A feature of the UK housing market is the low quantity of new houses built compared to the long term growth in demand.

Despite high house prices, firms are unable / unwilling to build as many as market forces dictate. The supply of housing is price inelastic.

The lack of supply has meant that the UK has seen a decline in affordability of housing; as a consequence, it is difficult for young people to buy a house and get on the property ladder. Housing is another factor causing increased inequality in the UK.

Reasons to Build more Houses.

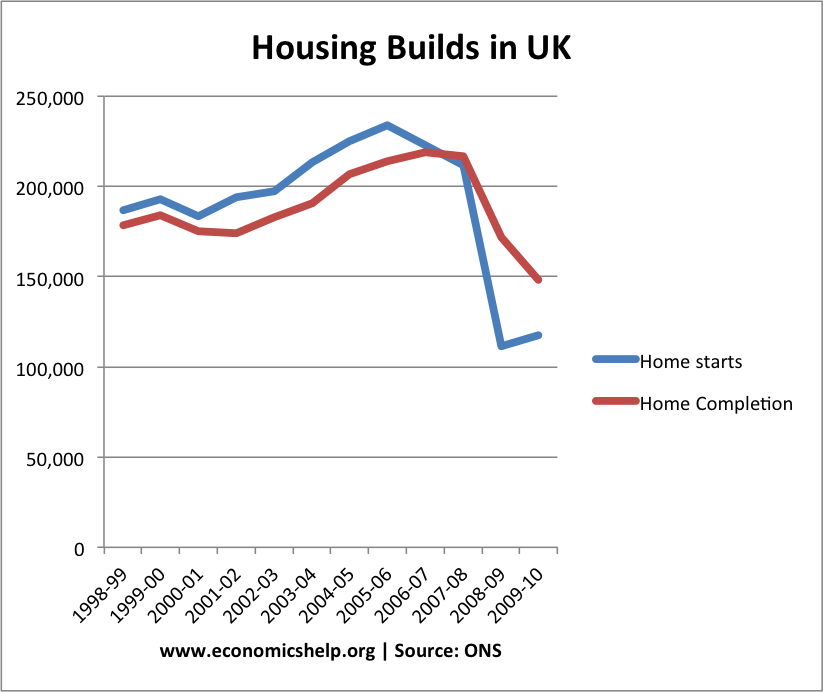

Supply is growing less than expected demand. The number of new households is expected to grow by 200,000 – 250,000 a year. Yet, supply has been averaging less than 150,000 in recent years. This leaves a shortfall of housing stock, putting upward pressure on both house prices and cost of rent.

Even at the end of the boom years, house builds were struggling to meet the target of 250,000 a year.

Even at the end of the boom years, house builds were struggling to meet the target of 250,000 a year.

- The number of households in England is projected to rise by 5.8 million from 2008 to 2033, an increase of 232,000 per year on average reaching 27.5 million in 2033. (Communities.gov.uk)

The number of new houses built in the UK in 2010/11 was only 106,000. This is partly a reflection of the economic outlook, but it also raises long term questions over sustainability of supply.