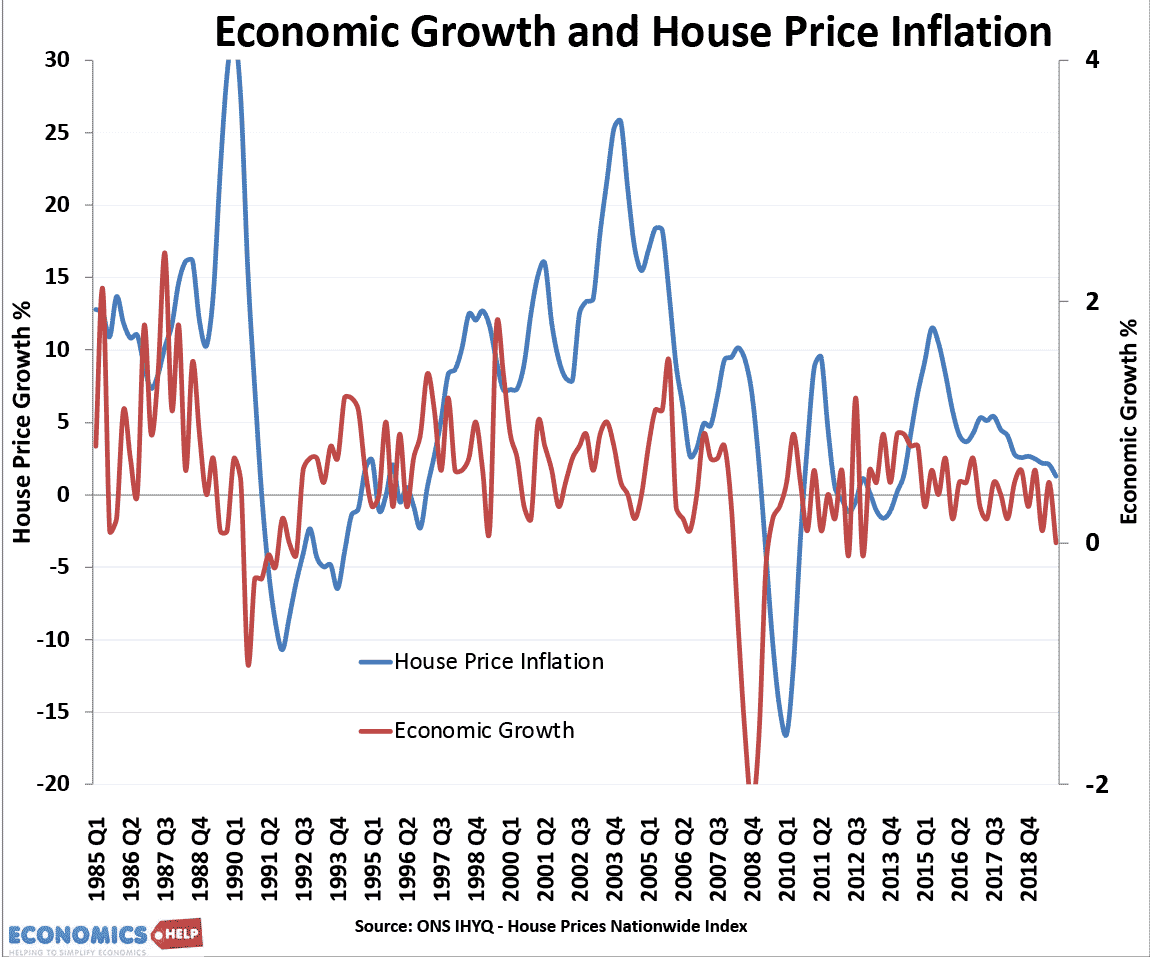

A look at how the housing market and changes in house prices affect the rest of the economy. In summary:

- Rising house prices, generally encourage consumer spending and lead to higher economic growth – due to the wealth effect.

- A sharp drop in house prices adversely affects consumer confidence, and construction and leads to lower economic growth. (falling house prices can contribute to economic recession)

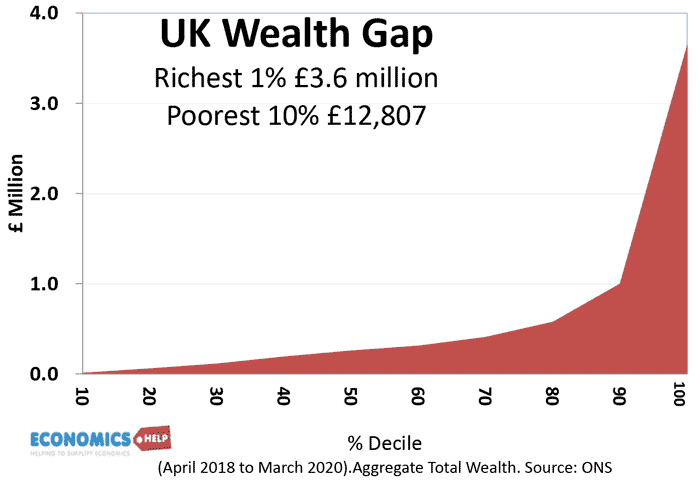

- Rising house prices can also redistribute wealth within an economy – increasing the wealth of homeowners (primarily older people), but reducing effective living standards for those who do not own a house (often the young)

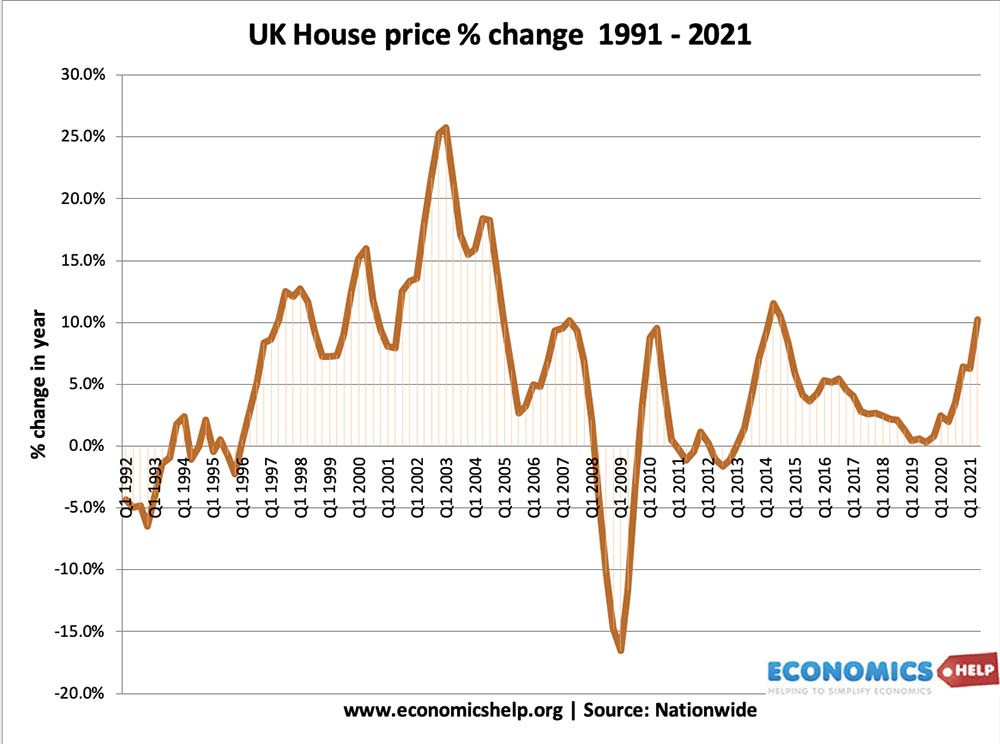

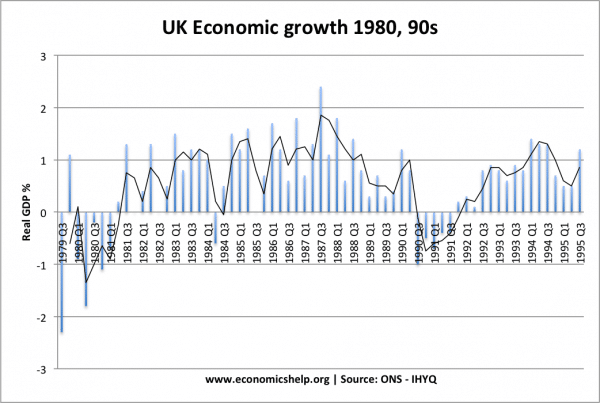

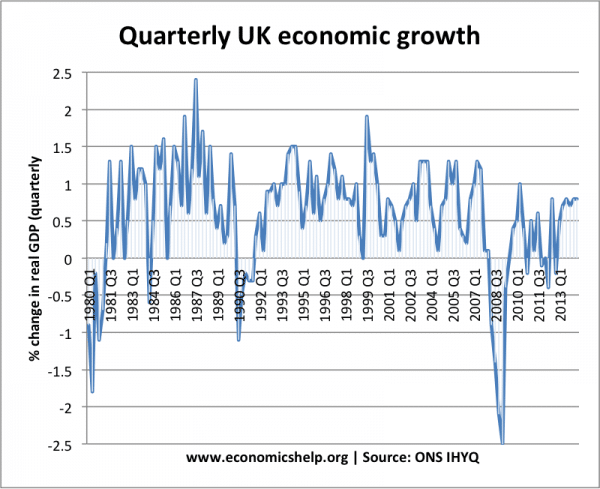

House price drops in 1990 and 2007 – corresponded with the recession of 1991 and the recession 2007/08.

Wealth effect

The wealth effect looks at the impact of the rising value of assets on consumer spending.

A rise in house prices creates an increase in wealth for householders. As a consequence of this increase in house prices, householders will generally:

- Be more confident about spending and borrowing on credit cards. They can always sell their house in an emergency.

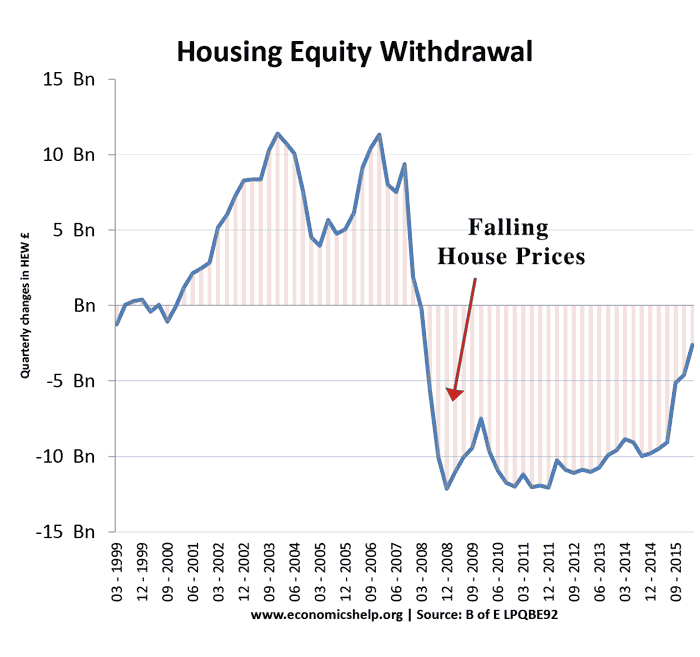

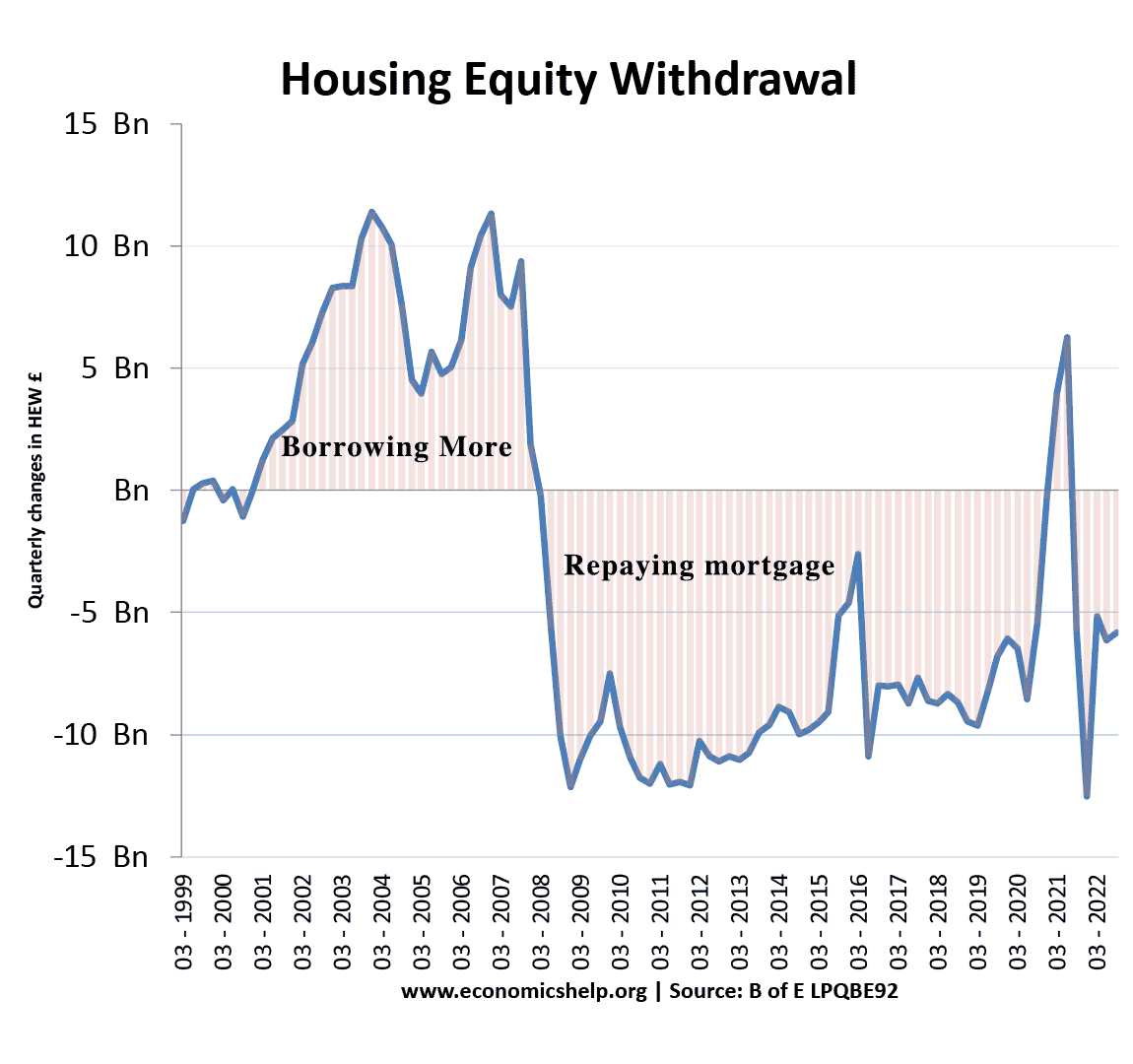

- Increase in equity withdrawal. A rise in house prices enables homeowners to take out a bigger mortgage. Banks can lend more on the basis of the increased price of the house. Households could use this bigger loan to spend on other items. This can create a significant increase in consumer spending. For example, in 2006, with rising house prices, equity withdrawal added an extra £14bn to consumer spending. In 2008, with falling house prices, equity withdrawal was -£7bn. (people taking the opportunity to pay off the mortgage)

Housing equity withdrawal

Source: Housing Equity Withdrawal at Bank of England.

Rising house prices from 2000 to 2007 saw positive housing equity withdrawal. After house prices fell, equity withdrawal went into negative figures –

Since 2007 housing equity withdrawal has been negative which means households are net repaying mortgages rather than borrowing more.

Housing Prices and Banking Sector

House prices can impact the lending practices of banks. When house prices are rising rapidly, banks see an improvement in the value of their assets. They feel more confident in increasing bank lending and reducing their reserve ratio. The long housing boom of 1995-2007, was one factor that encouraged bank lending to increase. Some former building societies like Northern Rock and Bradford & Bingley were so keen to lend; they were borrowing money on money markets to lend more mortgages. This bank lending proved unsustainable when the credit crunch hit.

Falling house prices tend to cause a fall in bank lending. Banks will see a decline in the value of their assets and may lose money, should homes become repossessed. This was particularly a problem in 1991 when falling house prices were combined with high-interest rates.

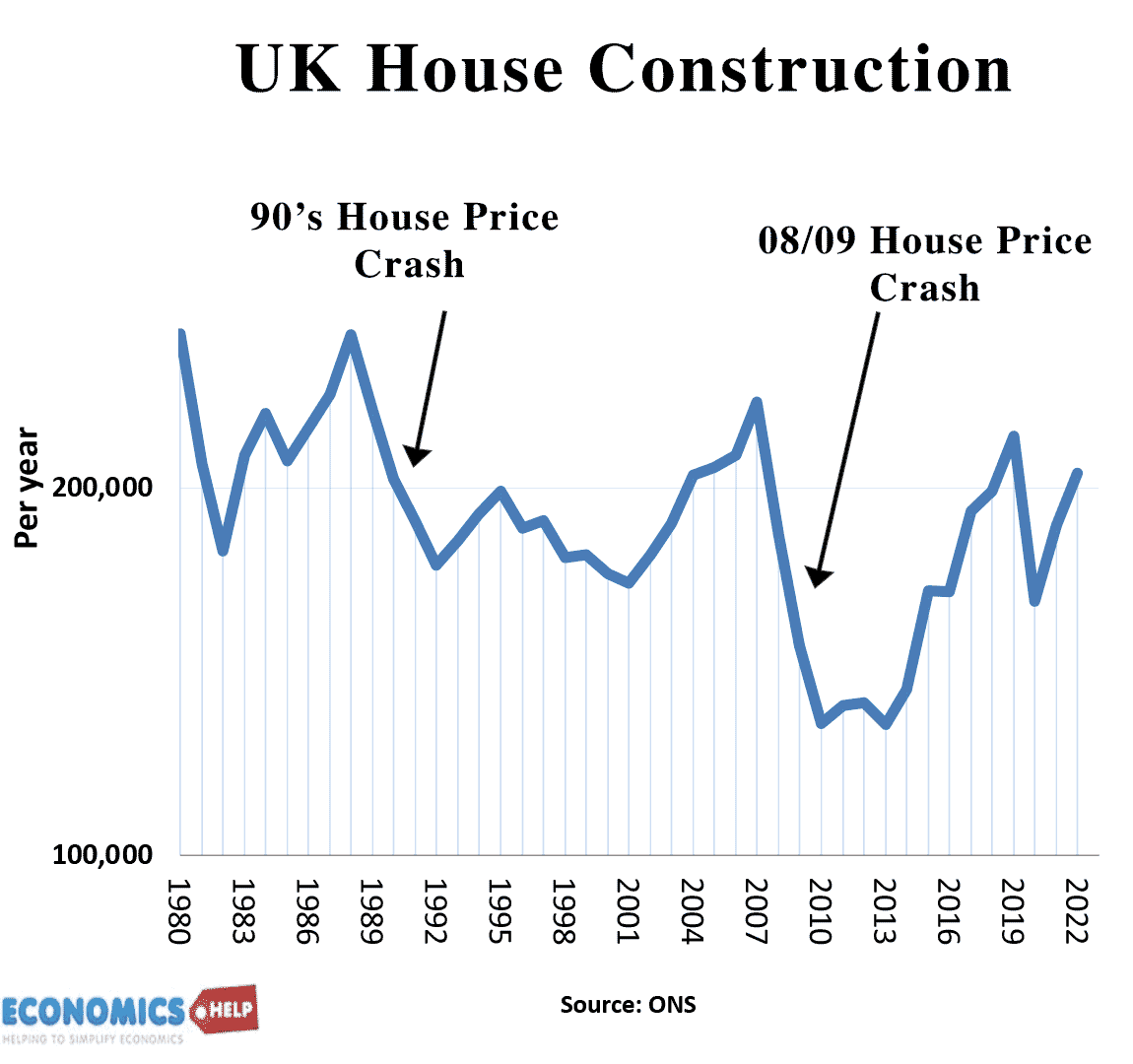

House prices and construction sector

The construction sector is quite volatile and a period of falling house prices is likely to discourage investment and building of new homes. This decline in construction is another factor which will lead to lower economic growth.

Effect on economic growth

If house prices rise, then the wealth effect is likely to cause an increase in consumer spending. This will cause higher Aggregate Demand (AD), and it is likely to cause an increase in Real GDP and a higher rate of economic growth.

Similarly, a fall in house prices is likely to lead to lower consumer spending and

Multiplier effect

If there is an increase in aggregate demand from rising house prices, there may also be a multiplier effect which causes the increase in aggregate demand to be bigger than the initial effect.

How does a fall in house prices affect the economy?

- When there is a fall in house prices, there tends to be a negative wealth effect and a negative impact on economic growth.

- Because households see a fall in house prices, their main form of wealth declines, this reduces their confidence to spend. They are more likely to devote a higher % of their income to try to pay off their mortgage early.

- Falling house prices cause more people to be trapped in negative equity (a situation where your house is worth less than an outstanding mortgage). This causes a fall in spending and precludes any opportunity for equity withdrawal.

- Falling house prices have a negative impact on the construction of new houses.

Examples of falling house prices

After the 1990 house price crash, there was a sharp fall in consumer spending, and this was a major cause of the recession of 1991-92. Falling house prices weren’t the only factor harming the economy (the economy also suffered from high-interest rates and high value of Sterling) But, falling house prices was an important contributing factor.

Falling house prices have an important psychological impact. A fall in house prices can pop a bubble of rising expectations.

The recessions of 1980, 1990/91 and 2008 occurred during a period of falling house prices.

In 2008, falling house prices also occurred at the same time as the deepest recession since the 1930s. Again, there were many other reasons for the recession, but falling house prices was bad news for both consumers and banks.

Inflation

If the economy is close to full capacity and already growing strongly, then a rise in consumer spending due to rising house prices could contribute to inflationary pressures. For example, in the late 1980s, the rise in UK house prices and consequent boom in spending was a key factor in causing inflation of 10% by 1989.

However, in the house price boom of 2000-2007, inflation remained relatively muted and close to the government’s inflation target.

Impact on interest rates

The MPC is committed to keeping inflation within the government’s target of CPI 2% +/-1.

If the Monetary Policy Committee of the Bank of England felt rising house prices was causing inflation to go above the target, then they may decide to increase interest rates. For example, the late boom of the late 1980s saw rising interest rates to combat the inflation in the economy.

Higher interest rates will reduce the rate of economic growth and moderate inflationary pressure.

However, the MPC is unlikely to increase interest rates just because house prices are rising at a rapid rate. The MPC primarily consider headline inflation and economic growth. They can’t use interest rates just to moderate house price growth. For example, in 2000-2007, there was a housing boom, but the MPC didn’t change interest rates because they were focused on inflation and economic growth. Similarly, from 2012 to 2016, house prices rose rapidly – especially in London, but interest rates stayed at 0.5%

Evaluation of housing market on economy

1. Importance of housing

Housing is the biggest component of most household’s wealth. Therefore it has a big impact on the economy. The UK has one of the highest rates of property ownership in the UK. In 2006, it was roughly 77% compared to 50% in France.

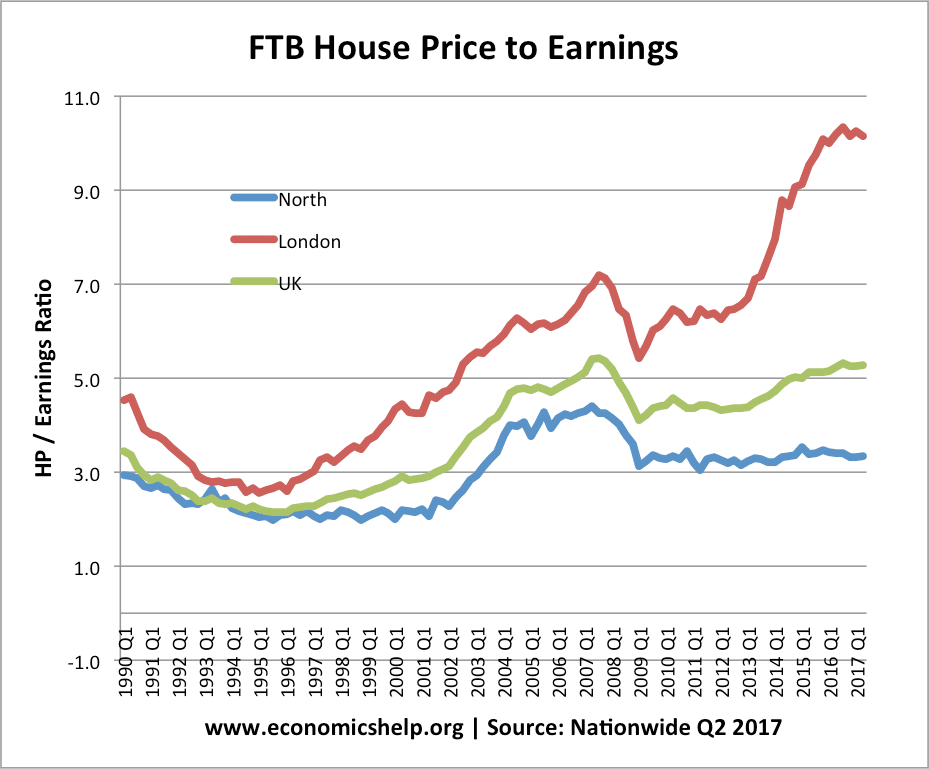

However, in recent years, the % of first-time buyers owning a house has declined because it has been more difficult to get a mortgage. Home-ownership rates have declined to 66%, meaning the importance of the house prices is slightly reduced.

2. Geographical inequality

High house prices could cause some workers to be unable to afford to buy houses. High property values have caused a shortage of workers in London and the South East.

3. Renters

In the past decade, the proportion of homeowners has declined. There are more people privately renting. Falling house prices may make this group (generation rent) relatively better off. Because falling house prices tend to reduce rents (or at least limit growth in rents). Therefore, the falling house prices will have less impact on consumer spending than in previous times when more people owned a house.

Wealth inequality in the UK

Housing market contributes to high levels of wealth inequality in the UK.

Related

The condition of the real estate business is reflected by the condition of the economy and vice versa. Lehman brother crisis is one of many examples which proves the point. Newbie real estate investor often considers the real estate investment as one of the most profitable ways of investment. However, investors should be very careful while making any major investments in the real estate business. Lack of knowledge is solely responsible for the downfall of any kinds of business and thus information given in different types of books and blogs could be very useful to get a competitive edge in the real estate business.