Readers Question:Do you really think the UK will keep the AAA credit rating for say the next 2 years?

The UK is one of the few countries to have a AAA credit rating. (list of countries with highest credit rating)

I’ve always felt that the UK should be able to maintain its AAA credit rating (with possible minor downgrade). However, there is a danger of downgrade due to two factors

The UK fail to recover, but get stuck in a persistent depression. Most analysts expect positive growth for the UK by the end of 2012, but this is far from guaranteed. In the past 4 years, forecasters have been persistently over-optimistic when it comes to UK growth. There are 3 factors which could cause the UK to endure persistent depression

- Government spending cuts are still to come into full force. If the government cuts spending, but the private sector continue to save and not invest, there could be a large fall in demand.

- The European economy could deteriorate much further. A deep European recession would reduce demand for UK exports (and AD) but, more significantly undermine confidence

- Further falls in Private sector spending and investment. For example, UK house prices are overvalued. If banks suffer substantial losses related to Eurozone debt default, mortgage availability could fall further, leading to lower house prices and a negative wealth effect on consumer spending. But, also households have been squeezed by rising living costs and stagnant wage growth. Consumer confidence is already very low, but could still deteriorate. (Confidence fairy)

Nevertheless, I still think (or perhaps hope is a better word) that this can be avoided. I would like to see a strong year of economic growth, that would be key to improve credit rating prospects.

Some Reasons to Hope UK will Keep its AAA credit rating.

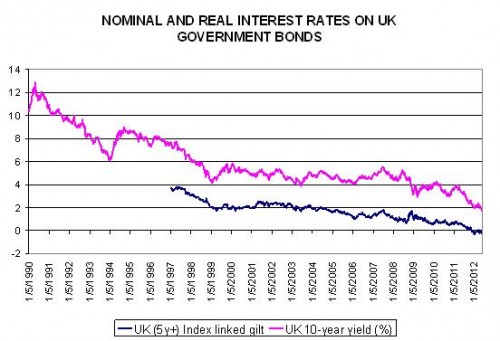

Bond Yields

IMF graph, source: FT

UK bond yields keep falling. This contrasts with bond yields in the Eurozone. (EU Bond yields)

Bond yields tend to rise when markets fear default. This is why Greek bond yields rose and why Spain and Italy have faced much higher bond yields.

Low bond yields mean it is very cheap for government to borrow, and people want to currently buy UK bonds.

(low bond yields are also a reflection of low economic growth and high savings)

Despite a very large budget deficit, the UK has seen falling bond yields. This is because:

- Independent Monetary Policy. Bank of England can purchase bond yields and avoid any liquidity shortages.

- UK seen as a relative safe haven compared to Eurozone, where inflexibilities make countries more likely to default.

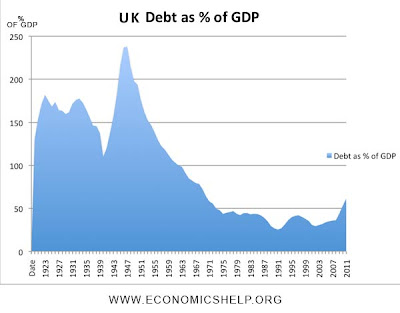

UK Debt

UK public debt is not good, but by historical standards we have had much higher in the 1940s and 1950s. This suggests there is no reason why the UK should enter into default with a lower debt to GDP ratio. If we didn’t lose AAA rating in the 1950s, why should we lose it now? (though, there are also many reasons why 2010s are much different to the 1950s)

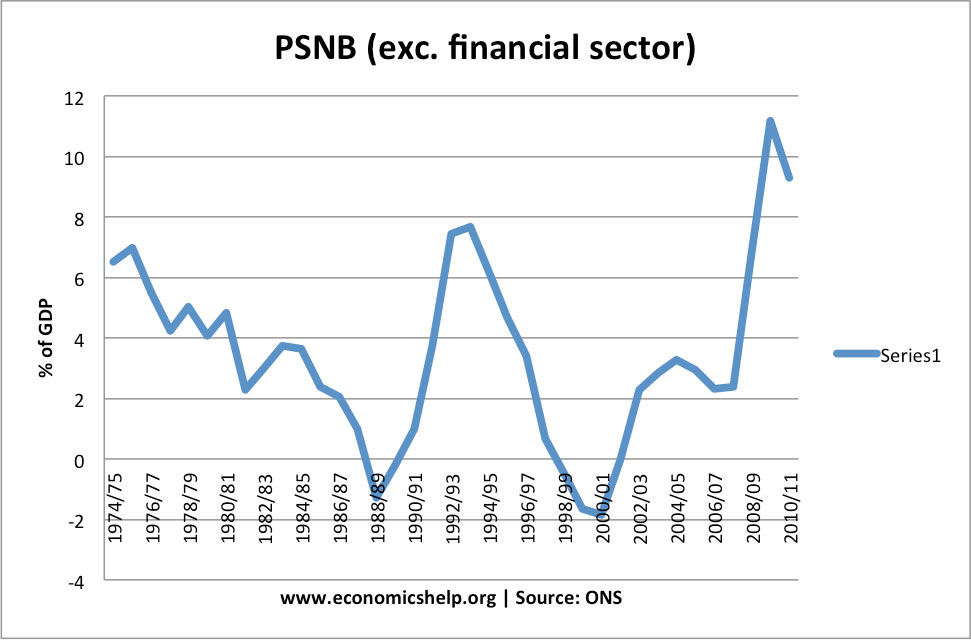

The government has targets for long-term deficit reduction.

I think the government made a mistake in cutting public sector investment during a recession. This has ironically reduced prospects for growth and meant the government have had to revise down their targets for deficit reduction. Yet, the UK at least has a certain political will to do things like raise taxes and cut spending. There is a degree of confidence, that is absent in countries like Greece and Italy.

Will the UK Lose its AAA Credit Rating?

If the Eurozone was strong, I would expect the UK economy to recover. This return to economic growth would boost tax revenues and reduce unemployment benefit spending. This would enable the government to start to reduce debt to GDP ratios quite soon. Strong growth would also enable deficit reduction without pushing us back into recession.

However, the Eurozone is not strong, in fact there is danger of serious economic and fiscal problems getting even worse. I can’t see Greece staying in the Euro. Greece will default and leave. This will cause other European banks to lose money, which they have in Greek bonds.

The real problem would come if big European countries like Spain and Italy also got into real difficulties (i.e. worse than now). This would cause two problems.

European recession would become even deeper, dragging the UK economy into a persistent depression. This would lead to higher debt to GDP ratio.

A second credit crunch following widespread government default and banking collapse. If big Spanish banks went under, there could be a crisis of confidence and mass withdrawals. This could affect the UK bond market, as investors feared the UK could follow suit.

Could UK benefit from a Eurozone fallout?

One possibility, is that if there was great volatility in the Eurozone, investors may decide the UK is one of best places for putting funds. Investors need to put their savings some-where, the UK could be seen as least worse option. To some extent this has already occurred, and is one reason behind the low UK bond rates.

Answer. Yes, it should. But, if there is a major banking crisis in Europe or persistent depression, this could change.

Related

The UK will lose its triple aaa rating and the levels of debt are now at 2009 levels. Euro debt is a major problem with 60% of our exports going to Europe. House prices are overvalued placing banks in further difficulty. Benefits are too generous in respect to working population cut backs needed to save revenue. Small & Medium size businesses need capital to grow and take personnel off employment register which has not happened. The real problem is we have no gold reserves which places us in difficulty a run on the pound is a reality.At present the pound is overvalued given these set of circumstances. We need a change in direction these measures that have been implemented have placed us in a straight jacket and have reduced growth prospects.

Low interest rates have been bad for the economy only USA 0.25% & UK 0.5% & Europe 0.75% all in financial difficulty, because inward investment has moved to coutries like Australia and Brazil were good interest rates have been paid.

Why are their economies booming because of extra investment coming in at an alarming rate and less borrowing costs because of full employment.We need to export to new countries who can pay us back