Readers Question: Does mortgage equity withdrawal enhance economic growth?

There is good evidence that mortgage equity withdrawal can lead to higher levels of consumer spending and economic growth

Definition of Mortgage equity withdrawal – Mortgage equity withdrawal occurs when homeowners remortgage taking out bigger loans to take advantage of rising property values.

- Suppose you bought a house for £100,000 with a £95,000 mortgage. (+ £5,000 cash deposit)

- 10 years later the house might be worth £160,000. Yet, you only owe the remainder of your £95,000 mortgage. If the bank is still willing to lend 95% of the value of your house. You could remortgage for say £150,000. This means you will have a bigger mortgage and will have to pay extra monthly mortgage payments, but you can now spend the extra £50,000 on holidays and cars. Remortgaging is a way for consumers to increase spending. It has become quite common in the UK.

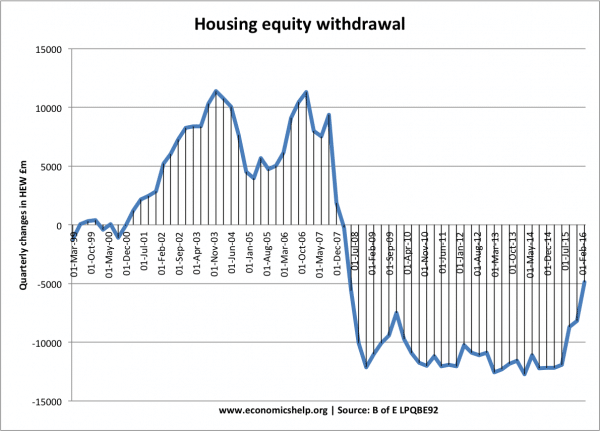

Mortgage Equity Withdrawal in the UK

Negative equity withdrawal after credit crunch of 2008

After the 2008 crash, house prices fell by 20% and consumers were reluctant to borrow agains the value of their house

According to the Council of Mortgage Lenders equity withdrawal increased from £10 billion in 1984 to £23 billion in 1988.

After the recession (and fall in house prices) of 1992 equity withdrawal fell to £12.5 billion.

By 2000, equity withdrawal had increased to £30 billion. During this period there was a steady rate of economic growth.

The Bank of England reports that mortgage equity withdrawal has continued to rise since 2000, reaching a peak in the 3rd quarter of 2003 of nearly £9 billion. This was also equal to nearly 10% of post tax income. A considerable determinant of consumer spending in the UK. Bank of England MEW

Mortgage Equity Withdrawal does increase Aggregate Demand and can finance higher economic growth. However, we should make some qualifying remarks.

Problems of Mortgage Equity Withdrawal

- MEW increases AD, but it does not increase the productive capacity of the economy.

- MEW increases the debt burden of consumers. If interest rates had to rise, it would mean many consumers are susceptible to falling disposable incomes.

- Now that house prices are falling, an increased number of homeowners may face the problem of negative equity. Therefore, although MEW helped growth in the past, it could also contribute to a recession in the future.

Related

thanx a lott 🙂

this site is fantastic.

—beijing