Evaluation is an important component of an advanced essay. It requires the ability to look at facts, arguments and analysis, with a degree of critical distance. Evaluation involves:

- Looking at what other factors may affect the outcome.

- Time lags involved.

- How it might depend on other issues, e.g. elasticity of demand

- Why the original statement may be incorrect.

- How significant is a factor?

Which questions need evaluation?

Questions which require evaluation usually have these words a the start:

- Evaluate

- Assess

- To what extent

- Discuss

Examples of Evaluation

1. How reliable is the data?

For any essay, you will be using a variety of sources. For example, an essay on trades unions may include information from the TUC. It is good to give data from a source like TUC. However, a valid evaluation technique is to question the reliability and independence of your source.

For example, it is quite likely that the TUC will choose statistics that are more advantageous to workers. Business organisations, e.g. CBI on the other hand, are likely to give alternative sets of data which is more favourable to their point of view.

Therefore, examine the likelihood of bias in data and resources for the essay.

2. Short run and long run?

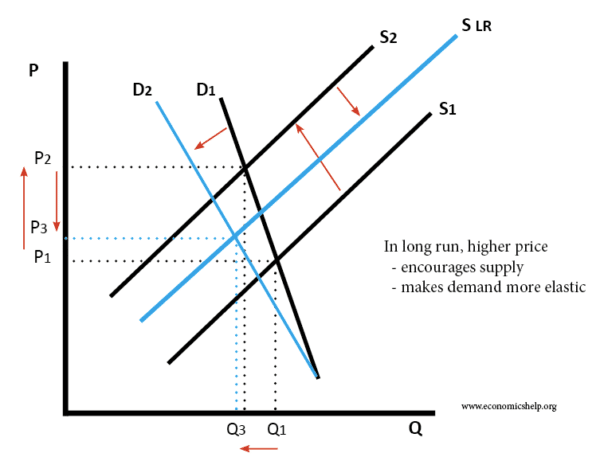

The effects of a decision can be quite different in the long run. For example, suppose you had an essay, which examined the impact of an increase in tax on petrol. The obvious answer is to say: “very little, demand for petrol is inelastic”

However, it would be evaluative to say; “However, over time demand may become more elastic. After a couple of years people may find alternative ways of driving.

3. It depends on other factors

When looking at the effect of one outcome, it is worth bearing in mind it is often difficult to isolate other factors. For example, if we were looking at the impact of a rise in interest rates. The effect would usually reduce consumer spending. However, there are many other factors that can affect consumer spending. If confidence was high, for example, consumer spending may not fall at all – despite the increase in interest rates.

4. Look at both points of view

In subjects like economics, history and politics there are usually several different viewpoints. It is important to give them all consideration, even if we don’t necessarily agree with them. For example, if we look at the impact of a rise in government spending, a Keynesian might say this will increase growth; a Monetarist, on the other hand, may argue higher spending merely causes crowding out. Therefore, there are two different possibilities.

5. State of economy

The impact of a devaluation in the currency depends on the state of the economy. If the economy is experiencing inflation and is in a boom, a devaluation could worsen the inflation. However, in a recession, a devaluation can help boost exports and there is likely to be limited impact on inflation.

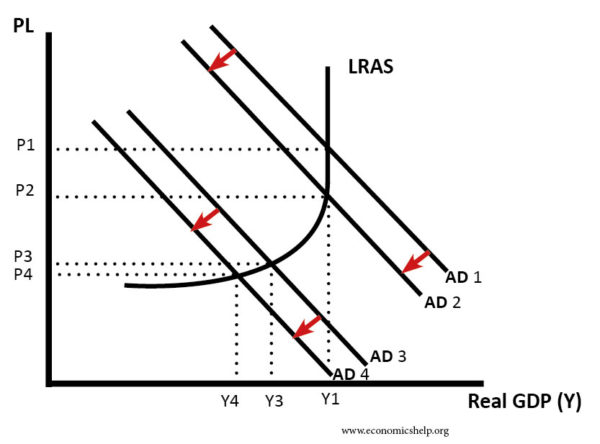

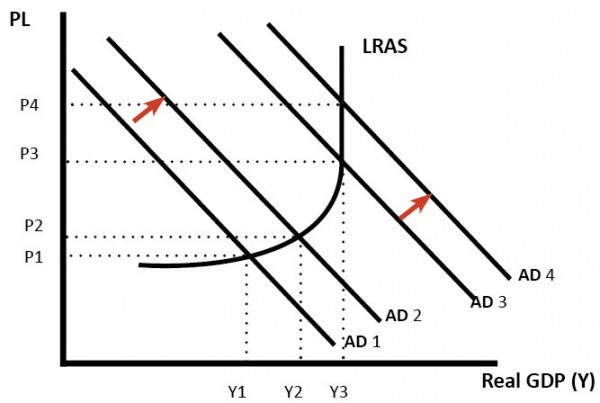

The effect of a fall in AD depends on state of economy

Higher interest rates would have a bigger effect in reducing inflation if the economy is at Y1.

Higher interest rates would have a bigger effect in reducing inflation if the economy is at Y1.

6. How significant is a factor?

A recession in France would lead to lower UK exports to France. France is an important trading partner, however on its own French exports are only a relatively small % of UK AD. If the rest of the Eurozone was growing, and it was just France in recession, it is unlikely to have much impact on the UK economy. However, if the whole global economy was in recession, this would be much more significant and likely cause a recession in the UK too.

7. Different perspectives

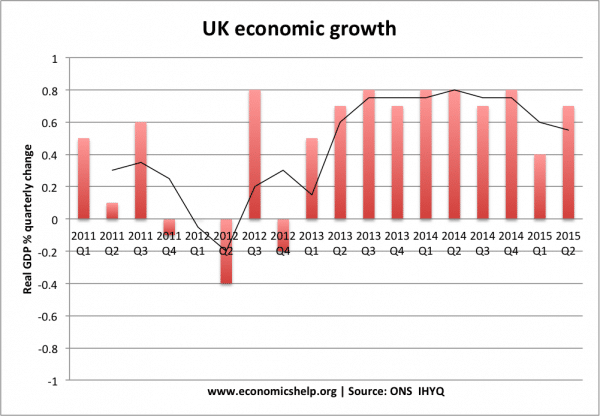

As we mentioned in, UK economic growth in the past four years. How you interpret data is important.

If you showed a graph of UK economy growth since 2013 Q1 – it would give quite a favourable impression of economy.

Including figures from 2011 Q1 gives less favourable.

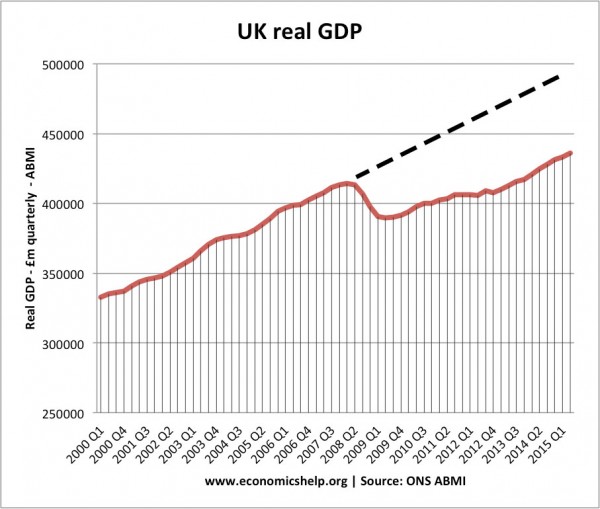

If we look at this graph, it shows the UK economy still has a large negative output gap.

The important thing is that statistics may only tell part of the story. Just because an economy like Spain grew in the last quarter – doesn’t necessarily mean their economy is doing very well.

More on macroeconomic evaluation – discuss the impact of a cut in interest rates

Example question

Discuss impact of the MPC cutting interest rates from 5% to 4.5%?

Lower interest rates make it cheaper to borrow and therefore encourage consumer spending. Cheaper borrowing also encourages firms to invest. With an increase in C + I, we see a rise in Aggregate Demand and therefore we can expect higher economic growth and higher inflation.

Examples of Evaluation of this question

- In theory, lower interest rates will increase spending. However, commercial banks may not pass the base rate cut onto consumers. This happened during the credit crisis because there was a shortage of cash. Therefore, banks were reluctant to lend – they needed to improve their balance sheets. Therefore, even though the MPC cut base rates in 2008-09, consumers may not notice lower interest rates and therefore, there was little if any increase in consumer spending. This explains why the interest rate cut of 2009, failed to cause a strong economic recovery.

- Lower interest rates may not increase economic growth because other aspects of the economy are doing badly. For example, falling house prices are causing a decline in consumer wealth and confidence. Therefore, despite lower interest rates, falls in house prices are offsetting the potential boost to spending from lower rates. Also, in 2009-11, we experienced a global recession. The recession in the Eurozone caused lower exports and therefore the cut in rates could be insufficient given the fact other aspects of AD are being reduced.

- The cut is only very small. 0.25% is probably insufficient to have much effect especially given problems already mentioned. However, you could argue the UK is sensitive to interest rates because of the number of variable mortgages. Even a 0.25% cut in rates can increase disposable income for people with large mortgages. (this is what you might call double evaluation, evaluation of the evaluation)

- The cut will take time. A cut in interest rates will not boost spending immediately. For example, It will not affect people on a fixed-rate mortgage for about 2 years. Therefore, after a cut in interest rate, we may not see the boost to spending for up to 18 months; this makes monetary policy much more difficult.

Further resources for Economic Essays

Related posts