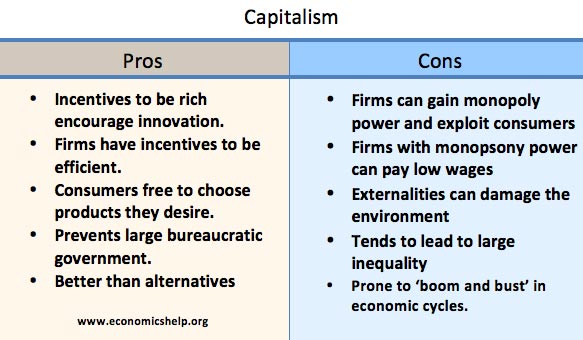

Capitalism is an economic system characterised by:

- Lack of government intervention

- Means of production owned by private firms.

- Goods and services distributed according to price mechanism (as opposed to government price controls)

Pros of capitalism

“A society that puts equality before freedom will get neither. A society that puts freedom before equality will get a high degree of both.”

― Milton Friedman

- Economic freedom helps political freedom. If governments own the means of production and set prices, it invariably leads to a powerful state and creates a large bureaucracy which may extend into other areas of life.

- Efficiency. Firms in a capitalist based society face incentives to be efficient and produce goods which are in demand. These incentives create the pressures to cut costs and avoid waste. State-owned firms often tend to be more inefficient (e.g. less willing to get rid of surplus workers and fewer incentives to try new innovative working practices.)

- Innovation. Capitalism has a dynamic where entrepreneurs and firms are seeking to create and develop profitable products. Therefore, they will not be stagnant but invest in new products which may be popular with consumers. This can lead to product development and more choice of goods.

- Economic growth. With firms and individuals facing incentives to be innovative and work hard, this creates a climate of innovation and economic expansion. This helps to increase real GDP and lead to improved living standards. This increased wealth enables a higher standard of living; in theory, everyone can benefit from this increased wealth, and there is a ‘trickle-down effect‘ from rich to poor.

- There are no better alternatives. As Winston Churchill, “It has been said that democracy is the worst form of government except for all the others that have been tried.” A similar statement could apply to capitalism.

Cons of capitalism

“Capitalism is the astounding belief that the most wickedest of men will do the most wickedest of things for the greatest good of everyone.”– John Maynard Keynes (1)

- Monopoly power. Private ownership of capital enables firms to gain monopoly power in product and labour markets. Firms with monopoly power can exploit their position to charge higher prices. See: Monopoly

- Monopsony power. Firms with monopsony power can pay lower wages to workers. In capitalist societies, there is often great inequality between the owners of capital and those who work for firms. See: Monopsony exploitation