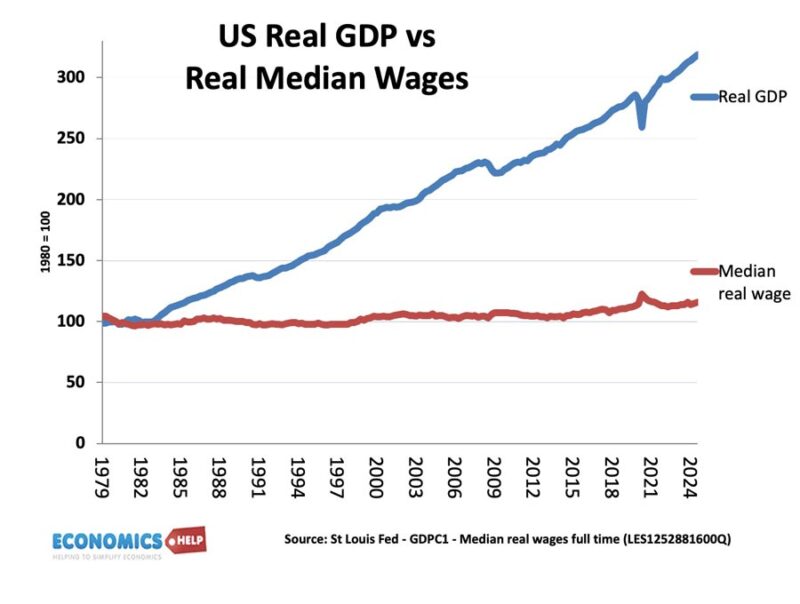

America is the richest country in the world, but America is also a story of two economies. Since 1980, real GDP has increased 300%, someone is definitely getting rich.

But, it isn’t the average worker, because in the same period median wages have barely increased. In recent years, the US economy has outperformed the rest of the advanced world, in terms of GDP the US is racing ahead. And in 2024, there was no shortage of economists pointing out the US economy was doing very well, but there is a growing disconnect between GDP and how Americans experience the economy. Are economists failing to understand what matters?

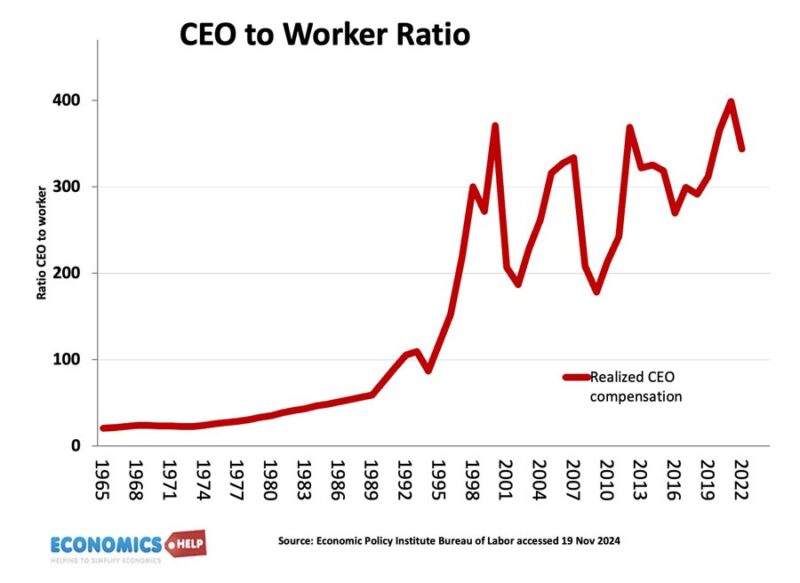

Some people have definitely benefited from the booming American economy. In 1980 CEO pay was on average 35 times a typical worker. Today it is 344 times typical pay.

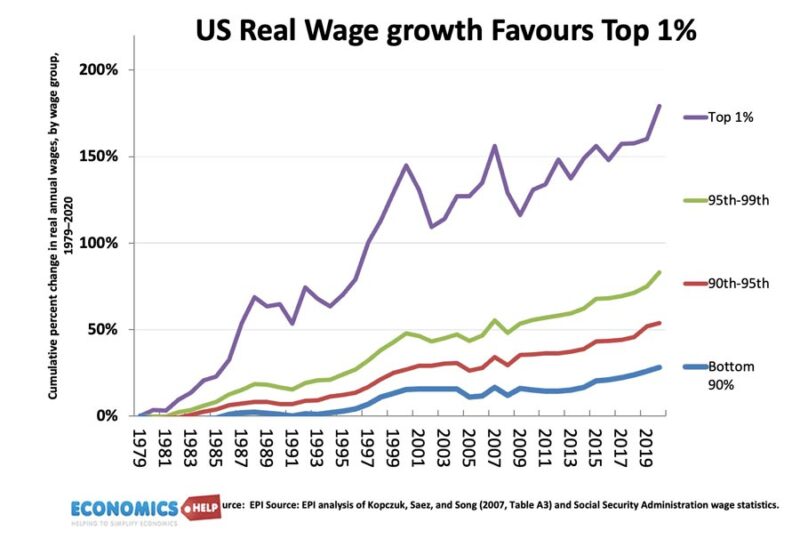

Since 1979, the pay of the bottom 90% of workers has increased 28%, but the pay of the top 1% has increased 180%.

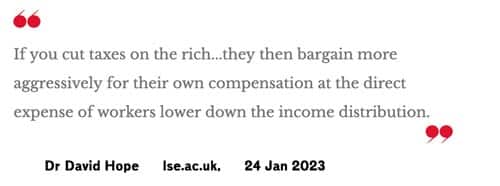

1980 and the election of Reagan and Thatcher saw a new economic consensus – Trickle-down economics – tax cuts for the rich, privatisation and deregulation. The problem with trickle-down economics is that it hasn’t worked. Ironically, a study by LSE showed that lower tax rates for the rich encouraged high income workers to spend more time aggressively getting more compensation at the expense of lower income workers.

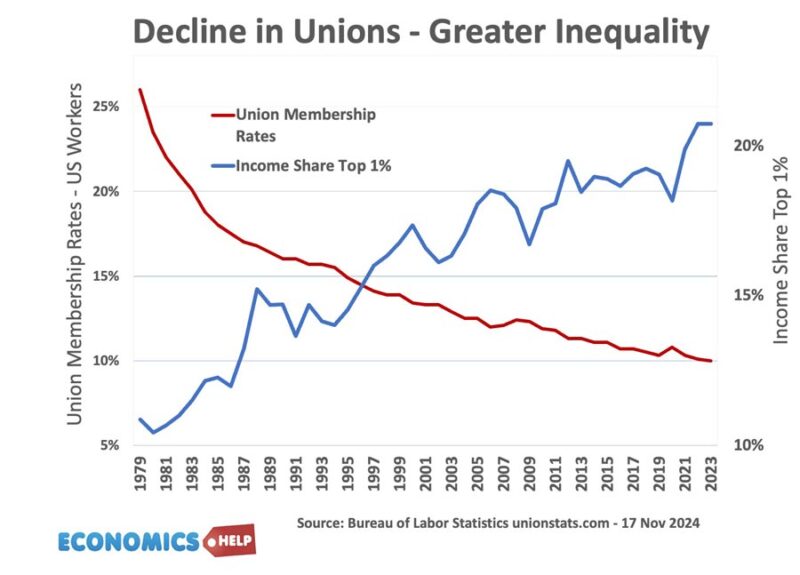

Tax cuts for high earners also corresponded with a period of continued decline in trade union power. The decline in union power has corresponded with rising inequality.

It is a similar story in the UK where inequality has increased, good jobs have trickled away. GDP statistics mean nothing when over 50% of your income goes on debt interest, rent and insurance.

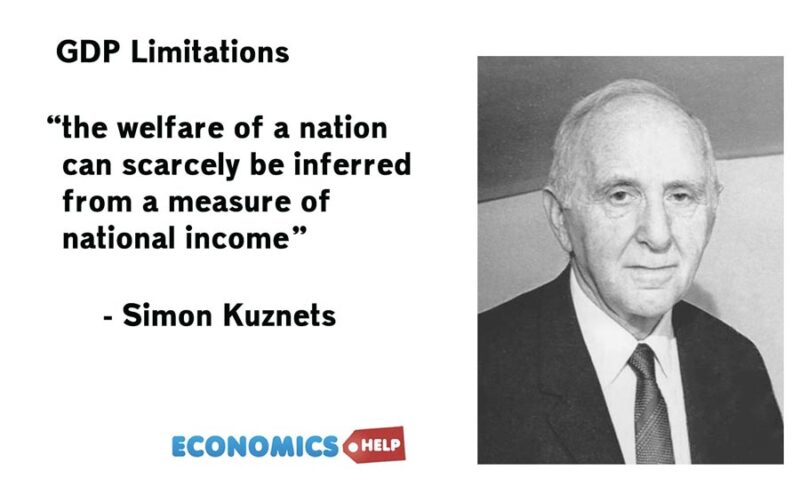

Limitations of GDP

The fundamental paradox is that GDP has never been higher, yet people report they are struggling more now than ever before. Firstly, GDP measures national output and national expenditure, but spending a lot of money doesn’t mean your living standards increase. Even Simon Kuznets who developed GDP warned Congress in 1934 that whilst it had its uses. “the welfare of a nation can scarcely be inferred from a measure of national income”

The BP oil spill of 2010 led to spending of $63bn to clean it up. This spending gives a minor boost to GDP, but living standards declinde. Hurricane Katrina cost $125bn of damages and spending to rebuild. Extreme weather events from Climate change may boost GDP, but not improve the quality of life. You can boost GDP by burning more fossil fuels, but you will also create more pollution and need to spend more on health care in the future.

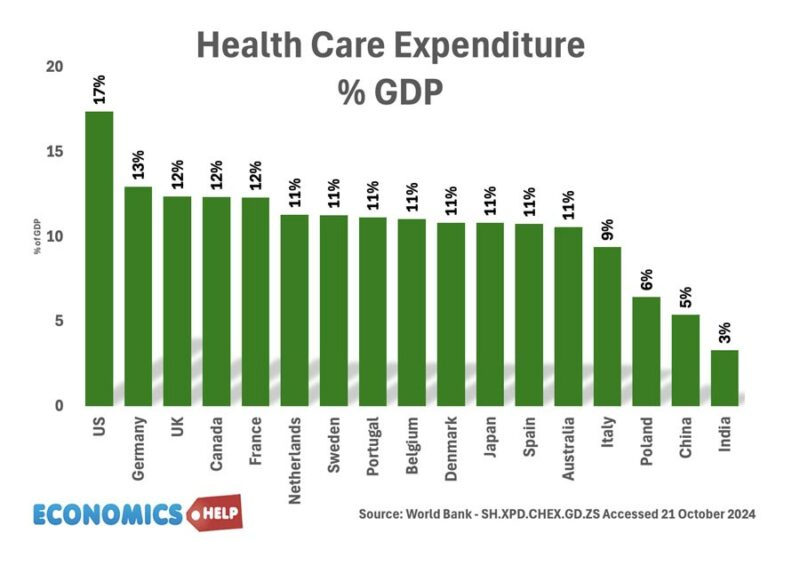

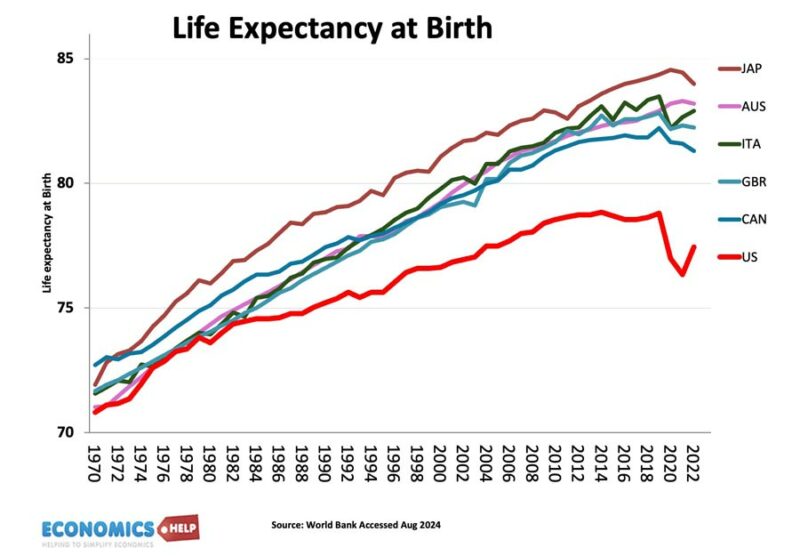

In the US a full 17% of GDP is dedicated to healthcare spending but what do Americans have to show for spending so much?

The worst life expectancy in the developed world. Americans are spending more and more on health care, but healthy life expectancy is declining.

Environment

In the past few decades, there has been a steady rise in use of pesticides, forever chemicals in industry. This increases productivity and boosts GDP, but after a few decades of increased chemical pollution, all kinds of health conditions such as cancer, and auto-immune conditions are on the rise. To get treatment in the US is very expensive. Visiting a doctor is $500 and the annual treatment for diabetes is close to $19,736. This all boosts GDP but it is leaving increased numbers of Americans with medical debt. In 2021, the average medical debt was $18,660 a 50% rise from 2017. If the UK had the American healthcare system, I’m pretty sure the economy would collapse.

The US spends over $1.1 trillion on food expenditure, yet the direct medical costs attributed to obesity and other health complications from poor diet is an estimated $959 billion. The weightloss industry alone is worth an $93.8 billion 2024. By the way the new weight loss drug Ozempic is very nicely boosting GDP in Denmark.

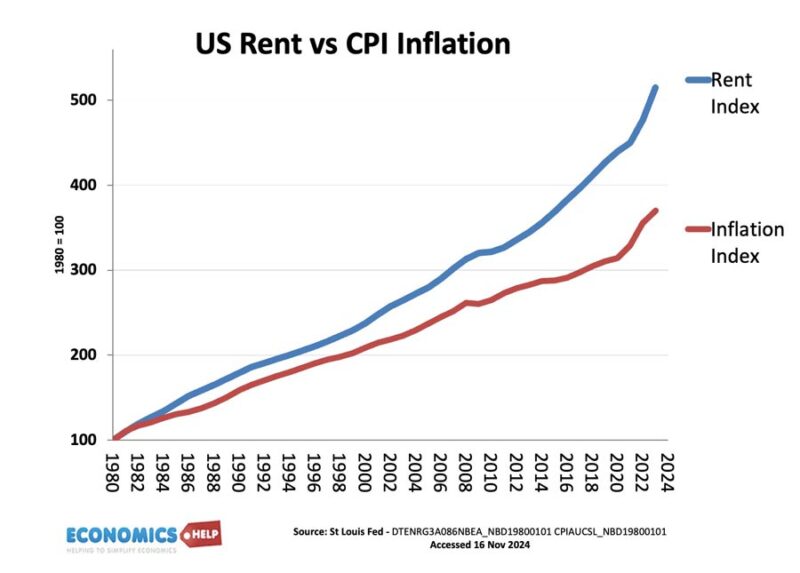

Housing Costs

But, for the average worker whether American, British or Australian, the really big impacts on living standards in recent years are housing costs. Housing costs are rising faster than inflation and wages. This is why GDP is not delivering. In the UK, Wealth is growing faster than income, and this creates an economy of winners and losers. There is a big gap between homeowners and those who don’t. In 1980 UK house prices were 3 times income. Today it is closer to 8 times. It is similar to whichever country you look at. But, this housing crisis is not accurately reflected by GDP. In the 2016 Brexit debate, an economist was warning of the dangers of Brexit and a member in the audience hit back. It’s your bloody GDP. Not ours. I’m sure American voters who have seen wages slip behind GDP might share a similar sentiment.

In defence of Economics

At this point, it is only fair to offer some defence to economics. Three points. Firstly, not all economists take the neo-liberal, trickle-down economics viewpoint. Secondly, the only thing worse than rising GDP is falling GDP.

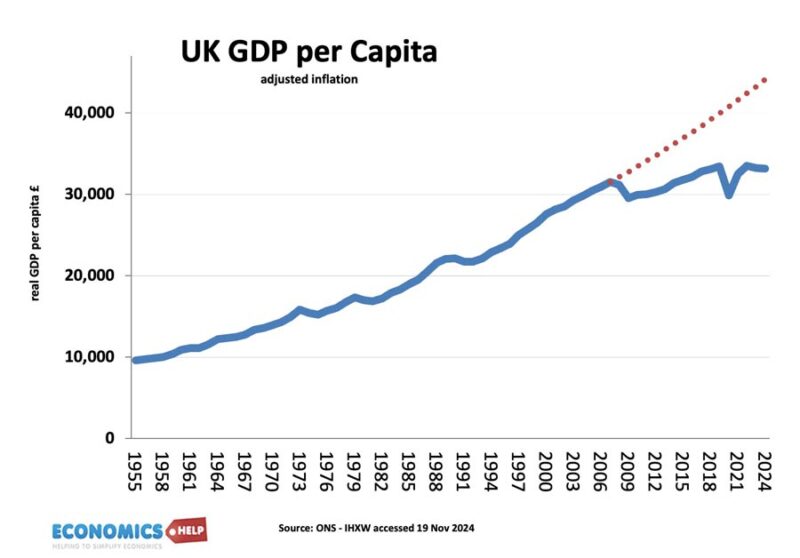

The UK’s real GDP per capita has basically been stagnant since 2009, and it has exacerbated all the UK’s problems, falling living standards, declining tax revenues and public services. The UK has a bad combination of high inequality and stagnant GDP. It may not be politically correct to say, but actually, GDP does affect everyone. Falling GDP, and you will see higher taxes and or lower spending. By the way, the prominence of immigration in recent years can perhaps be understood by this graph, which shows that real GDP in UK has increased faster than real GDP per capita. When people talk of higher GDP, it doesn’t mean more spending on doctors per person, so people don’t see the benefit of more people in the country.

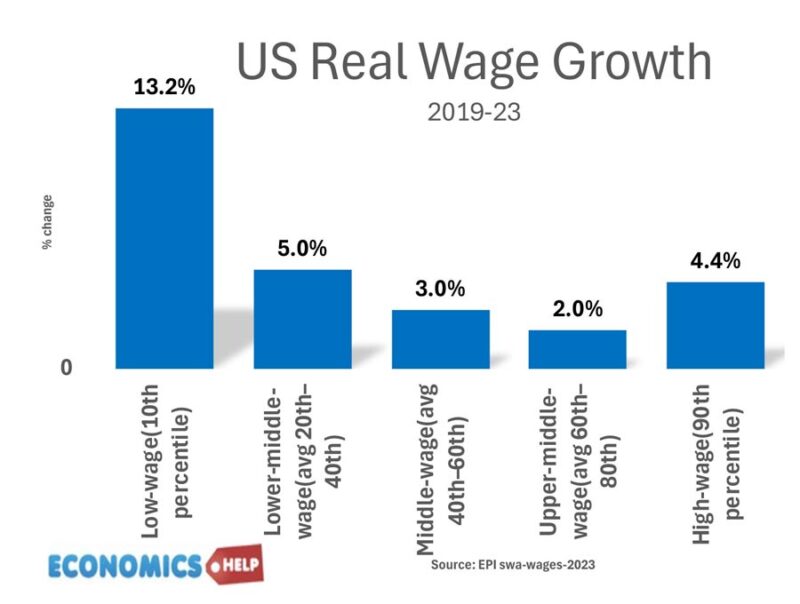

America’s economic problems would almost have been worse without the recent economic growth. Since 2019, low-income workers have actually seen better wage growth than average. Though it does very little to catch up with the past 50 years. In the long term rising GDP can be very beneficial. It is a big factor in the massive reduction in absolute poverty rates we’ve seen in the developed world. However, that doesn’t change the fact, that for advanced economies like the US, increasing GDP has very much diminishing returns. The economy is four times bigger than in 1980. But, are people even 1% more satisfied?

Measures of Economic Welfare

One solution is to use a measure an economic index which does measure real welfare. Genuine Progress Indicator (GPI), Human Development Index, Gross Domestic Happiness, index of sustainable economic welfare, Happy Planet Index. I could go on, in fact, there are almost too many alternatives. GDP is surprisingly resistant to efforts to replace it with other indexes. It has a raw simplicity and it is important for understanding the economic cycle. The only thing worse than stagnation of GDP is a recession where GDP falls and unemployment rises.

Economists Selfish?

There is a theory that since economists prioritise utility and GDP, it can make them more prone to being selfish. There are some reports which claim this is true. Others claim it is selfish people more prone to study economics.

The father of economists Adam Smith, put it in blunt terms “It is not from the benevolence of the butcher, the brewer or the baker that we expect our dinner but from their regard to their own interest.” The irony is that Adam Smith was a very moral philosopher worried about the impact of monopolies and the exploitation of workers. He was no free-market ideologue he is sometimes made out to be. But, I digress, the point is that economics or perhaps I should say politicians traditionally gives a high value to GDP, yet this is failing to increase economic welfare.

It is a crisis, which ultimately can’t be solved by economics alone. There are alternative theories of a more just economy, but is the political will there? And is this failure of economics a reason to understand why young people are becoming increasingly inactive and no longer willing to work? This video looks at the epidemic of not working.

Related

Sources

A timely reminder that GDP is not everything. A pity that economists cannot come up with a concrete alternative that is fact-based. Measuring happiness is impossible.

Adam Smith quote on monopoly always remind me why I needed to study economics. Thanks for the amazing blog post.