- Definition – Inflation – Inflation is a sustained rise in the cost of living and average price level.

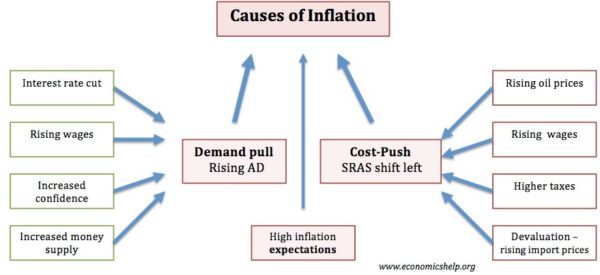

- Causes Inflation – Inflation is caused by excess demand in the economy, a rise in costs of production, rapid growth in the money supply.

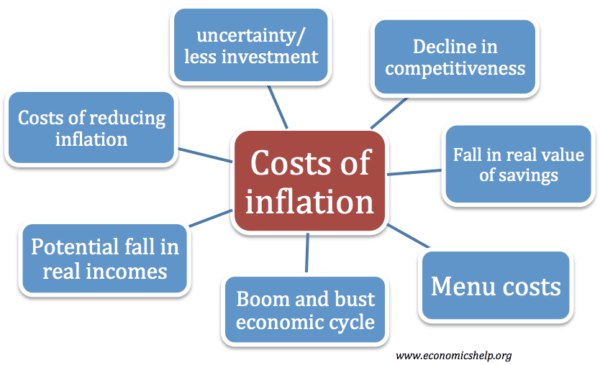

- Costs of Inflation – Inflation causes decline in value of savings, uncertainty, confusion and can lead to lower investment.

- Problems measuring inflation – why it can be hard to measure inflation with changing goods.

- Different types of inflation – cost-push inflation, demand-pull inflation, wage-price spiral,

- How to solve inflation. Policies to reduce inflation, including monetary policy, fiscal policy and supply-side policies.

- Trade off between inflation and unemployment. Is there a trade-off between the two, as Phillips Curve suggests?

- The relationship between inflation and the exchange rate – Why high inflation can lead to a depreciation in the exchange rate.

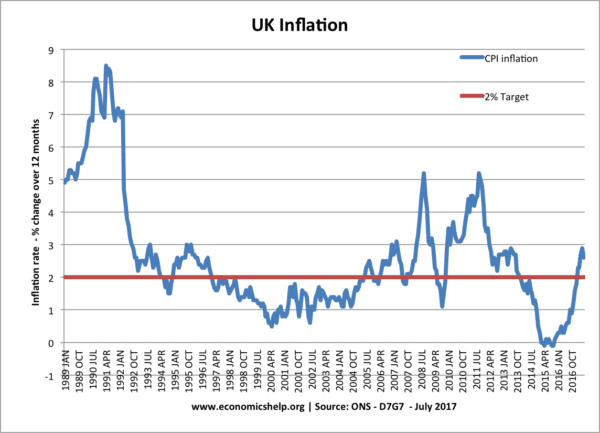

- What should the inflation target be? – Why do government typically target inflation of 2%

- Deflation – why falling prices can lead to negative economic growth.

- Monetarist Theory – Monetarist theory of inflation emphasises the role of the money supply.

- Criticisms of Monetarism – A look at whether the monetarist theory holds up to real-world scenarios.

- Money Supply – What the money supply is.

- Can we have economic growth without inflation?

- Predicting inflation

- Link between inflation and interest rates

- Should low inflation be the primary macroeconomic objective?

See also notes on Unemployment