Earlier this summer the Bank of England warned that the UK was heading into the deepest recession in a generation. Yesterday the Bank of England warned the UK was in the longest recession in a generation – a double gloomy prognosis to go with their record-breaking rise in interest rates by 75 basis points from 2.25% to 3.00%.

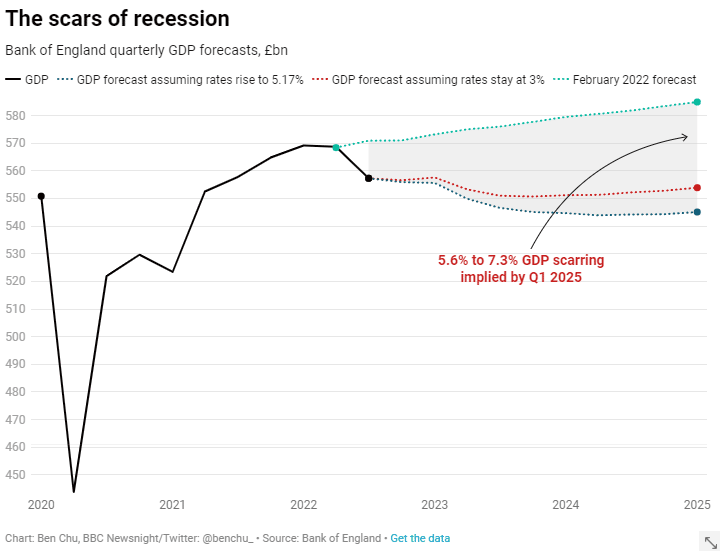

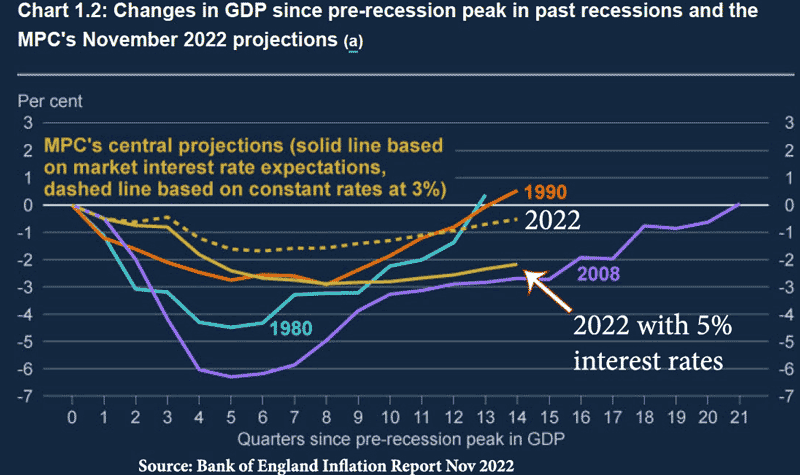

They forecast output to fall 2% next year, but more concerningly warn that output could be 5-7% less than the pre-2022 crisis trend.

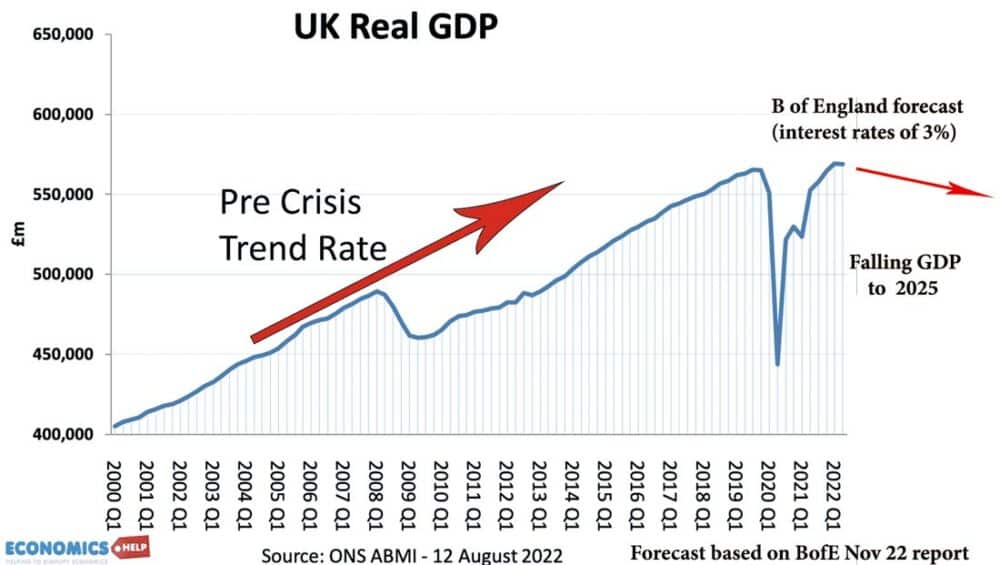

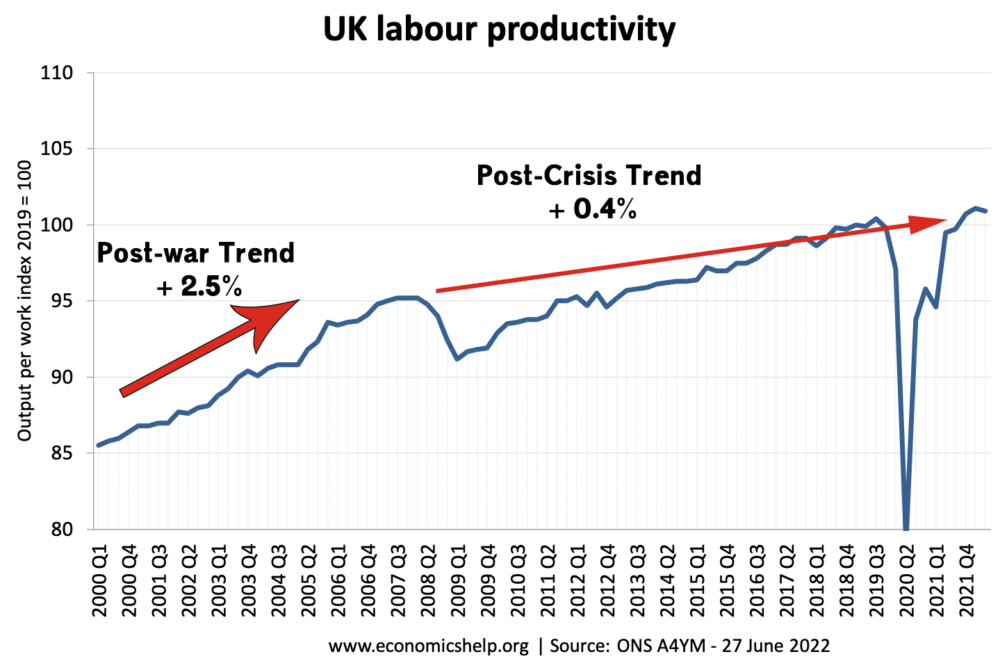

To put this into context, UK GDP had already fallen behind the historical trend rate of growth – post-financial crisis, leading to a permanent loss in output. Since Covid, real incomes have not caught up.

Usually, with a big drop in GDP, you would expect a rebound, but the expectation in the coming years is the opposite – that GDP will continue to decline.

What is behind the very dismal Bank of England forecasts about the UK economy?

Inflation

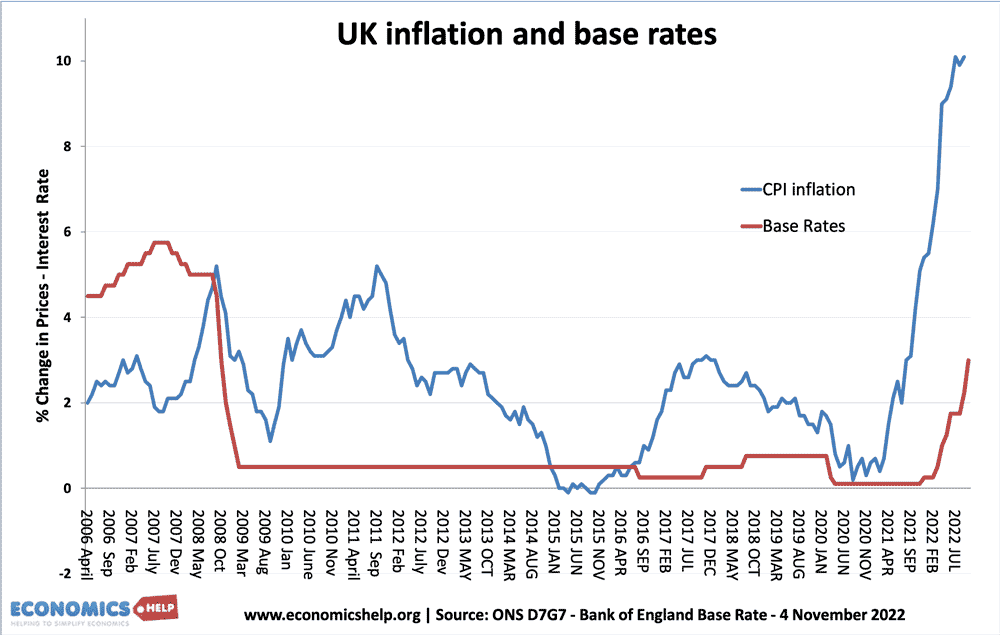

As you are probably tired of hearing, we have seen a surge in inflation to over 10% – levels not seen since the early 1980s. It is not just a UK issue but inflation is elevated all other the world. OECD inflation is currently averaging 10.5%. It is also the ‘worst’ kind of inflation. It is not traditional demand-pull inflation caused by an over-heating economy – but rising energy prices (oil, gas) which are causing an unprecedented cost of living crisis.

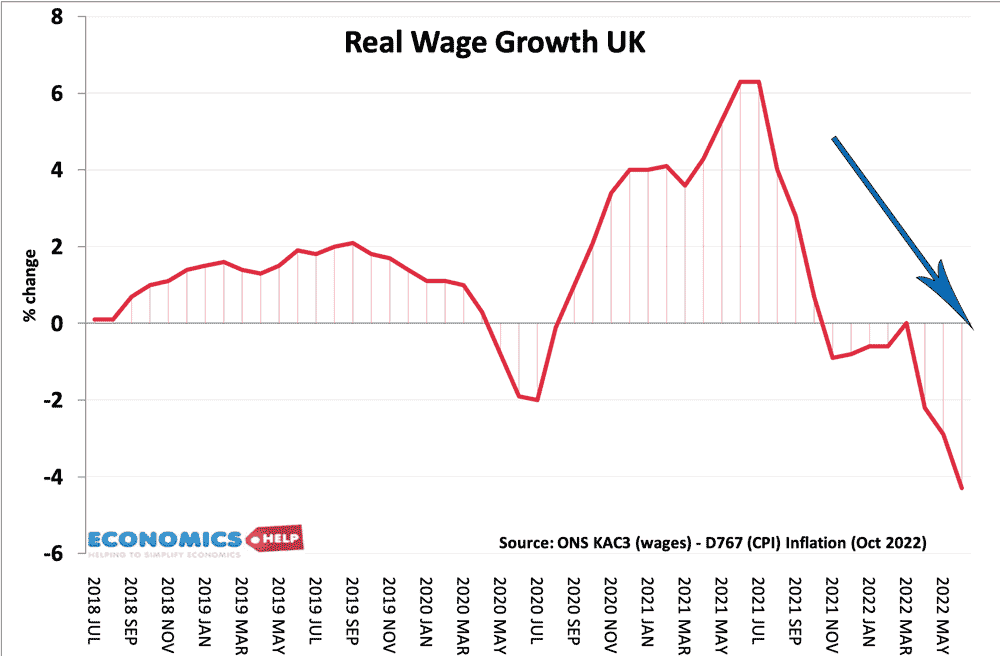

Often in the past, rising energy prices have caused temporary inflation, and indeed the Bank probably hoped this would be too. But, there is growing evidence inflation is becoming embedded in a wider range of goods and services. The Bank noted core services inflation has been rising for two years and private sector pay growth rose to 6.2% – Nominal wage growth enough to cause inflation, but not enough to prevent real wages from falling.

This presents the Bank of England with a dilemma, it feels the need to bring inflation under control, but it knows increasing interest rates will cause a recession.

The one good piece of news in the Bank of England report is that it feels market expectations of interest rates are overvalued. They argue with market predictions of 5.5% base rates, the recession would be even deeper. But, they hope they will be able to keep interest rates lower.

The yellow dotted line shows the predicted GDP given interest rates of 3% – it is not deep, but will still cause a recession longer than 1990 or 1980.

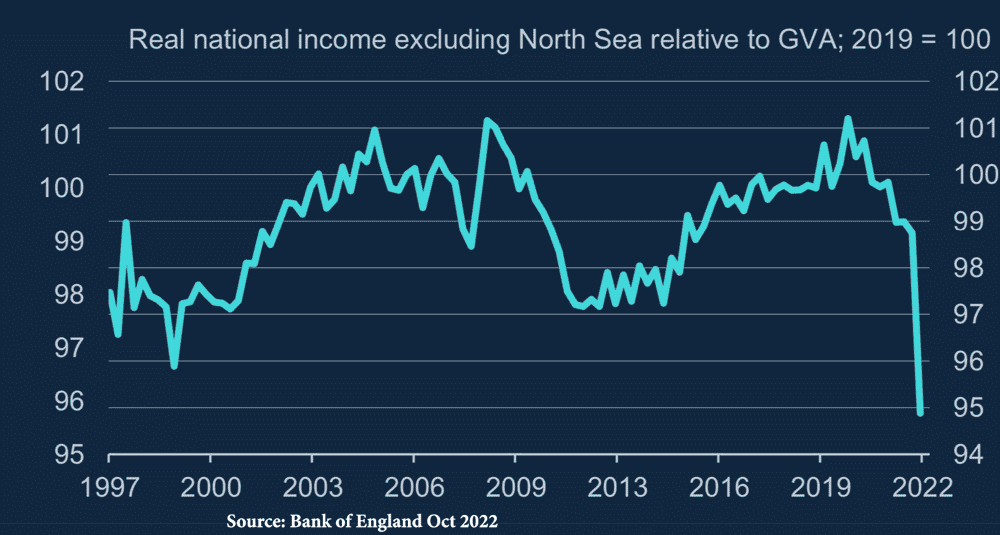

The extent of the fall in UK real national income

This graph which shows National Income (excluding North Sea) shows the decline in national income (which is usually masked by oil output). This explains why we are seeing such drops in real wages

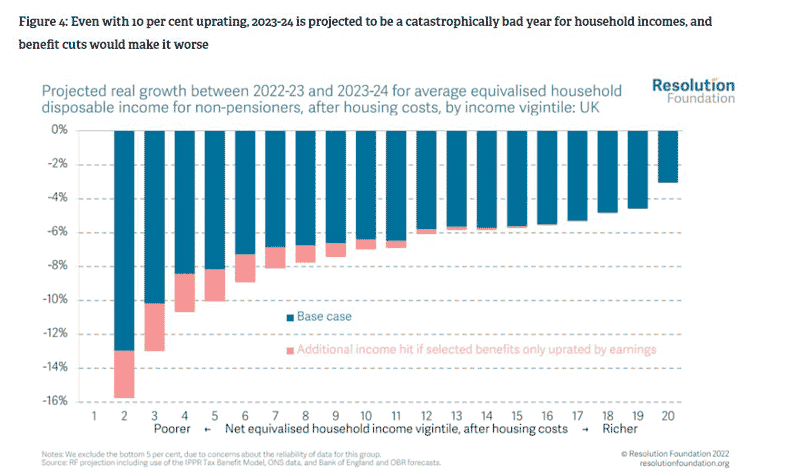

This fall in real wage growth means households will have to cut back on spending on dip into savings. The problem is 2023, is likely to see a further deterioration in real incomes – especially for those on low incomes.

A return to austerity

After the disastrous mini-budget of September where markets took fright at the scale of proposed tax giveaways, the new PM and chancellor have reversed course promising to put fiscal credibility as a major priority. This enabled market interest rates to come down, but the downside is likely to be further tax rises and spending freezes to try and fix the budget black hole. In early 2022, we had a loose monetary and loose fiscal policy – now we are getting both fiscal and monetary tightening.

The big concern is that if the OBR have a similarly dire forecast to the Bank of England, it will put even more pressure on the government for tax rises and spending cuts. Austerity in a period of falling real wages will cause significant falls in demand.

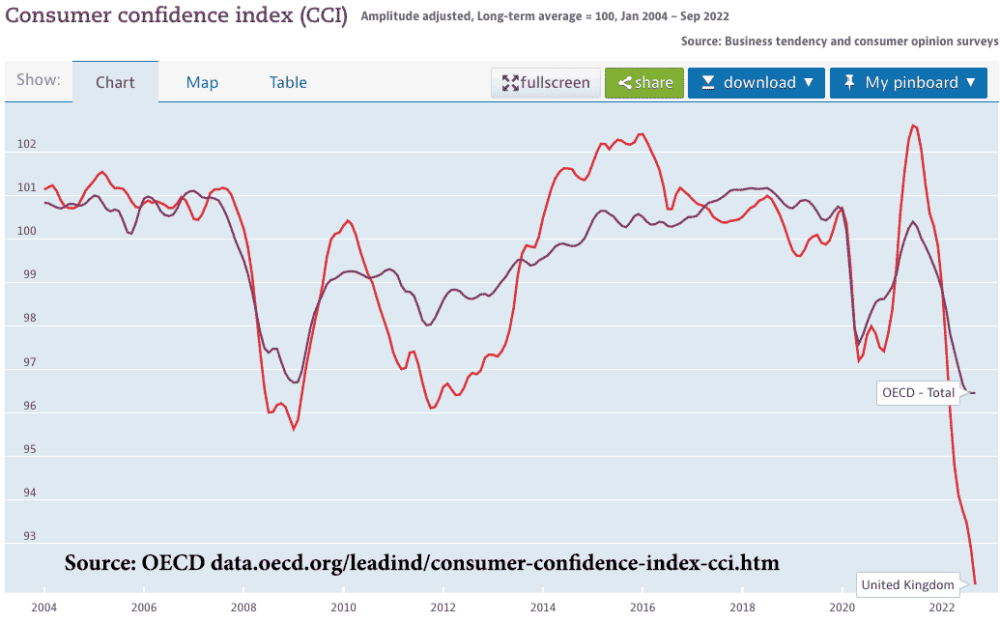

Consumer confidence

Given all the bad economic news it is unsurprising to see there has been a sharp decline in consumer confidence. Consumer confidence has deteriorated more than the last 2008 recession and the 2020 Covid pandemic.

The precipitous decline in UK consumer confidence is an indicator of a coming recession as consumers will hold back spending.

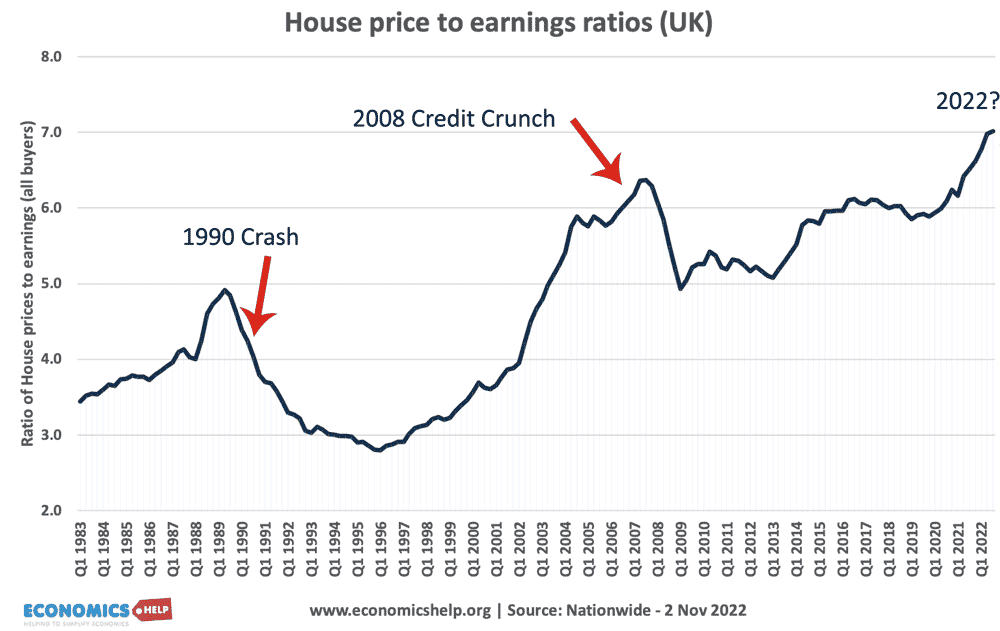

House price falls

On top of this, the UK economy (like many others) is bracing itself for a fall in house prices in 2023. House prices began to fall last month. But, with interest rates rising, and mortgage costs going up, it is likely to be the pivotal moment when overvalued house prices fall even more. (It is noteworthy that although market predictions of interest rates have come down a little. Mortgage rates are still hovering around 6 – 6.5%). Even if house prices fall a modest around 10%, it will have a large drag on economic growth and confidence as falling house prices reduce the biggest form of wealth. House price falls invariably cause a deep recession, such as the last house price crashes of 1990 and 2008

It is not just the cost of living crisis which will cause a fall in demand. The UK also faces a decline in investment spending as firms are concerned about future private sector demand. The uncertainties and frictions of Brexit are also acting as a constraint on UK growth.

Global factors

It is not just the UK heading into a recession. Europe has also been badly affected by rising oil and gas prices. A global slowdown will affect UK exports and general business confidence.

A complication for the world economy has been the strength of the US dollar. The US economy has strong demand. And so the Fed has been raising rates to reduce US inflation and US growth. However, this has caused a soaring US dollar. A strong dollar and a weaker Pound/Euro – add to our imported inflation. Also to protect currencies such as the Euro and Sterling, it requires higher interest rates in Europe too. At a time when Central Banks don’t really want to.

Longer-term issues

The main risk factor for recession is the short-term factors, such as interest rates, inflation, falling real wages, falling house prices and a drop in confidence. However, there are other longer-term factors which are adding to the difficulties of the economy.

Brexit has increased trade frictions with Europe, leading to a decline in foreign direct investment and exports lower to Europe than they otherwise would have been. The costs of new trading arrangements are an additional burden for many businesses (especially small and medium-sized firms exporting to Europe).

Shortages of the labour market. One good story for the UK economy is low unemployment. But, this is partly caused by falling labour supply, especially with older workers leaving the labour force. This is a combination of factors, such as poor health, and early retirement. Perhaps the housing market is playing a role. Those who have paid off their mortgage and have a house worth £300,000 – why work when you can use the value of your home for early retirement? Shortages in the labour market have been exacerbated in some sectors because of Brexit limiting flows from Europe.

Poor productivity. The UK economy has underperformed ever since 2007, where poor-productivity growth has led to the weakest growth since before WWII. Poor productivity itself doesn’t precipitate a recession. But, when average growth is less than 1%, it doesn’t take much of a demand shock to push you into recession.

Further reading