Readers Question: Is large government spending bad for economic growth? to what extent does empirical evidence support this assertion?

How Government Spending Might Lead to Lower Economic Growth

- Higher spending leads to higher taxes. Higher income taxes may discourage people from working. High corporation tax might discourage firms from setting up in that country. (e.g. Ireland has attracted significant inward investment due to low corporation tax)

- Generous government welfare benefits may discourage people from taking a job, creating voluntary unemployment.

- Arguably government spending tends to be more inefficient than private sector spending. There tends to be greater bureaucracy and government civil servants don’t have the same profit motive as the private sector. (This leads to poor decisions like Concorde, Millennium Dome)

- Government spending decisions may be taken for political rather than economic motives (e.g. subsidising a failing firm to prevent politically unpopular job losses.)

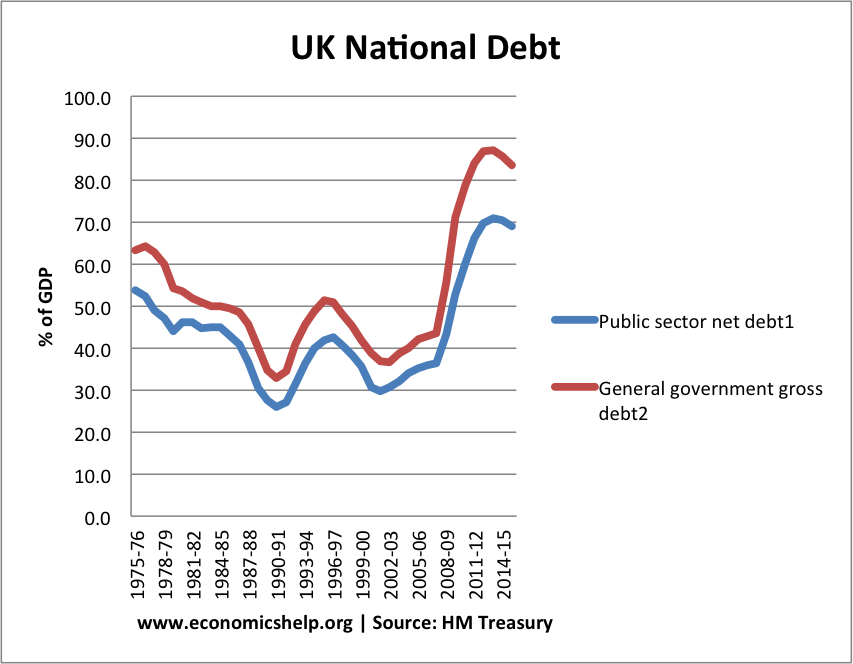

- Government Borrowing to finance higher spending can push up interest rates and cause financial crowding out

- Higher share of government spending leads to lower share for private sector.