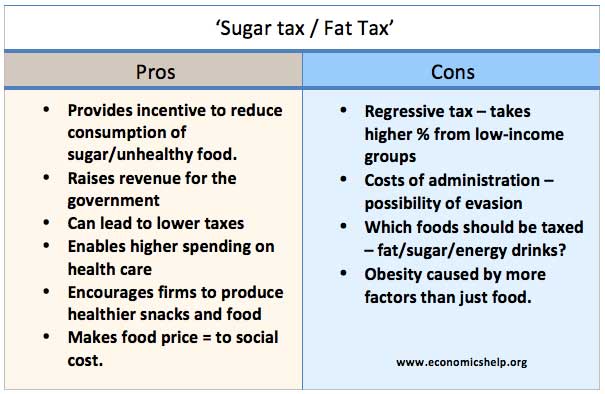

The impact of taxation

Taxation on goods, income or wealth influence economic behaviour and the distribution of resources. For example, higher taxes on carbon emissions will increase cost for producers, reduce demand and shift demand towards alternatives. Higher income tax can enable a redistribution of income within society, but may have an impact on reducing the incentives to work …