Some potentially common mistakes in economics.

1. Confusion of rates of change and actual levels

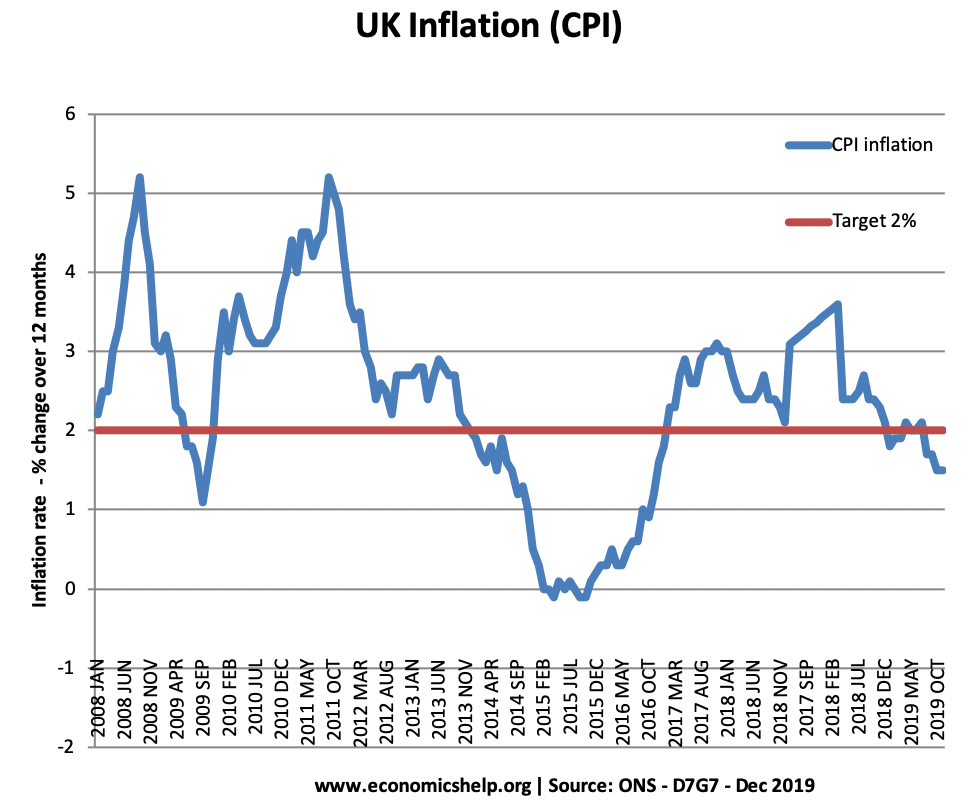

- What happened to the UK price level between May 2011 and Feb 2015?

- The answer is that prices rose at a slower rate. There was a fall in the inflation rate. Prices were still rising just at a lower rate.

- A common mistake would be to say prices fell. But, the axis is showing not the absolute price level but the rate of change of prices.

2. Mixing up cause and effect

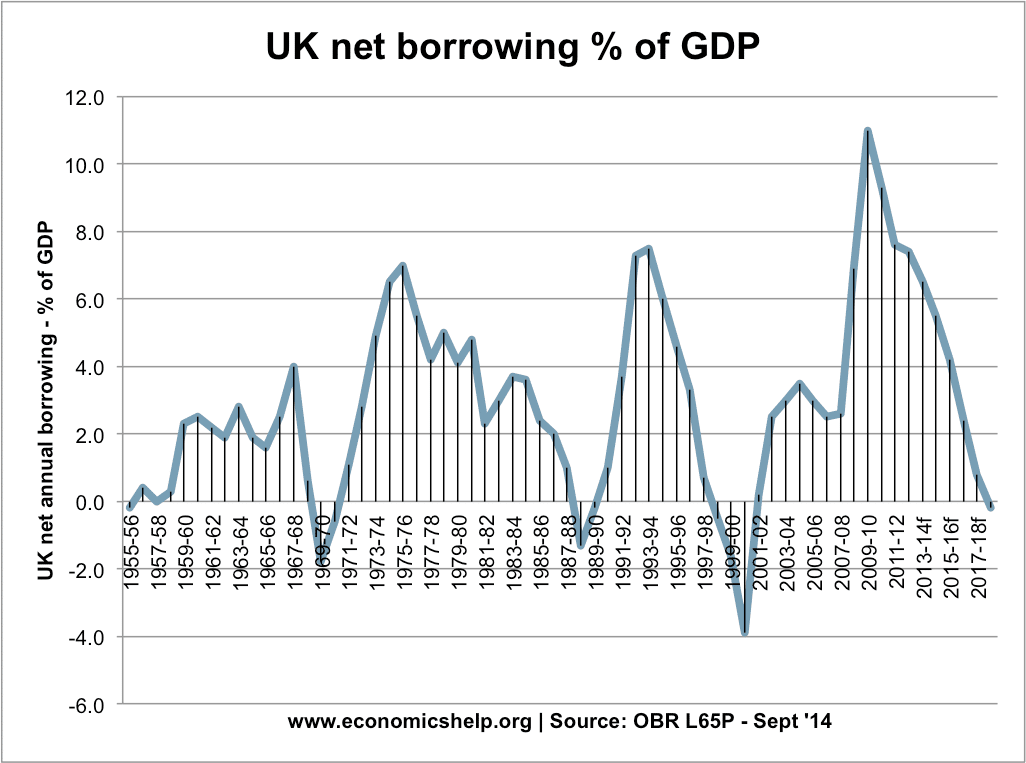

It can be a mistake to mix up cause and effect. For example, borrowing in the UK increased to a very high level in 1974, 1992/93 and 2010. We could make the assumption this shows that high borrowing leads to recession. However, this would be a mistake of cause and effect.

A more likely scenario is that government borrowing rose as a result of the economic downturn. In a recession, tax revenues fall and the government may pursue the expansionary fiscal policy. Without the rise in government borrowing, the recession may have been deeper.

Even economists are not immune to this potential mistake. The 2010 paper “Growth in a Time of Debt,” by Carmen Reinhart and Kenneth Rogoff seemed to suggest that GDP growth significantly falls once government-debt levels exceed 90% of GDP. It was quite influential at the time. However, other economists criticised them for mixing up cause and effect. Low growth – led to higher debt. (does government debt lead to lower growth?)

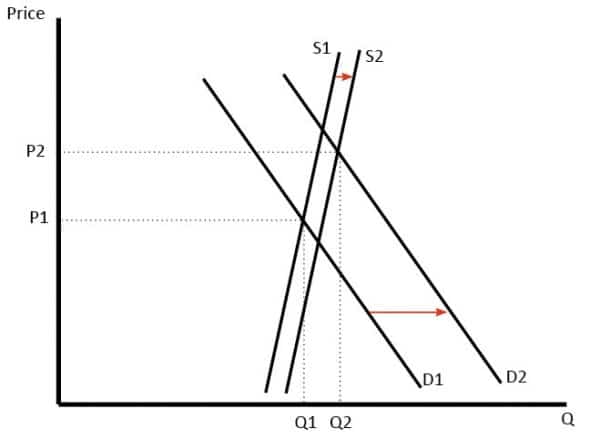

3. Looking at factors in isolation

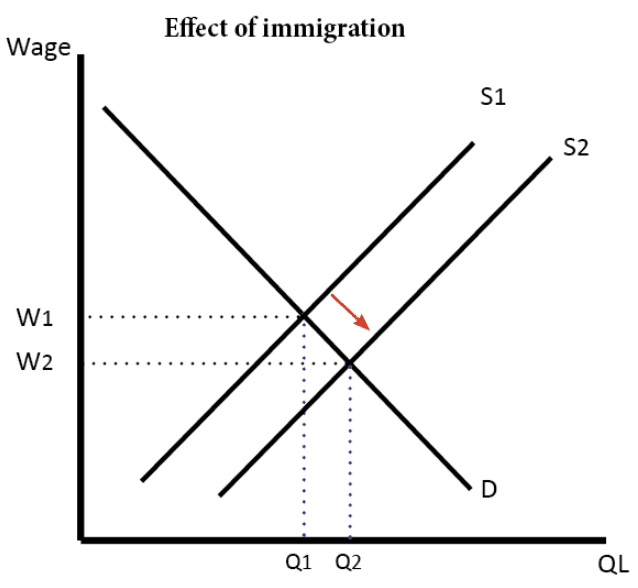

An interesting question is what is the impact of immigration on wage levels. One analysis would be to say that an increase in labour supply is likely to depress wages.

- This is sound economic analysis in the sense that an increase in labour supply would lead to lower wages in a competitive market.

- But, it would be a mistake to stop there.

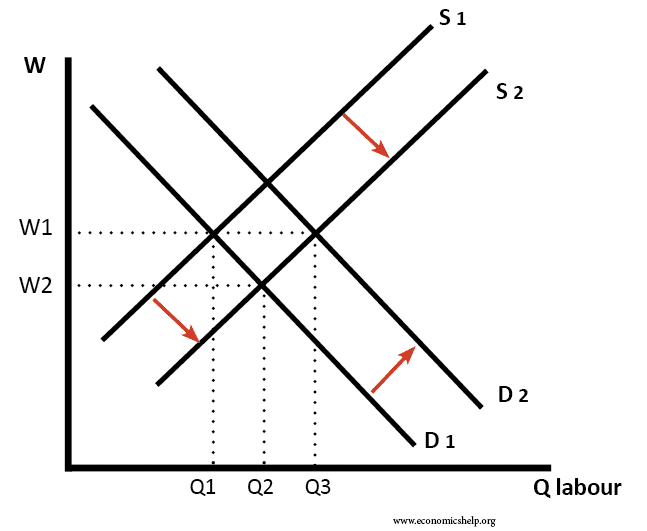

- We also need to consider the impact on the demand for labour after a rise in immigration and a rise in the population. With more people working, there will be an increase in demand in the economy. Immigrants don’t just ‘take’ jobs, they also create them.

In reality, the impact on wages may depend on many factors, such as the skills of immigrants and the state of the economy. But, it is a mistake to only consider one impact.

4. Rational economic man is not always rational

This is a mistake traditional economists have often made. Assuming individual agents are rational and will behave according to some assumptions such as maximising utility – maximising income. In reality, economic decisions are much more complex. Behavioural economics has gone some way to include more psychological influences on decisions, such as impulsive decisions, risk aversion.

For example, the efficient market hypothesis suggests market prices reflect true value because investors have an incentive to maximise income. However, these models of efficient market hypothesis ignore factors such as irrational exuberance – a factor behind US boom in house prices.

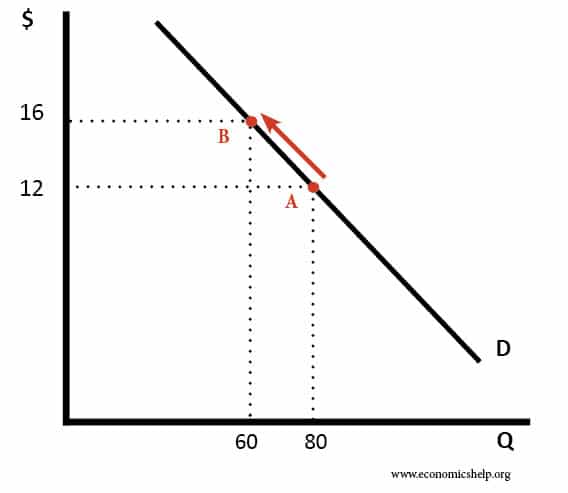

5. Rising prices cause falling demand

This is a little tricky because if we take an ordinary demand curve, an increase in the price will cause lower demand, there is a movement along the demand curve and so less is bought.

However, it is not always as straightforward. Prices of an asset could be rising due to rising demand. Therefore, even though house prices are rising, we may be getting higher demand at the same time.

Prices rising, but demand continues to rise.

6. Bad things must cause a recession

It is tempting to look at many economic mistakes and assume that these must be the cause of a recession. For example, the US has a huge national debt, current account deficit and has wasted billions of pounds on the Iraq War. Although these can be seen as economic problems. On their own they do not cause a recession. In fact government spending on war can often cause a higher rate of economic growth. See: Iraq War and Recession

7. Inflation causes a fall in demand

This is a similar mistake to rising house prices. Periods of high inflation do not cause aggregate demand to fall immediately. Again higher inflation is invariably caused by rising demand in the economy. However, periods of high inflation can lead to periods of recession. The reason is that:

- To reduce high inflation monetary authorities increase interest rates, this reduces demand and inflationary pressure.

- The inflationary boom is unsustainable and therefore causes a boom and bust economic cycle. E.g. the Lawson boom and the recession of 1991.

Related