Nearly two years after leaving The Single Market, the UK economy is facing a host of problems including high inflation, low investment and falling growth. All problems exacerbated by Brexit.

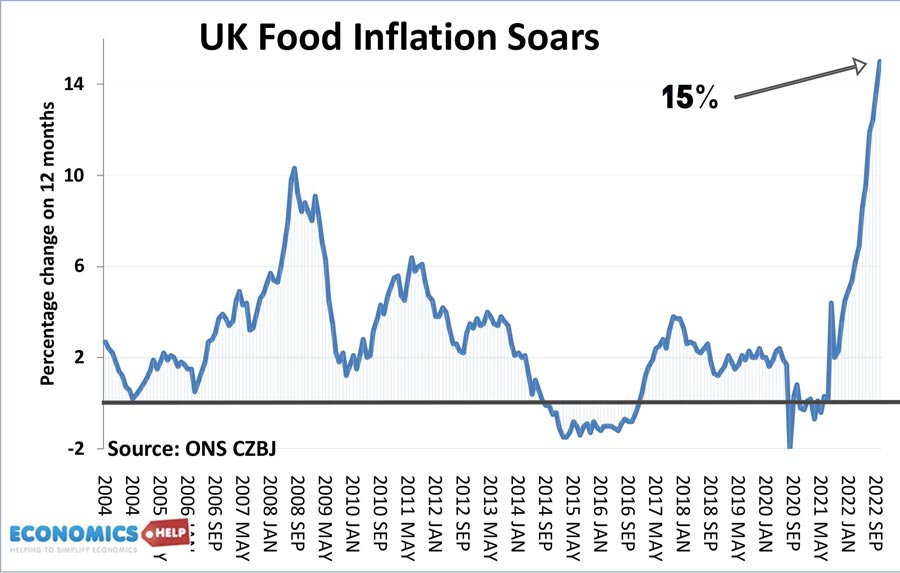

Last month, food inflation rose to 15%, the highest level for decades. This is primarily due to rising energy prices, But, experts at LSE state Brexit has also played a significant role, increasing prices by 3% a year, adding £6bn to food bills in the past two years, equivalent to £210 per household. This is at a time of falling real wages and real cost of living pressures.

The reason Brexit has increased food prices is threefold:

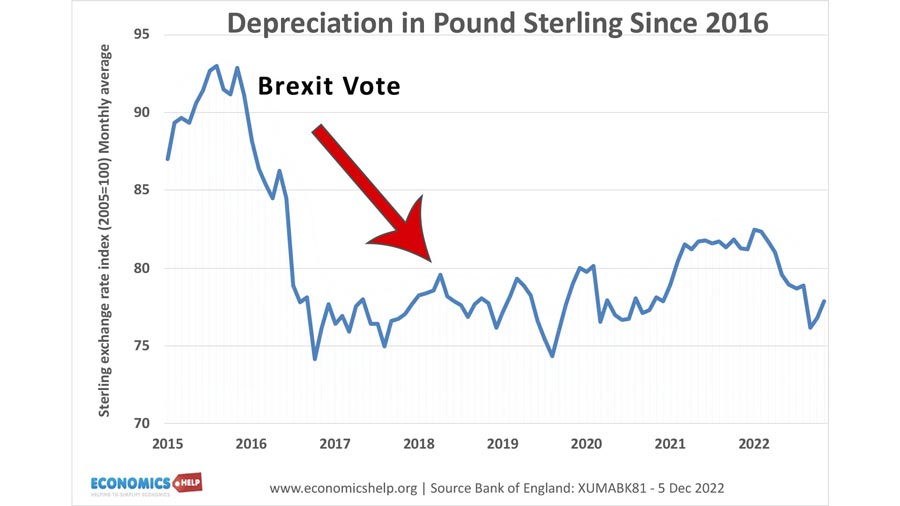

Firstly, the post 2016 referendum devaluation in Sterling. Since 2016, The Pound has fallen against a basket of currencies by about 20%. This has pushed up import prices, especially food and oil. Theoretically, it is hoped a 20% devaluation would increase competitiveness of exports and increase export demand, but so far there has been little sign of strong export growth.

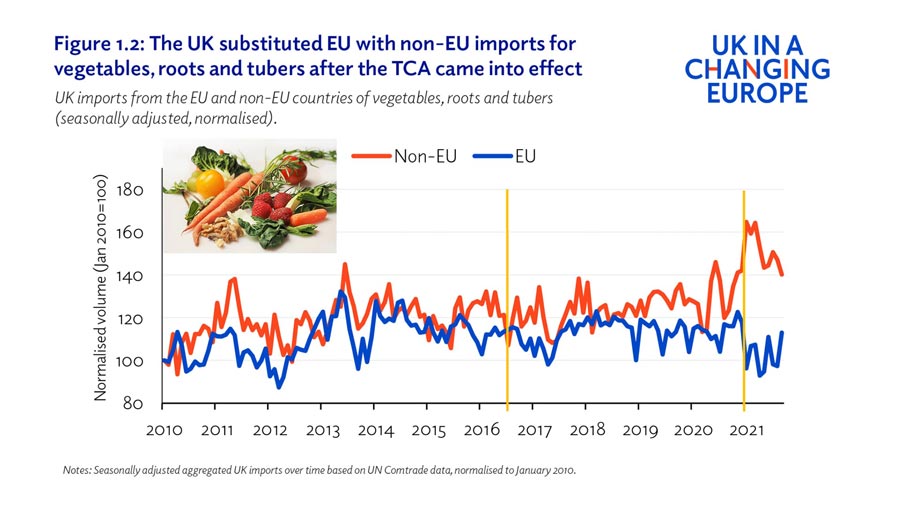

Secondly, Since leaving the Single Market in Jan 2021, the UK faces new non-tariff barriers, which have increased the cost of importing food, especially complex food items, such as fish, meat and eggs. Non-tariff barriers include custom forms, regulations, safety checks and long delays at the border.

Thirdly, a shortage of labour has led to farmers not able to harvest all their groups, reducing supply. As many farmers have commented restricting freedom of movement has had a devastating effect for their business.

Also, the Brexit impact on food inflation has hit the poorest income groups the hardest because those on low incomes tend to pay a higher proportion of their income on food.

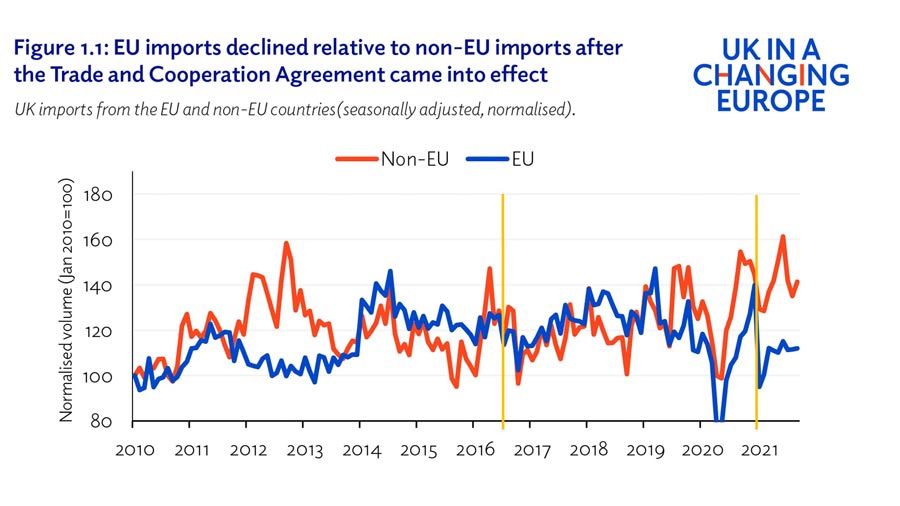

Since 2021, there is a clear decline in imports from Europe. Although trade was hit by a combination of Covid and Ukraine war, the decline in trade has been much stronger for the UK than other countries. This is true for both import growth 2019-22 and export growth. The decline in import is particularly noticeable for perishable items like vegetables which can’t survive delays at ports.

In addition, to falling imports, exports have also been hit by customs duties and increased paperwork. This has particularly hit small exporters, who have struggled with new bureaucracy. The number of UK export products has fallen 40%, with many firms struggling with customs and regulation.

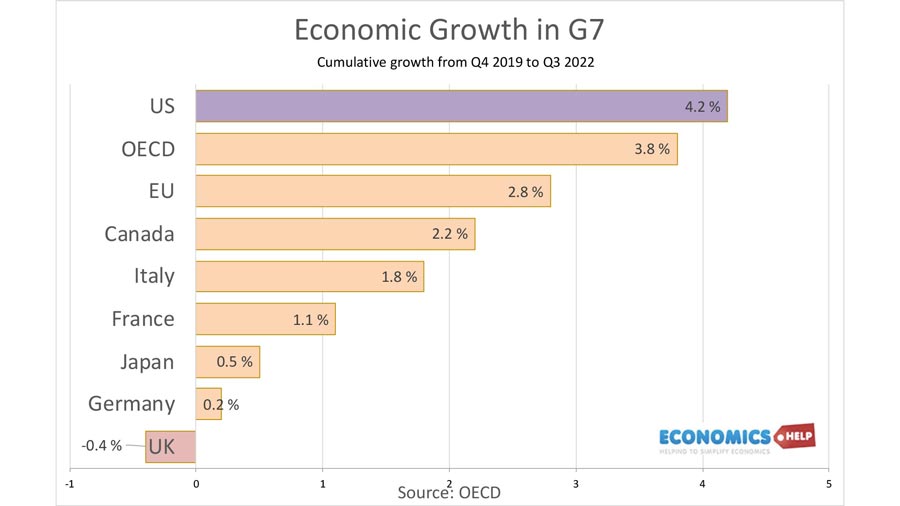

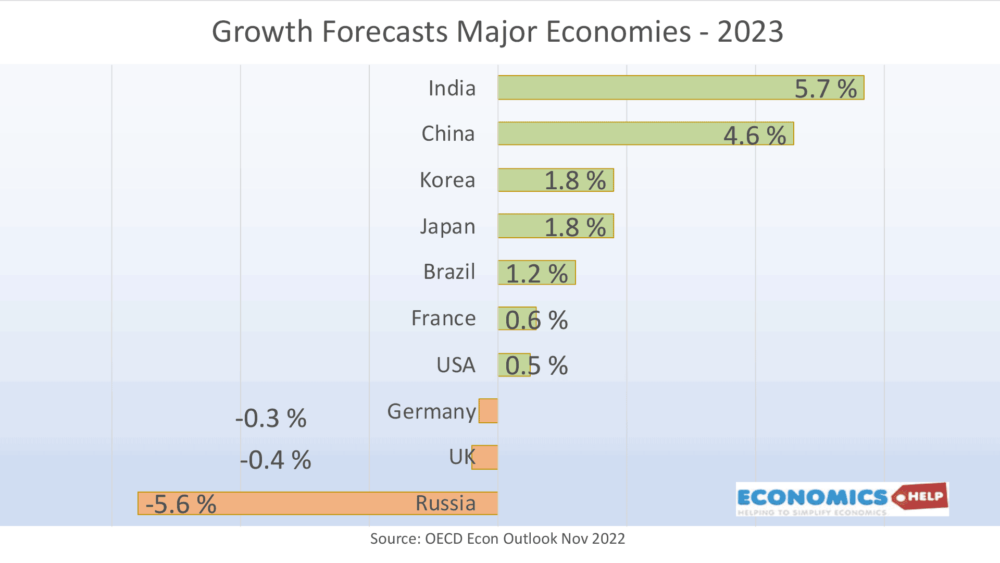

The problems of Brexit have contributed to the UK having the lowest growth rate in the G7, and according to the IMF and OECD, to have one of the lowest forecast growth for 2023.

I actually have personal experience of this new trading arrangement, as I ship books to Europe for a literary organisation. Before 2021, exporting was seamless. But, since Jan 2021, shipping costs have soared, as you have to pay additional duties before export.

You can see how a typical order for €900 has significantly higher shipping since Brexit. But, the worst has not been the higher costs, but the uncertainty, delays and the fact numerous shipments have failed to make it or get returned. It is a nightmare for small businesses, and a reason many have relocated to Europe.

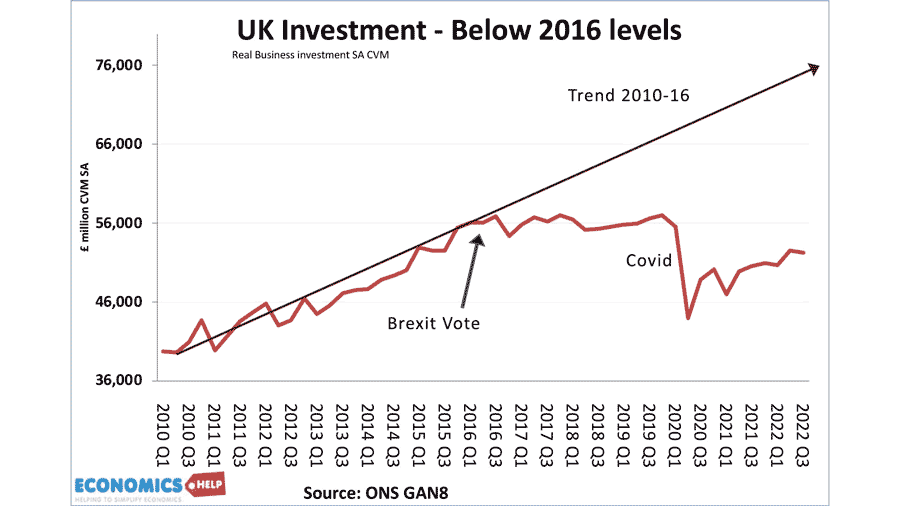

Understandably, the Brexit uncertainties and higher costs have led to a sharp fall in business investment. This fall was worsened by Covid, but the UK has not recovered anything like the EU and US. It leaves the UK with one of the lowest levels of investment in G7, and comes at the worst time when the UK has a productivity crisis. To reverse this decline in the trend rate of growth, the UK desperately needs more investment, but Brexit has been a big factor in holding it back

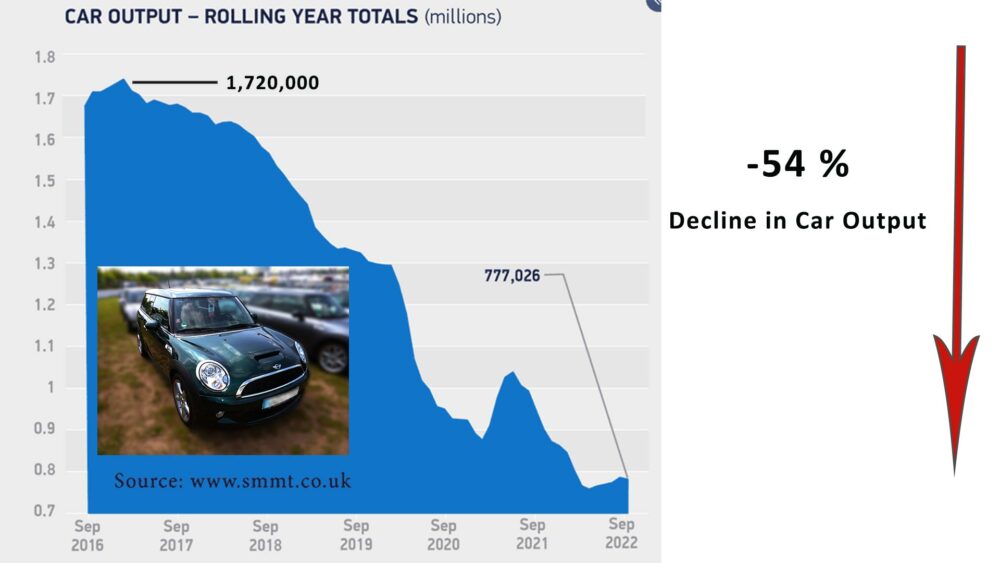

Business difficulties are highlighted by the plight of the car industry, which has seen a precipitous decline in car production, with nearly 54% fall in production. This decline was exacerbated by Covid and difficulties for the whole car industry. But, leaving the Single Market has increased costs and reduced the attractiveness of the UK car industry. In particular, the UK’s lack of strong battery capacity means the long-term outlook is grim. I live in Cowley, Oxford, a stone’s through from the successful BMW factory, But, recently the owners announced, they would stop producing the electric version there. With petrol cars getting phased out in 2030, this is worrying for the long-term future of the car industry. Firms prefer to be in a single market and not worry about the extra costs to trade.

To be fair, one of the few economists to promote Brexit, Patrick Minford did actually say, he expected Brexit to hit the car industry and mostly eliminate manufacturing, but he said it was worth it, to enable new trade opportunities to materialise.

Brexiteers have been keen to highlight the potential of free trade deals, which can help UK exports. However, so far, trade deals have been few and far between, rushed to get a deal, no matter whether it is good. This is highlighted by a free trade deal with Australia, which was negotiated by Liz Truss as trade secretary. At best government claimed it may increase UK GDP by 0.08% by 2035. But, it was later criticised by former cabinet member George Eustice for giving too much away in a rush to get a deal and damaging UK farmers.

It highlights the limit for free trade deals with non-EU countries to replace that of EU. The prospects of a UK-US free trade deal look slim, especially given the difficulties over Northern Ireland.

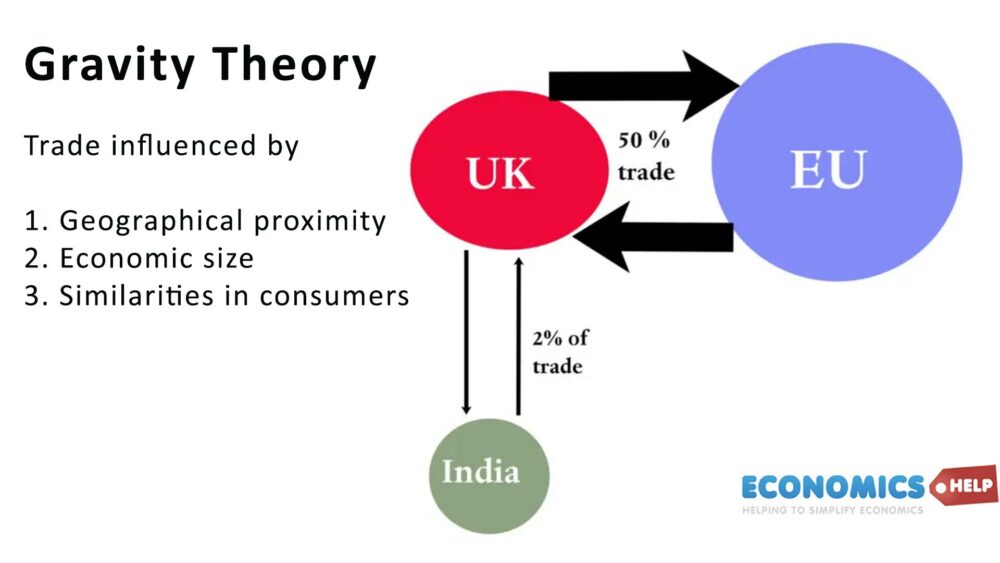

An important factor in modern trade theory is ‘gravity theory’ – the idea your best trade partners are those who are geographically close. The opposite of the logic of Brexit, which tries to replace trade with our near neighbours with those geographically distant.

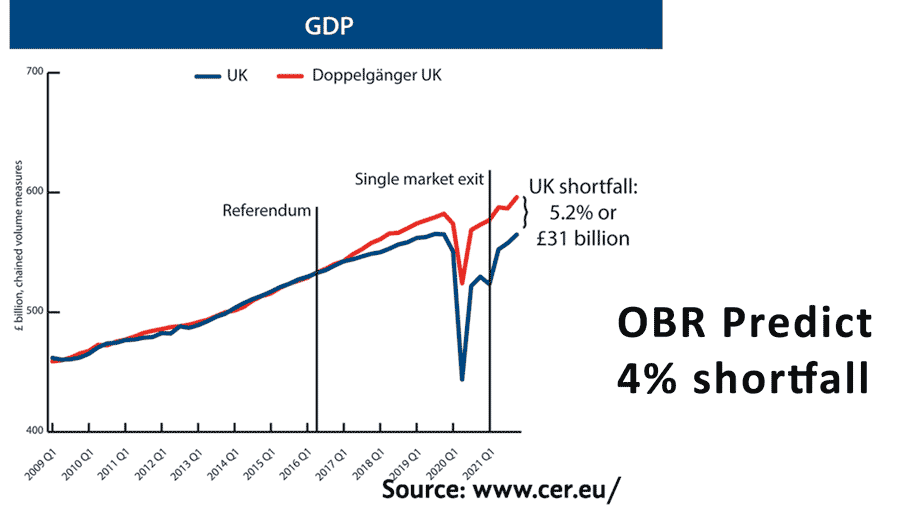

Overall Brexit has been expected to cost 4% of UK GDP. It is a decline the UK can’t afford, given the pressure on public services. The UK is facing a host of problems with public services. The decline in growth is causing lower tax revenue and fewer funds for the NHS. We can see that in the surge in waiting lists on the NHS, whether it is A&E or access to cancer treatment, the effect is very worrying. The strain on public finances predates Brexit and goes back to the austerity of 2010, if not earlier. But, the decline in growth from Brexit will make these issues much harder to fix.

Further reading

External links

- Post-Brexit Imports and Supply Chains

- CER.EU Costs of Brexit