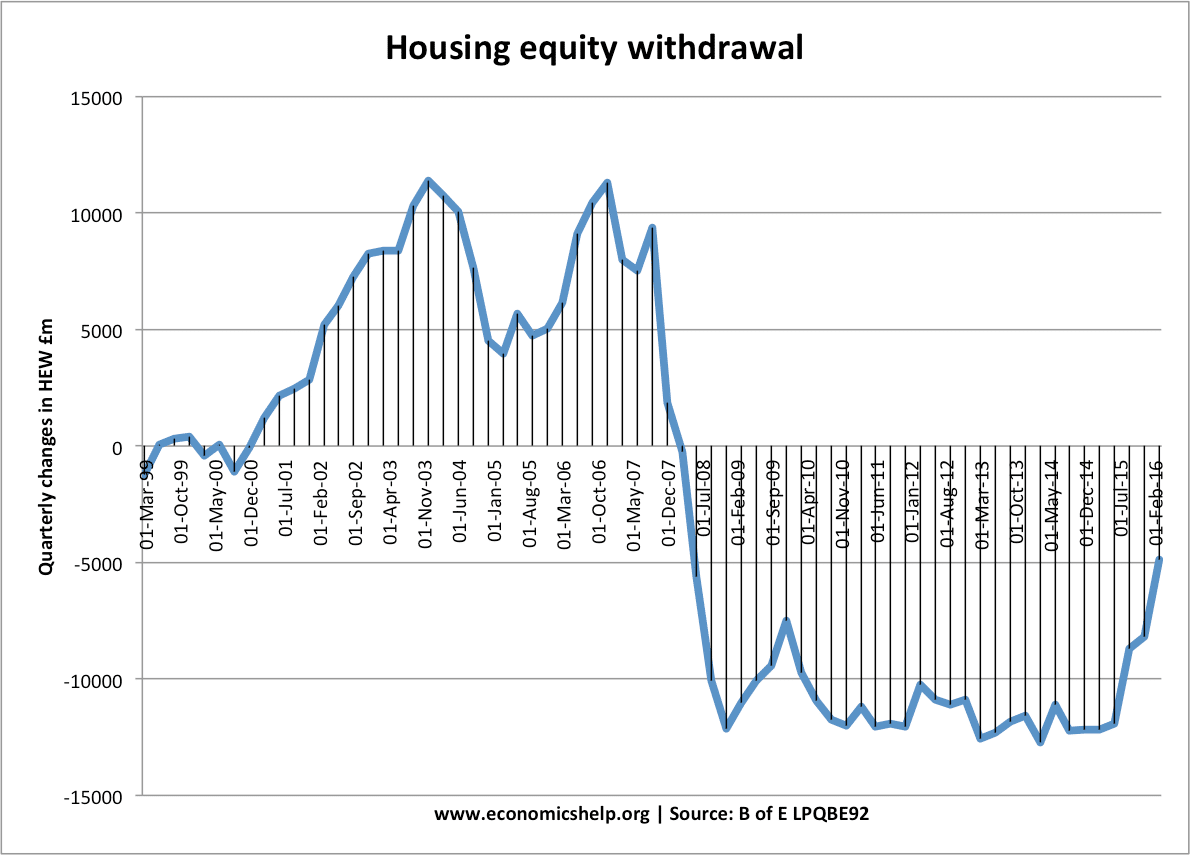

Readers Question: During 1995 – 1997 in the UK, mortgage equity withdrawal was negative. What does a negative mew value show? and why was there a negative value during this period in the UK?

Mortgage equity withdrawal occurs when people borrow money against the value of their house.

A common way to withdraw equity is to re-mortgage your house. This is especially common when house prices are rising because the house is worth more than the initial mortgage. Mortgage equity withdrawal is thus a way to increase borrowing secured against your rising house value.

Net Mortgage Equity Withdrawal is a way to measure the total amount that people borrow against their house, but, don’t use to invest in housing. i.e. people re-mortgaging to buy a car e.t.c

However, in addition to withdrawing your equity through re-mortgaging. Consumers also inject money through buying houses and improving the condition of existing houses.

A negative value of MEW means that the value of housing stock is increasing faster than the amount of equity taken out by homeowners.

In 1995, we see the following statistics:

(A) Withdrawal by Mortgages £ million 11,519

(B) Other Equity Withdrawals £ million 17,434

(C) Equity Injected through House Purchase £ million 11,721

(D) Financial Equity Injected £ million 13,045

(E) Dwelling Improvement Investment £ million 10,573

(F) Net Equity Withdrawal £ million -6,386

Source Council of Mortgage Lenders CML pdf