Summary. A look at policies a country can consider to increase the value of a currency.

Readers Question: I was wondering, what are some of the policies and possibilities a country can use to increase the value of their currency? Specifically, countries who would be trying to “overthrow” the US dollar like China, India, Brazil, Russia etc.

To increase the value of their currency, countries could try several policies.

- Sell foreign exchange assets, purchase own currency

- Raise interest rates (attract hot money flows

- Reduce inflation (make exports more competitive

- Supply-side policies to increase long-term competitiveness.

1. Sell foreign exchange assets and buy their own currency

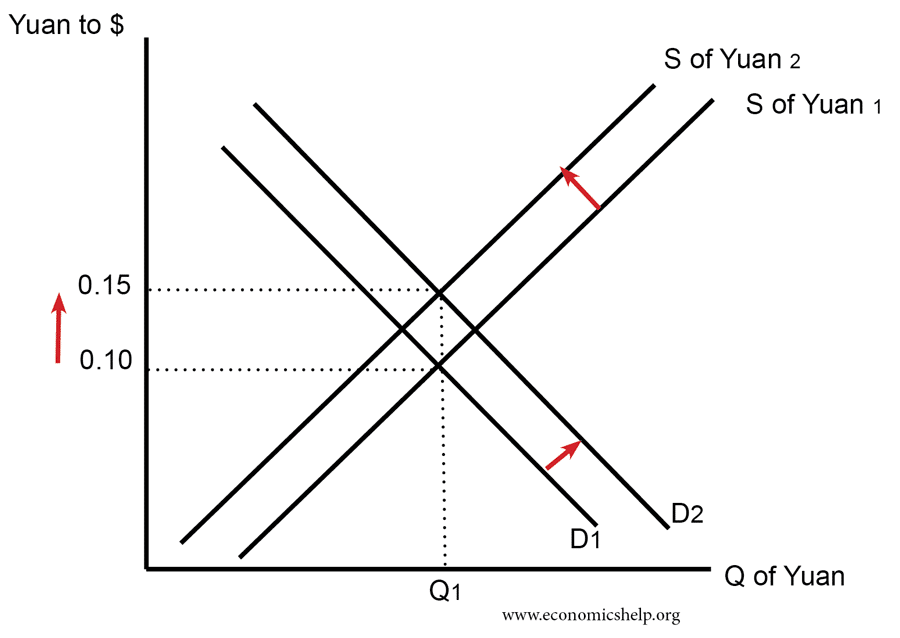

China has over $1.4 trillion of US government bonds. If the Chinese sold these Treasury bills and brought back the proceeds to China, this would cause a depreciation in the dollar, and the Chinese Yuan would appreciate. (supply of dollars would rise, and demand for Chinese Yuan would increase) Because China has substantial dollar assets, they could cause a reasonably significant fall in the value of the dollar.

In fact, China could appreciate the value of their currency simply by not buying any more dollar assets. Currently, China has a large current account surplus with the US. This flow of money into China would usually cause an appreciation. However, China has deliberately decided to use its foreign currency earnings to buy US assets. They do this to keep the Yuan weaker and therefore keep their exports more competitive.

In the case of Russia and Brazil, they only have relatively limited dollar reserves. Therefore, there is only limited scope for selling dollars and buying their own currency.

2. Higher interest rates

Higher interest rates would attract some ‘hot money flows‘. Hot money flows occur when banks and financial institutions move money to other countries to take advantage of a better rate of return on saving. Given interest rates are close to zero in the US, higher interest rates in developing countries give a significant incentive to move money and savings there.

- However, as a drawback, higher interest rates may reduce the rate of economic growth (see the effect of higher interest rates). In many circumstances, e.g. in recession, higher interest rates would not be suitable due to side effect on economic growth. Though if the economy was booming, higher interest rates would cause an appreciation and moderate the rate of economic growth.

3. Expectations

At the moment, it is hard to find a country which wants to have a stronger exchange rate. For example, Switzerland was once seen as a ‘safe haven’ currency. This caused investors to buy Swiss Francs. However, the Swiss government and Central Bank were worried about the appreciation in the Swiss Franc causing problems for exporters. If a country gave a credible assurance that they were targeting a higher exchange rate, this might encourage speculators to move money into that country.

4. Reduce inflation

If inflation is relatively lower than competitors, then the countries goods will become more attractive and demand will rise. Lower inflation tends to increase the value of the currency in the long term. To reduce inflation, the government / Central bank can pursue tighter fiscal and monetary policy and also supply-side policies.

4. Long-term supply-side policies

In the long term, a strong currency depends on economic fundamentals. To have a stronger exchange rate, countries will need a combination of low inflation, productivity growth, economic and political stability.

For example, if India increased interest rates, this might not be enough to cause an appreciation in the exchange rate. This is because, despite high-interest rates, investors would be concerned about the high inflation in the Indian economy.

To increase the value of the currency in the long-term, the government will need to try supply-side policies to increase competitiveness and cut costs of production, for example, privatisation and cutting regulations may help the export industry become more competitive in the long-term.

Difficulties of influencing the exchange rate

It is worth mentioning that it can be difficult for many governments to influence the exchange rate.

- In 1992, the UK tried to keep the Pound in the ERM. The government sold foreign exchange and bought pounds and also increased interest rates. However, the markets didn’t think this was sustainable and kept selling Pounds. Ultimately the government had to give in and allow the Pound to devalue.

- If a country like Canada relies on commodities for foreign currency earnings, then it is hard to increase the value of the currency when the price of commodities is falling. If the price of oil falls, then currencies like the Russian Rouble will tend to fall because the value of oil exports declines. The only solution would be to try and diversify the economy away from oil into other manufacturing, but this will take a long time.

- Lower wage costs are important for helping the exchange rate in the long-term, but it can be quite time-consuming and difficult to reduce wage inflation in a country.

Do countries want a stronger exchange rate?

A strong currency is a mixed blessing. It makes imports cheaper and can improve living standards. However, it can also make exports less competitive and lead to lower economic growth. See: Impact of appreciation

Related

Good analysis – there’s a mistaken impression that countries other than the US want a “strong” currency and associated deflation. In reality, no one really does – hence why the Swiss acted. Nice to see someone accurately debunk that.

i do not know of others , but india severely needs strong exchange rate , currency have depreciated like 20% in last 4 months , students like me abroad are having problems , and nepal , bhutan and srilankan currencies depends on indian currency too.

people are earning same wages , dollar have appreciated like 20-25%, people who send money from abroad might be happy , bu india’s net exports are much lower than imports , so we need strong exchange rates

Abe chutiye it does not work that way. Lodi economics Kabhie Padi Hai

This is awesome. Thanks a lot.

Let’s say you have one million in your bank account but at this time the value of your currency is very low , now your country discovered significant amounts of oil deposits and the value of your dollar went up significantly . Now would the one million in your bank account also increase ? Hence making you more prosperous . Would that one million remain as 1,000,000 just that the value went up significantly.

The figures remain the same but the value will increase, in short things become cheaper for you.

You can buy more with the 1m now than u could before

The 1Million dollar would remain same, but it would make you more rich,as the purchasing power parity of your country would increase and you can get the same loaf of bread which was 10$ ,now in 2-3$ depending on how strong your currency gets.

1: How can the currency of a country like

Somalia who uses dollar in exchange for every thing in side the country can grow its own currency and make it stronger?

the amount remains the same, but the value on exchange to your local currency explains the appreciation.

you can even get ×2 of what you expected before.

i.e. if a dollar was @2500 shillings by the time you banked it and became 3700 shillings.

if the initial deposit was 2$, at first it would’ve been 5000 shillings but turns to 7400 shillings value

SL is not realign on Indian Currency. SL currency has been depreciated due to the nationalistic policy adopted by Donald Trump.

I realy wish my country had strong currency. So sad that 1usd is 2,320Tzs.

I am asking so should we increase exports so our currency could increase?

It’s a matter of making your exports more competitive in foreign markets.This will indubitably boost demand of your country’s exports and eventually make your currency appreciate against the dollar all factors constant.

ok

If the central bank sell it reserve, is it going to save it currency from depreciation at a fixed exchange rate?

How can I increase the value of a currency that has fallen complelety that even the World Bank delcares the money has a value of 0 ?

so is the reason the american government might be scared of the chinese government because they could make the american dollar worthless? also what exactly does it mean for a country to buy its own currency?

It is very common, China has a potential destroying US currency but they can’t, the moment China sells US assets, bonds and buys Chinese currency, it will make Chinese currency stronger therefore Chinese export will decrease significantly. But if China someday got no natural resources just like United Arab Emirates losing oil reserves, then UAE moved to free trade and start building infrastructure and free trade to attract businesses. In a similar fashion, if China loses exports due to strong Chinese currency, it will trigger transfer of power, large industries will move to China because you want strong currency in your hands so you can buy everything cheap in the world just like dollar today. If Chinese current becomes stronger than US dollar, would you prefer 1 million dollar or 1 million chines yuan? Think about it. In my opinion China is waiting for the right moment, even now China don’t needs to, investment in China increase more than investment in US in 2020 due to Covid, research shows it will remain the same in 2021. If two consecutive years investment in China increase at it remains the same for the next few years, China will become the most financially power country in the world.

You said something about investors being reluctant to buy the Indian Rupee even if the interest rate was high because of the high rate of inflation.

Isn’t a high interest rate supposed to push down inflation?

Yes, in theory, but it depends what else is happening in the economy.