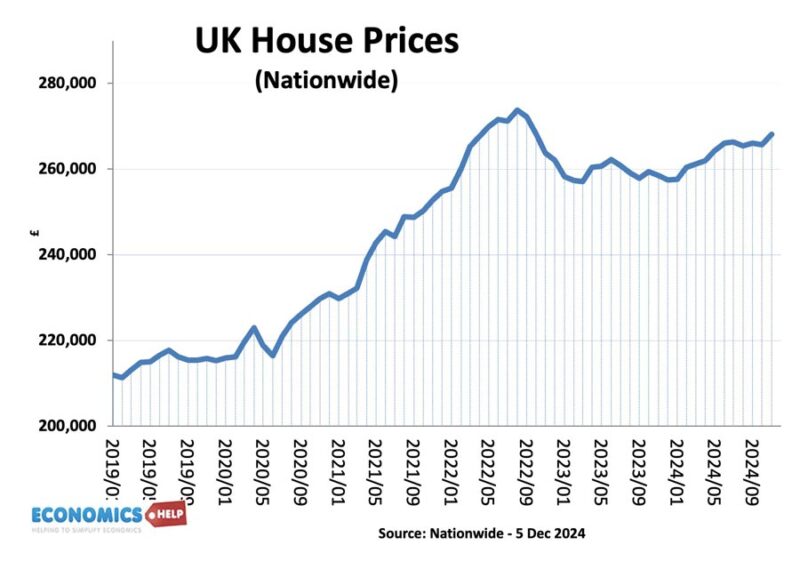

2024 has seen UK house prices seamingly defy gravity once more, with prices rising back close to the all-time peak. If you bought an average house at the start of 2020, you would be sitting on capital gains of £53,000. A 25% rise.

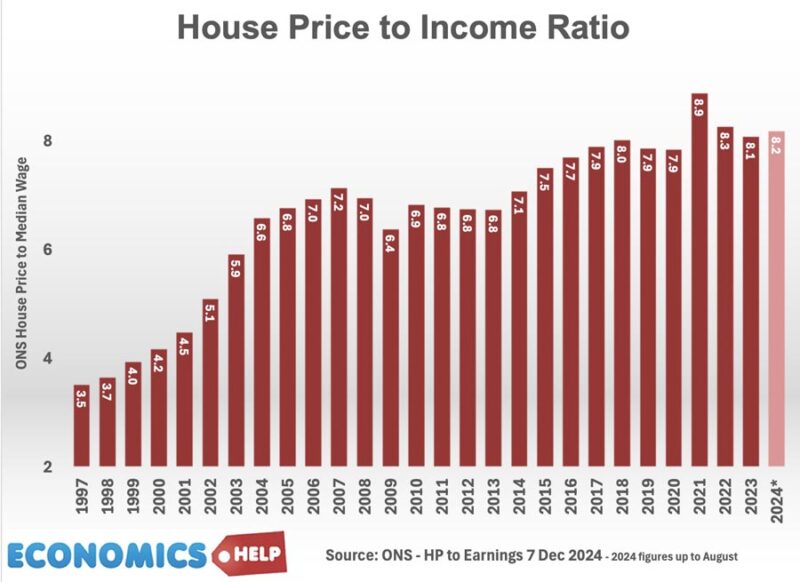

When house price to income ratios reaching record levels in 2022, there was much speculation that with rising interest rates, the housing market was due a well-deserved correction.

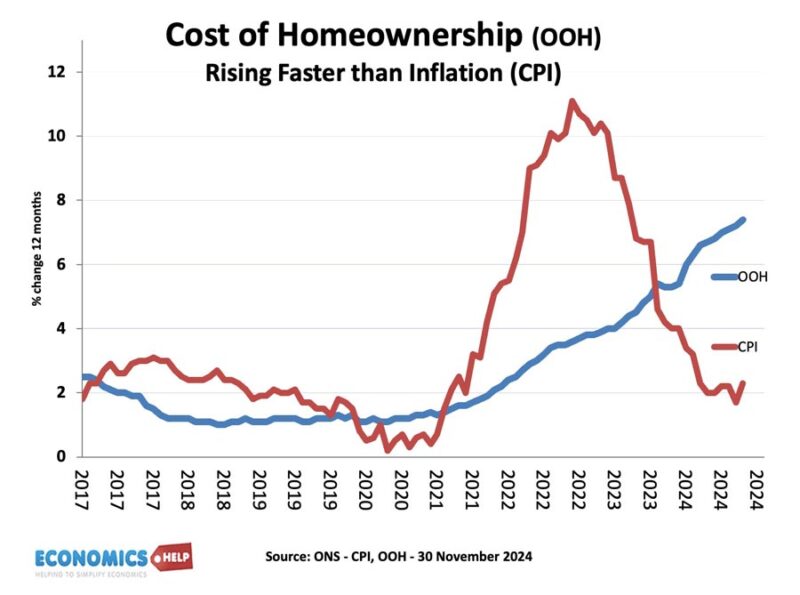

It is quite possible to look at the UK housing market and think they are badly overvalued and should fall, Yet house prices in the UK seem to be following their own trajectory, pushed up by rising rents, lower interest rates and large injections of wealth. However, going into 2025, the market does face a number of difficulties and uncertainties. The latest ONS figures report average house prices rose nearly 3% in the past 12 months to £292,000, but it is worth bearing in mind, the ONS have frequently revised house price data downwards suggesting prices never rose as much as the past boom suggested. Secondly, inflation is not completely over, and owner occupier costs are rising even faster than inflation. This reflects things like owners still remortgaging to higher mortgage rates and higher maintenance costs.

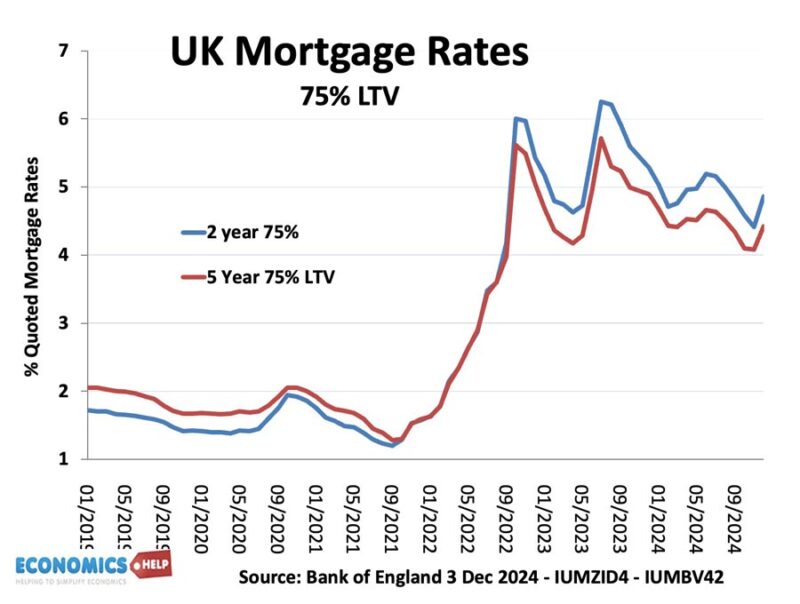

Earlier in the year, with inflation falling below target, there were a number of optimistic predictions interest rates would fall substantially. Goldman Sachs predicted 2.75% by the end of 2025. Savills/Oxford Economics made a similar prediction by 2027. If this was true, it would be a real game changer for the housing market, with the return of cheap mortgages bringing more buyers back to the market. However, others are less convinced by these predictions of falling rates. Since its early March forecast, the OBR has predicted mortgage rates will remain elevated. Recent events have only strengthened this more cautious view. The budget brought in higher stamp duty from April 2025. But, perhaps more importantly the budget will provide a short-run boost of government spending which could increase inflationary pressures. Combined with the threat of higher prices from tariffs, inflation is still forecast to be above target for the next two years. If you’re delaying buying in the hope fixed-rate mortgages fall substantially, there’s a reasonable chance of being disappointed.

Mortgage Rates

Mortgage rates have fallen from their peaks in 2022 and 2023, and this is important for the recent recovery in house prices. A £200,000 mortgage at 6% would be £1,289 a month, the fall to 5%, saves a mortgage owner £120 a month. But, it is worth noting, despite the fall in base rates, the uptick in actual mortgage rates suggests markets are expecting fewer cuts next year. The large variance in mortgage rate predictions also reflects the market is unsettled, with no clear pattern and a lot of uncertainty about what might happen next year. Predicting interest rates has often been a fool’s game in the past 15 years.

Stamp Duty

The other aspect of the budget which will impact the housing market is changes to stamp duty. In April, thresholds will fall, from £250,000 to £125,000 for homeowners, and from £450,000 to £300,000 for first-time buyers. It will drag more into the stamp duty tax bracket. The higher stamp duty on 2nd home purchases will be a further weight on the buy to let market, but even first time-time buyers will be more likely to be hit by stamp duty.

Many potential buyers may be rushing to buy a home to beat the deadline, but with only just over 100 days to go, it is worth bearing in mind Zoopla reckon it takes an average of 185 days from a property being advertised to being completed. It’s not helped that more chains are being broken as potential landlords drop out because of higher stamp duty on 2nd home purchases. An investor buying a 2nd house valued at £500,000 would have stamp duty of £40,000. The kind of figure which would take a long time to recoup.

Prices in 2025?

What explains house price resilience in 2024 and will this continue into 2025?A big factor determining house prices is income. After falling real wages in 2022, this is finally being reversed. Zoopla report that in the past 2 years, nominal household income for first-time buyers has increased 12%, whilst house prices have been stagnant. This goes some way to explaining the stronger buyer demand that we have seen in 2024. This is reflected in the growth in housing transactions and mortgage approvals. But, the big question is what about the forecasts for income in 2025, The good news is the UK is forecast to be one the fastest growing economy in the g7 in 2025 with the OECD revising growth upwards to 1.7%. The bad news is that it still pretty weak by historical standards, and also it will be at the expense of higher inflation and rising debt, take into account population and real wage growth is still pretty poor. Rises to NI will also hit wage growth with employers likely to curtail wage growth. The OBR projects real earnings growth will fall to around zero in 2026 and 2027.

Why are House Prices expensive?

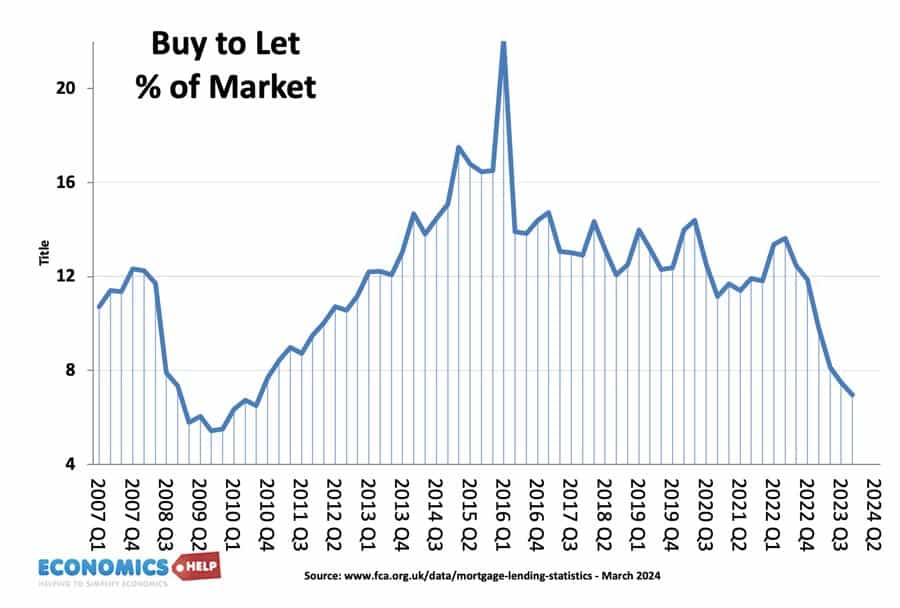

Given a fairly stagnant economy since 2019, real GDP per capita has barely increased, so why do house prices remain so expensive? There are 3 reasons which are important for future house prices. But, it is also really important to take inflation into account. When we say house prices have risen 25% since the start of 2020, so has inflation. Since 2007, Real house prices have fallen 22%. This is a new era for property investors, adjusted for inflation, the housing market is giving much poorer capital returns, and so with higher tax and regulation, the buy to let sector is diminishing. But, if buy to let is shrinking there’s no sign of first time buyers giving up on the housing market.

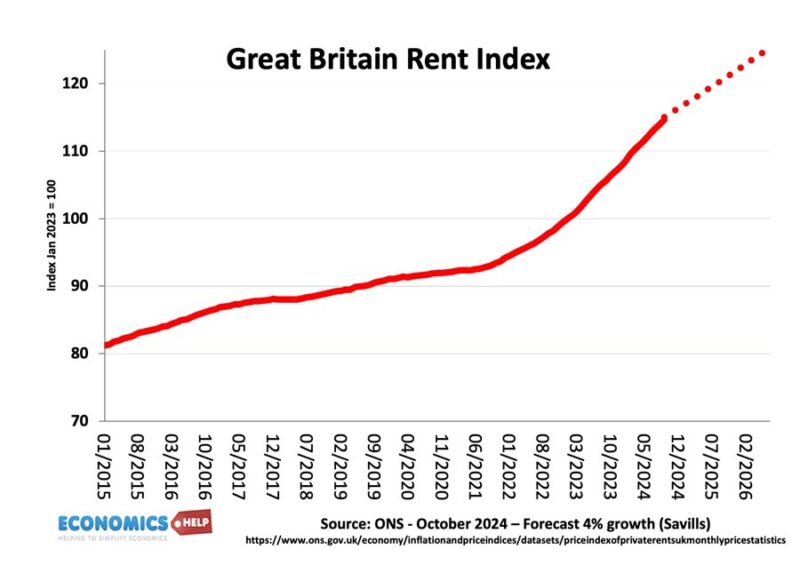

Firstly, one of the few alternatives to buying is renting or living with your parents. Rents have been rising faster than inflation because of both rapid growth in the population, and also very slow growth in rented properties in the market. The ONS report that rents rose 8.7% in the 12 months to October. Average rents in Great Britain are now £1,300, with rents in London well over £2,100 a month. Even Scottish rents are heading towards £1,000 a month. High migration is a factor behind rising rents. With the ONS producing revised figures of a record-breaking 900,000 net migration in the year to June 2023.

Despite rising rents and slight improvements in rental yield, the market is much less attractive for landlords, higher taxes and more expensive regulation is detering private landlords from buying new properties, with many looking to exit.

As rents take a bigger share of income, more young people are living with their parents in an effort to save for a deposit rather than spending thousands a month on rent. But, this also creates an incentive for wealthy parents to help their children get on the property ladder and get out of the house. The amount of lending and gifts from parents has risen with the rise in house prices. Last year a record £9.4bn. Without parental support, even high income earners in London and the South may be frozen from the housing market. With average London deposits at £144,000, its no wonder the London housing market is stuck. The problem is that rents are expected to keep rising for the next 3 years with Savills predicting 4% annual growth for the next 3 years. This only increases the incentive for people to throw the kitchen sink at buying a property. Even usually sober lenders like Nationwide have released mortgages which offer a mortgage six times income. Longer mortgage terms, help from parents, more dual income families, and a growth in corporate cash buyers all help to explain the long-term rise in house price to income ratios. If interest rates remain at 4% or even lower, there is no reason to believe this story will be significantly altered.

House Price Forecasts 2025

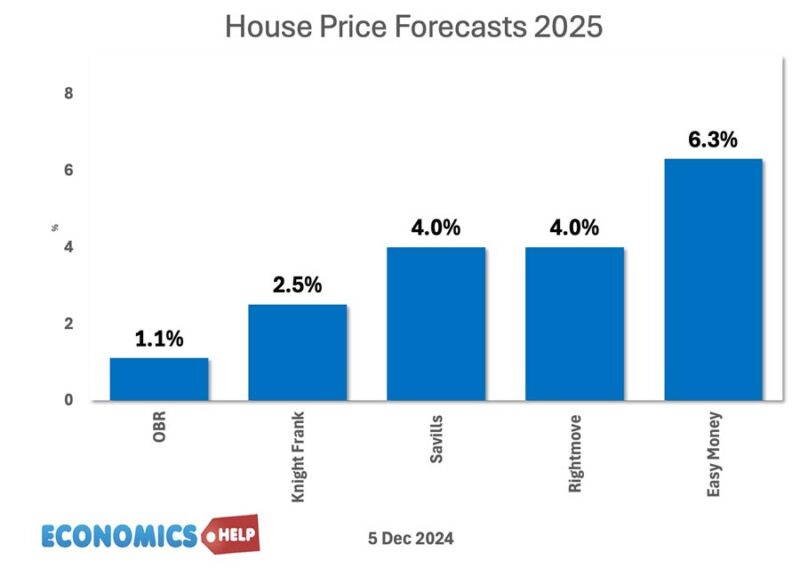

What do experts predict for house prices in 2025? We can see a range of forecasts with the OBR being the most pessimistic at just 1% house growth next year. Savills and Rightmove both predict around 4%, which would be slightly higher than inflation at 2.5%. Savills predict house prices will rise 23% over the next 5 years. The one exception to forecast for higher prices is the top end of the market, especially in London. It is the most expensive house prices most affected by higher interest rates and stamp duty. One interesting feature of the past 10 years is the decline in regional house price premiums for London and the southeast. Affordability is too stretched perhaps working from home is a factor too.

Could house prices fall?

In the past house prices have responded to higher interest rates by falling with a delayed impact. It takes time for interest rates to work their way through the system. But stress testing made the market more protected from rising rates than say 2007. Certainly house prices are overvalued by historical norms, but as mentioned there are reasons to explain this. At this stage a significant fall in house prices would require one of two things, a real slowdown in economy and rising unemployment or another cost-push inflation shock, which causes interest rates to go back up. In a fragile world, both of these remain possibilities.

When is the best time to buy?

Is it worth trying to time the purchase of house to get the best fixed rate deal in the future? Generally, it is hard enough buying a house, without trying to predict the market too. As a general rule, if buying makes financial sense and you find a good-value house, go for it. Don’t wait for house prices to fall or interest rates to fall. No one can predict with certainty what may happen anyway. And it is just as likely house prices will rise to counteract the effect of falling interest rates.

Sources

Thank you. This was interesting. You mentioned inflation. I’ve read some of what you wrote about inflation, but am still trying to get one thing straight: I understand that inflation can be caused by increased lending, but if, hypothetically, all those loans were payed off, would the number of units in the system be zero? Where are the raw pounds actually added to the equation?