Readers Question: In finance and economics, there are such things as “bubbles” in the economy. And when bubbles start forming, it normally isn’t a good thing. My question is, how many different kinds of “bubbles” are there? Such as the property bubble or stock market bubble. And how do they form and what are their economic impacts?

Bubbles typically refer to a situation where assets or financial instruments see a rapid increase in price – an increase in price which is driven by speculative demand and are unsustainable in the long run. At a certain price, the bubble ‘bursts’ and prices come down to a level which more closely reflects the fundamental economic value. A bubble strongly implies that psychological factors such as irrational exuberance and over-confidence play a role in increasing the value of the asset.

Different Types of Bubbles

- Market Bubble. When a particular market sees a rapid increase in price. For example, this could be a housing bubble.

- Commodity bubble. When the price of one commodity or several commodities increases in price. For example, we might see a speculative bubble in the price of gold, e.g. in the 1970s and 1980.

- Stock market bubble. When the value of stocks and shares increase rapidly, e.g. prices increase faster than earnings. A stock market bubble is vulnerable to a crash, where market traders come to feel the bubble prices are over-inflated.

- Credit bubbles. A rapid growth in consumer and business credit to finance higher consumer spending.

- Economic boom/bubble. Related to the concept of market bubbles is the idea of a general economic boom. A boom implies that the economy expands at an unsustainably fast rate, leading to inflation (e.g. aggregate demand grows faster than productive capacity). Ultimately an economic boom usually proves unsustainable. There may be a strong link between market bubbles and an economic boom. For example, a house price bubble may cause rising wealth and confidence leading to higher consumer spending and economic growth. In turn, the higher economic growth feeds the housing boom.

Examples of Bubbles

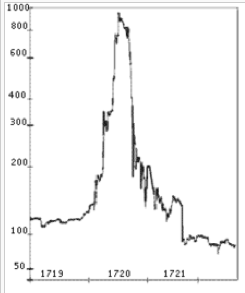

- South Sea Bubble 1711-1720 A company set up to profit from British trade with South America. The price of shares rose rapidly, but with the company failing to make any real profit, share prices collapsed in 1720 and returned to pre-issue levels.

- Tulip mania of the 1630s. When the price of tulips rose to over 500 times their previous price before collapsing when buyers stopped entering the market.

- 1920s credit and the housing bubble in U.S. In the 1920s, there was a rapid growth of credit in the US. This financed a boom in house building and also a boom in the stock market. This rise in credit and share prices came to an abrupt end in 1929 with prices crashing.

- Dot Com Bubble. A rapid growth in the share value of internet shares in 1997-2000.

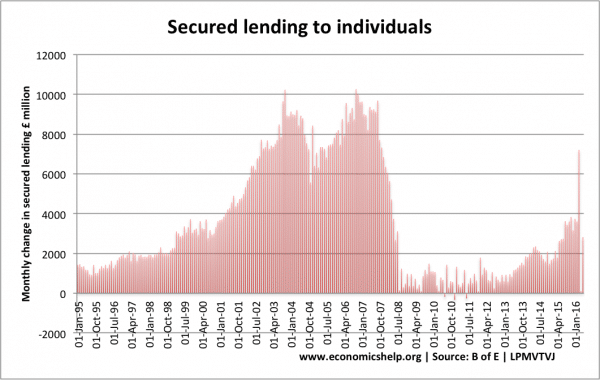

- Credit bubble of 2000s, which saw a rise in asset prices and bank lending.

- Bitcoin bubble the latest bubble?

- Bond bubble? Some argue there is a bond bubble with bond prices over-inflated by quantitative easing. Others argue it isn’t a bubble but reflection of a liquidity trap.

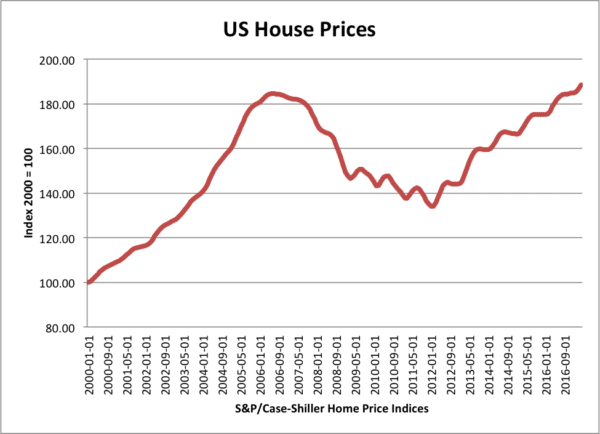

House price bubble

Between 2000 and 2006, house prices rose 80% and house price to earning ratios rose above long-term averages. This was partly fuelled by a growth in mortgage lending to subprime customers. When interest rates rose a modest amount in 2004/05, the housing market started to turn and prices fell 2006-12.

Causes of Bubbles

Usually, bubbles start for some good economic reasons. For example in the early 2000s, low-interest rates and economic growth encouraged people to buy a house. In 1990s internet stocks did offer good potential growth for this new business. However, rising prices and rising demand can create a dynamic where positive news encourages people to take more risks and prices rise more than they should. Some factors that can cause bubbles:

- Irrational exuberance. In certain circumstances, investors can buy assets because of strong psychological pressures which encourage them to ignore the fundamental value of the asset and believe that prices will keep rising.

- Herding behaviour. People often assume the majority can’t be wrong. If banks and well-established financial leaders are buying, they assume it must be a good investment. (the economics of herding and irrationality)

- Short-termism – people make decisions based on short-term rather than the long-term.

- Adaptive expectations. People often judge the state of a market and economy by what has happened in the recent past.

- Hope they can beat the market. People believe they can beat the market and get out before the bubble pops.

- Cognitive dissonance – filtering out of the bad news and looking for views which reinforce their beliefs.

- Financial instability hypothesis. The theory that periods of economic prosperity cause investors to be increasingly reckless leading to financial instability.

- Monetary policy. Sometimes bubbles occur as an indirect consequence of monetary policy. For example, the FED’s decision to keep interest rates in the US low encouraged the credit bubble of the 2000s. Excess liquidity can more easily lead to bubbles because people need somewhere to put their money.

- Global imbalances. Some argue the US financial bubble of the 2000s was caused by an inflow of currency from abroad. The US ran a trade deficit and attracted hot money inflows, leading to higher demand for US securities. This kept interest rates lower and values of US higher than they otherwise would be

Robert Shiller, the Yale economist said on the psychological basis of bubbles:

“Irrational exuberance is the psychological basis of a speculative bubble. “Irrational exuberance is the psychological basis of a speculative bubble. I will define a speculative bubble as a situation in which news of price increases spurs investor enthusiasm which spreads by psychological contagion from person to person, in the process amplifying stories that might justify the price increase and bringing in a larger and larger class of investors, who, despite doubts about the real value of the investment, are drawn to it partly through envy of others’ successes and partly through a gambler’s excitement.”

Effects of Bubbles

Bubbles can be damaging to the wider economy, especially if it is a key market, such as housing or the stock market. A stock market crash can cause a loss of confidence and lower spending. In 1929, the stock market crash was one important factor that triggered the great depression. However, stock market crashes don’t always cause a recession. For example, in 1987, the stock market crash didn’t cause any slow down in economic growth.

A bubble in the housing market tends to be more damaging because housing is the biggest form of wealth. If house prices fall rapidly, it will cause a significant fall in consumer spending and can cause a recession, for example, the housing crash of 1991 contributed to UK recession. The house price bubbles and bust were a strong factor behind recessions in Ireland and Spain.

For commodity bubbles, the economic effect is more uncertain. For example, a rapid fall in gold and oil prices will mean some investors lose a lot of money. But, falling oil prices will help increase consumer disposable income and can actually help the economy.

Related