Readers Question: what does AD stand for in economic terms?

AD = Aggregate Demand – the total planned expenditure in an economy.

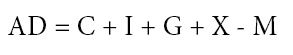

Aggregate Demand is composed of various factors C, I, G, X – M

- C= Consumer spending

- I = Investment (Gross Fixed Capital Formation)

- G= Government Spending

- X= Exports

- M= Imports

AD places a crucial role in determining the level of national output in an economy. Although Monetarists will argue it is AS which will determine the long run trend rate of growth.

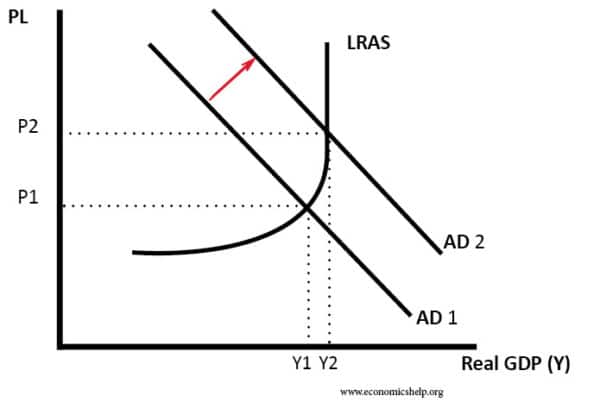

Diagram of a shift in AD

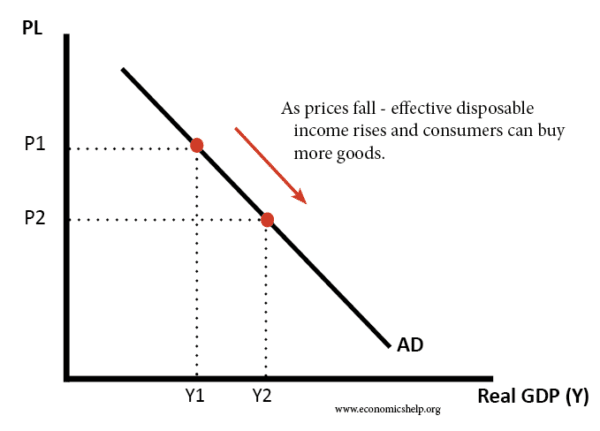

Movement along the AD curve

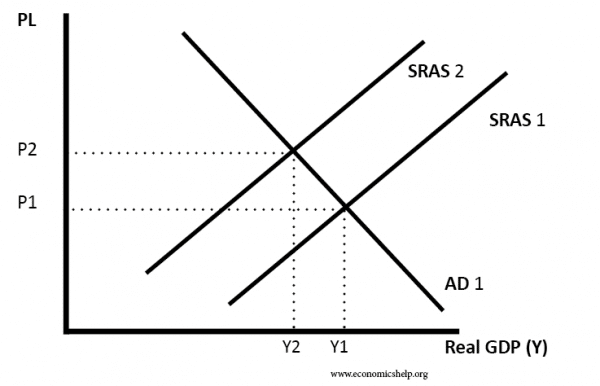

In this case, there is a shift in the SRAS (e.g. increase in oil price shifts SRAS to the left). This leads to a higher PL and lower real GDP.

Why does AD slope downwards?

- At a lower price level, consumers are likely to have higher disposable income and therefore spend more. (Note this assumes that wages are constant and not falling with prices)

- If there is a lower price level in the UK, UK goods will become relatively more competitive, leading to higher exports. Exports is a component of AD so AD will be higher.

- At a lower price level, interest rates usually fall, and this causes higher aggregate demand.

Related

it give me some knowledge ABOUT ECONOMICS AND RELATED TO this MATTER! thank you.God Bless and more success!

what will happen when the government spending increasing to the aggregate demand?????

will shift to the right

AD INCREASE- PRICE INCREASES- PRODUCTION INCREASE- EMPLOYMENT INCREASE- INTEREST RATE INCREASE

kareem, look up keynesian economics and that’ll show you how government spending will increase aggregate demand.

If G rises then the unemployment goes down on the philips curve

The uncertainties in our economic times and the global integration of financial markets have created a 24/7 financial banking environment. If one includes computer driven financial software in the commodities and other markets. It almost becomes impossible to sort things out and reach any conclusions that will stand up in the next twelve hours.

Chance Korse

The uncertainties in our economic times and the global integration of financial markets have created a 24/7 financial environment. If one includes computer driven financial software in the commodities and other markets. It almost becomes impossible to sort things out and reach any conclusions that will stand up in the next twelve hours.

Chance Korse

The uncertainties in our economic times and the global integration of financial markets have created a 24/7 financial investment environment. If one includes computer driven financial software in the commodities and other markets. It almost becomes impossible to sort things out and reach any conclusions that will stand up in the next twelve hours.

Chance Korse

Job creation in the in the U.S. The U.S. Chamber of Commerce is taking a very cooperative step in welcoming our U.S. President Obama to discuss job creation.Just to be clear, I know of no CEO who does not have job-cuts at the very top of the corporate agenda. Employee payroll is an obstacle to profit and must reduced at all times. Innovation, in its business context, means jobless growth and expansion. That’s Business 101. Does anybody understands the conflicting motives behind job creation and business job creation? CHANCE KORSE, TEMECULA, CALIFORNIA

The uncertain economic times and the integration of financial global markets have created a 24/7 financial investment environment. With computer driven stock exchange stock trading software the investment speculation takes on a new level. It almost becomes impossible to sort things out and reach any conclusions that will stand up in the next minutes of trading

Chance Korse

Past uncertain economic times of fifty years ago had no integration of financial global markets. Traditional economic assumptions worked well. Today we have a 24/7 financial investment environment. With computer driven stock exchange stock trading software the investment speculation takes on a new level. It almost becomes impossible to sort things out and reach any conclusions that will stand up in the next minutes of trading

Is the U.S. economy slowly growing? What about U.K? The exchange markets go up and down with more volatility than we have ever known. Every 12 hours there is a new reason the markets gain or go south. One day it’s oil, the next day employment, next natural disasters, the next political upheaval. There is no sustainable direction one way or the other. Broader trends are harder to detect. Is it the new speed of trading, volume, and globalization of interactive exchanges.

My question is: Is the U.S. economy slowly growing? What about U.K? The exchange markets go up and down with more volatility than we have ever known. Every 12 hours there is a new reason the markets gain or go south. One day it’s oil, the next day employment, next natural disasters, the next political upheaval. There is no sustainable direction one way or the other. Broader trends are harder to detect. Is it the new speed of trading, software-driven split second trading, volume, and globalization of interactive exchanges.

Thank you for debating the market and globalization issues that I put forward. All inputs are greatly appreciated. Chance Korse,Temecula, California, USA

consumption expenditure+investment

What are you supposed to do with G if G=Gbar but it required in the equation?