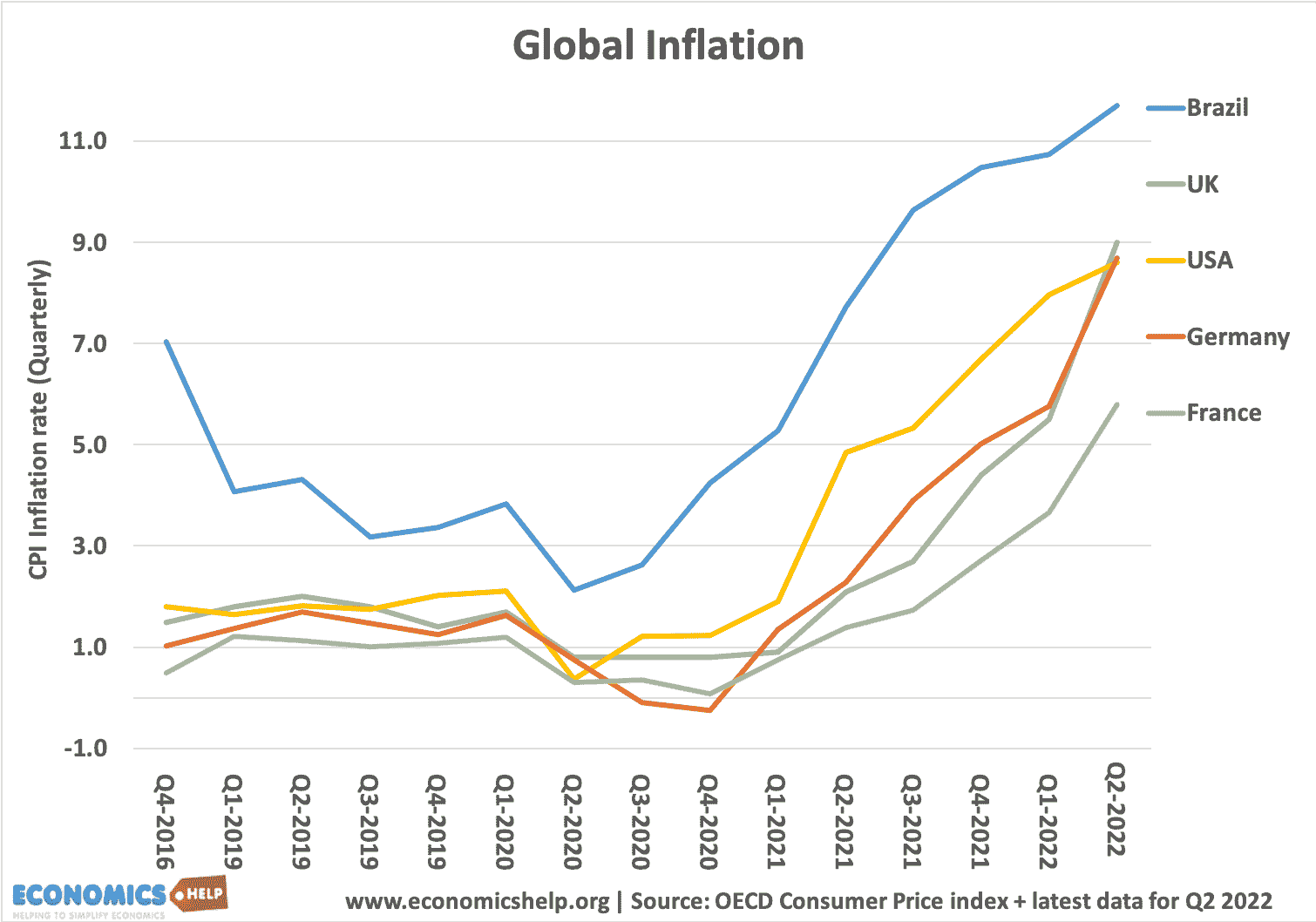

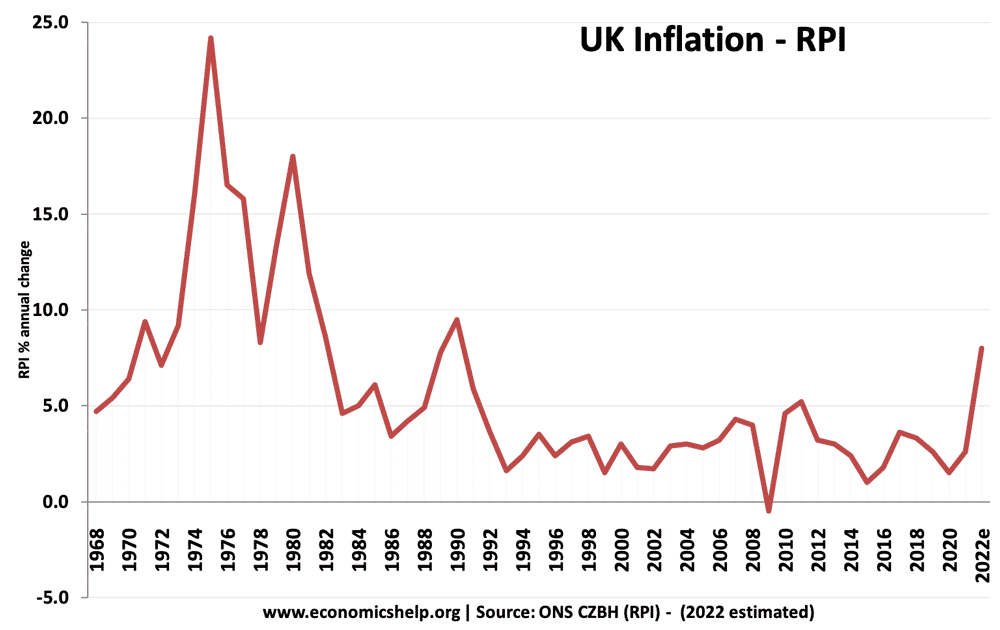

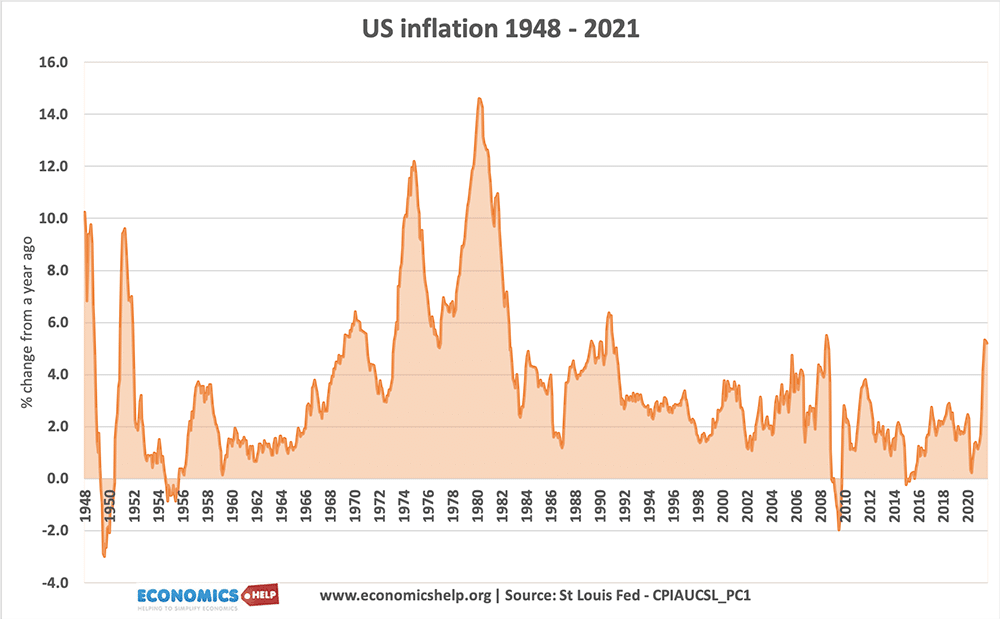

In 2022, inflation has increased in western Europe to the highest levels for many years. With inflation in UK and US approaching 10%. Yet, despite rising oil prices and other inflationary pressures, inflation is still considerably lower than in the 1970s.

A big question is whether we will see inflation rise to 1970s levels or will this inflation prove temporary and fall back soon?

Arguably there are several factors that caused inflation to be higher in the 1970s – different demographics, more robust underlying investment, more powerful unions and less confidence in monetary policy. Therefore, there are reasons to believe inflation will remain lower than in the 1970s.

Why was high inflation so high in the 1970s?

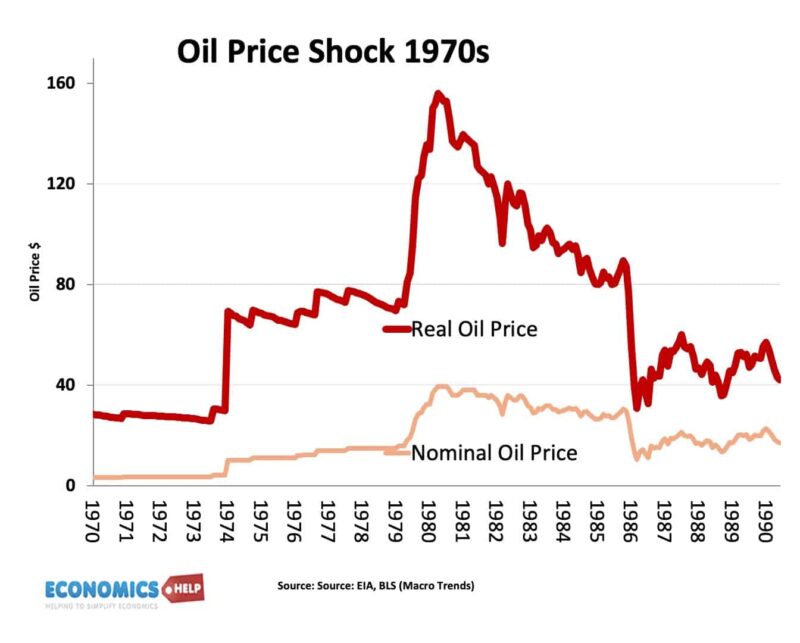

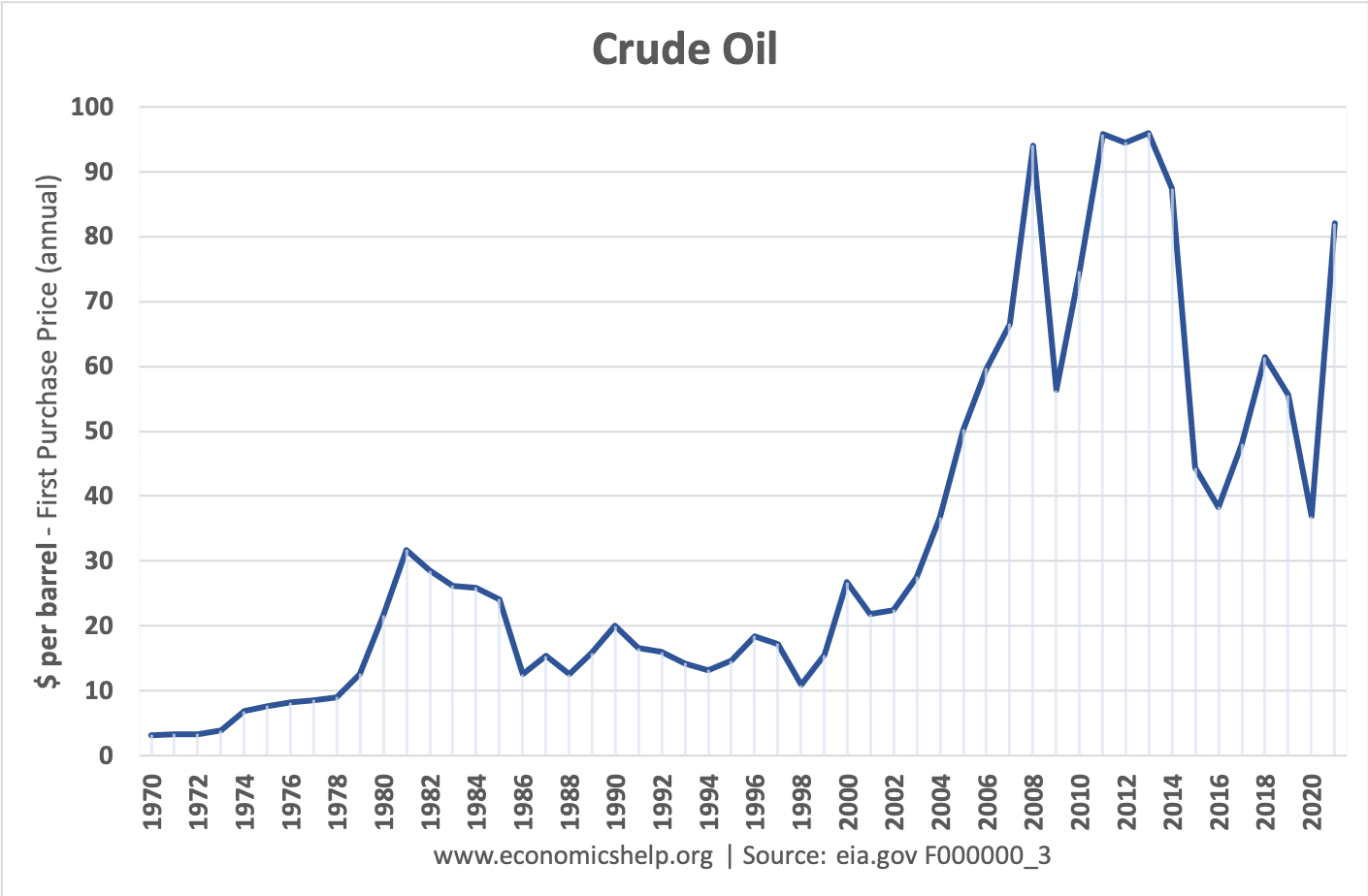

Firstly, in the 1970s the rise in the price of oil was a bigger percentage rise. In 1973, the oil price tripled overnight due to a successful OPEC cartel. In the 1970s, the world was unprepared for higher oil prices, cars were not fuel efficient and there were fewer alternatives to oil. In the 1970s, oil was more important to the world economy and had a bigger direct impact on inflation. In recent years, oil has had a smaller percentage effect on GDP. We have more fuel-efficient cars and are increasingly finding replacements, such as electric cars. Therefore, the link between oil prices and inflation is important but weaker than it used to be.

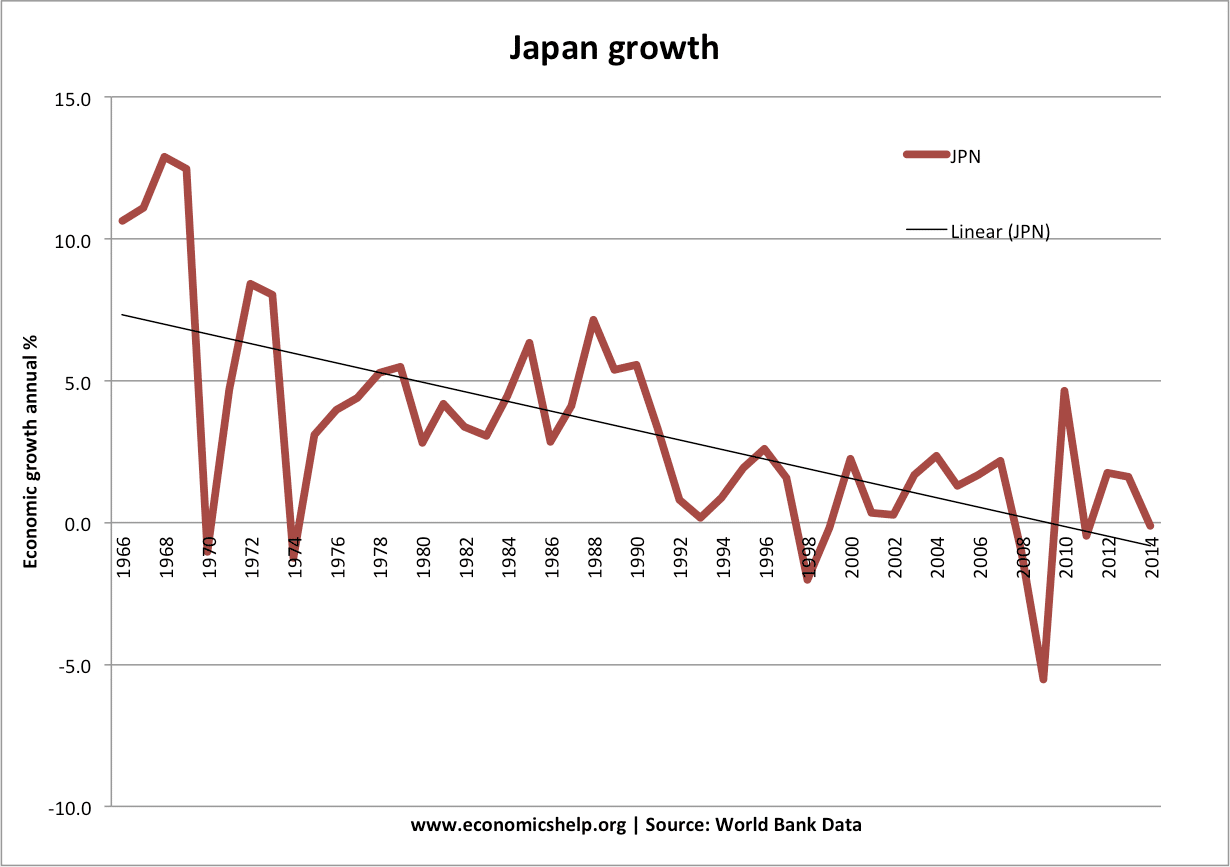

The second factor is the theory of secular stagnation. The observation advanced societies have experienced very low interest rates, weak economic growth and lower inflationary pressures. The post-war period was a prolonged period of strong economic growth and investment. This reflected post-war optimism but also a demographic structure and growing working age population that suited investment. In this period of high growth and investment, it was easier for the economy to experience inflationary pressures.

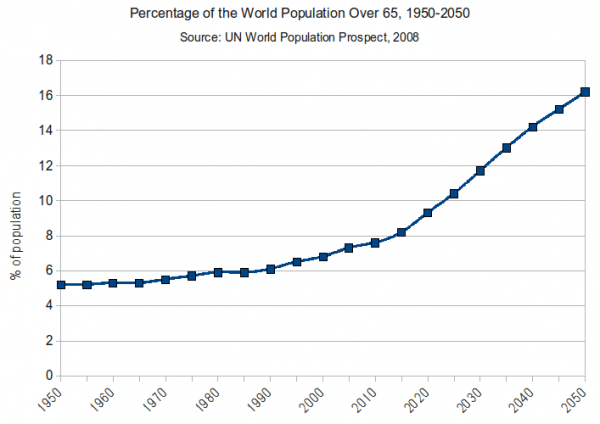

But, in recent years, we have seen a rapidly ageing population and a stagnant working age population. The impact of this ageing population is that there is structurally less demand for investment. (It is young working age people, who tend to want new shops, new activities, new business) With less demand, businesses has been unwilling to invest at a level to use up the levels of household savings. This surplus of savings has led to very low-interest rates and low underlying inflation.

Central Banks have struggled to return the economy to a more ‘normal’ situation of moderate interest rates and consistent growth.

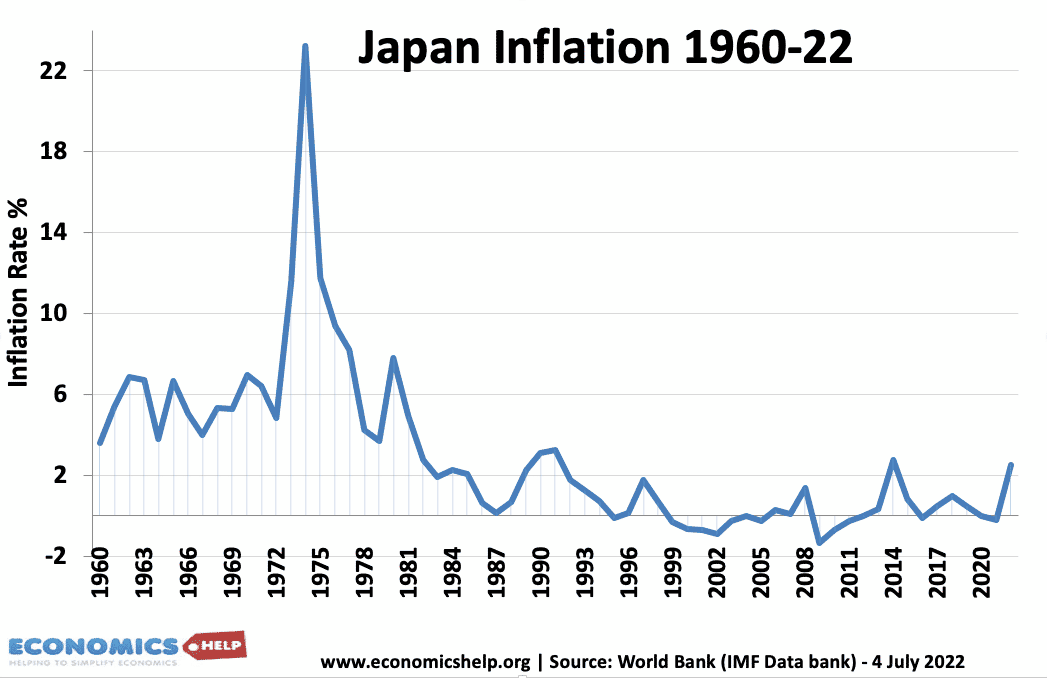

The leading exponent of secular stagnation was Japan, whose ageing population was not replaced with net migration. Since the early 1990s, Japan has alternated between very low inflation and deflation.

Even attempts by Central Banks to cause inflation fell flat. The argument is that Europe and the US are catching up with Japan’s demography, and these countries will be increasingly open to the same demographic influences of low investment and low-interest rates.

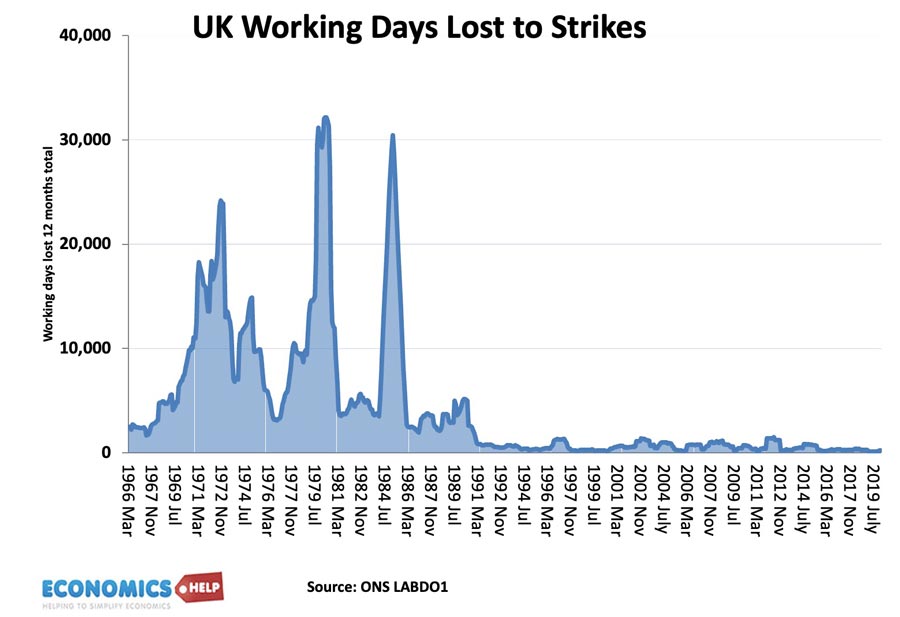

Another factor to explain high inflation in the 1970s was the contrasting influence of trade unions. The 1970s were widely viewed as the high watermark of trade union influence in the UK and US. In the 1970s many days were lost to strikes and trade unions wielded significant power in bargaining for inflation-busting pay rises.

The 1970s was a period of strong trade union power, which enabled higher wages.

The UK cabinet papers point out the role of unions in pushing for wage inflation.

“The influence of shop stewards in local negotiations increased the demand for higher and higher pay rises averaging over 26 per cent in 1975.”

The influence of trade unions was important in creating a wage price spiral that entrenched the initial cost-push inflation of higher oil prices. With workers getting above inflation pay increases – firms faced higher costs and so put up prices. With increased nominal wages, workers were able to spend more causing more demand-pull inflation. It was a vicious cycle of inflationary pressures.

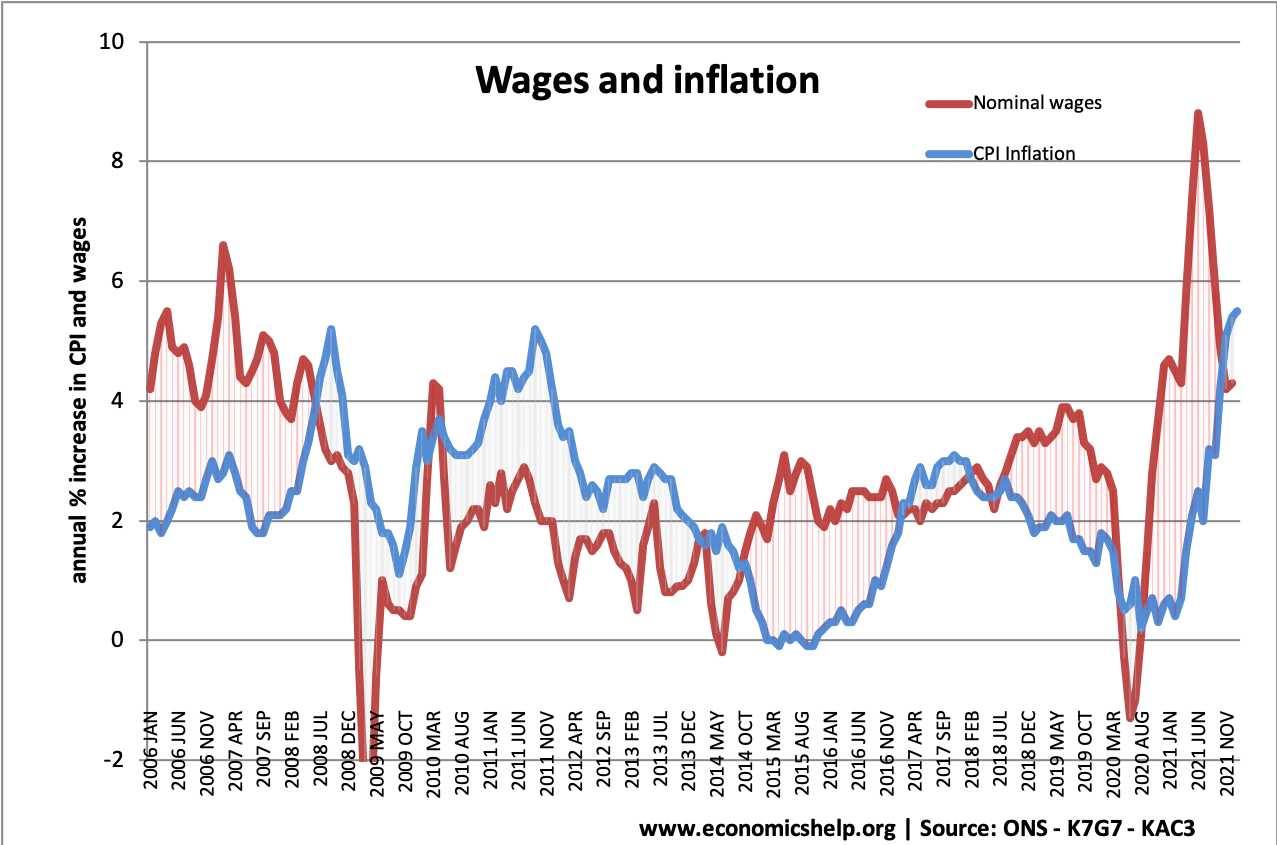

By contrast in the 2020s, union power is much more limited and the ability of workers to bargain for higher wages is much more difficult. Union membership is lower and many jobs are non-unionised in a highly flexible ‘gig economy‘. Despite labour shortages causing some localised pay rises, the graph for real wages shows how inconsistent is the ability of workers in the UK to get above inflationary pay increases.

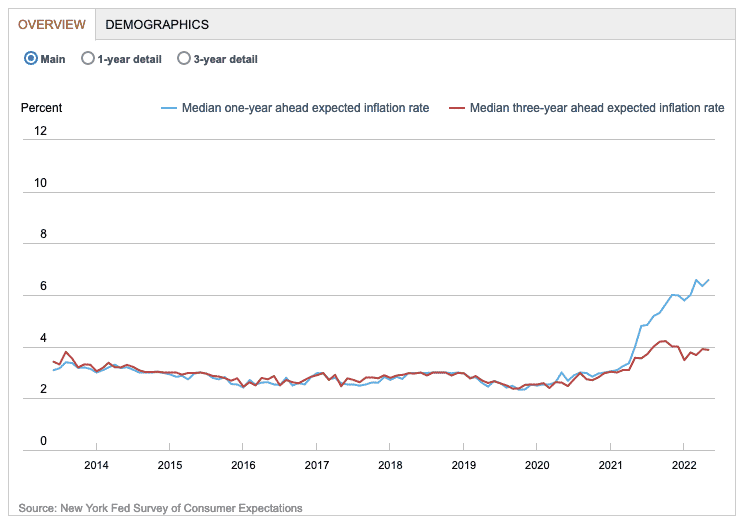

The experience of 2020 has caught many Central Banks by surprise with inflation rising far above expectations. This is a rare failure among independent Central banks and could damage their reputation for keeping inflation low and lead to higher inflationary expectations in the future. However, so far, it appears medium-term inflation expectations are still low. With people generally expecting inflation to fall.

US inflation expectations are currently lower than actual US inflation.

Source: New York Fed

In the 1970s, inflation became entrenched in expectations making it become self-fulfilling. But, in the 2020s, we don’t have that same memory of entrenched inflation. And there is still greater confidence in Central Banks targetting of inflation than in the 1970s.

Video version

This seems to be a little slanted and blames unions and doesn’t take into account monetary policy in the 70’s, the shock and counter shock of price controls placed by the Nixon administration and OPEC shock (which the article has listed).

Firstly, the price controls of oil prices implemented by the Richard Nixon administration historically speaking did contribute to the shortages of oil. Secondly I agree that low interest rates & the OPEC shock did initially contribute with the high cost-push inflation rates due to increase in oil prices as a result of the OPEC shock or the oil embargo implemented by the Arab nations to the US & high demand-pull inflation rates due to the low interest rates, but the problem is rather than attempting to reduce demand-pull inflation rates by increasing interest rates (which was implemented by the Reagan administration which resulted in inflation rates falling to around 4.1% in the year 1988) & rather than attempting to reduce oil cost-push inflation rates by deregulating the oil industry by decontrolling domestic oil & natural gas prices alongside getting rid of the windfall (or excise) tax on domestic oil production to increase domestic oil production to reduce reliance on oil imports (one congressional study found that the tax reduced domestic oil production by 3-6% and increased U.S. imports by 8-16%), the issue is with trade unions is that when unions increase the wages of their member workers this then increases the cost of producing goods & providing services as labour is one of the four factors of production, not only increasing cost-push (wage) inflation as labour costs are fixed costs, businesses in order to recover from their losses have to raise their prices, hence contributing to overall inflation rates on an aggregate level. Moreover, if consumers have more money to purchase goods & services in the market due to higher salaries, this then not only translates to a substantial increase in the level of consumer spending, an increase in demand-side economic growth (or aggregate demand/AD) as consumer spending is one of the components of aggregate demand or AD but this also means that if more & more consumers are purchasing more & more goods & services due to their disposable nominal incomes increasing, that means that not only is aggregate demand or AD is increasing but at the same time aggregate demand or AD is exceeding aggregate supply or AS (both SRAs & LRAs) above the equilibrium point & if the supply of goods & services (or aggregate supply/AS – both SRAs & LRAs) cannot keep up with the increasing aggregate demand or AD characterised by a substantial increase in consumer spending due to the substantial increase in the disposable nominal incomes of workers this is commonly known as a macroeconomical scenario where there is too much money chasing too few goods & services, then prices of goods & services will simultaneously & substantially rise.

Hope this answers your question!