In a recession, you would usually expect a fall in the inflation rate due to lower demand and lower economic activity. The inflation rate fell in major recessions like 1929-32, 1981, 1991 and 2020..

However, it is not guaranteed inflation will fall in recession. For example, we could have a period of stagflation – rising inflation and falling output (e.g. after a rise in the price of oil – 1974 and 2008). Also, if countries respond to a fall in output by printing money, then this could lead to hyperinflation (e.g. Zimbabwe in 2008)

Why inflation tends to fall in a recession

A recession means two consecutive quarters of negative economic growth. With falling economic output and rising spare capacity, prices are likely to fall (or at least go up at a slower rate.)

This is because:

- Firms have unsold goods. Therefore, to improve their cash flow they try discounting goods to get rid of their excess stock.

- Lower wage growth. As unemployment rises and there is more competition for job vacancies, it is harder for workers to bargain for higher wages. Unemployment should reduce wage inflation, which has a prominent impact on headline inflation.

- Lower commodity prices. A global recession should usually reduce demand for commodities and therefore reduce the price of commodities – leading to lower cost-push inflation.

- Lower expectations. Low confidence in an economy usually reduces inflation expectation.

- Falling asset prices. In a recession, the price of houses and other assets tends to fall due to lower demand. This leads to lower wealth and therefore, less spending.

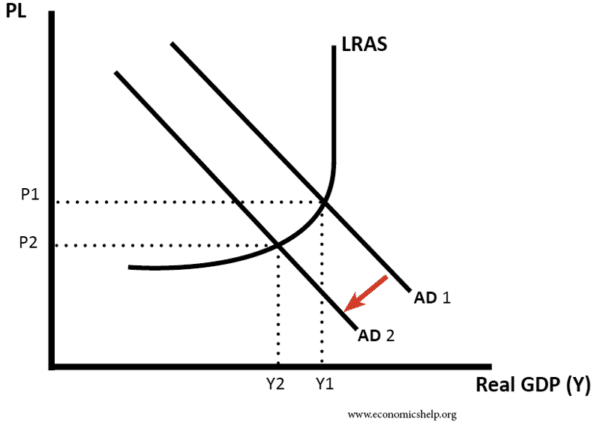

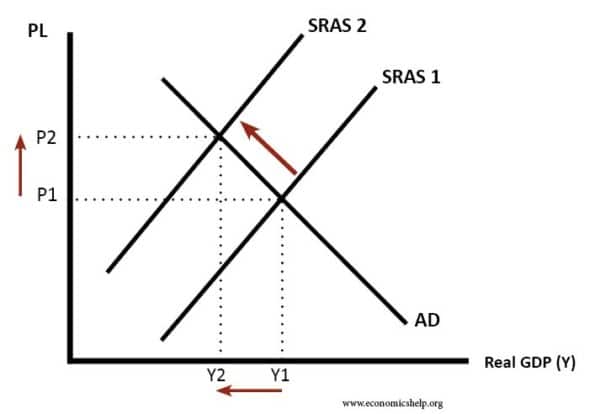

AD/AS diagram showing how fall in AD leads to lower inflation.

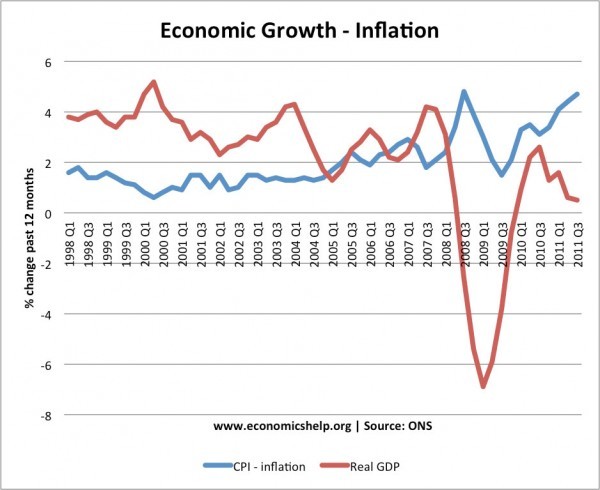

Example of UK after 2008/09 recession

This graph shows the recession of 2009. During 2008 and 09, the inflation rate falls from 5% to under 2%. Inflation increased in 2011 because of cost-push factors (devaluation)

Why inflation can rise during a recession

Inflation may not always fall in a recession.

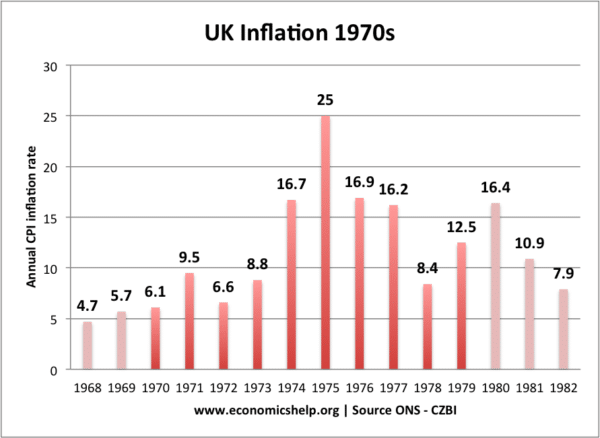

In the 1970s, we had a recession caused by cost-push factors. Oil prices tripled in late 1973. This caused inflation to soar – but also caused an economic downturn – firms and consumers couldn’t afford the higher oil prices. In other words, 1974 was a recession caused by cost-push factors.

In this case, the fall in output is caused by fall in short run aggregate supply (SRAS) this leads to higher inflation.

2008-12 recession

In 2008, at the start of the recession, inflation was running close to 5% – but this was primarily due to cost-push inflation from higher oil prices.

During 2012, there was a double dip-recession with low economic growth, but rising inflation. This was because

- Impact of depreciation in value of Pound. Fall in the value of pound increased the cost of imports which feeds into inflation

- A rise in oil and hence petrol prices.

- A rise in taxes.

- The rise in spare capacity was less than expected. Helped by zero interest rates, there were fewer insolvencies than in previous years. Also, the rise in unemployment is less than in previous years

- Firms have sought to maintain good cash flow by not cutting prices.

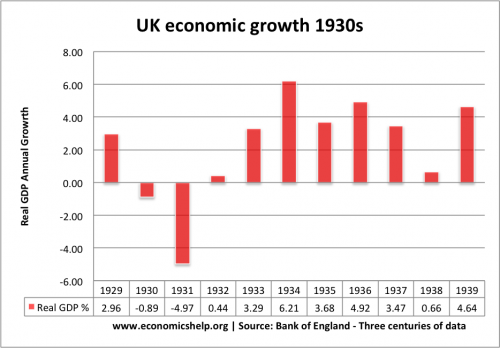

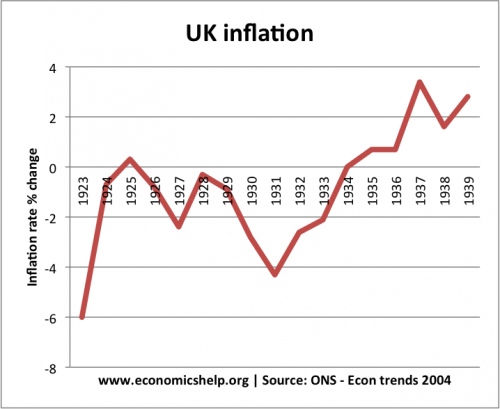

Deflation and the Great Depression

In the Great Depression, there was a large fall in output, and this caused deflation. Prices fell quite significantly.

The reason the Great Depression let to deflation was

- Fall in money supply due to banking crisis in the US

- Fiscal austerity. UK government pursued austerity in 1931 – cutting unemployment benefits and raising taxes.

- Global slump caused global fall in commodities and manufactured goods.

- The Pound was overvalued in the Gold Standard. An overvalued exchange rate tends to reduce inflation

Inflation and 2020 Covid Recession

In the 2020 Covid Recession, the global downturn was so severe that it put downward pressure on oil and energy prices. In Feb 2020, energy prices were rising 2.3%. In March, energy prices fell 3.6% (Fall in inflation)

In 2020, there has been a fall in inflation rate, and there are concerns the depth of the downturn could lead to deflation.

However, the response to the COVID recession will involve creating money which has the potential to increase inflation in the medium term.

Further Reading

- Causes of inflation

- Inflation or Deflation?

- Definition of Inflation

- Why is CPI Inflation so High? – Bank of England, Paul Fisher 29 June 2010

Affiliate link

- Macbook Pro 2022 at Amazon

The key issue in the Uk is the devaluation of the pound vs the dollar, and critically the extent now of global integration.

In past recessions capacity has been created, now with most manufacturered products made in the Far East and even for Uk manufacturers components sourced from the Far East, the capacity is created there.

It has made the Uk economy much more able to cope with the recession, but has caused both higher than expected inflation and lower than expected unemployment.

Expect Inflation to increase fast, unless Interest rates go up.

In Romania, in full recession, instead of lowering the VAT, they increased it from 19% to 24% making this way the inflation go higher.

Spain has got it bad with around 20% of their people out of work. However Greece vs spartans would be a difficult one to decide whom would win, the demand for this production would lead to less spare capacity.

As real estate prices go up any up. The government is giving money away and printing more. Do you line up and over pay for a home or investment property? I can’t believe this is our reality.! I just sold out of two properties cashing in on real estate may be a stupid move. Maybe I can get free rent from government.

East and even for Uk manufacturers components sourced from the Far East, the capacity is created there.

As real estate prices go up any up. The government is giving money away and printing more. Do you line up and over pay for a home or investment property? I can’t believe this is our reality.! I just sold out of two properties cashing in on real estate may be a stupid move. Maybe I can get free rent from government.