Readers Question: What are the implications of a higher dependency ratio?

The dependency ratio measures the % of dependent people (not of working age) / number of working people.

Children (0-15) + Number of elderly (> 65)

————————————————

Number of working age (16-65)

In the western world, we are seeing an increase in the dependency ratio because the population is living longer. This is creating an increase in the number of people over 65 and higher dependency ratios.

Dependency Ratios in Western Europe

Implications of Higher Dependency Ratio

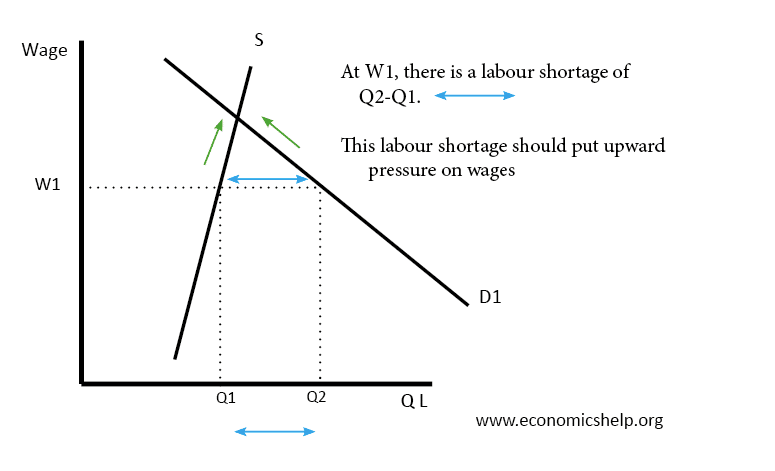

- Lower Tax Revenues. Retired people pay lower income tax. Therefore, the working age population has a greater responsibility to pay tax.

- Higher Government Spending. The government is committed to paying a state pension and related benefits such as a minimum income guarantee. There are also greater demands for indirect spending on retired people. People over 65 are more likely to require treatment by the NHS. Therefore, there are greater demands placed on government spending by a rise in the dependency ratio.

- Potential higher taxes. The pressures on government finances could lead to higher tax rates on a declining working population, which could create disincentives to work and reduce disposable income. The government may be forced to use collect more revenue from indirect taxes or wealth taxes.

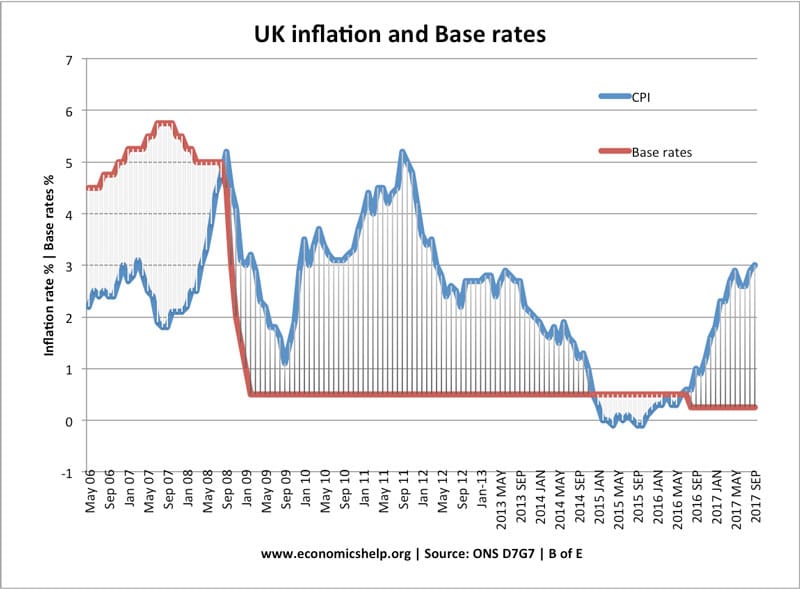

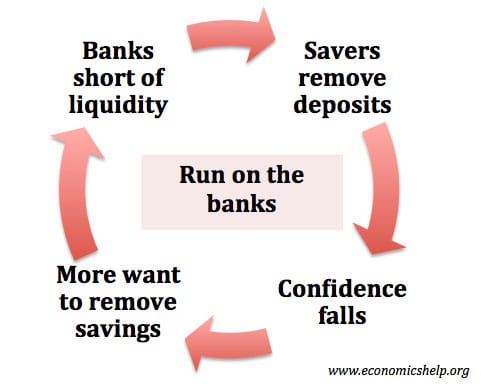

- Lower Pension Funds. Because of the rising % of retired people, pension funds are having to stretch further than before. Many pension funds haven’t planned for the rapid rise in the dependency ratio. Combined with the credit crisis and low interest rates, the average income retired people can expect has fallen.