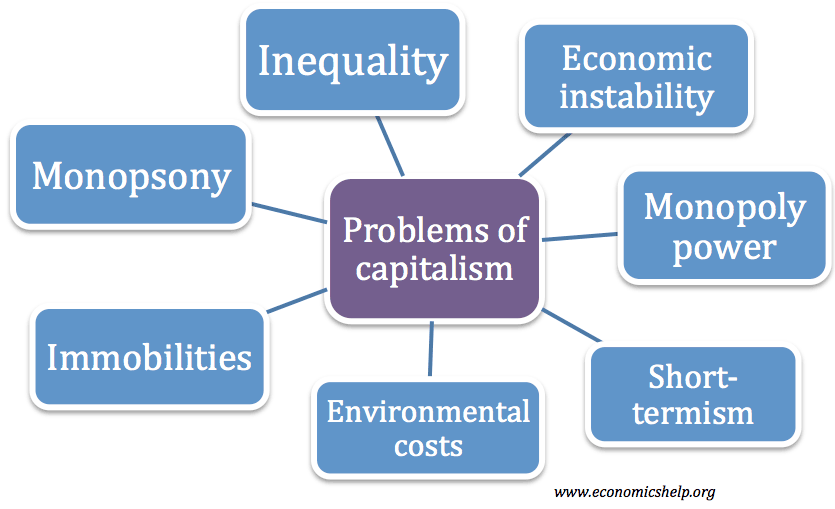

Capitalism is an economic system based on free markets and limited government intervention. Proponents argue that capitalism is the most efficient economic system, enabling improved living standards. However, despite its ubiquity, many economists criticise aspects of capitalism and point out is many flaws and problems. In short, capitalism can cause – inequality, market failure, damage to the environment, short-termism, excess materialism and boom and bust economic cycles.

Problems of Capitalism

1. Inequality

The benefits of capitalism are rarely equitably distributed. Wealth tends to accrue to a small % of the population. This means that demand for luxury goods is often limited to a small % of the workforce. The nature of capitalism can cause this inequality to keep increasing. This occurs for a few reasons

- Inherited wealth. Capitalists can pass on their assets to their children. Therefore, capitalism doesn’t cause equality of opportunity, but those born in privilege are much more likely to do well because of better education, upbringing and inherited wealth.

- Interest from assets. If capitalists are able to purchase assets – bonds, house prices, shares, they gain interest, rent and dividends. They can use these proceeds to buy more assets and wealth – creating a wealth multiplier effect. Those without wealth get left behind and may see house prices rise faster than inflation.

- The economist Thomas Piketty wrote an influential book Capital in the Twenty-First Century, which emphasised this element of capitalism to increase inequality. As a general rule, Picketty argues wealth grows faster than economic output. He uses expression r > g (where r is the rate of return to wealth and g is the economic growth rate.)

2. Financial instability/economic cycle

Capitalism relies on financial markets – shares, bonds and money markets but financial markets have a tendency to cause booms and busts. In a boom period, lending and confidence rise, but frequently markets get carried away by ‘irrational exuberance‘ causing assets to the spike in value. But, this boom can quickly turn to a crash when market sentiment changes. These market crashes can cause economic downturns, recession and unemployment. At various times, capitalism has suffered prolonged recessions (the 1930s), periods of mass unemployment and a decline in living standards.

3. Monopoly Power

In a free market, successful firms can gain monopoly power. This enables them to charge higher prices to consumers. Supporters of capitalism argue only capitalism enables economic freedom. But, the freedom of a monopoly can be abused and consumers lose out because they have no choice. For example, in industries like tap water or electricity supply, which are a natural monopoly, consumers have no alternative but to pay the prices charged by consumers. In the Nineteenth Century, monopolies like Standard Oil bought our rivals (often with unfair competitive practices) and then became very profitable.

4. Monopsony

Monopsony is market power in employing factors of production. For example, firms can have monopsony power in employing workers and paying lower wages. This enables firms to be more profitable but can mean workers don’t share from the same level of proceeds as the owners of capital. It explains why with increasing monopsony power we have seen periods of stagnant real wage growth while firms profitability has increased (2007-17 in UK and US)

5. Immobilities

In a free market, factors of production are supposed to be able to easily move from an unprofitable sector to a new profitable industry. However, in practice, this is much more difficult. E.g. a farmworker who is made unemployed cannot just fly off to a big city and find a new job. He has geographical ties to his birthplace; he may not have the right skills for the job. Therefore, in capitalist societies, we often see long periods of structural unemployment.

6. Environmental costs and externalities

In capitalist economies, there is limited government intervention and reliance on free markets. However, market forces ignore external costs and external benefits. Therefore, we may get over-production and over-consumption of goods that cause harmful effects to third parties. This can lead to serious economic costs – pollution, global warming, acid rain, loss of rare species; external costs that damage future generations.

7. Encourages greed/materialism. The nature of capitalism is to reward profit. The capitalist system can create incentives for managers to pursue profit over decisions which would maximise social welfare. For example, firms are using theories of price discrimination to charge higher prices to consumers who want to jump the queue. This makes sense from the perspective of maximising profit. However, if we have a society, where the rich can pay to jump a queue at a Fairground – or pay to see Congressman quicker – it erodes social norms and a sense of ‘fair-play’

The pursuit of the profit motive has encouraged some law firms to aggressively pursue litigation claims. This has created a society where we devote resources to protecting ourselves from being sued. Further reading – “Moral Limits of Markets” by Michael Sanders

See also:

Just to let you know, you spelled two words wrong under “Encourages greed.” It’s maximized with a Z, not an S. You might want to fix that.

in British English we use s not z.

In British English, we use both. It’s a matter of preference.

This is rather biased, and frankly incorrect in a number of ways.

Capitalism doesn’t cause the boom and bust cycle. Monetary policy does. This is expressed in the Austrian mantra “the market coordinates time with interest.” This is the result of the prime interest rate synchronizing the expansion operations of millions of firms at once.

Environmental costs and externalities are not features of capitalism per se. They result from consumption in *every* socioeconomic system, including socialism and communism. Jared Diamond has documented these problems, along with local resource overconsumption, in his book Collapse. They date from the very earliest civilizations, and in some cases are found even in foraging societies.

Monopoly power does not derive from the market alone. Except in the case of natural monopolies, every true monopoly that ever existed was created by government. The canonical example usually trotted out of “monopoly” is Standard Oil, which was never a monopoly (never fewer than 100 domestic competitors and 300 or so global competitors). “Monopoly” is simply overused, and badly misused, by the critics of capitalism.

Standard Oil’s market share did climb upwards of 91%, but by the time the Sherman Act was enacted, its share had fallen to 70%, and was around 65% by the time it was prosecuted. There was little that was “unfair” about its practices. It offered a superior product at a better price, and consumers responded to that. It was all but the exact opposite of a “predatory monopoly,” often allowing the heads of the firms it bought out to continue running their offices as subsidiaries, provided they agreed to meet Standard’s quality and price guidelines.

Inequality is perhaps exacerbated by corporatism, but is not a feature of capitalism per se. Again, it’s found in every socioeconomic system, and is known to have existed from the advent of civilization onward. A complete rebuttal of your thesis would require more space than I think is merited in a reply, but the short answer is that in the freest markets–the so-called “pure competition model”–there are no barriers to entry, and therefore P = MC and P = min ATC. This means there are no long-run economic profits, and therefore no tendency to drive wealth upwards. It’s in the oligopolistic markets that you see wealth concentration…and these, always and everywhere, are the consequence of barriers to entry…which in turn are the consequence of regulations.

The concentration of wealth is a feature of highly-regulated markets, not free markets. So, not capitalism per se, but rather corporatism.

So basically capitalism doesn’t cause capitalism? Rather capitalism is this utopian mythical system that has been corrupted by its own institutions that make it up? And it doesn’t cause any of the bad things that are the manifestations of its inherent logic like (i) concentration of land and capital (economic power), (ii) wealth accumulation and profit, (iii) competition (and monopoly as a result of economic power concentration(i)) and (iv) wage slavery for those who don’t have access to accumulated wealth(ii)?

Concentration of economic power is a result of people doing their jobs the best out of anyone, thus they get more capital to do their job better at larger scales. This is the one of few situations where the government needs to intervene to prevent one business from gaining too much, in order to keep competition healthy.

Wealth accumulation is not bad in itself. If you own a business, everyone is buying from you, thus you make money. I hate it when people act like the successful “steal” from the average person. It’s not stealing if they make the choice to do business with you. If someone isn’t stealing, then they are entitled to their wealth. If you’re more productive to society, you are entitled to more wealth. People rip on Jeff Bezos for his wealth, and yet they contribute to his wealth by buying from Amazon. It’s hypocritical to do business with someone, then yell at them for making money.

I also get annoyed by the “wage slavery” argument. Wages get driven down by increased competition. The reason we’re seeing it now is largely in part to increased levels of unskilled labor. Minimum wage jobs are ones that require little to no skill to complete, and a large amount of unskilled immigrants competing for these jobs only makes it worse. In the past, immigration at least brought its own specializations. That trend has decreased.

The problem today is that people see a problem, and they blame the wrong thing out of ignorance. Or they blame the wrong thing because that’s what helps them push other agendas. Just like people blame slave wages on capitalism as a whole instead of unskilled immigrants and failed education systems. Blaming capitalism draws attention away from any negatives of immigration, allowing people to continue blindly supporting unlimited immigration. Political issues are tied to one another and often used as tools to complete other agendas.

I’d just like to raise some questions. I don’t hate rich people for being rich. I, too, want to believe that they are entitled to their wealth because they are of good use for society. But what about inherited wealth? There can be people who did not contribute to society at all, but still have more money than 90% of the population. But maybe, the one who earned the money wanted his family to be rich for decades without them having to work, so this may just be alright.

I think what makes the situation a bad one is that money equals power. You can not deny that, as huge accumulated wealth enables people to do tons of things, which can have an impact on everyone’s life. Money can buy political advantage as well, it seems. As a conclusion, people who “contribute the most” to society, who are the most productive have an advantage in areas they should not have. At least in a democracy.

You’ve got all these theories, but in the practical sense, a capitalist system that does not look after a society is of no use to humanity. If you’ve got the unskilled worker having to work for ‘tips’ iso a wage, while his CEO is making $10m a year, where is the humanity?

At the end of it all, human well being should be the highest priority, on a global scale and universal scale.

An economic system that does not provide that MUST be changed, else like every system that is not fair, it is not sustainable, and will eventually lead to revolution and bloodshed. Lessons we seem to have forgotten.

Love this reply, my feelings to a tee! A society should be judged by the wellbeing of the least of its citizens and we as a whole are doing a terrible job of creating a fair and equitable society. Capitalism prioritizes profit over people, as long as the well being of humans takes a back seat to how much money can be made we continue the cycle of wealth being concentrated into the hands of the few. While we have developed strategies in the modern world to help stave off the lack of monetary resources and wealth to those at the bottom wealth is still continuing to be directed to the top with the top 1% now holding 40% of all the world’s wealth. No matter what they do this trend will only continue to the point that eventually the 1% will be in control of most of the worlds monetary and natural resources. This will eventually lead to the average person not being able to have even close to a decent life. We are already seeing this with low wage workers being forced to work ungodly amounts of hours to support their families and this is looked at as normal? And just the way things are… There is no reason some people should be allowed to accumulate so much wealth and property that it causes the ownership of property to the average person to become almost unattainable. Housing prices have done nothing but soar most of my adult life except for the housing market crash in 2008 which actually caused me to have to give my house back to the bank because that made the best sense when my home decreased in value over 30% so I owed a ridiculous amount more than the home was worth. And yes smaller towns have much better real estate prices, but they also have the least amount of available jobs, especially decent paying jobs. While the elite continue to accumulate more and more the rest of us have to work harder and harder just to carve out a decent living and we have to get loans for just about everything necessary to provide for ourselves and our families, first and foremost cars and housing. I could go on and on, but the basic point is that Capitalism does nothing in the way of regulating how much one person or a very few can attain and the planet has a finite amount of resources, natural or otherwise. And on this path eventually the few will have so much the rest of society has no choice other than to redistribute those resources by force.

I have to disagree with your comment about certain people being “more productive to society” and therefore deserving of more wealth. Some of the wealthiest people and industries have historically and continue to be the most damaging to society. Oil, mining, deforestation, fishing, tabacco (and the list goes on and on) have damaged the world profoundly (people and environment included). Yet, the only thing that seems to matter are the wallet(s) at the top. Perhaps if you were better educated you could learn more about the devastating effects some of these people and their industries have actually had on society.

Oil provides fuel which allows people to travel faster and in more comfort. Mining produces materials which are used to manufacture just about everything (including both the computer you used to whine about capitalism and the servers this website is stored on). “Deforestation” isn’t an industry, logging is. Logging as an industry, like mining, provides materials for a large portion of the products you buy. Ever read a book before? that paper came from the logging industry. Fishing provides food for people to eat, ’nuff said. Tobacco as an industry is harmful, which is why capitalists have put in place regulations so that only people who know the risks and consent to the harm can buy tobacco products.

If you truly believe that Transportation, Manufacturing, Books, Pencils, and Food have “damaged the world profoundly” perhaps you yourself need to get a better education.

Would you argue that that monetary policy was the cause of the “roaring twenties”, the stock market crash in 1929, and the subsequent “great depression”? If so, exactly what were those polices?

Didn’t Marx write that capitalism had to have periodic crises in order to operate?

he did say that in Das Kapital. its one of the reasons capitalism is a failed system, the crises hurt the poor the most.

Limited Capitalism or Freedom Communism may an alternative solution.

While traditional capitalism has unlimited freedom and unlimited consumption, communism has sticky limited freedom and limited consumption.

The middle way between these two conservative ideas is to give people the right of freedom to choose anything they want, but to control people not consuming too much.

Limited Capitalism has unlimited freedom but limited consumption.

That solution seem to keep thing relative calm at the current world we live in. However the Human problem is who should have the power limited everyone else, if this entities intention is relative good the society can function for a while until that changes to a different direction. So what is the ultimate direction we should head to, do Human doom to fail in every system it’s created ?

Capitalism will lead to revolution,

“Capitalism” is unethical. ANY system with “capital” rather than decency and morality at the center is clearly wrong. I can’t believe that we are still having this discussion, as we rush toward the 6th great extinction event, thanks in large part to individual greed, the jewel in the crown of the “free market”. If we continue in deliberate ignorance and evil, we deserve everything we have coming…it’s not ALL capitalism, to be sure. We’ve had slavery, feudalism, monarchy- ALL exploitation of the many by the few, including the exploitation of the planet and every other species on it.

The United States is not a purely capitalist economy. It’s a mixed economy. Yes most business are held by private entities and able to make decisions as they see fit, but there is the government sector of the economy which would include weapons and defense contracts, infrastructure, social safety nets and much more than I’m obviously forgetting. The government shouldn’t be playing police by bailing out “too big to fail companies” and if the choice is made to do so there should be a “restructuring” of that business that is failing that is going to tank the economy. The best rule is to cut once, and cut deep. Anyone who holds a board position or has 3-4 letters after their name need to go. It made me sick to see the bail outs that we taxpayers have to payback while the COO’s, CEO’s, and CFO’s gift themselves a huge bonus. I’d much prefer to let the market crash out for a while and let them reap what they have planted. I would almost guarantee this would send shockwaves of ice up and down the spines of these companies who practices are devious and manipulative. Like selling AAA guaranteed loans that were a steaming pile and they knew it as to appear legitimately a great opportunity. To fix our problems that do occur yes, we need a trustworthy sector of government to break up monopolies which are few and far. We also need school choice, it’s a capitalistic model which would make school throw out 1619 and replace critical theory with reading, writing, arithmetic, and 1776. Teach economics in every grade level and how loans, simple interest, spending habits hurt/help, supply chain, distribution and how to build credit. Teach the kids the importance of food, diet, exercise, and how it sets the tone for their life. Teach kids to think logically versus having to memorize and repeat. Make it mandatory that all state and federal funded schooling be required to a set number of hours and participate in a service/community service to graduate to the next grade. Our educational system should t cut off the tall grass to make everyone “equal” by challenging the advanced with outside the box opportunities to grow. Bust up the school unions so we can flush the tenured turds posing as educators. I know this was the long route but this is where it starts otherwise we will be paying an idiocracy tax for the burden of those who just didn’t try or didn’t want to try.

Solutions to the alledged problems of Capitalism (hint at why Capitalism is morally good and the alternatives morally evil).

1. Inequality – bad solution is equality. Everywhere and at every time that necessarily means equally unable to exercise one’s individual rights. So equally unable to save and invest capital. So equally impoverished.

2. Boon and bust – not a feature of Capitalism. Government interference picks winners and losers – suppressing price information. (good solution is purer Capitalism)

3. Monopoly power – bad solution – all efforts to produce are granted monopoly powers (e.g. too big to fail), made outright monopolies, or nationalized.

4. Monopsony – bad solution – successful companies that create value are throttled. Less value created, government choice of winners and losers distorts the market (creating misinformation that leads to losses for the masses), fewer employees, and denying the masses their first choice when spending their hard earned dollars.

5. Immobilities – bad soluiton – don’t allow progress. Total oppression of any individual who could improve the lives of millions, and well, robbing the masses of innovations that would improve their lives (over and over and over again and so on). The base idea is that farmers shouldn’t even have shovels – more people would be employed digging with their hands. Which is itself wishful thinking – there would just be far fewer people (mass starvation).

6. External costs – bad solution – see #1 and #5 for the ‘just say no to everything’ solution, and #3 for the ‘gulag anyone who asks questions about the national effort to whatever’ solution.

7. Greed – greed is irrelevant, either someone or a group of folks know how to create value, and do, or the value isn’t created (lack of greed, don’t know how, tried but didn’t profit, etc.). As for jumping the queue, access to a politician has nothing to do with Capitalism (pure Capitalism means the politician has no sway). Jumping the queue for a private business? Bad solution – throttle any and all innovation. For example, a life saving medicine. If it’s possible to sell the early doses at massively high prices to the rich (low volume x high price), we can afford to start mass producing (high volume x low price). If it’s not possible, it’s too risky to do it – first they need the money as capital, and second early adopters are always important in going to market.

And the bad solutions I’ve outlined are *always* the solutions implemented. The base delusion is that taking capital away from businesses, or taking some measure of control of it, or seizing it outright, won’t disrupt the flow of goods and services to the masses. The base moral corruption is that it’s okay to make slaves of productive individuals. Anyone who sanctions or champions the reduction or elimination of Capitalism – and achieves it – will wake up one day either shocked to discover they were on the productive side of the equation, or that it’s much harder to live off of the efforts of the *formerly* productive.

I guess that “monetary policy” caused the “roaring twenties” and the “great depression”, huh?