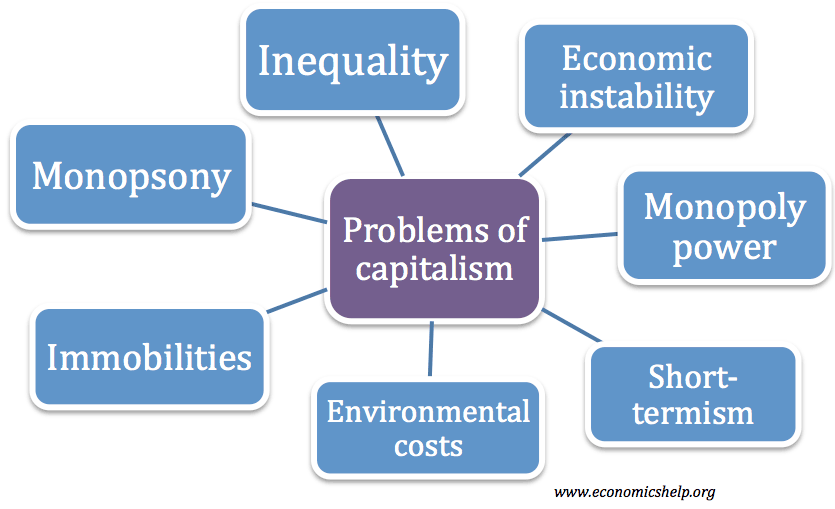

Capitalism is an economic system based on free markets and limited government intervention. Proponents argue that capitalism is the most efficient economic system, enabling improved living standards. However, despite its ubiquity, many economists criticise aspects of capitalism and point out is many flaws and problems. In short, capitalism can cause – inequality, market failure, damage to the environment, short-termism, excess materialism and boom and bust economic cycles.

Problems of Capitalism

1. Inequality

The benefits of capitalism are rarely equitably distributed. Wealth tends to accrue to a small % of the population. This means that demand for luxury goods is often limited to a small % of the workforce. The nature of capitalism can cause this inequality to keep increasing. This occurs for a few reasons

- Inherited wealth. Capitalists can pass on their assets to their children. Therefore, capitalism doesn’t cause equality of opportunity, but those born in privilege are much more likely to do well because of better education, upbringing and inherited wealth.

- Interest from assets. If capitalists are able to purchase assets – bonds, house prices, shares, they gain interest, rent and dividends. They can use these proceeds to buy more assets and wealth – creating a wealth multiplier effect. Those without wealth get left behind and may see house prices rise faster than inflation.

- The economist Thomas Piketty wrote an influential book Capital in the Twenty-First Century, which emphasised this element of capitalism to increase inequality. As a general rule, Picketty argues wealth grows faster than economic output. He uses expression r > g (where r is the rate of return to wealth and g is the economic growth rate.)