Economic uncertainty refers to how firms and consumers are unsure about the future direction of the economy and usually react in a more conservative behaviour (i.e. less spending and investment) Economic uncertainty usually causes a lower rate of economic growth, until the uncertainty is resolved.

UK economic uncertainty

Measuring uncertainty

There is no easy way to measure uncertainty, the group ‘economic policy uncertainty’, use three components:

- Mentions of uncertainty in newspapers / media

- Number of temporary federal tax code provision (US)

- Variance between different economic forecasters on issues like CPI and government spending. i.e. bigger divergence in economic forecasters suggests greater

In addition, uncertainty, could be measured using:

- Levels of consumer confidence

- Levels of business confidence

- Surveys asking firms whether they plan to invest in next few months.

Causes of uncertainty

- Political turmoil, e.g. major wars, e.g. Gulf War II in Iraq 2003. General elections where outcome is uncertain. Scottish independence referendum.

- Major economic change. UK leaving EU, with uncertain outcome for trade and investment decisions.

- Financial turmoil. Credit crunch, failure of Lehman Brothers, fall in stock markets, rising bond yields (e.g. Eurozone crisis 2011/12)

Effects of uncertainty

- Firms delay investment. Investment tends to be volatile because it is risky and quite a commitment. If you are uncertain what will happen, there is strong motivation to delay investment and see whether it will still be profitable in the future. This decline in investment can cause a negative impact on economic growth

- Consumers delay consumption. Consumption is less volatile than investment because many items of consumption are necessities, but consumers may delay purchases of expensive luxury goods as they wait and see the outcome which could affect their job prospects.

- Financial markets. Financial markets tend to dislike uncertainty. Uncertainty in the UK, may lead to a weaker Pound as investors are less keen to hold reserves in Pounds; share prices may also fall.

- Bond yields. Bond yields could go either way. If there is uncertainty about the financial solvency of government, bond yields will rise (e.g. Eurozone crisis 2011/12). However, in most cases, uncertainty causes bond yields to fall. This is because uncertainty raises prospect of recession and therefore, investors look for safety of government bonds and are more willing to accept lower yields. See: Brexit caused negative bond yields in UK

- Mini-boom post uncertainty. If uncertainty causes firms to delay investment, the resolution of uncertainty can lead to a mini investment boom as all these delayed projects come back on tap, and there is then strong growth in the future.

- On the other hand, it is possible uncertainty leads to a permanent loss in economic activity. If the uncertainty is sustained, firms may delay investment for a long time and this could lead to a negative multiplier effect, where the fall in investment causes knock on effects on employment and spending.

Does uncertainty lead to recession?

Not necessarily.

- The sharp rise in uncertainty in 2003, did not derail the long period of economic expansion of the great moderation.

- The rise in uncertainty in 2008 was quite muted, but in 2008/09, the UK saw the steepest decline in real GDP on record.

- It depends on the economic fundamentals behind the uncertainty. If it is political uncertainty of a war, the extra military spending can actually increase increase economic growth. If the uncertainty of financial instability proves more damaging than expected, then it is the decline in bank lending which will cause the biggest fall in economic growth, rather than just uncertainty.

- However, ceteris paribus, rising uncertainty will adversely affect the rate of economic growth because of delays to investment and consumer spending.

Dealing with uncertainty

- Monetary policy. The Central Bank can, to some extent, deal with uncertainty by relaxing monetary policy. Lower interest rates and injecting money into banking system can help alleviate some of the falls in spending and give firms encouragement there is an effective monetary policy to help the economy.

- Confidence. To some extent policy pronouncements from politicians and Central Banks can reassure confidence and reduce uncertainty. For example, during the Eurozone crisis of 2011/12 it was only when ECB stated they would do everything necessary to protect bond markets, that the uncertainty subsided. Until then there had been a difference of opinion, with some German ministers not wanting the ECB to act as lender of last resort. However, with something like Brexit, it is hard for a political statement to reassure investors because there are so many variables beyond their control – e.g. how Europe will react both politically and economically.

Brexit and uncertainty

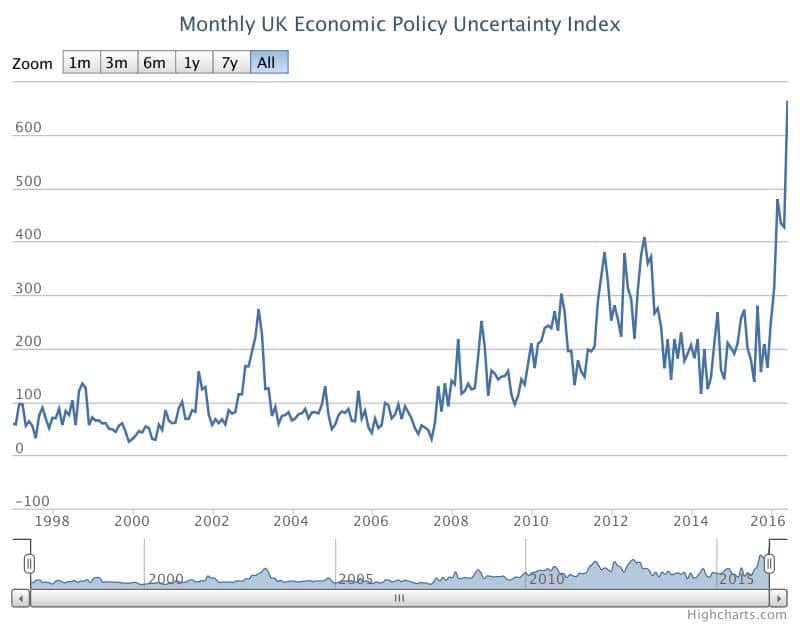

- According to the uncertainty index, Brexit has caused the highest level of uncertainty in the UK. It is a major political and economic change with firms uncertain about the UK’s future access to the Single Market.

- The uncertainty is manifested in a falling Pound as investors feel the UK is less attractive place for investment.

- Firms which rely on exporting to single market are also affected as they are unsure of how Brexit will actually affect them. It is potentially more than just uncertainty, but there could be higher costs for UK firms exporting to Europe.

- An issue with Brexit is whether it is just a case of uncertainty or whether it is uncertainty plus a significant deterioration in long-term economic conditions.

- If the issue is mainly uncertainty, once talks with EU begin, then the investment on hold may be started, and the UK could even have another mini boom as delayed investment leads to rise in economic growth. However, it maybe that loss of complete access to Single Market could lead to permanent decline in inward investment and deterioration in export conditions. In this case, the fall in output may not just be temporary, but lead to permanently lower rates of economic growth.

Related